US president Joe Biden has imposed a 100% tariff on Chinese EVs imported into the US and a 50% tariff on semiconductors.

Both tariffs are in response to an anticipated flood of cheap EVs and chips.

“We know the PRC’s playbook and cannot allow China to undermine U.S. supply chains by flooding the market with artificially cheap products that hurt American businesses and workers,” says US Secretary for Commerce Gina Raimondo.

China js reported to have a 7-8 million surplus of EVs from government subsidised production and is looking for markets for them. It is said to have built a fleet of Ro-Ro ships capable of taking 7,000 EVs at a time to foreign markets.

In semiconductors it is said to be spending 47% of the world’s total capex on new capacity and is bringing 18 new fabs on-line this year. By 2030 it is expected to have doubled capacity.

These moves are aimed at flooding foreign markets with cheap chips and undermining the Western semiconductor industry, say analysts.

The EU has been considering its response to the threat of Chinese surpluses being dumped in Europe and is expected to report in November. However the German car industry is said to be against market restrictions on Chinese EVs because it doesn’t want to lose the access it enjoys to the China market.

Stay up to date with the latest in industry offers by subscribing us. Our newsletter is your key to receiving expert tips.

MediaTek announced on September 16, 2025, that it has completed the tape-out of its first flagship system-on-chip (SoC) using TSMC's 2nm process, becoming one of the earliest adopters of the advan

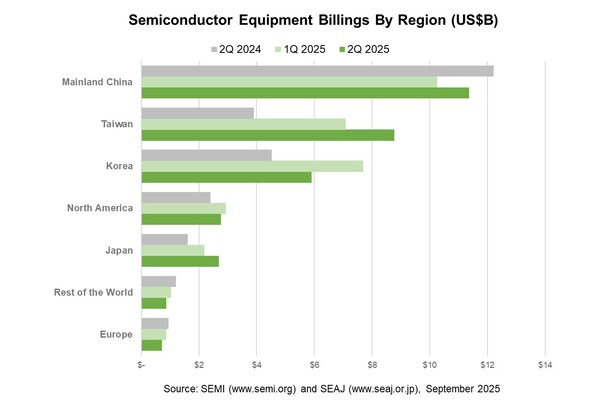

SEMI, the industry association serving the global semiconductor and electronics design and manufacturing supply chain, today announced in its Worldwide Semiconductor Equipment Market Statistics (WWSEM

TSMC's CoWoS capacity remains in high demand, securing its dominant position in advanced semiconductor packaging with rumored gross margins nearing 80%. However, TSMC is proceeding cautiously with