In a sharply bifurcated foundry landscape, TSMC continues to assert dominance, driven by surging AI demand, even as macroeconomic headwinds—including stronger tariffs and a strengthening New Taiwan dollar—threaten to erode profitability across the broader sector. Chairman C. C. Wei remains undeterred, projecting record-high revenue and net income for 2025 despite mounting operational frictions.

"I can assure you—AI demand remains exceptionally strong. How should I put it? The demand is very high. Both our revenue and profit for this year are on track to hit new all-time highs," Wei said, noting that AI-related momentum is more than compensating for external shocks.

AI surge creates winner-takes-all market

TSMC's upbeat outlook stands in sharp contrast to rivals like UMC, VIS, PSMC, SMIC, GlobalFoundries, Intel, and Samsung. These chipmakers are facing stalled or shrinking profits, caught in a mix of intensifying price competition and shifting customer priorities. Few have shown signs of a meaningful rebound, especially as non-AI demand stays soft.

The broader recovery the semiconductor industry was banking on for 2025—driven by a return of smartphone, PC, and auto demand—isn't materializing as expected. Instead, a wave of global uncertainties is weighing on the outlook. From wars in Ukraine and the Middle East to inflationary pressures and volatile markets, macro headwinds continue to cloud visibility.

Currency and trade tensions test resilience

Starting in the second quarter of 2025, a stronger New Taiwan dollar and rising tariff tensions have added pressure across the chip sector. While TSMC(2330.TW) mostly exports its products and avoids direct tariff costs, it still feels the pinch from weaker global demand and higher input costs.

"For every 1% gain in the New Taiwan dollar, our operating and gross margins drop by about 0.4%," Wei said. With the currency up nearly 8% this year, that's already shaved more than 3% off margins—a significant hit for a company of TSMC's scale.

Wei said TSMC is committed to maintaining its position at the forefront of global technology while ensuring it commands the value its innovations warrant—a comment widely interpreted as signaling across-the-board price hikes to offset rising costs.

Despite macro headwinds, AI demand remains a key driver. TSMC is ramping up investment in sub-7nm nodes to keep pace with accelerating orders, solidifying its dominance in the foundry space, and outpacing industry growth.

Third quarter outlook reveals strategic positioning

TSMC is scheduled to offer additional insight during its earnings call on July 17, 2025. Analysts anticipate that the company will reaffirm robust revenue projections despite ongoing pressure on gross margins.

Meanwhile, sources suggest that the majority of the cost pass-through measures have already been enacted. With no competitors currently matching its technological capabilities, TSMC continues to maintain a dominant position in pricing and customer demand.

Advanced nodes separate leaders from laggards

As AI chip demand increasingly flows to TSMC—especially for cutting-edge nodes below 7 nanometers—competitors like UMC, GlobalFoundries, VIS, Intel, SMIC, and Samsung are fighting for scraps. SMIC has held up relatively well, backed by Chinese government subsidies and local demand, but its margins continue to lag. For most others, the picture is worse, with profits shrinking or disappearing altogether.

Executives say artificial intelligence has become the main growth driver for the global semiconductor industry, with demand spilling over into equipment, materials, testing, and memory segments.

TSMC continues to push the envelope on advanced nodes below 2 nanometers and high-performance packaging technologies such as CoWoS (Chip-on-Wafer-on-Substrate). This strategic investment has not only widened its technology lead but also ensured robust order visibility throughout its ecosystem. Equipment and materials vendors remain on elevated revenue trajectories, while the surge in demand for high-bandwidth memory (HBM) has positioned firms like SK Hynix and Micron to capture significant upside.

Legacy markets await AI transformation

Not all segments are sharing in the AI boom. Demand in legacy markets—including PCs, smartphones, automotive electronics, and IoT—has yet to undergo the expected upgrade cycle. Despite the proliferation of AI-enabled devices, the absence of a true "killer app" has delayed mass adoption, leaving growth in these verticals muted for now.

The supply chain remains cautiously optimistic, but the lack of broad-based acceleration continues to cap upside potential. Companies reliant on these applications are waiting for AI functionalities to mature and become essential to mainstream consumer behavior.

Pricing power becomes critical differentiator

TSMC's unparalleled pricing power and technological leadership have allowed it to successfully pass on rising costs, shielding its bottom line from currency-related erosion. In contrast, other Taiwanese semiconductor firms, while holding steady order books, are facing a profitability squeeze due to the appreciating New Taiwan dollar.

Unlike TSMC, these firms lack the leverage to implement price increases, forcing them to absorb foreign exchange-related losses. This caps earnings growth across the broader semiconductor supply chain, even as revenue holds up.

Stay up to date with the latest in industry offers by subscribing us. Our newsletter is your key to receiving expert tips.

Arm has opened a new chip design center in Bengaluru focused on advanced 2nm chips. Union IT minister Ashwini Vaishnaw called it a milestone for India's semiconductor goals, making Arm the second

MediaTek announced on September 16, 2025, that it has completed the tape-out of its first flagship system-on-chip (SoC) using TSMC's 2nm process, becoming one of the earliest adopters of the advan

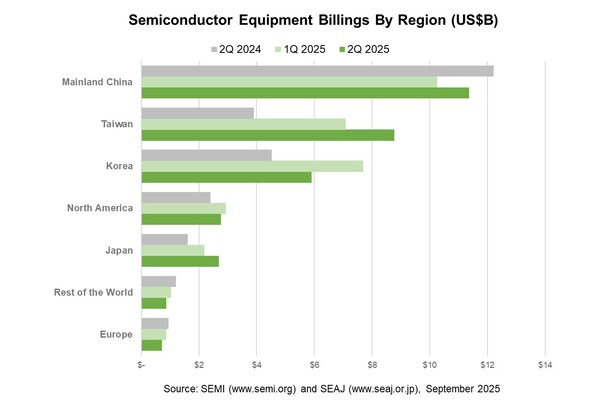

SEMI, the industry association serving the global semiconductor and electronics design and manufacturing supply chain, today announced in its Worldwide Semiconductor Equipment Market Statistics (WWSEM