The global market is watching how TSMC, pressured by the US, might assist Intel's foundry operations, while Samsung Electronics and Rapidus, also facing challenges, may similarly require TSMC's support.

Since Trump assumed office, there has been speculation that Trump targets TSMC to help restore US dominance in semiconductor manufacturing. Efforts include plans to speed up advanced manufacturing expansions in the US and move advanced packaging capacity stateside, with hopes that TSMC can support Intel through various strategies.

If TSMC teams up with Intel on the sub-4nm process node in any form, it could significantly affect Japanese and Korean counterparts, potentially hindering their ability to secure major chip clients. This scenario might lead to financial losses similar to Intel's and increase their deficits while they await government support.

TSMC under Trump's pressure: will it be forced to rescue Intel?

Under pressure from Trump, who accuses Taiwan's TSMC of taking away American chip business, there are threats to alter the CHIPS Act subsidies. Rumors indicate TSMC may have to assist Intel, but this could put TSMC at a disadvantage, forcing it to seek the least harmful option.

TSMC's acquisition of an Intel wafer fab could alleviate Intel's losses by simplifying its factory operations. However, this process could take two to three years to become fully operational and is complicated by both companies being publicly traded.

However, industry insiders argue that Intel's primary challenge is its foundry operations, not its design business, adding that only US government intervention might persuade a company to tackle it due to the high acquisition costs of fabs and patents.

Even if TSMC were to acquire Intel's foundry business, the acquisition's high cost, coupled with valuing fabs and patents, poses significant challenges. Even post-takeover, restructuring would take at least three years. Ongoing quarterly losses add to the difficulties, while TSMC must also factor in US government interests. Rescuing Intel seems nearly impossible.

However, while involvement in Intel's foundry business poses a substantial risk, TSMC would likely comply if the US government insists.

Risks other than Intel

Amid the Trump 2.0, several countries are struggling, with TSMC potentially being the semiconductor industry's biggest casualty.

Industry insiders reveal an air of uncertainty surrounding the future of Samsung and Rapidus. In the competitive market for advanced processes below 7nm, Intel has faced significant challenges, witnessing years of financial losses. While Samsung aspires to surpass its rivals, it remains considerably behind TSMC, struggling to secure external clients or substantial orders for its sub-5nm processes.

If TSMC acquires Intel's foundry business, it could maintain dominance over major US firms' orders with government backing, potentially raising foundry prices for profitability. This would further challenge Samsung's position.

Samsung might expand its collaboration with TSMC, similar to Intel's approach, to maintain its competitiveness in the chip industry beyond memory products. On the other hand, Rapidus plans to start trial production of 2nm technology by April 2025 but faces uncertainties with yield and clients.

With Samsung and Intel dealing with financial challenges, Rapidus, dependent on government and private investments such as those from Sony, might find it difficult to sustain itself. TSMC may eventually be asked to intervene again.

Stay up to date with the latest in industry offers by subscribing us. Our newsletter is your key to receiving expert tips.

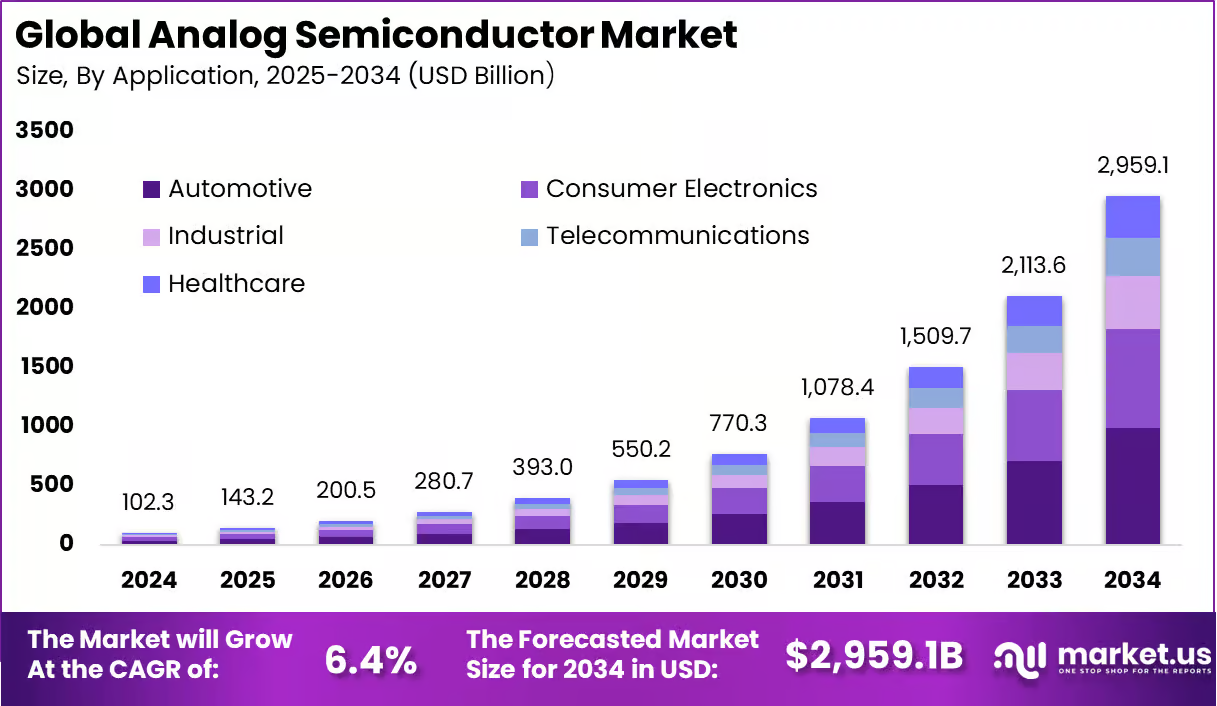

The market size of analog semiconductors was recorded at USD 102.3 billion in 2024 and is projected to register consistent expansion, rising from USD 143.2 billion in 2025 to approximately USD 2,959.1

On 27 July 2025, European Union and United States of America reached a political agreement on tariffs and trade. The transatlantic partnership is a key artery of global commerce and is the most signif

Samsung Electronics will raise contract prices for DRAM and NAND flash in the fourth quarter of 2025, industry sources told Newdaily.co.kr. The move reflects shrinking output of legacy products and su