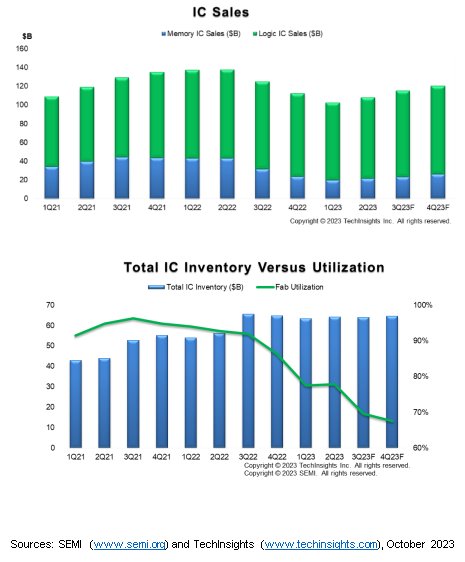

Q4 sales of electronics are forecast to rise 22% q-o-q after a 7% rise in Q3, says SEMI, and IC sales are expected to rise 4% sequentially after improving 7% in Q3 2023 as end demand improves and inventories normalise

However, despite the improvement in electronics and IC sales, semiconductor manufacturing indicators remain soft. Fab utilization rates and capital expenditures continue to decline in the second half of this year.

Overall, CapEx on non-memory is expected to outperform memory in 2023, but even spending in the non-memory segments has begun to weaken.

Total capital expenditures in Q4 2023 are hovering at the levels seen in Q4 2020.

While overall semiconductor capital equipment sales are declining in line with capital expenditures, the contraction in wafer fab equipment spending has turned out to be much shallower than expected this year. Furthermore, back-end equipment billings are projected to increase in Q4 2023.

“While semiconductor markets have seen year-over-year declines the last five quarters, year-over-year growth is expected to return in the fourth quarter of 2023 as production cuts have worked their way through the supply chain,” says TechInsights’ Boris Metodiev, “on the other hand, front-end equipment sales have been performing much better than the IC market, buoyed by government incentives and the filling of backlogs, strength expected to continue next year.”

“Despite low fab utilisation rates and slowing capital expenditures in the second half of 2023, we expect back-end equipment billings to bottom in Q4 2023,” says SEMI’s Clark Tseng, “this will mark an important turnaround for the chip manufacturing industry, signaling a recovery from the downturn with building momentum in 2024.”

Stay up to date with the latest in industry offers by subscribing us. Our newsletter is your key to receiving expert tips.

The US has initiated a Section 301 investigation into China's mature semiconductor processes and third-generation silicon carbide (SiC) semiconductors. Supply chain operators state that the increa

In 2025, we expect 9.5% growth in the global semiconductor market, driven by robust demand for data centre services, including AI. However, growth in other, more mature segments is expected to be stag

Taiwanese chip manufacturer TSMC has announced a $100 billion investment in the United States, aiming to build five additional semiconductor facilities.The plan was revealed by TSMC CEO C.C. Wei along