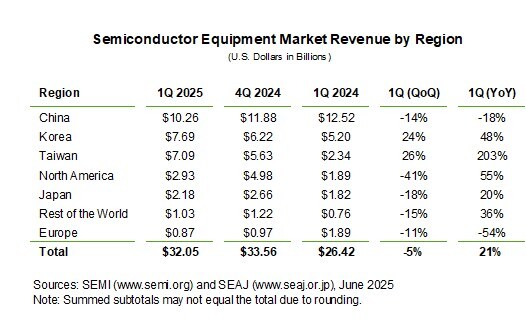

SEMI, the industry association serving the global semiconductor and electronics design and manufacturing supply chain, today reported in its Worldwide Semiconductor Equipment Market Statistics (WWSEMS) Report that global semiconductor equipment billings increased 21% year-over-year to US$32.05 billion in the first quarter of 2025. In line with typical seasonality, first-quarter 2025 billings registered a 5% quarter-over-quarter contraction.

"The global semiconductor equipment market began 2025 with a solid quarter that reflects future-looking investments in vital chipmaking capacity across regions," said Ajit Manocha, SEMI President and CEO. "With the ongoing AI boom continuing to drive fab expansions and equipment sales, the industry is showing resilience in the face of uncertainty around geopolitical tensions, tariff volatility and export controls. SEMI is actively engaging with governments to advocate for policy stability essential to multi-billion-dollar fab investments, including equipment, and the long-term success of advanced manufacturing operations."

Stay up to date with the latest in industry offers by subscribing us. Our newsletter is your key to receiving expert tips.

Samsung Electronics is transforming its Pyeongtaek Campus Line 4 (P4) in South Korea into a manufacturing base focusing on HBM4 production. Analysts indicate that Samsung is increasing the proportion

Samsung scores another major foundry victory, expanding its roster of high-profile clients on advanced nodes. After Tesla selected the company in July to produce its AI6 processor under a $16.5 billio

Texas Instruments, a leading analog IC maker, has released its Q3 2025 results, with its cautious Q4 outlook sparking concerns over the broader semiconductor market. According to Reuters, the company