The battery cell supply chain is primarily led by Asian players: China accounting for 57%, with South Korea at 25% and Japan at 7% following.

In the coming years, there will be a growing need to recycle tons of end-of-life xEV battery packs.

The total annual demand for lithium-ion battery packs used in PHEVs and BEVs is projected to experience substantial growth, surging from approximately 430 GWh in 2022 to roughly 1,500 GWh by 2028, says Yole.ev

This represents a more than threefold increase in demand. The primary driver of this demand will be BEV applications, which are expected to require a battery capacity of 1,370 GWh, constituting 90% of the total market in terms of GWh by 2028.

“The overall annual market for Li-ion battery packs designed for BEVs and PHEVs is anticipated to expand from about $70 billion in 2022 to approximately $180 billion by 2028,” says Yole’s Shalu Agarwal, “in 2022, CATL from China is the leading manufacturer of EV battery cells, followed by LG Energy Solution, BYD from China, and Panasonic from Japan. While Europe focuses on establishing local cell suppliers, US automakers primarily collaborate with Asian suppliers, like Tesla partnering with Panasonic, LG Energy Solution, and CATL, and GM Motors with LG Energy Solution.”

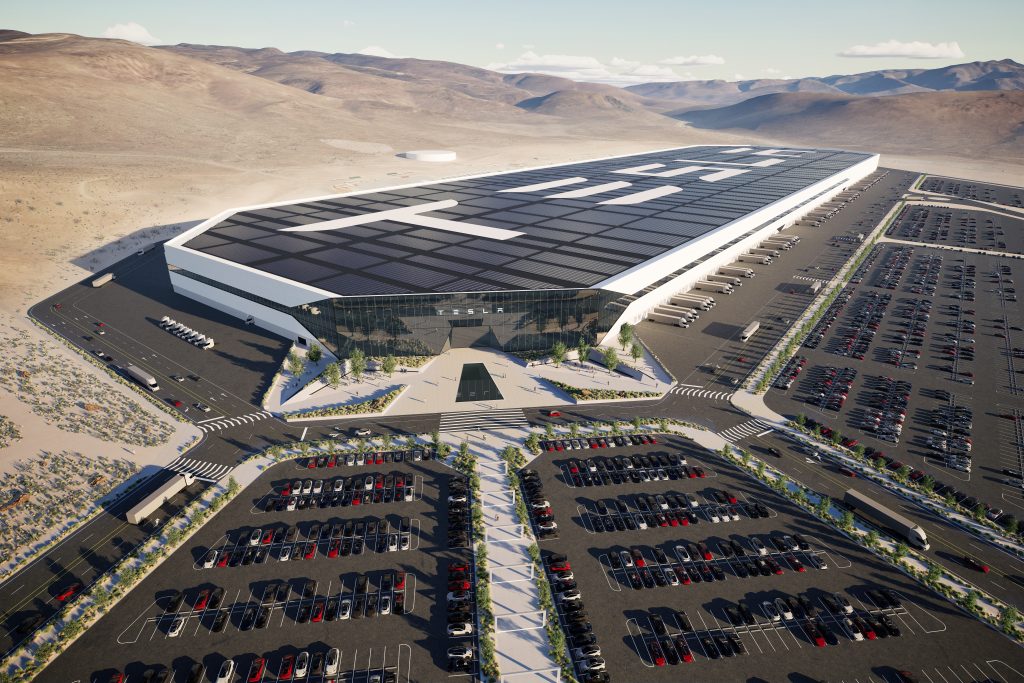

Battery production capacity is rapidly expanding, with manufacturers announcing expansion plans, particularly in regions with xEV manufacturing facilities.

Many Chinese players, including BYD, CATL, Gotion, and EVE, plan to increase capacity in countries like India, Indonesia, Thailand, and Vietnam.

BATTERY PACK FOR AUTOMOTIVE 2021-2022 MARKET SHARES

The urgent need for increased battery cell manufacturing capacity arises due to the surging demand for EVs.

Projections suggest global battery manufacturing capacity will exceed 6 TWh by 2030, four times the demand, although some announced projects may never materialize.

However, overreliance on China could pose long-term challenges for startups and smaller battery manufacturers.

Europe and the USA face cost disadvantages in the EV battery industry compared to China, mainly due to higher manufacturing costs.

This cost discrepancy is linked to lower material costs in China, driven by advanced supply chains with vertical integration of material supply, processing, and manufacturing.

The relationship between car OEMs and cell suppliers is complex and often involves multiple partnerships. Vertical integration in battery manufacturing is increasing for cost efficiency and supply security reasons.

Both cell makers and automakers are seeking strategic deals with raw material mining companies to secure their supply chains.

Low cobalt-content batteries like NMC 811 and cobalt-free LFP batteries are highly sought-after cell chemistries. Initially used by Chinese companies, LFP cells are now adopted by various global automakers.

The trend is shifting towards a cell-to-pack approach to enhance energy density and reduce weight in battery packs, with some companies like Tesla, BYD, and Leap Motor integrating cells directly into the vehicle chassis.

Battery recycling has become a strategic focus for many battery manufacturers and car OEMs. Players are venturing into the recycling sector through subsidiaries, in-house processes, partnerships, or joint ventures with battery recyclers.

Stay up to date with the latest in industry offers by subscribing us. Our newsletter is your key to receiving expert tips.

Samsung Electronics is transforming its Pyeongtaek Campus Line 4 (P4) in South Korea into a manufacturing base focusing on HBM4 production. Analysts indicate that Samsung is increasing the proportion

Samsung scores another major foundry victory, expanding its roster of high-profile clients on advanced nodes. After Tesla selected the company in July to produce its AI6 processor under a $16.5 billio

Texas Instruments, a leading analog IC maker, has released its Q3 2025 results, with its cautious Q4 outlook sparking concerns over the broader semiconductor market. According to Reuters, the company