The recovery in 2024 will be slow, and the world will face severe inflation, which will reduce people’s desire to consume, thereby affecting the development of the global market; coupled with geopolitical issues, various uncertainties have affected the development trend of the semiconductor industry. Fortunately, generative artificial intelligence (AI) has become popular and will become the driving force of the semiconductor industry in 2025.

The rise of generative AI applications is driving a surge in demand for computational power, which directly translates to a need for more advanced semiconductors. This demand is expected to push the industry towards a new growth phase in 2025, and the integration of generative AI into consumer and business applications will create new market opportunities for these semiconductor chips, in areas like AI-enabled smartphones and PCs. For example, by 2025, it’s projected that over 30% of smartphones shipped will be equipped with on-device generative AI capabilities.

As generative AI becomes more integrated into business processes, new markets will emerge for AI-driven applications across sectors like healthcare, finance, and creative industries. Growing smart cities and IoT initiatives will create demand for IoT devices and sensors, leading to new applications in urban management, energy efficiency, and public safety. And in automotive the shift towards electric and autonomous vehicles will drive demand for advanced semiconductors, particularly in areas like battery management systems and AI for navigation and safety.

The impact of these new applications on the semiconductor industry will be that more companies will move towards in-house chip design to tailor solutions for specific applications, enhancing performance and reducing dependency on external costly chip suppliers.

Specifically for generative AI, there will be ongoing development of lightweight and efficient generative models optimized for edge deployment. By 2025, we may see breakthroughs in techniques like:

Quantization and pruning: Resulting in smaller models to be deployed on resource-constrained devices without sacrificing accuracy.

Knowledge distillation: Improvements in this area could lead to more efficient transfer of knowledge from large, cloud-based models to smaller, edge-optimized versions, ensuring high performance even with limited resources.

Novel architectures: Research into new model architectures specifically designed for edge deployments could yield smaller, more efficient models capable of handling complex generative tasks.

Automated model optimization: Tools that automatically optimize models for specific edge hardware, reducing the need for manual intervention and streamlining the deployment process.

Increased demand for specialized AI hardware, with emphasis on energy-efficient solutions, and the rise of licensable hardware and open-source software models.

One of the main challenges with generative AI applications becoming more prevalent is that the energy consumption of data centers is expected to double by 2030. This poses a challenge for the semiconductor industry to innovate not just in performance but also in energy efficiency to mitigate environmental impacts. This will drive a sharp increase in deploying generative AI workloads on edge devices, fueled by the need for real-time processing, enhanced privacy, reduced reliance on cloud infrastructure, and lower energy consumption. As generative AI applications become more prevalent, there will be a growing demand for edge devices capable of running these complex AI models efficiently. In 2025 we will likely see new opportunities for semiconductor companies to develop and market specialized hardware, such as neural processing units (NPUs), specifically designed for generative AI applications at the edge with a focus on energy efficiency.

Semiconductor companies should prioritize the development of energy-efficient chips, including the adoption of licensable, industry-standard NPU solutions that do not incur any regulatory restrictions to reduce overall risk. It is important to increase the collaboration between semiconductor companies, LLM model vendors, research institutions, and regulatory bodies to establish industry-wide standards for measuring and reporting the energy consumption of AI models, develop best practices for energy-efficient AI deployment, while considering factors like hardware selection, model optimization, and data management.

Another aspect that the semiconductor industry needs to address is the challenge of model compatibility across a wide range of edge devices. Generative AI models optimized for one specific hardware platform might not perform as well on others, leading to inconsistent performance and hindering widespread adoption. This requires the development of standardized frameworks and tools that promote interoperability and ensure consistent performance across diverse hardware architectures and processing capabilities.

Stay up to date with the latest in industry offers by subscribing us. Our newsletter is your key to receiving expert tips.

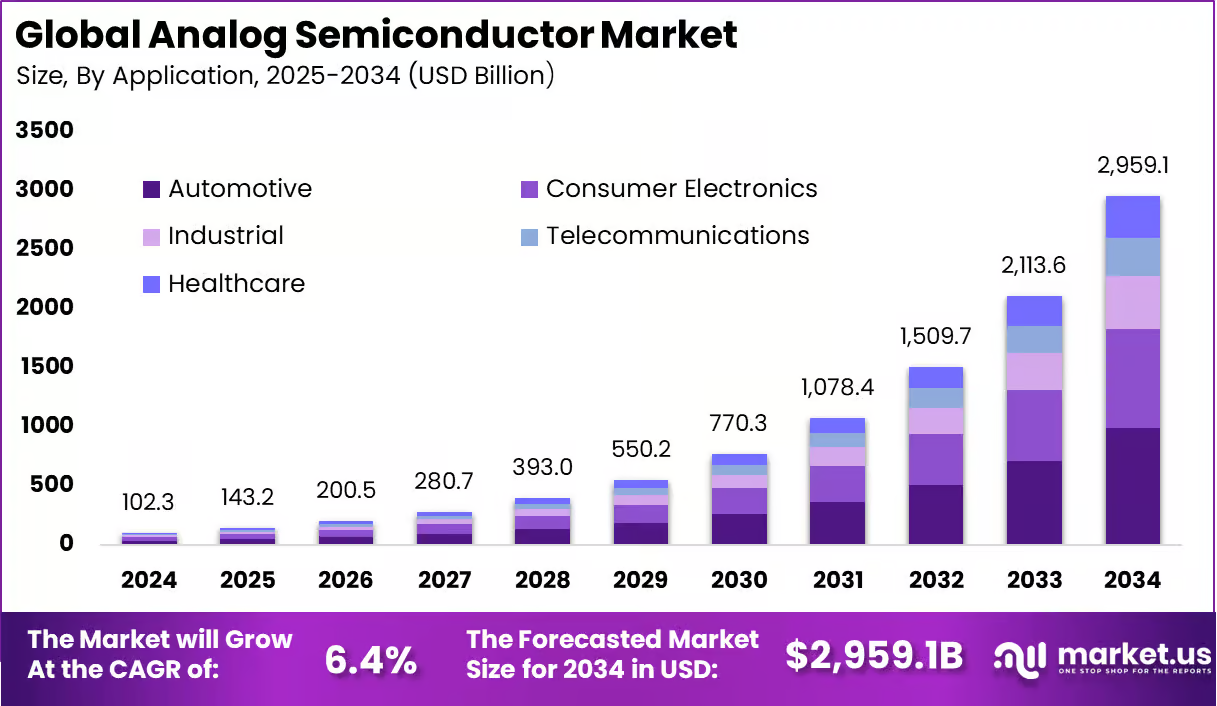

The market size of analog semiconductors was recorded at USD 102.3 billion in 2024 and is projected to register consistent expansion, rising from USD 143.2 billion in 2025 to approximately USD 2,959.1

On 27 July 2025, European Union and United States of America reached a political agreement on tariffs and trade. The transatlantic partnership is a key artery of global commerce and is the most signif

Samsung Electronics will raise contract prices for DRAM and NAND flash in the fourth quarter of 2025, industry sources told Newdaily.co.kr. The move reflects shrinking output of legacy products and su