Japan's push to revive its semiconductor manufacturing is hitting speed bumps as major manufacturers expressed cautiousness over operation or expansion amid weak demand outside of AI.

According to Nikkei, TSMC recently postponed the construction of its second chip plant in Japan's Kumamoto Prefecture, originally slated to break ground in fiscal 2024 (April 2024–March 2025), which reflects broader concerns over market demand, especially in non-AI semiconductor applications. Despite the delay, TSMC maintains that its target to begin mass production at the second plant before the end of 2027 remains unchanged.

The first fab of TSMC's Japanese subsidiary, JASM, began production in December 2024, but Nikkei, citing industry sources, noted that its utilization rate has yet to pick up.

Both the first and second JASM fabs focus on mature process nodes, including 22/28mm and 6/7mm, which are less aligned with the surging global demand for generative AI chips. These limitations have raised questions about the feasibility of further expansions, including the possibility of a third JASM facility with advanced manufacturing capabilities—something Japanese stakeholders have advocated but that TSMC has yet to confirm.

The sluggish demand for semiconductors not used in generative AI is being felt across Japan. According to another Nikkei report, out of seven semiconductor fabrication plants constructed in Japan between April 2023 and March 2025, only three have begun mass production as of the end of April 2025.

Sony has started production at its new fab in Isahaya City, Nagasaki Prefecture, which focuses on image sensors for smartphones. However, Apple's iPhone sales have stagnated since early 2024, leading Sony to adopt a cautious stance on further equipment investments despite having additional cleanroom space available.

Renesas resumed operations at its Kofu plant in Yamanashi Prefecture in April 2024, nine years after its closure. Although mass production was set for early 2025, the schedule is being reconsidered due to a sharp drop in demand for automotive power semiconductors, particularly in the EV market. Renesas has not announced a new timeline.

Rohm began pilot production at its new silicon carbide semiconductor plant in Kunitomi, Miyazaki Prefecture, in November 2024 but has not confirmed when full-scale production will start. The decline in EV demand has caused rare losses, leading the company to cut investments and reduce staff.

Sanken Electric also postponed its power semiconductor expansion in Ojiya City, Niigata Prefecture. Production, originally planned for 2024, is now expected to start after 2026, about two years later than initially scheduled.

Non-AI chip demand weakens across automotive, industrial, and consumer sectors

The ongoing US-China tech conflict has escalated with tighter export controls and restrictions on key raw materials, prompting chipmakers to reassess their global manufacturing strategies and accelerate diversification beyond traditional hubs.

In the automotive sector, weakened electric vehicle (EV) sales in Europe and the US have dampened demand for power semiconductors, with recovery now expected no earlier than mid-2025. Industrial markets are also under pressure as fabs prioritize advanced AI chips over mature technologies crucial for automation and energy systems, risking supply shortages and cyclical imbalances.

Meanwhile, the consumer electronics sector is grappling with saturation. Smartphones, PCs, and other devices are seeing slower replacement cycles, with less innovation in mid- and entry-level models. This has contributed to stagnating demand for traditional semiconductor components.

As investment decisions become more cautious, the industry faces growing tension between the need to support AI-driven innovation and the risks of oversupply in legacy chip segments.

Stay up to date with the latest in industry offers by subscribing us. Our newsletter is your key to receiving expert tips.

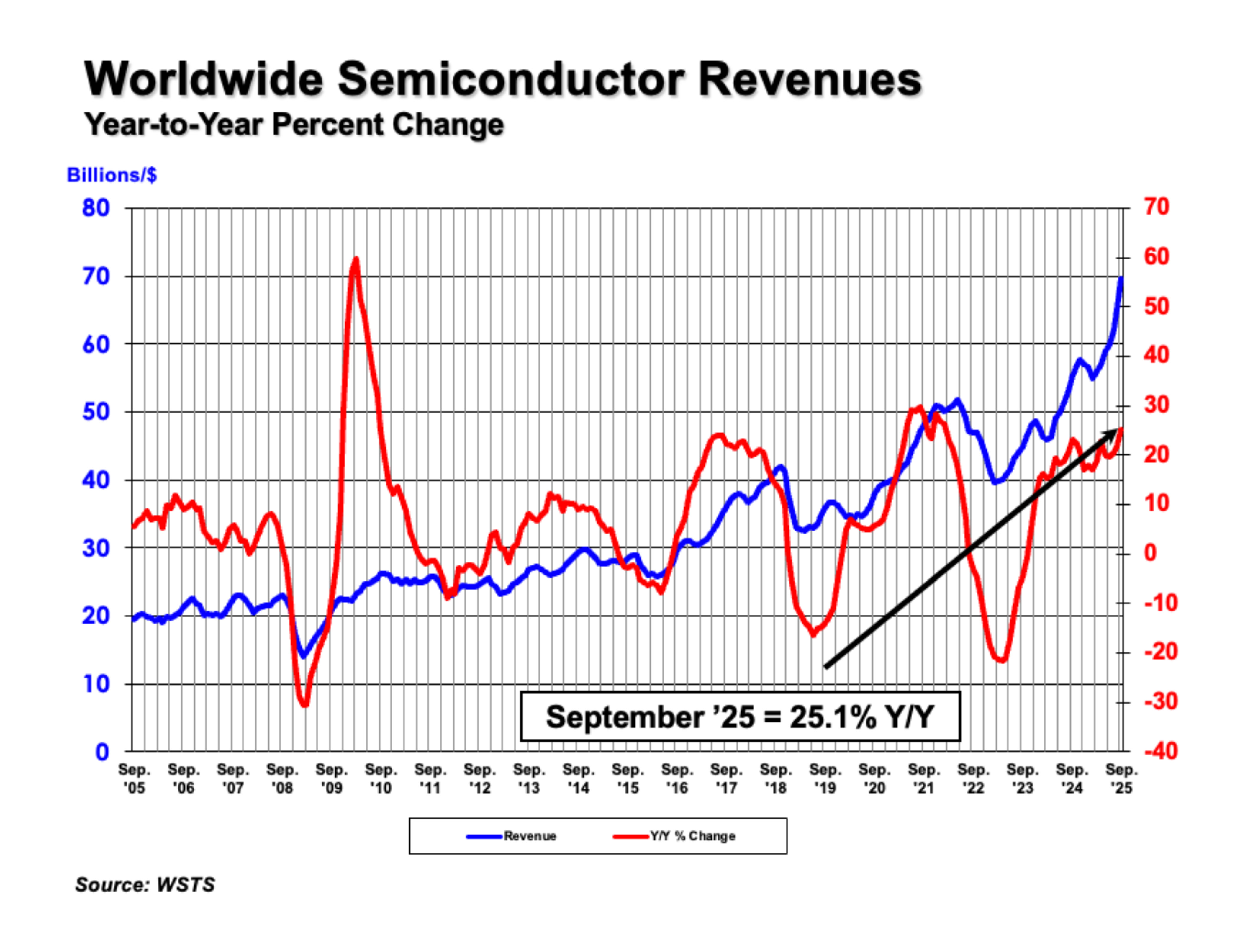

WASHINGTON—November 3, 2025—The Semiconductor Industry Association (SIA) today announced global semiconductor sales were $208.4 billion during the third quarter of 2025, an increase of 15.8% compared

Samsung Electronics is transforming its Pyeongtaek Campus Line 4 (P4) in South Korea into a manufacturing base focusing on HBM4 production. Analysts indicate that Samsung is increasing the proportion

Samsung scores another major foundry victory, expanding its roster of high-profile clients on advanced nodes. After Tesla selected the company in July to produce its AI6 processor under a $16.5 billio