An unexpected upturn in Q2 has resulted in a better than anticipated result for the 2023 semiconductor market, said Malcolm Penn (pictured) CEO of Future Horizons, at the company’s IFS2023 forecast seminar yesterday.

The industry down-cycle bottomed out in Q1 which was a quarter earlier than the historical trend indicated. “The 18th industry up-cycle has started,” said Penn.

In Q2, the market increased by 6%, instead of taking an expected 5% drop and, with 6% growth forecast in Q3 followed by 1% growth in Q4, the full year forecast improves from an anticipated 22% decline to a 10% decline.

Inventory depletion will not, however, be over before the end of the year, and it could be longer if end demand softens.

Future Horizons’ forecast for next year is a minus 1% Q1, a plus 2.3% Q2, a plus 6.3% Q3, and a minus 1.5% Q4 for full year growth of 9% to deliver a market worth $562 billion.

There should be a return to the historical 8% unit growth trend line next year, however the capex overspend will keep utilisation rates low and excess capacity will keep a tight rein on ASPs.

Stay up to date with the latest in industry offers by subscribing us. Our newsletter is your key to receiving expert tips.

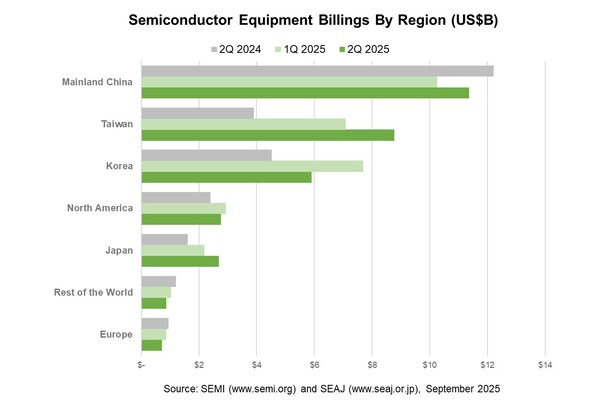

SEMI, the industry association serving the global semiconductor and electronics design and manufacturing supply chain, today announced in its Worldwide Semiconductor Equipment Market Statistics (WWSEM

TSMC's CoWoS capacity remains in high demand, securing its dominant position in advanced semiconductor packaging with rumored gross margins nearing 80%. However, TSMC is proceeding cautiously with

The global semiconductor industry is undergoing a seismic shift, driven by the explosive growth of artificial intelligence (AI) infrastructure. By 2025, the semiconductor market is projected to reach