The memory market has shown signs of stabilization after a notable downturn, with recent price increases indicating a positive shift. This transition comes in the wake of manufacturers announcing impending price hikes, resulting in a rebound in spot market quotes for DRAM and NAND Flash products over the past month.

Particularly, DDR4 products, which had previously faced an oversupply, have begun to recover since March. Reflecting these emerging market dynamics, CXMT, a leading Chinese DRAM manufacturer renowned for its competitive pricing, has decided to raise its DDR4 prices to foster industry stability.

Major players such as SanDisk, Micron, YMTC, Samsung Electronics, and SK Hynix have also indicated plans for price increases. This has raised alarm among supply chain stakeholders, many of whom regret not securing inventory sooner. While initial optimism about rising prices characterized the first half of 2024, the narrative dramatically shifted in the second quarter. Weak end-user demand during the latter part of the year hampered earlier momentum, leading prices to revert to previous levels.

The memory sector's recovery has outpaced expectations, largely driven by robust demand in the AI field and a balanced supply environment. This unexpectedly strong recovery has propelled price hikes to occur earlier than anticipated, prompting concerns from market observers regarding potential short-term overheating.

In the face of these developments, leading NAND producers stress the necessity of maintaining a gross margin of at least 35% to ensure sufficient funding for future technology investments and capacity expansions. However, a brisk increase in prices may dampen demand, risking negative consequences.

Kioxia aims to achieve profitability in the fiscal year 2024, which runs from April 2024 to March 2025, while planning to cut equipment investments by approximately 25%. Conversely, SK Hynix, Micron, and Samsung have reported improved operational performance, primarily due to increased sales of HBM products amid a slowdown in NAND investments.

Micron has projected record revenues between US$8.6 billion and US$9 billion for the third quarter of fiscal 2025, expecting gross margins between 35.5% and 37.5%. However, margins for its other product lines remain suboptimal without contributions from high bandwidth memory.

Continued market fluctuations

While price hikes appear imminent, downstream stakeholders may struggle to quickly build up their inventories. Micron's announcements of price increases suggest a strategy aimed at discouraging stockpiling against a potential rise in prices. Should order volumes exceed expectations, companies could face canceled or delayed shipments, potentially leaving those with slower-moving products unable to replenish their stock amid soaring prices.

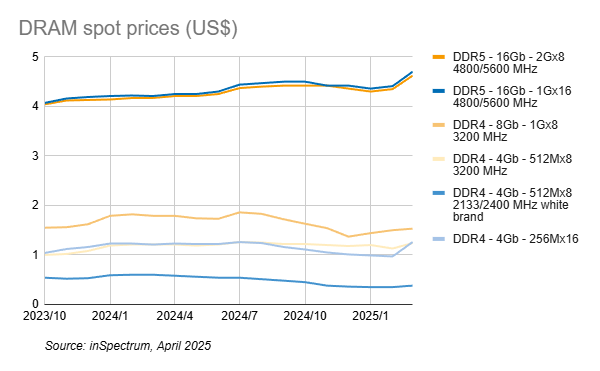

Recent spot market data indicate that DRAM prices have held firm, with a significant increase in DDR5 prices leading to heightened interest in DDR4 chips. The price of 8GB DDR4 has surged considerably since March, while 16GB DDR5 prices have appreciated by an estimated 8% monthly since March, in contrast to a more modest 4% rise in February.

Despite a drop in DDR4 prices earlier, March witnessed a recovery, with 8GB DDR4 climbing by 12% and 16GB DDR4 increasing by 9%. Analysts speculate that CXMT, which had previously reduced prices, is now poised to raise DDR4 contract prices in line with upward market trends.

In March, spot prices for DDR3 4GB products saw a rise of approximately 10%, driven by reduced supply and improving market conditions. Likewise, the spot price for Flash Wafer 512GB TLC experienced an approximate 6% increase, a substantial change compared to a negligible rise of less than 1% in February. The industry anticipates that contract prices for flash wafers will increase by at least 10% in the second quarter, affirming a clear upward trend.

A strategy of withholding supplies in the spot market has limited transaction volumes, prompting module manufacturers to deplete their inventories. This situation has incentivized various manufacturers to ramp up their stocking efforts. By the fourth quarter of 2024, some companies had started securing low-cost materials in advance; for instance, Apacer had begun accumulating stocks of DDR3 and DDR4.

Meanwhile, Adata maintains a positive outlook for a market recovery in the upcoming first quarter, with current DRAM inventories at around 16 weeks and NAND at approximately 12 weeks.

