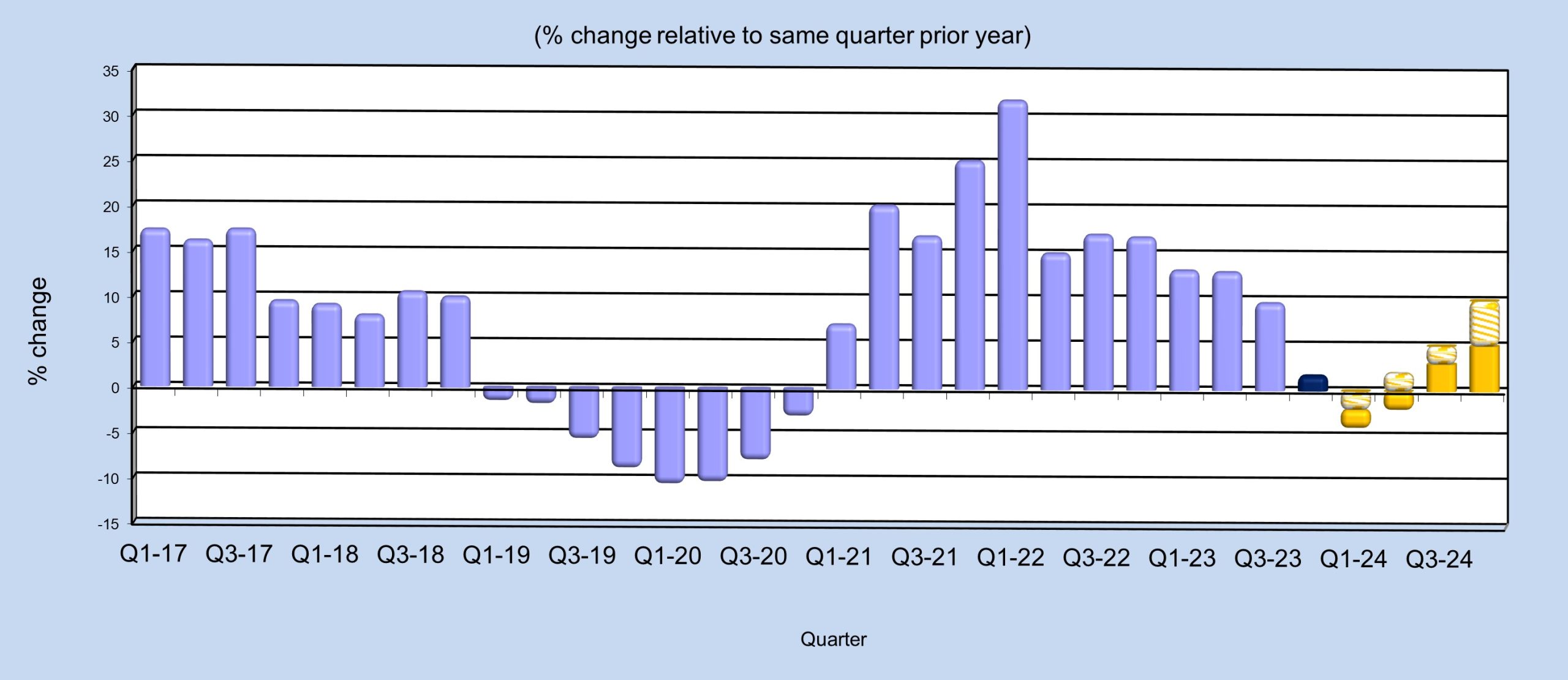

Last year, Aubrey Dunford, the ECSN (Electronic Components Supply Network) market analyst declared the UK electronics components market had returned to normality. At this year’s Electronics Components Forecast, he reclassified its status as a new, new normal.

2024 total forecast 1.6% (min) to 4.1% (max)

At the end of 2022, ECSN suppliers were preparing for 2023 with strong order books and confidence in customer demand and an expectation that prices will generally be maintained. Another prediction for 2023 was that growth in the first half of this year was likely but the second half would be less certain as pent-up demand for 5G and smart vehicle infrastructure systems could bear fruit. The book-to-bill ratio was expected to remain strong in 2023 as lead times returned to more normal levels albeit with some shortages expected. All of this came to pass despite uncertainties such as product availability, global trade and political tensions and falling consumer confidence. At the time, Dunford maintained that authorised distributors are “key to helping the industry find its way through uncertainties”.

Component market sales in 2023 were high with a DTAM of £1886m and a TAM of £4254m, compared to £1722 (DTAM) and £3938m (TAM) in 2022.

For 2024, ECSN members are cautious, based on many statistics. Firstly, inventory is still high, making it difficult to judge demand. Price pressures will be minimal and price levels achieved in 2023 are expected to be maintained. A flat first half is expected, supported by the HM Treasury’s comparison of independent forecasts predicts UK economy average growth of 0.5% for 2023 and 0.4% for 2024. The second half of the year will depend on trade and political tensions, with the added unrest in the Middle East and what effect that will have, not least in terms of oil price rises.

There is still a demand for 5G and vehicle infrastructure systems and some strong demand particularly in the industrial sector as UK manufacturing output rises. There are indications that some market sectors will remain strong, said Dunford, but the overall picture is uncertain. A growth in UK consumption may not be reflected in sales in 2024. It is important to note, said Dunford that manufacturers do not know how much stock is out there, as double ordering of inventory through the pandemic is still to be worked through. The DTAM quarter-on-quarter growth since 2021 is related to price increases in a commodity market rather than increased unit sales, he added.

The one seeming certainty is moderate growth in the first half of 2024, said Dunford, followed by a slight to moderate (~1.4% growth), he estimated.

Stay up to date with the latest in industry offers by subscribing us. Our newsletter is your key to receiving expert tips.

The US has initiated a Section 301 investigation into China's mature semiconductor processes and third-generation silicon carbide (SiC) semiconductors. Supply chain operators state that the increa

In 2025, we expect 9.5% growth in the global semiconductor market, driven by robust demand for data centre services, including AI. However, growth in other, more mature segments is expected to be stag

Taiwanese chip manufacturer TSMC has announced a $100 billion investment in the United States, aiming to build five additional semiconductor facilities.The plan was revealed by TSMC CEO C.C. Wei along