Nvidia had revenue for the three months ending April 30 (Q1FY25) up 268% at $26 billion and profit up 628% at $14.9 billion. Datacentre sales were up 427% y-o-y at $22.6 billion.

For next quarter (FYQ2). Nvidia forecasts revenue of $28 billion, give or take 2%, with a gross margin of 75.5%.

“The next industrial revolution has begun — companies and countries are partnering with Nvidia to shift the trillion-dollar traditional data centers to accelerated computing and build a new type of data center — AI factories — to produce a new commodity: artificial intelligence,” said Jensen Huang (pictured), “AI will bring significant productivity gains to nearly every industry and help companies be more cost- and energy-efficient, while expanding revenue opportunities.

“Our data center growth was fueled by strong and accelerating demand for generative AI training and inference on the Hopper platform. Beyond cloud service providers, generative AI has expanded to consumer internet companies, and enterprise, sovereign AI, automotive and healthcare customers, creating multiple multibillion-dollar vertical markets,” said Huang.

“We are poised for our next wave of growth,” added Huang, “the Blackwell platform is in full production and forms the foundation for trillion-parameter-scale generative AI. Spectrum-X opens a brand-new market for us to bring large-scale AI to Ethernet-only data centers. And Nvidia NIM is our new software offering that delivers enterprise-grade, optimized generative AI to run on CUDA everywhere — from the cloud to on-prem data centers and RTX AI PCs — through our expansive network of ecosystem partners.”

Nvidia’s market cap has increased by over $1 trillion so far this year. At the end of 2022, it was $359 million, now it’s $2.33 trillion.

Stay up to date with the latest in industry offers by subscribing us. Our newsletter is your key to receiving expert tips.

South Korea’s semiconductor industry is experiencing a significant investment surge, driven by the explosive demand for artificial intelligence (AI) chips and bolstered by strong government support. C

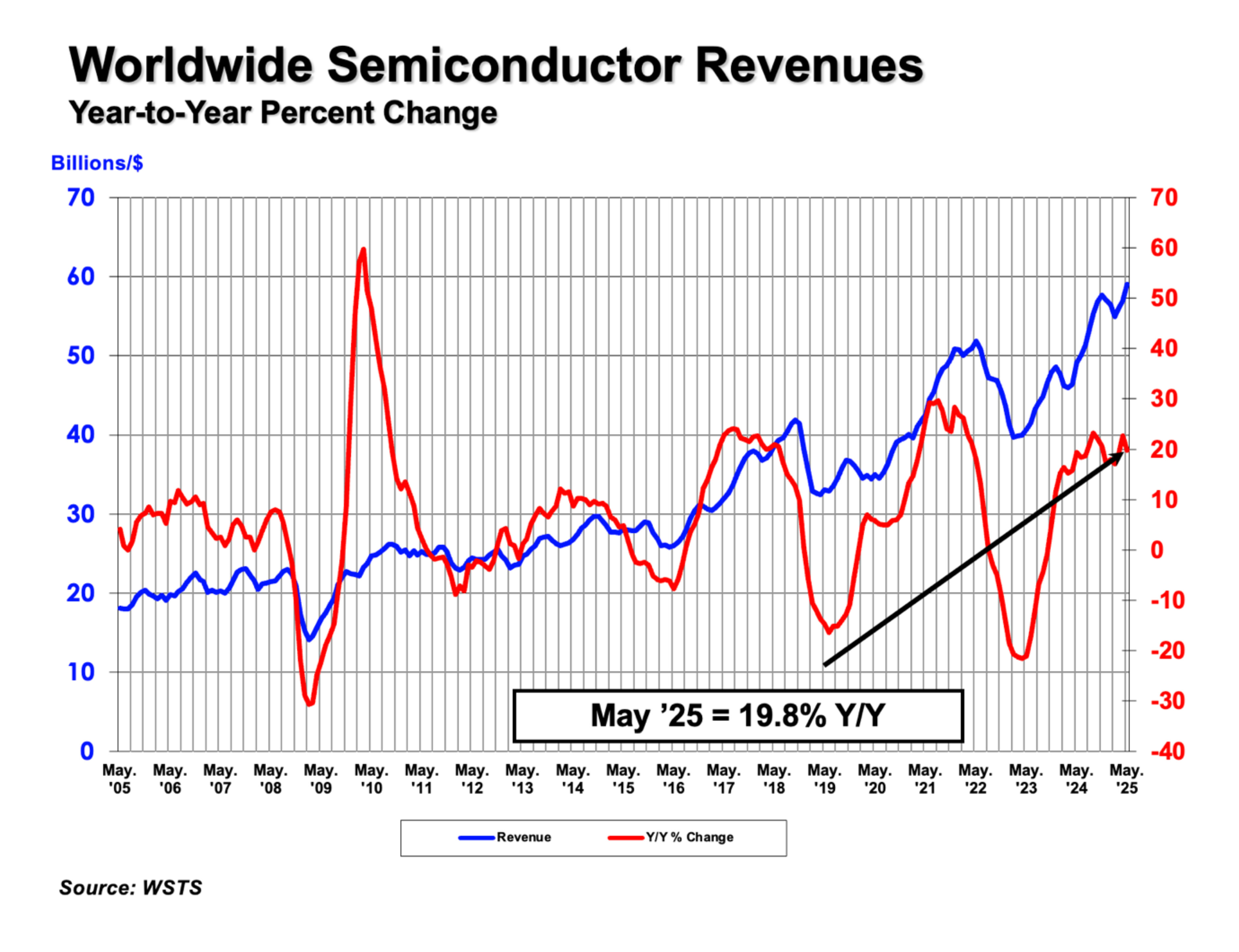

The Semiconductor Industry Association (SIA) announced global semiconductor sales were $59.0 billion during the month of May 2025, an increase of 19.8% compared to the May 2024 total of $49.2 billion

Intel is reportedly reconsidering its foundry strategy under new CEO Lip-Bu Tan, with plans to shift focus from its 18A (1.8nm-class) process node to the next-generation 14A (1.4nm-class) technology.