Stay up to date with the latest in industry offers by subscribing us. Our newsletter is your key to receiving expert tips.

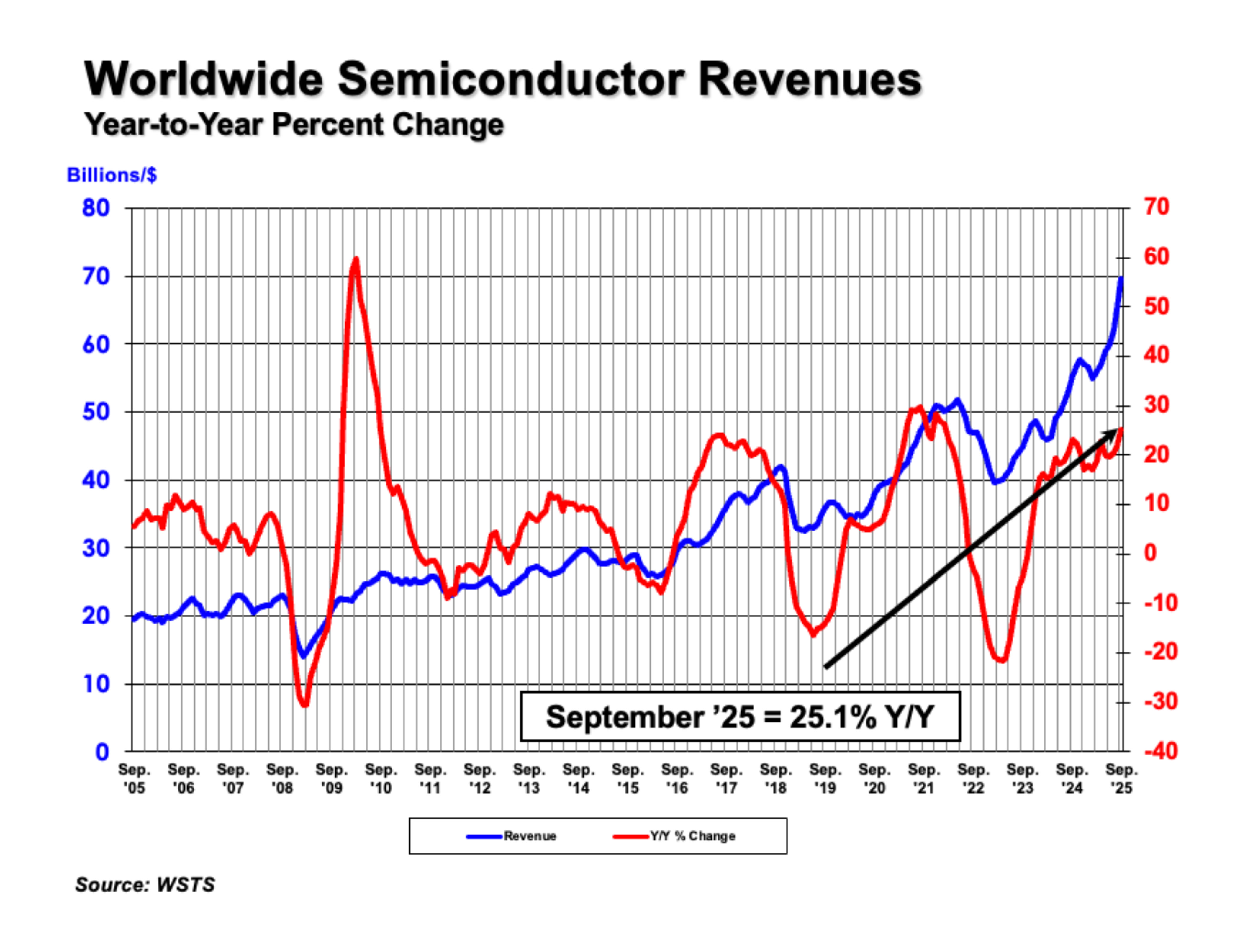

WASHINGTON—November 3, 2025—The Semiconductor Industry Association (SIA) today announced global semiconductor sales were $208.4 billion during the third quarter of 2025, an increase of 15.8% compared

Samsung Electronics is transforming its Pyeongtaek Campus Line 4 (P4) in South Korea into a manufacturing base focusing on HBM4 production. Analysts indicate that Samsung is increasing the proportion

Samsung scores another major foundry victory, expanding its roster of high-profile clients on advanced nodes. After Tesla selected the company in July to produce its AI6 processor under a $16.5 billio