While Intel’s Lunar Lake struggled in the market, AMD has made significant strides in its CPU business. AMD has partnered with Microsoft to develop next-generation Azure virtual machines.

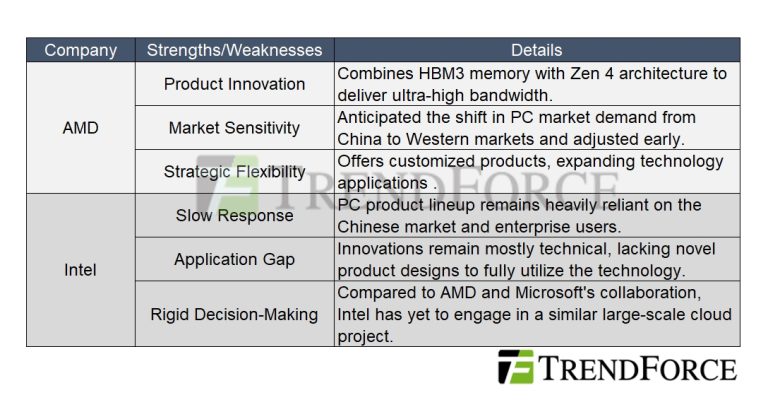

Regarding this, TrendForce points out that AMD’s success is built on product innovation, market sensitivity, and flexible strategy.

AMD focuses precisely on product innovation for high-performance computing needs

AMD has effectively addressed the core needs of the server market for high-performance computing (HPC) and data centers by offering high-performance, high-core-count processors built on its Zen architecture.

In the server market, AMD has combined HBM3 memory with the Zen 4 architecture to deliver ultra-high bandwidth. Furthermore, it provided tailored solutions, such as custom processors for HBv5 VM, earning the trust of major clients like Azure.

According to TrendForce, AMD’s highly targeted product strategy not only ensures its leadership in performance but also strengthens its position in high-value market segments.

AMD’s market sensitivity and rapid adaptation to structural changes

AMD successfully identified the shift in PC market demand from China to Western markets, and the strong growth in the desktop and high-performance PC segments.

According to TrendForce, AMD is flexible in adapting to market changes, leading to its steadily rising market share. In contrast, Intel has failed to respond to this trend and remains heavily reliant on the sluggish Chinese and enterprise markets.

AMD leverages ecosystem resources to provide customized designs

Instead of competing across all product lines, AMD has adopted a targeted strategy, focusing on high-potential segments, according to TrendForce. By partnering with cloud service giants like Microsoft, AMD delivers customized products, such as the Zen 4 core combined with HBM3 for HBv5.

On the other hand, Intel’s decline is not solely attributed to competition with AMD but is largely the result of its own series of missteps

Intel’s slow market response and reliance on weak markets

Intel’s PC product lineup is heavily reliant on the Chinese market and enterprise users, both of which face weak demand and fail to drive growth. Intel fails to respond swiftly to the shifting market trends, which further accelerated its loss of market share.

In contrast, TrendForce notes that AMD has successfully captured growth opportunities in Western markets, thanks to its diversified product portfolio in the desktop segment.

Intel’s technological innovation is often disconnected from practical application

While Intel has increased average selling prices (ASP) in its AI PC product line, its innovations largely remain confined to the technical level. The transition from technology to product implementation often lacks creativity, focusing too much on performance metrics without clear application goals.

As TrendForce notes, Intel struggles to effectively translate its technical advancements into competitive market advantages. This issue is even more evident in its server business, where it faces dual pressure from AMD and Arm-based servers and lacks targeted products to respond effectively.

Intel lacks flexibility in decision-making, leading to ecosystem limitations

Intel is overly reliant on its existing ecosystem and struggles to adapt flexibly to emerging demands. According to TrendForce, compared to AMD’s deep collaboration with Microsoft, Intel’s decision-making with ecosystem partners is not flexible enough, causing it to miss key opportunities to better align its products with market demands.

Stay up to date with the latest in industry offers by subscribing us. Our newsletter is your key to receiving expert tips.

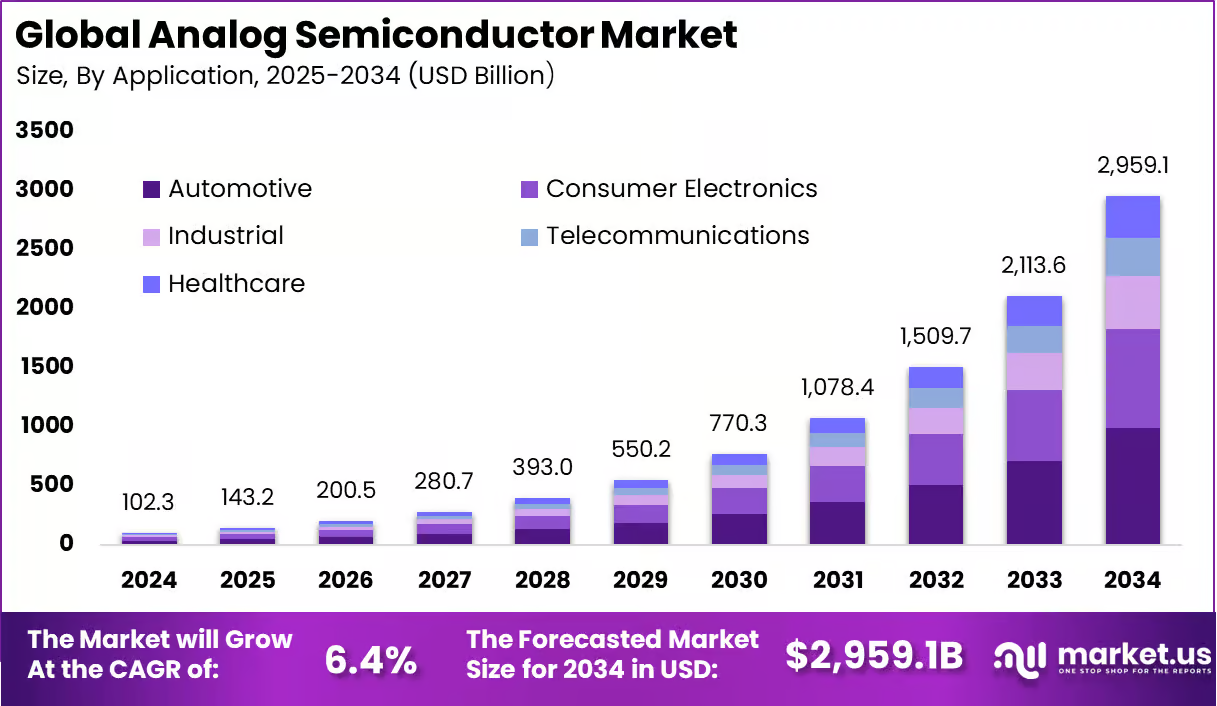

The market size of analog semiconductors was recorded at USD 102.3 billion in 2024 and is projected to register consistent expansion, rising from USD 143.2 billion in 2025 to approximately USD 2,959.1

On 27 July 2025, European Union and United States of America reached a political agreement on tariffs and trade. The transatlantic partnership is a key artery of global commerce and is the most signif

Samsung Electronics will raise contract prices for DRAM and NAND flash in the fourth quarter of 2025, industry sources told Newdaily.co.kr. The move reflects shrinking output of legacy products and su