Prices of mature process memory, long hit by oversupply due to fast capacity expansion at Chinese makers, are expected to rebound, thanks to the Chinese government's consumption stimulus programs.

However, as China's semiconductor technology and production capacity are rapidly catching up with Samsung Electronics and SK Hynix, the South Korean industry is worried that prices may fall again soon.

According to reports from Korean media outlets, such as Edaily and Newsis, the Chinese government incentives encouraging device replacements have stimulated consumption. Data from China's National Development and Reform Commission (NDRC) shows that during the Lunar New Year period in 2025 (from January 28 to February 4), smartphone sales shot up by 182% year-on-year, while home appliance sales soared 166% year-on-year.

Against this backdrop, DRAM and NAND flash product prices stopped falling and showed signs of rebounding.

South Korea's KB Securities said that as of February 2025, the memory module inventory at handset and PC makers has dropped by more than 50% compared to the peak levels in the second half of 2024, and DRAM and NAND prices, which have plummeted since the fourth quarter of 2024, are starting to stabilize.

Memory inventory easing

With China's stimulus policy helping suppliers clear their inventory, new demand for memory will emerge soon, easing oversupply. The mature process memory market will see a rebound starting from the second half of the year.

A researcher at the Korea Electronics Technology Institute (KETI) pointed out that products from Samsung and SK Hynix have a strong presence in the global market and China, so China's stimulus programs will also benefit South Korean vendors.

Components makers such as Samsung Electro-Mechanics (Semco) will also see demand pick up. For Semco, about 40% of the revenue for its core product line -- multilayer ceramic capacitors (MLCC) -- comes from shipments supporting Chinese IT products.

However, some analysts believe that the upward memory price trend will not last long, as China steps up its semiconductor development.

If Chinese companies continue to expand their production capacity, memory prices may fall again soon. Even if they rise again later, only Chinese companies will benefit because of their expanded capacity. The South Korean memory sector faces increasing uncertainty.

The Korea Institute of S&T Evaluation and Planning (KISTEP) pointed out that as of 2024, China has caught up with South Korea in many semiconductor sectors in terms of technology levels, such as memory, packaging, power devices, sensors, and artificial intelligence (AI).

Therefore, accelerating the development of high-value-added products such as high-bandwidth memory (HBM) and widening the gap with China has become a top priority for South Korea.

Stay up to date with the latest in industry offers by subscribing us. Our newsletter is your key to receiving expert tips.

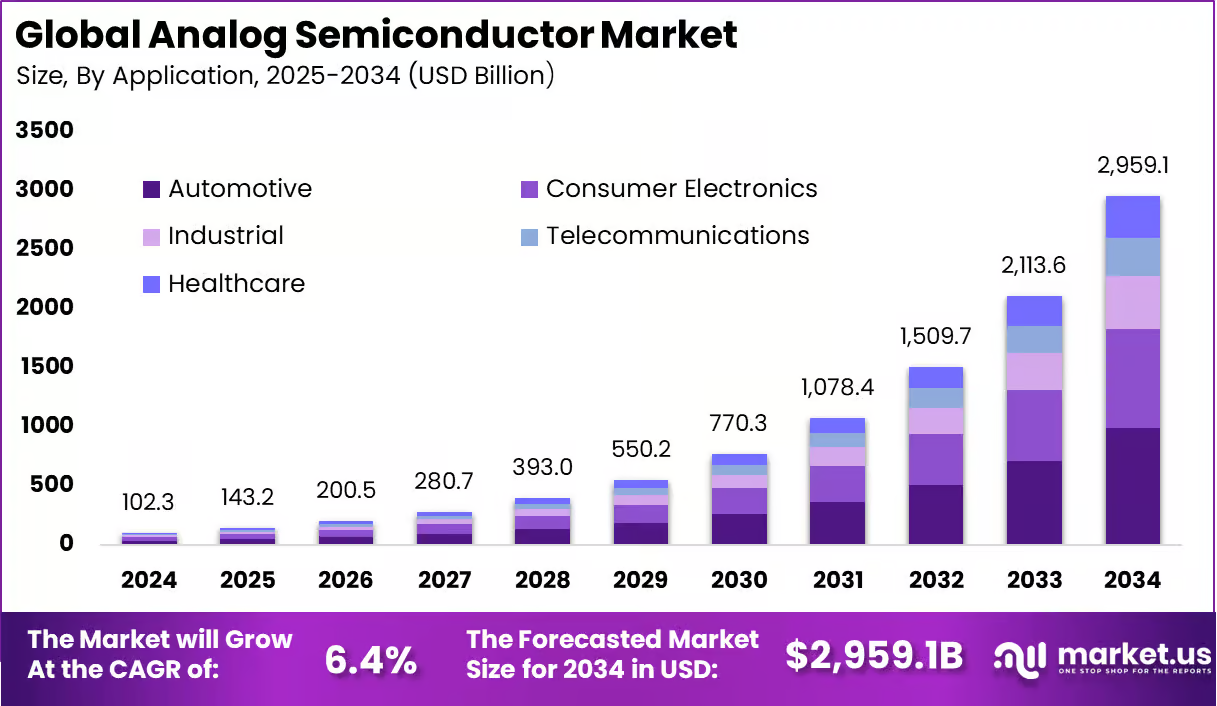

The market size of analog semiconductors was recorded at USD 102.3 billion in 2024 and is projected to register consistent expansion, rising from USD 143.2 billion in 2025 to approximately USD 2,959.1

On 27 July 2025, European Union and United States of America reached a political agreement on tariffs and trade. The transatlantic partnership is a key artery of global commerce and is the most signif

Samsung Electronics will raise contract prices for DRAM and NAND flash in the fourth quarter of 2025, industry sources told Newdaily.co.kr. The move reflects shrinking output of legacy products and su