Nvidia is gearing up to debut its next-gen "Rubin" GPU in 2025, featuring eight HBM4 chips, with a Rubin Ultra version to follow, packing twelve. In a strategic bid to reclaim HBM market share, Samsung Electronics is betting on sixth-generation HBM4 and has hinted at a potential production collaboration with foundry rival TSMC, according to South Korean media outlet Newsis.

Foundry partnership could reshape competition

Industry experts anticipate that should Samsung partner with TSMC for HBM manufacturing, this could significantly reduce the longstanding performance gap with SK Hynix. Reports indicate that by late 2025, Samsung might outsource basic bare die production to TSMC to meet specific client demands, abandoning its previous all-in-house strategy.

Challenges have emerged as Nvidia reportedly delayed Samsung's HBM quality approval over yield rate issues in Samsung's foundries. The South Korean tech giant has since curtailed foundry investments, prioritizing core memory operations. Industry sources suggest that Nvidia might have encouraged the Samsung-TSMC collaboration.

Advanced stacking technologies take center stage

For HBM4 production, Samsung plans to leverage TSMC's CoWoS technology, potentially bringing Samsung and SK Hynix's product power consumption and performance into closer competition, shifting the focus to stacking technologies. Both Samsung and SK Hynix will deploy their proprietary techniques—Samsung's TC-NCF and SK Hynix's MR-MUF—as stacking innovation becomes pivotal for HBM differentiation.

Currently, SK Hynix's HBM4, scheduled for production with TSMC by 2025, maintains a performance advantage over Samsung. SK Hynix has successfully validated MR-MUF in HBM3E, while Samsung is turning to hybrid bonding to boost chip performance and reduce die size in its HBM4 lineup.

Stay up to date with the latest in industry offers by subscribing us. Our newsletter is your key to receiving expert tips.

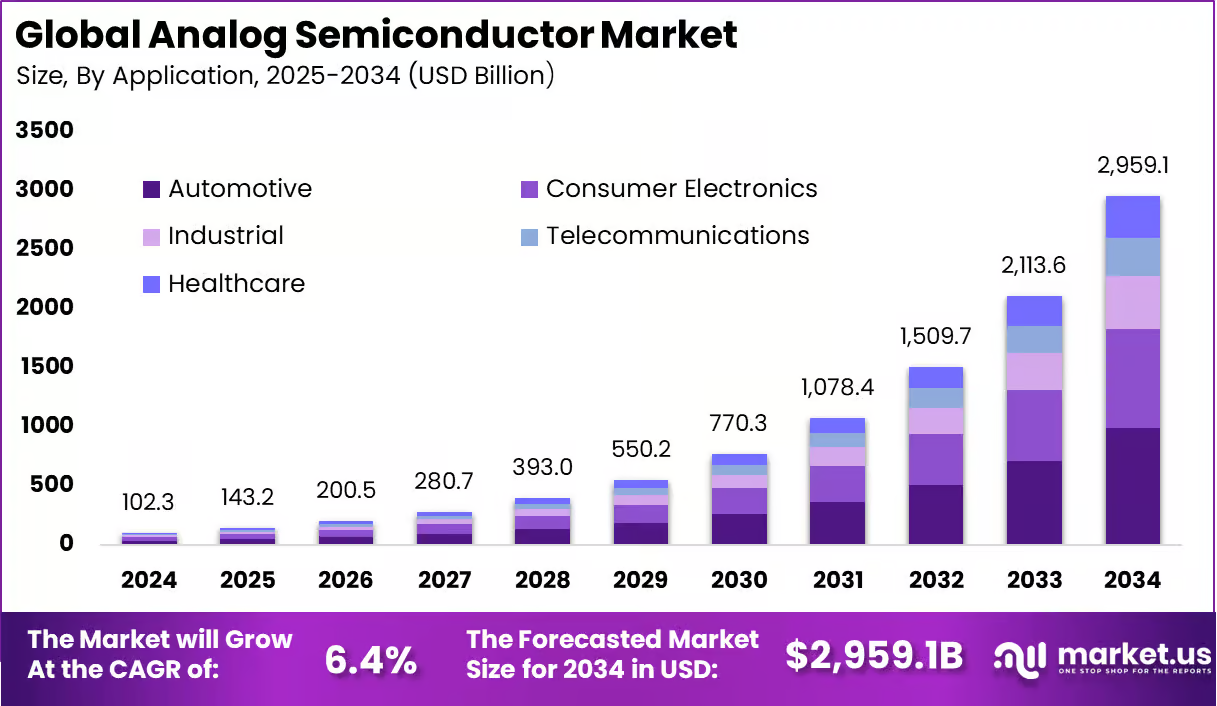

The market size of analog semiconductors was recorded at USD 102.3 billion in 2024 and is projected to register consistent expansion, rising from USD 143.2 billion in 2025 to approximately USD 2,959.1

On 27 July 2025, European Union and United States of America reached a political agreement on tariffs and trade. The transatlantic partnership is a key artery of global commerce and is the most signif

Samsung Electronics will raise contract prices for DRAM and NAND flash in the fourth quarter of 2025, industry sources told Newdaily.co.kr. The move reflects shrinking output of legacy products and su