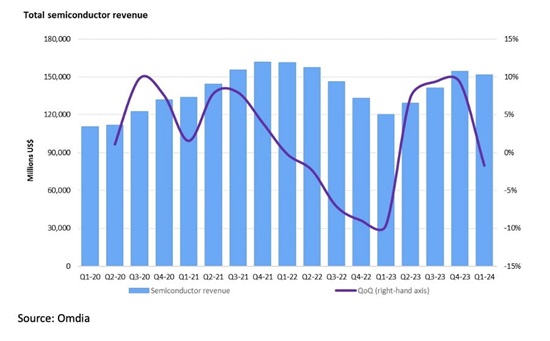

The Q1 semiconductor market fell about 2% to $151.5 billion, says Omdia.

Consumer fell 10.4% q-o-q, industrial fell 8.5% and auto dropped 5.1% but data processing rose 3.7%, driven by demand for NVIDIA’s chips and other AI-related products.

NVIDIA expanded its market share by more than two percentage points and now represents 14.5% of the total semiconductor market revenues overtaking Samsung and Intel who collectively hold 18.6%.

Hynix and Micron rose in their market share rankings as memory recovered.

After 13 consecutive quarters of revenue growth, starting in 3Q20, auto experienced a slight downturn decline of 0.6% in 4Q23 which deepened into a 5.1% Q1 drop.

Omdia’s Global Semiconductor Manufacturing Market Tracker (GMMT) and the Pure Play Foundry Tracker (4Q23 reports), find that the combined factory utilisations (IDM + Foundry) saw utilisation rates fall in 2H22 and, despite semiconductor revenue growing throughout 2023, fab utilization rates have remained in the low 80% figures.

“Utilization rates began a slight uptick in 2H23 as the market began seeking equilibrium,” says Omdia’s Craig Stice, “however, it has yet to materialize as traditional demand patterns have not fully emerged.”

Stay up to date with the latest in industry offers by subscribing us. Our newsletter is your key to receiving expert tips.

Global semiconductor sales reached $64.9 billion in August 2025, marking a remarkable 21.7% increase compared to the same period the previous year. This performance underscores the strength of a secto

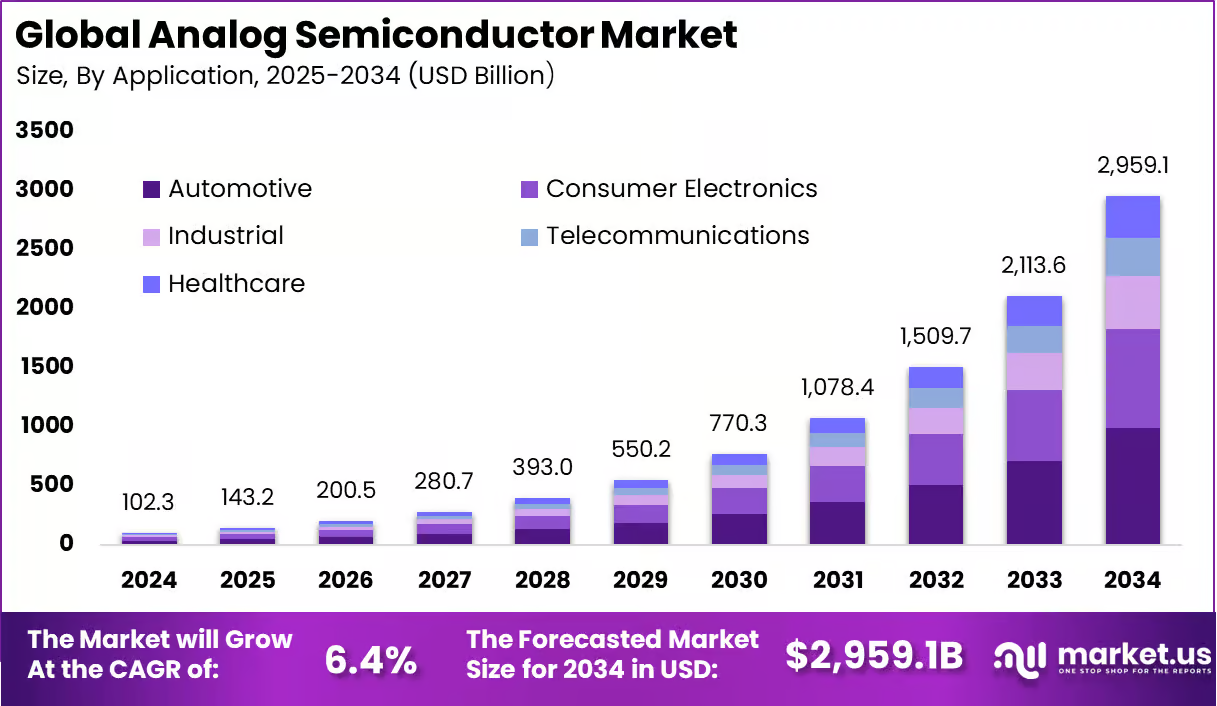

The market size of analog semiconductors was recorded at USD 102.3 billion in 2024 and is projected to register consistent expansion, rising from USD 143.2 billion in 2025 to approximately USD 2,959.1

On 27 July 2025, European Union and United States of America reached a political agreement on tariffs and trade. The transatlantic partnership is a key artery of global commerce and is the most signif