Global passenger EV (BEV+PHEV) sales grew 18% YoY in Q1 2024, according to Counterpoint’s EV Market Tracker. While BEV sales increased by 7% YoY during the quarter, PHEV sales grew 46% YoY.

China remained the global leader in Q1, followed by the US and Europe. China’s EV sales grew 28% YoY, while the US recorded a modest 2% YoY growth.

Overall EV sales in the US grew, but BEV sales declined by 3% YoY.

Leading EV players like Tesla and BYD have managed to reduce their BEV manufacturing costs, allowing them to offer competitive prices.

This has put pressure on other automakers like Ford and GM which are struggling to reduce their manufacturing costs.

These companies have introduced BEVs at competitive prices but are facing significant losses.

To mitigate these losses, traditional automakers are adjusting their BEV targets and prioritizing PHEVs.

The increased adoption of PHEVs is expected to continue until these automakers develop strategies to reduce BEV manufacturing costs and meet emission targets to avoid fines.

PHEVs are available in different body types, like sedans, SUVs, and crossover. Buying mid-priced PHEVs is a more logical choice for consumers since their prices are comparable to or lower than most of BEVs. In this category, PHEVs with the SUV body type are more in demand.

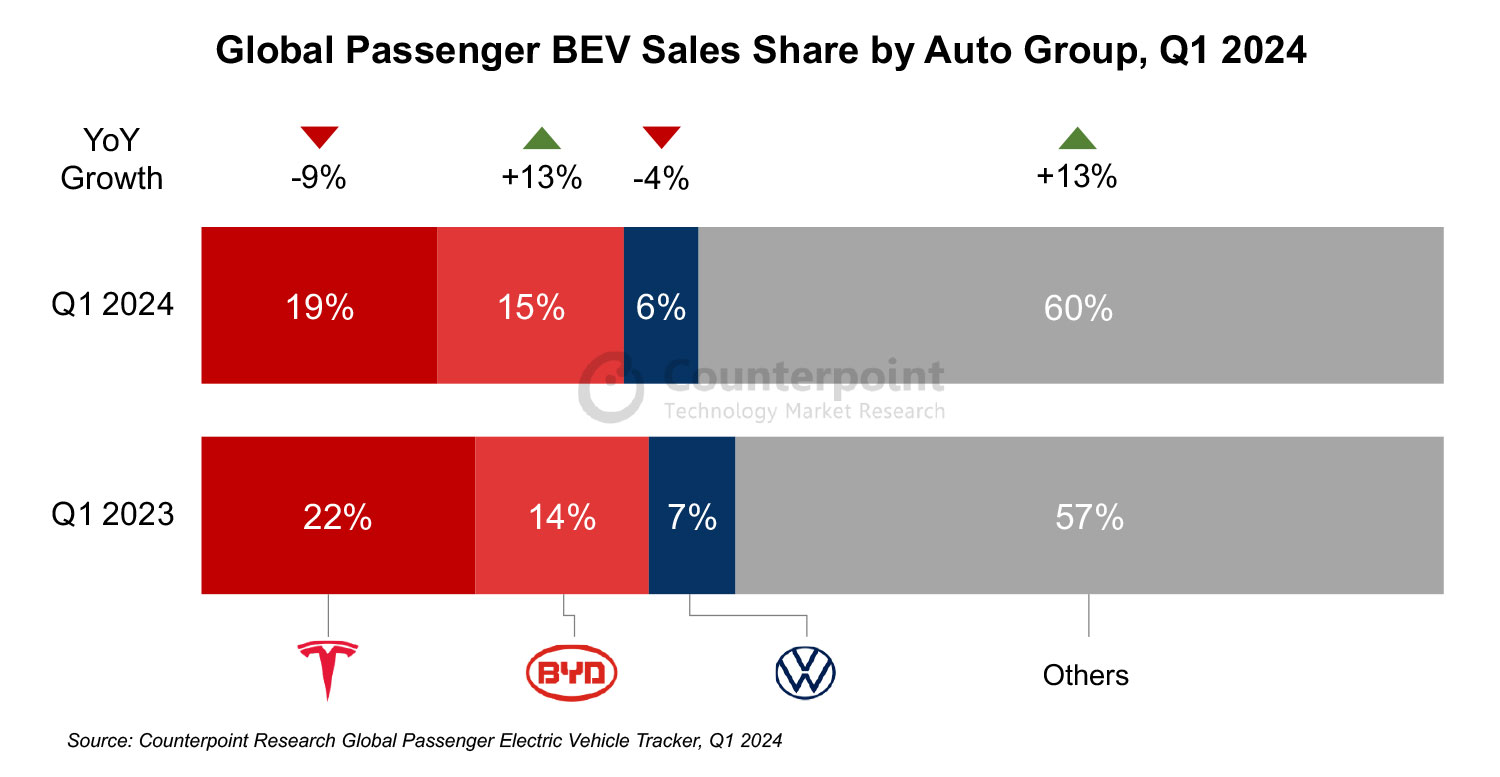

Despite a 9% YoY decline, Tesla regained the top position in BEV sales in Q1 2024, commanding a 19% market share.

