ChangXin Memory Technologies (CXMT), China's top DRAM supplier, is reportedly preparing to phase out DDR4 products for server and PC use by mid-2026. As the company pivots to DDR5 and high-bandwidth memory (HBM), analysts warn the move could flood the market with next-gen DRAM, intensifying oversupply risks.

Samsung Electronics and SK Hynix are also winding down older production nodes, tightening short-term DDR4 supply. Prices have surged accordingly, with Nanya-branded 8Gb DDR4 chips in China doubling to US$2.50—fueled in part by rumors surrounding CXMT's upcoming DDR4 withdrawal.

Rapid rise of CXMT upends DRAM landscape

CXMT's aggressive expansion is shaking up the global DRAM triopoly traditionally controlled by Samsung, SK Hynix, and Micron. Even under US export restrictions limiting access to advanced equipment, the Chinese chipmaker is scaling production at breakneck speed.

Having started with just a 2% market share, CXMT is projected to hit 280,000 wafers per month by late 2025, with an upside potential of 300,000 wafers, equating to as much as 15% of global DRAM output.

As CXMT scales up, it's also shifting rapidly to DDR5. The company only began mass-producing DDR4 in late 2024, yet it's already expected to issue an end-of-life (EOL) notice by the third quarter of 2025. The speed of this pivot and retooling has surprised many across the industry.

Industry sources say the sudden shift is policy-driven, as Beijing pushes key chipmakers to accelerate alignment with national goals, especially around AI and cloud infrastructure. CXMT is also prioritizing HBM, with HBM3 validation expected before year-end.

DDR5 quality concerns remain despite production surge

CXMT's late-2024 DDR4 ramp-up caused an initial price dip, as the company leveraged Taiwanese distributors to penetrate markets like India. However, a sudden fourth-quarter policy reversal forced CXMT to abandon DDR4 and double down on DDR5.

Even without an official EOL notice, DDR4 supply has largely vanished. This shortage has fueled a dramatic price jump in China, where Nanya-branded 8Gb chips have climbed from just over US$1 to US$2.50.

By year-end 2025, DDR5 is expected to make up more than 60% of CXMT's output, alongside LPDDR4 and LPDDR5. Its low-power DRAM lines will serve local smartphone brands. Although CXMT is phasing out standard DDR4, it will keep a few lines running to supply GigaDevice for consumer-grade outsourced production.

Meanwhile, Samsung and SK Hynix are keeping a narrow DDR4 pipeline alive using 1z-nm nodes, chosen because they don't require EUV tools, for continued use in consumer and embedded devices.

CXMT's push into DDR5 is ambitious, but quality and yield remain hurdles. Taiwanese firms say CXMT's first-quarter 2025 DDR5 samples failed key tests. Even Chinese brands marketing 6,400 MT/s DDR5 gaming modules still lean on South Korean chips for top-tier performance.

Thermal tests reveal CXMT's DDR5 chips become unstable above 60°C (140°F)—far below Samsung's –40°C to 85°C (–40°F to 185°F) operating range. Sub-zero stability poses an even bigger challenge, raising questions about their reliability in demanding environments.

Regardless of quality concerns, CXMT's DDR5 production ramp is all but inevitable. Lower-tier products may hit the market soon, sparking fears of a price war. While global DDR5 supply is expected to stay tight through mid-2025, surging Chinese output could destabilize the delicate DRAM supply-demand equilibrium.

Stay up to date with the latest in industry offers by subscribing us. Our newsletter is your key to receiving expert tips.

