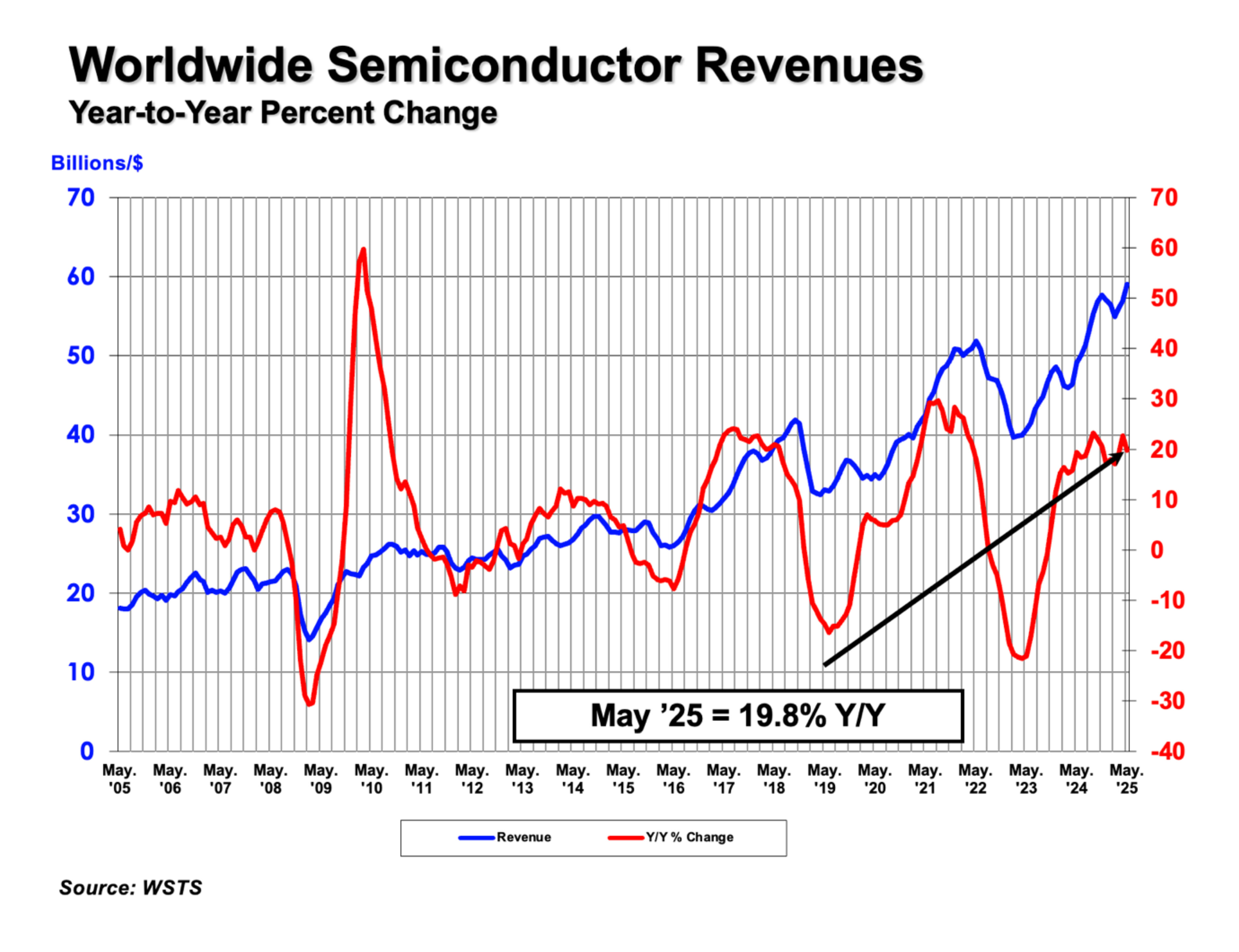

The Semiconductor Industry Association (SIA) announced global semiconductor sales were $59.0 billion during the month of May 2025, an increase of 19.8% compared to the May 2024 total of $49.2 billion and 3.5% more than the April 2025 total of $57.0 billion. Monthly sales are compiled by the World Semiconductor Trade Statistics (WSTS) organization and represent a three-month moving average. SIA represents 99% of the U.S. semiconductor industry by revenue and nearly two-thirds of non-U.S. chip firms.

“Global semiconductor sales remained strong in May, edging above the previous month’s total and remaining well ahead of sales from the same month last year,” said John Neuffer, SIA president and CEO. “Growth in the global chip market continued to be fueled by strong demand in the Americas and Asia Pacific/All Other regions.”

Regionally, year-to-year in May sales were up in the Americas (45.2%), Asia Pacific/All Other (30.5%), China (20.5%), Japan (4.5%), and Europe (4.1%). Month-to-month sales in May increased in Asia Pacific/All Other (6.0%), China (5.4%), Europe (4.0%), the Americas (0.5%), and Japan (0.2%).

Stay up to date with the latest in industry offers by subscribing us. Our newsletter is your key to receiving expert tips.

Samsung Electronics is transforming its Pyeongtaek Campus Line 4 (P4) in South Korea into a manufacturing base focusing on HBM4 production. Analysts indicate that Samsung is increasing the proportion

Samsung scores another major foundry victory, expanding its roster of high-profile clients on advanced nodes. After Tesla selected the company in July to produce its AI6 processor under a $16.5 billio

Texas Instruments, a leading analog IC maker, has released its Q3 2025 results, with its cautious Q4 outlook sparking concerns over the broader semiconductor market. According to Reuters, the company