Following closely behind were the BYD Group and Volkswagen Group. Notably, among the top three OEMs, only BYD achieved growth (13% YoY), while both Tesla and Volkswagen experienced declines of 9% and 4% YoY, respectively.

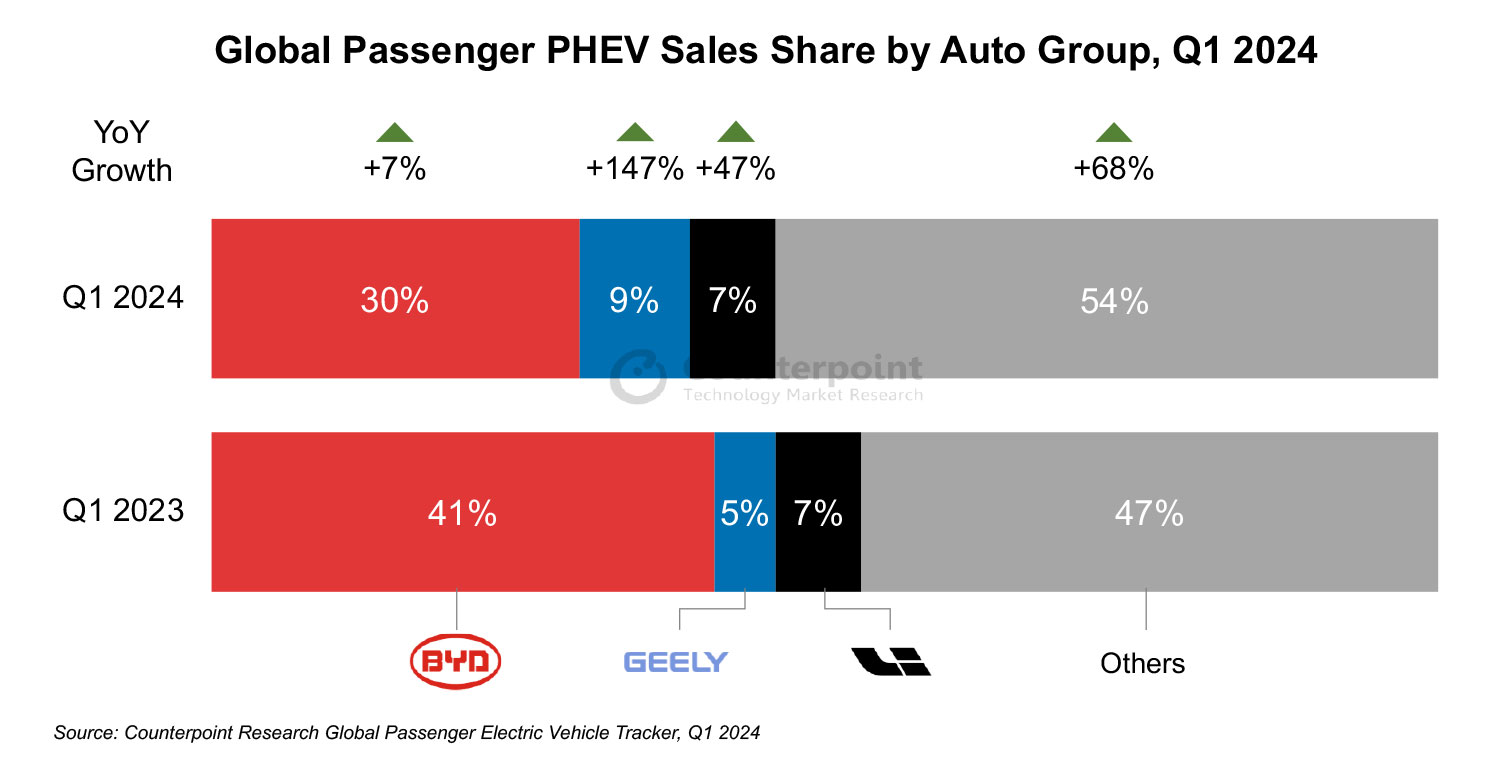

BYD also excelled in the PHEV segment, accounting for nearly one-third of global PHEV sales, followed by Geely Holdings and Li Auto. BYD exported almost 100,000 EVs, including PHEVs, with a substantial 152% YoY growth, primarily in the SEA region.

