The US has initiated a Section 301 investigation into China's mature semiconductor processes and third-generation silicon carbide (SiC) semiconductors. Supply chain operators state that the increasingly challenging environment seems to fuel the determination of Chinese manufacturers to break through barriers. Mainstream 6-inch SiC substrates from China saw significant price reductions in 2024, rapidly igniting internal competition. However, recent reports suggest that the aggressive pricing strategies have begun to slow down.

In the past quarter, supply chains across the Taiwan Strait have stated that some Chinese manufacturers are now targeting a price of US$700 per piece for 8-inch SiC substrates in 2025. This represents a drastic reduction from the expected price of US$1,500 per piece at the end of 2025, effectively more than halving the price. Such pricing levels could not only replace mainstream 6-inch products but also accelerate the arrival of the 8-inch SiC generation.

Particularly concerning is the limited number of companies capable of mass-producing 8-inch substrates. Reports suggest that the Chinese government may restrict the issuance of production permits for 8-inch SiC, estimating that no more than ten companies will obtain such licenses. Those without permits face challenges in securing bank loans and cannot participate in relevant government contracts.

In contrast, approximately 50 to 60 companies in China are currently engaged in producing 6-inch substrates, benefiting from economies of scale and demonstrating unparalleled cost competitiveness.

Industry insiders report that prices for 6-inch SiC substrates are being sold below cost, indicating a bleeding sales situation. While China's overall manufacturing capabilities are commendable, the issue of internal competition has led to excessive rivalry, resulting in market disorder. This is a primary reason why the Chinese government has imposed stringent restrictions on issuing permits for 8-inch production.

Due to the chaotic market conditions, many prices and quality metrics do not necessarily correlate effectively. Additionally, key markets such as electric vehicles (EVs) and solar energy are underperforming, limiting buyers' motivation to seek bargains.

Compounding these issues, there were previous reports of a European integrated device manufacturer (IDM) facing scrutiny from Chinese automakers due to quality problems linked to contaminated SiC substrates sourced from China.

This incident has made international IDMs more cautious in their procurement practices, especially in the automotive sector, where any quality issues could lead to liability for damages. The potential pressure from such risks far outweighs the benefits of acquiring cheaper SiC substrates. It is rumored that suppliers of SiC substrates may face a liquidity crisis as a result of this event.

Nevertheless, China's SiC industry has not retreated despite these setbacks. In fact, 6-inch SiC substrates may not be the focal point for Chinese manufacturers in 2025; rather, the more promising 8-inch technology is seen as the priority for development.

Strategic importance of third-generation semiconductors

Future-oriented third-generation semiconductors like gallium nitride (GaN) and SiC are essential for new energy applications, 5G base stations, AIoT, and EVs. Even if US President Donald Trump does not support the development of EVs, the demand for AI data centers and the associated power and grid requirements necessitate third-generation semiconductors. Moreover, these technologies are crucial for future military and aerospace applications, making it difficult for the US to overlook China's rapid advancements in this field.

Earlier this year, the US imposed a 50% tariff on Chinese semiconductors, followed by additional tariffs totaling 20% in February and March. Consequently, after the hearings, traditional semiconductors and SiC may face heavy tariffs. Conversely, the focus will also be on the US inflation problem, increased consumer burdens, and subsequent retaliation issues.

Regarding the Section 301 investigation, media outlets have pointed out that the Information Technology and Innovation Foundation believes that if the US fails to address China's subsidies for SiC wafers and market distortions, it could lead to severe consequences.

Stay up to date with the latest in industry offers by subscribing us. Our newsletter is your key to receiving expert tips.

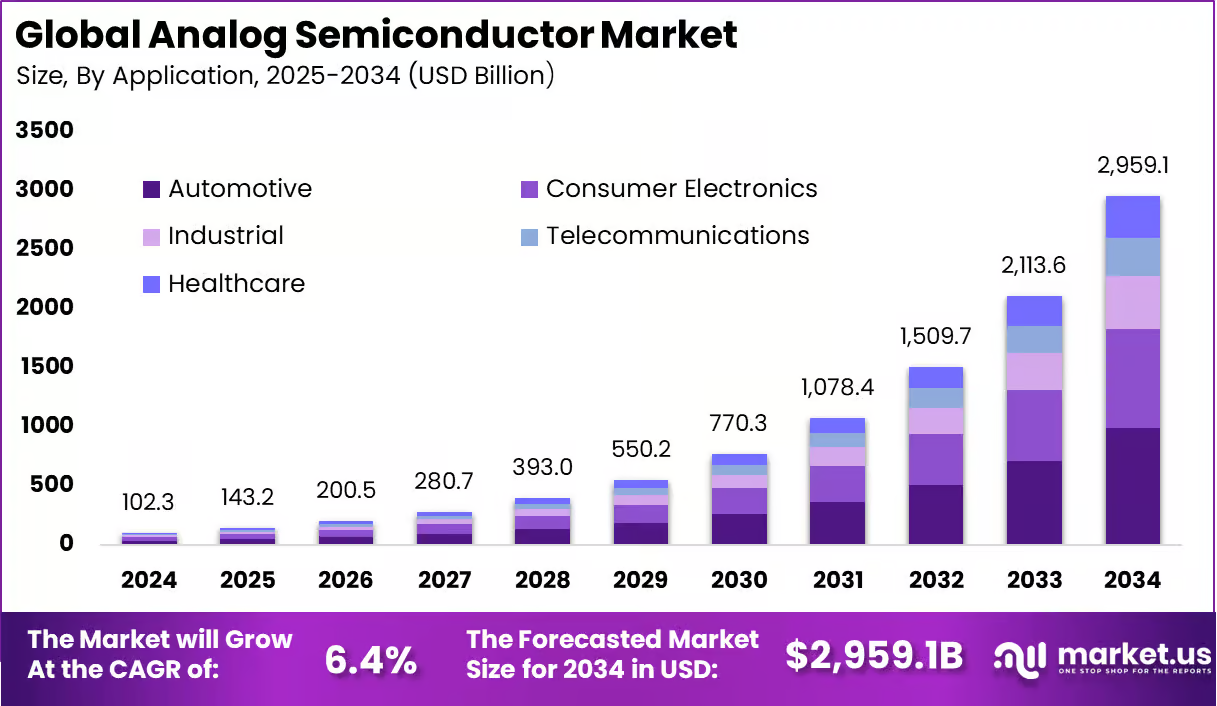

The market size of analog semiconductors was recorded at USD 102.3 billion in 2024 and is projected to register consistent expansion, rising from USD 143.2 billion in 2025 to approximately USD 2,959.1

On 27 July 2025, European Union and United States of America reached a political agreement on tariffs and trade. The transatlantic partnership is a key artery of global commerce and is the most signif

Samsung Electronics will raise contract prices for DRAM and NAND flash in the fourth quarter of 2025, industry sources told Newdaily.co.kr. The move reflects shrinking output of legacy products and su