TSMC's advancements in 2nm technology have been exceedingly seamless, as customers and orders were established some time ago. However, given current geopolitical concerns, industry insiders believe TSMC should downplay or postpone the 2nm Kaohsiung fab and beam-raising event.

On March 31, TSMC will have an expansion and beam-raising ceremony at its fabrication site in Kaohsiung, southern Taiwan, led by EVP and co-COO Y.P. Chyn. Taiwan's Premier, Jung-tai Cho, and several ministers were also invited to attend.

TSMC has already secured clients and orders for its 2nm process, which is thought to be the first GAA architectural process, according to supply chain sources. Nevertheless, the timing of this high-profile event is somewhat sensitive due to the current geopolitical tensions, which means that every move made by TSMC is under scrutiny.

Despite the fact that TSMC has expressed its intention to increase its investments in the US, it is uncertain what additional requirements or variables may arise, the sources indicated. It could be preferable to remain constant in the face of change.

C. C. Wei, chairman and CEO of TSMC, has previously expressed his confidence that the demand for the 2nm process will be unprecedentedly high, with prepared capacity surpassing that of the 3nm process and favorable yield rates anticipated. It is anticipated that mass production will commence in 2025.

Supply chain sources indicate that client orders for TSMC's 2nm process have been confirmed, with foundry bids exceeding US$30,000. Mass production is anticipated for the fourth quarter of 2025.

Plans for 2nm fab expansion

If the original plan is followed, TSMC's F20 fab in Baoshan, Hsinchu (northern Taiwan) will have a monthly capacity of around 30,000 wafers, along with the F22 fab in Kaohsiung, which is also expected to reach 30,000 wafers by early 2026. This means that within six months, TSMC's total 2nm fab capacity will top 60,000 wafers monthly, with projections indicating an increase to 120,000 wafers per month starting in 2027—outpacing the ramp-up speed of the 3nm process that began mass production in the fourth quarter of 2022.

In addition, the phase two facility of TSMC's F21 plant in Arizona, utilizing 2nm process technology, is scheduled to commence commercial production in 2028.

The foundry quotation for the 2nm process has surged to almost US$30,000, with even higher pricing for US facilities, indicating that 2nm will substantially enhance TSMC's revenue in the forthcoming years.

However, plans can't keep up with changes. TSMC initially planned to build three fabs in the US, with one fab migrating from 5nm to 4nm and eventually entering mass production. The second fab is planned to begin operations in the second half of 2026, combining not only the previously announced 3nm but also the A16 and 2nm processes.

The third fab of TSMC's Arizona site is expected to employ advanced process technologies of 2nm or less by 2030, with plans for more fabs and technical improvements ahead.

TSMC recently announced an unexpected increase in investment of US$100 billion in the US, including the construction of three new wafer fabs, two advanced packaging facilities, and an R&D team center, bringing the total investment in the US to US$165 billion.

The supply chain believes that rumors indicate that the second US fab will begin mass production six months earlier than scheduled, giving capacities for 3nm, A16, and 2nm sooner. How TSMC allocates these resources within the existing capacities of its Taiwanese fabs will be a key problem.

Additionally, it may be prudent for TSMC to postpone or minimize the forthcoming ceremony for the 2nm process in Kaohsiung, given the current sensitive circumstances. If the foundry is to navigate this challenging period safely, it should prioritize avoiding attention from major powers.

Stay up to date with the latest in industry offers by subscribing us. Our newsletter is your key to receiving expert tips.

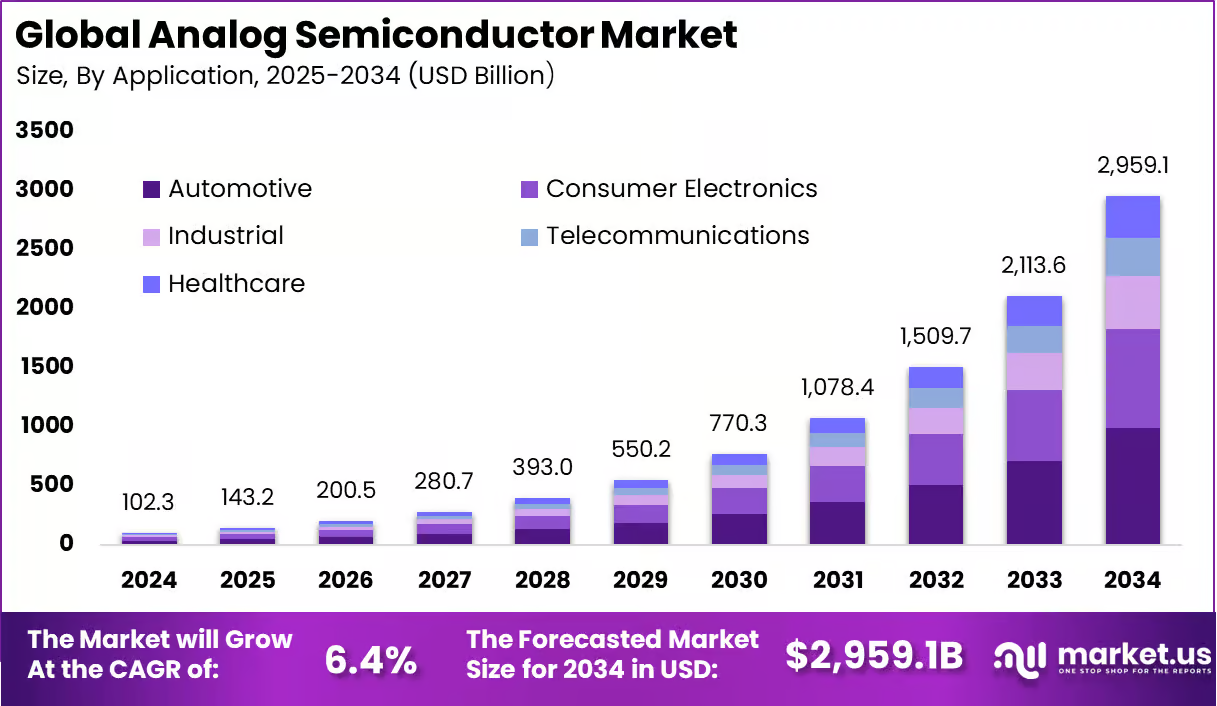

The market size of analog semiconductors was recorded at USD 102.3 billion in 2024 and is projected to register consistent expansion, rising from USD 143.2 billion in 2025 to approximately USD 2,959.1

On 27 July 2025, European Union and United States of America reached a political agreement on tariffs and trade. The transatlantic partnership is a key artery of global commerce and is the most signif

Samsung Electronics will raise contract prices for DRAM and NAND flash in the fourth quarter of 2025, industry sources told Newdaily.co.kr. The move reflects shrinking output of legacy products and su