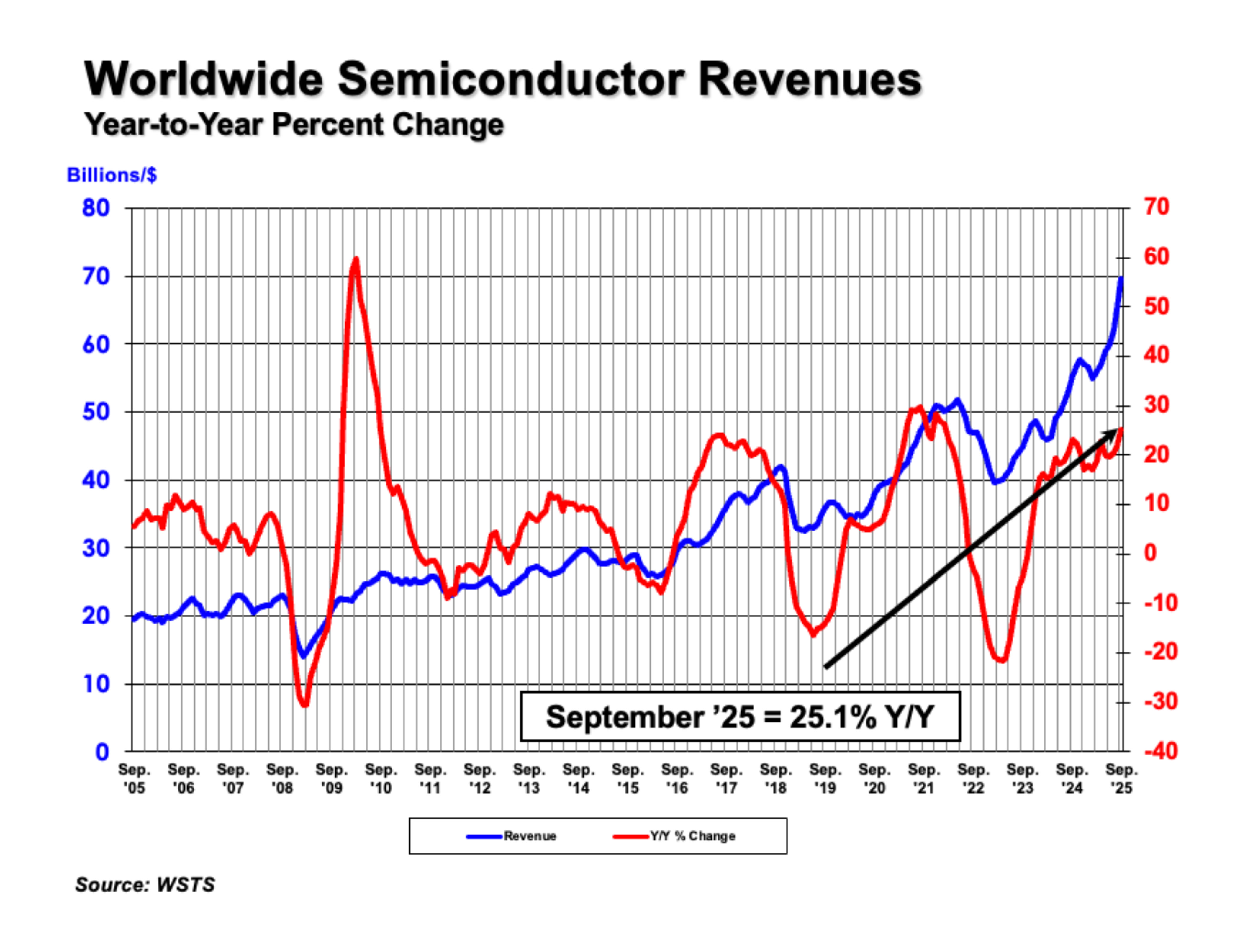

WASHINGTON—November 3, 2025—The Semiconductor Industry Association (SIA) today announced global semiconductor sales were $208.4 billion during the third quarter of 2025, an increase of 15.8% compared

Samsung Electronics is transforming its Pyeongtaek Campus Line 4 (P4) in South Korea into a manufacturing base focusing on HBM4 production. Analysts indicate that Samsung is increasing the proportion

Samsung scores another major foundry victory, expanding its roster of high-profile clients on advanced nodes. After Tesla selected the company in July to produce its AI6 processor under a $16.5 billio