BYD’s export performance, especially in the SEA region, highlights the growing global demand for EVs, including PHEVs.

However, Tesla, which has only BEV fleets, currently faces challenges such as production delays and weakened early-adopter demand, which initially boosted its sales in advanced markets.”

Stay up to date with the latest in industry offers by subscribing us. Our newsletter is your key to receiving expert tips.

South Korea’s semiconductor industry is experiencing a significant investment surge, driven by the explosive demand for artificial intelligence (AI) chips and bolstered by strong government support. C

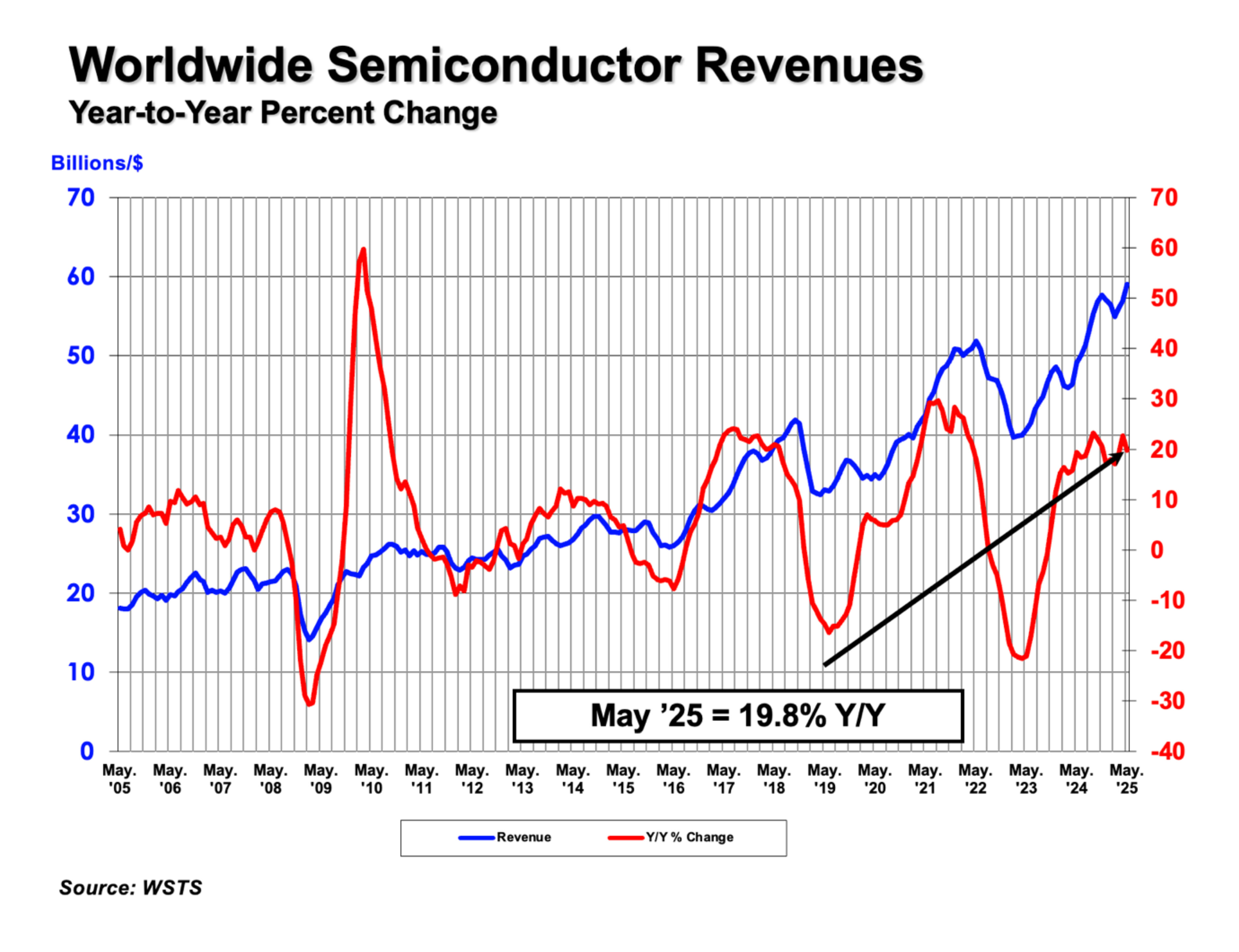

The Semiconductor Industry Association (SIA) announced global semiconductor sales were $59.0 billion during the month of May 2025, an increase of 19.8% compared to the May 2024 total of $49.2 billion

Intel is reportedly reconsidering its foundry strategy under new CEO Lip-Bu Tan, with plans to shift focus from its 18A (1.8nm-class) process node to the next-generation 14A (1.4nm-class) technology.