The Trump administration first imposed export restrictions on semiconductor equipment to China in 2019, targeting ASML's EUV lithography machines. The Biden administration has since ramped up controls on ASML's mid-to-high-end lithography equipment exports. ASML recently reported new orders and a 2025 forecast that fell short of expectations, with the CFO forecasting that China's revenue contribution to ASML would drop to around 20% by 2025.

Annual reports from 2017 to 2022 show ASML's market share in China held below 20%, only exceeding 30% in 2023 and 2024. Starting January 1, 2024, ASML must seek U.S. licenses for exports of its 2000i and newer immersion lithography models in line with the U.S. 1017 Act. As of September 7, 2024, exports of its 1970i and 1980i models now require Dutch government approval.

ASML's revised outlook for 2025 projects revenue between EUR30 billion and EUR35 billion (US$32.17 billion to US$38.25 billion), implying China's contribution will shrink to roughly EUR6 billion to EUR7 billion (US$6.42 billion to US$7.43 billion). Industry forecasts suggest that with China's wafer fab expansion nearing completion, its foundry sector will enter a maturation phase by 2025, decreasing revenue contributions for European, US, and Japanese equipment suppliers.

After reaching a historic peak of 40% to 50% in 2023, ASML's China revenue share is expected to decline significantly as expansion projects conclude. The exceptional revenue surge from China in 2023 primarily resulted from expedited deliveries of backlogged orders ahead of a US ban on DUV immersion machines.

Over the last two years, Chinese chipmakers have front-loaded orders, driving significant revenue growth for top equipment providers, with year-on-year increases reaching as high as 125%.

ASML faces the challenge of finding new growth drivers, yet it holds a strong position in the high-end ArF immersion DUV and EUV markets. In 2023, ASML's sales hit about $30 billion, capturing a 28% global market share in semiconductor equipment. Its largest customers—TSMC, Samsung, Intel, SMIC, and Micron—contributed 31.8%, 24%, 9.7%, 3.5%, and 2.7% of ASML's revenue, respectively.

ASML has strategically expanded its global presence with R&D, manufacturing, and service hubs near major clients' facilities in Taiwan, South Korea, Germany, and the US, optimizing equipment delivery and support. While ASML lacks production facilities in China, it operates customer support centers there.

Financially, EUV and ArFi DUV systems have long driven ASML's revenue. Between 2012 and 2016, ArFi DUV systems were ASML's core products until EUV gained traction. By 2020, EUV machines outpaced ArFi models as the main revenue source. Though ArFi sales spiked in 2023 and 2024 due to U.S. restrictions on exports to China, ASML's future growth will depend on EUV and DUV orders from key advanced-process and DRAM clients.

Stay up to date with the latest in industry offers by subscribing us. Our newsletter is your key to receiving expert tips.

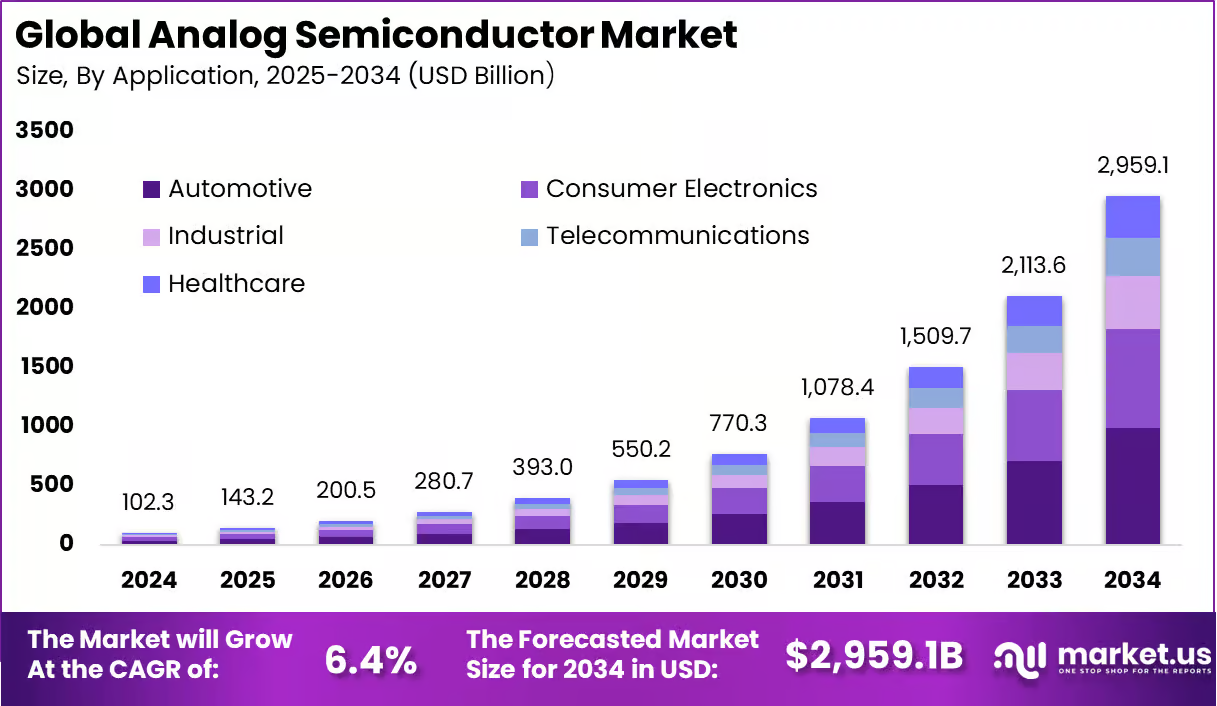

The market size of analog semiconductors was recorded at USD 102.3 billion in 2024 and is projected to register consistent expansion, rising from USD 143.2 billion in 2025 to approximately USD 2,959.1

On 27 July 2025, European Union and United States of America reached a political agreement on tariffs and trade. The transatlantic partnership is a key artery of global commerce and is the most signif

Samsung Electronics will raise contract prices for DRAM and NAND flash in the fourth quarter of 2025, industry sources told Newdaily.co.kr. The move reflects shrinking output of legacy products and su