China is to put a third tranche of cash, worth $47.5 billion, into the Big Fund – the colloquial name for the China Integrated Circuit Industry Investment Fund.

The Big Fund was set up in 2014 with $19.2 billion. In 2019, a second tranche of cash worth $28.2 billion was put into the fund.

The disbursement of those funds led to corruption and incompetence charges. Lu Jun, CEO of Sino IC Capital, which managed the fund was indicted on bribery charges last March, and many awards were made to companies with no experience in the semiconductor industry.

The original, 2014, remit of the fund was to bring the country’s semiconductor industry up to international standards by 2030 with investments in chip manufacturing, design, manufacturing equipment, and materials.

Recently it was thought that China had decided to concentrate on trailing edge chips and flood the market with them in an attempt to undermine the economics of the western chip companies.

However, this new tranche of cash may mean that it has reverted to its original aim of catching up with the West.

Stay up to date with the latest in industry offers by subscribing us. Our newsletter is your key to receiving expert tips.

South Korea’s semiconductor industry is experiencing a significant investment surge, driven by the explosive demand for artificial intelligence (AI) chips and bolstered by strong government support. C

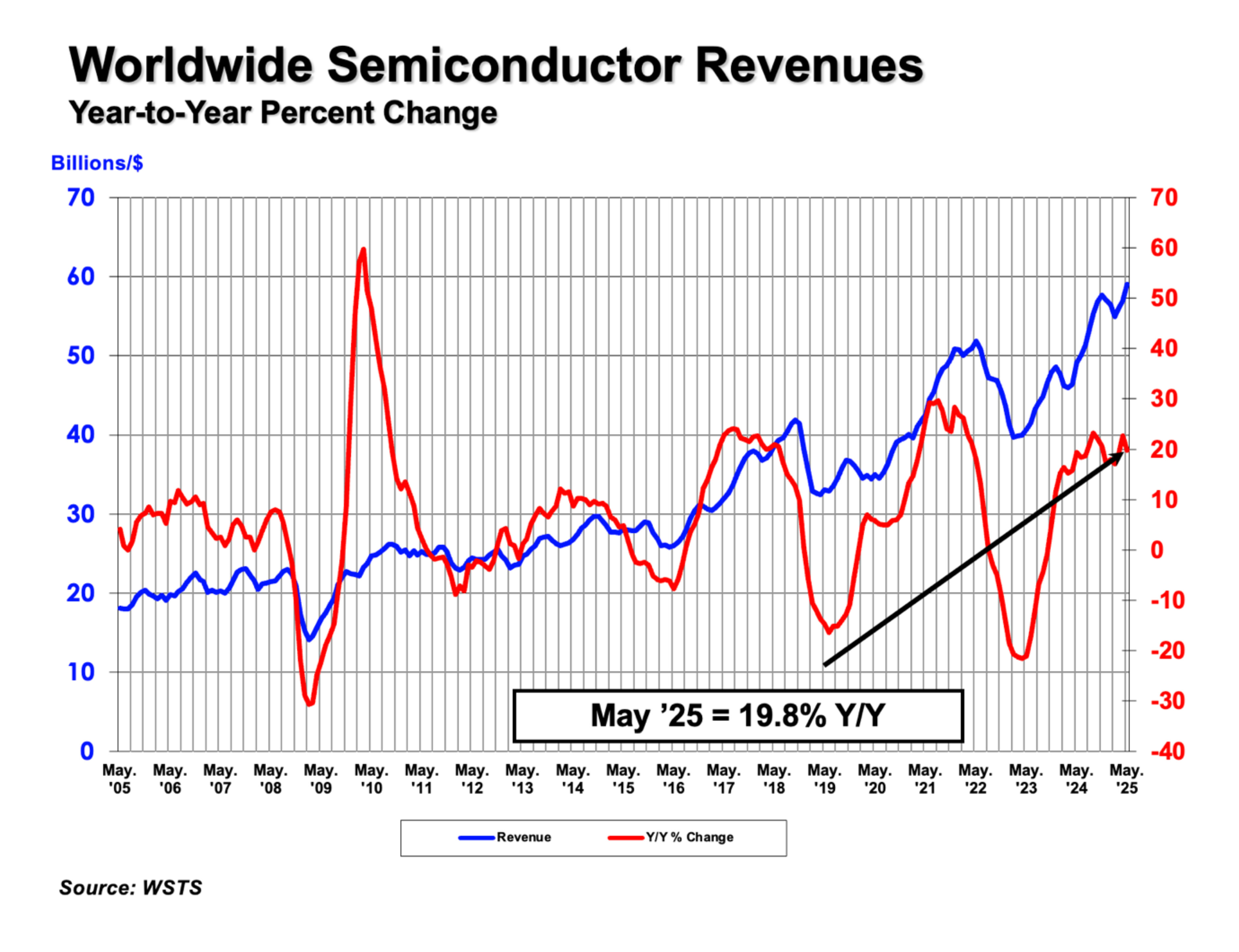

The Semiconductor Industry Association (SIA) announced global semiconductor sales were $59.0 billion during the month of May 2025, an increase of 19.8% compared to the May 2024 total of $49.2 billion

Intel is reportedly reconsidering its foundry strategy under new CEO Lip-Bu Tan, with plans to shift focus from its 18A (1.8nm-class) process node to the next-generation 14A (1.4nm-class) technology.