Q1 NAND and DRAM prices are set to rise significantly, reports TrendForce.

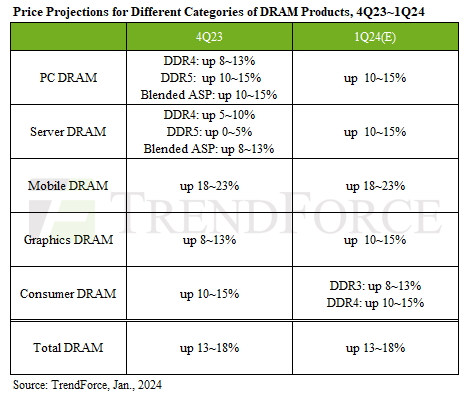

DRAM contract prices are estimated to increase by approximately 13–18% in 1Q24 with mobile DRAM leading the surge.

It appears that due to the unclear demand outlook for 2024, manufacturers believe that sustained production cuts are necessary to maintain the supply-demand balance in the memory industry.

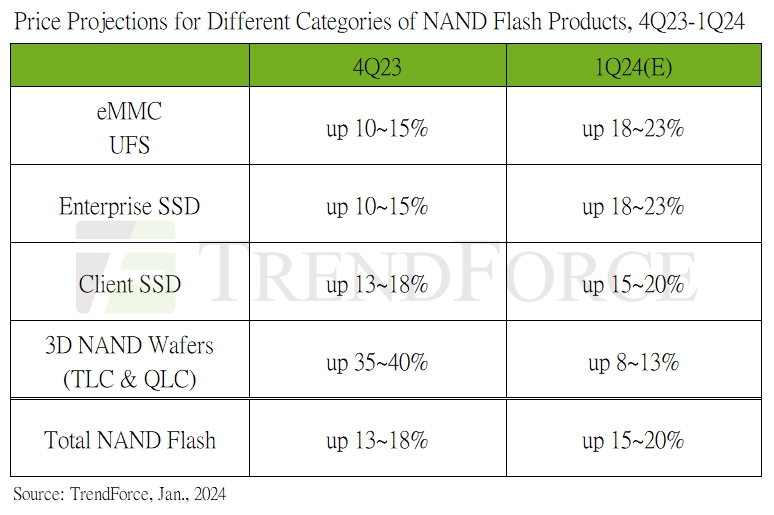

Despite facing a traditional low-demand season, buyers are continuing to increase their purchases of NAND Flash products to establish safe inventory levels.

In response, suppliers, aiming to minimise losses are pushing for higher prices, leading to an estimated 15–20% increase in NAND Flash contract prices in 1Q24.

A key point to note is the aggressive price hike initiated by NAND Flash manufacturers to offset losses. But, with demand struggling to keep pace with these rapid increases, future price escalations hinge on the resurgence of enterprise SSD procurement.

Stay up to date with the latest in industry offers by subscribing us. Our newsletter is your key to receiving expert tips.

The US has initiated a Section 301 investigation into China's mature semiconductor processes and third-generation silicon carbide (SiC) semiconductors. Supply chain operators state that the increa

In 2025, we expect 9.5% growth in the global semiconductor market, driven by robust demand for data centre services, including AI. However, growth in other, more mature segments is expected to be stag

Taiwanese chip manufacturer TSMC has announced a $100 billion investment in the United States, aiming to build five additional semiconductor facilities.The plan was revealed by TSMC CEO C.C. Wei along