NXP Semiconductors anticipates that its revenue and profit performance for the fourth quarter of 2024 will be below market expectations, with an estimated range of US$3 billion to US$3.2 billion, as a result of a slowdown in the automotive industry, uncertainty regarding demand in Europe and the US, and general macroeconomic weakness.

"Our guidance for the fourth quarter reflects broader macro weakness, especially in Europe and the Americas," said Kurt Sievers, NXP president and CEO, in a company statement. "We focus on managing what is in our control enabling NXP to drive resilient profitability and earnings in an uncertain demand environment,"

Automotive chip vendors have encountered difficulties in 2024 due to excess inventory and weak electric vehicle (EV) demand. STMicroelectronics has expressed pessimism about sales prospects for the first quarter of 2025, while Texas Instruments (TI) noted that automotive chips continue to face issues related to surplus inventory.

NXP announced third-quarter revenue of US$3.25 billion, reflecting a 5.4% decline year-over-year, with its principal division, automotive, contributing US$1.83 billion, a 3% year-over-year decrease. Revenue from its industrial and IoT chip segments amounted to US$563 million, reflecting a 7% year-over-year decline.

"NXP delivered quarterly revenue of US$3.25 billion, in line with our overall guidance," Sievers noted. "While we experienced some strength against our expectations in the communication infrastructure, mobile, and automotive end markets, we were confronted with increasing macro-related weakness in the Industrial & IoT market."

Consumers in the European market remain hesitant to purchase EVs due to pricing concerns, according to market sources. European automakers are also actively responding to competition from more affordable Chinese EVs.

In the meantime, the Chinese government is making significant strides in the development of its domestic semiconductor market, particularly in the area of automotive chips, sources said. The EU has previously issued a warning that European chip manufacturers are at risk of losing a substantial portion of their market share.

Chinese automakers' products face sanctions in the US and increasingly harsh regulations in Europe. On October 31, the EU placed increased taxes on Chinese electric vehicles, heightening tensions, with European automakers claiming this would affect their sales in China.

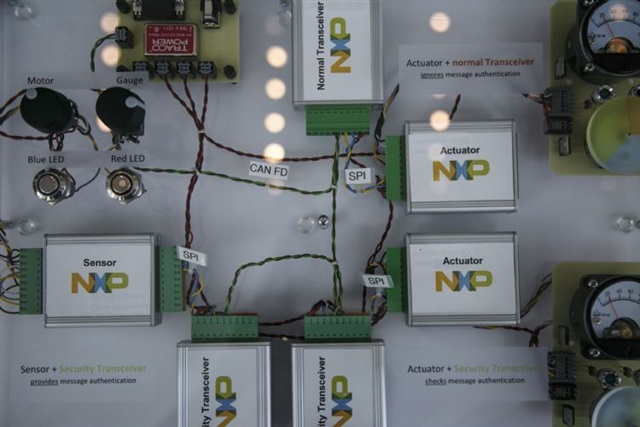

In other news, NXP has announced a partnership with GlobalFoundries to develop next-generation solutions for a variety of end markets, such as automotive, IoT, and smart mobile devices. This collaboration optimizes the efficiency, performance, and time-to-market of NXP's solutions by utilizing GF's global manufacturing footprint and 22FDX process technology platform. GF's 22FDX chips will be produced in Dresden and Malta, New York, ensuring that NXP's customers have access to a geographically diverse supply.

Stay up to date with the latest in industry offers by subscribing us. Our newsletter is your key to receiving expert tips.

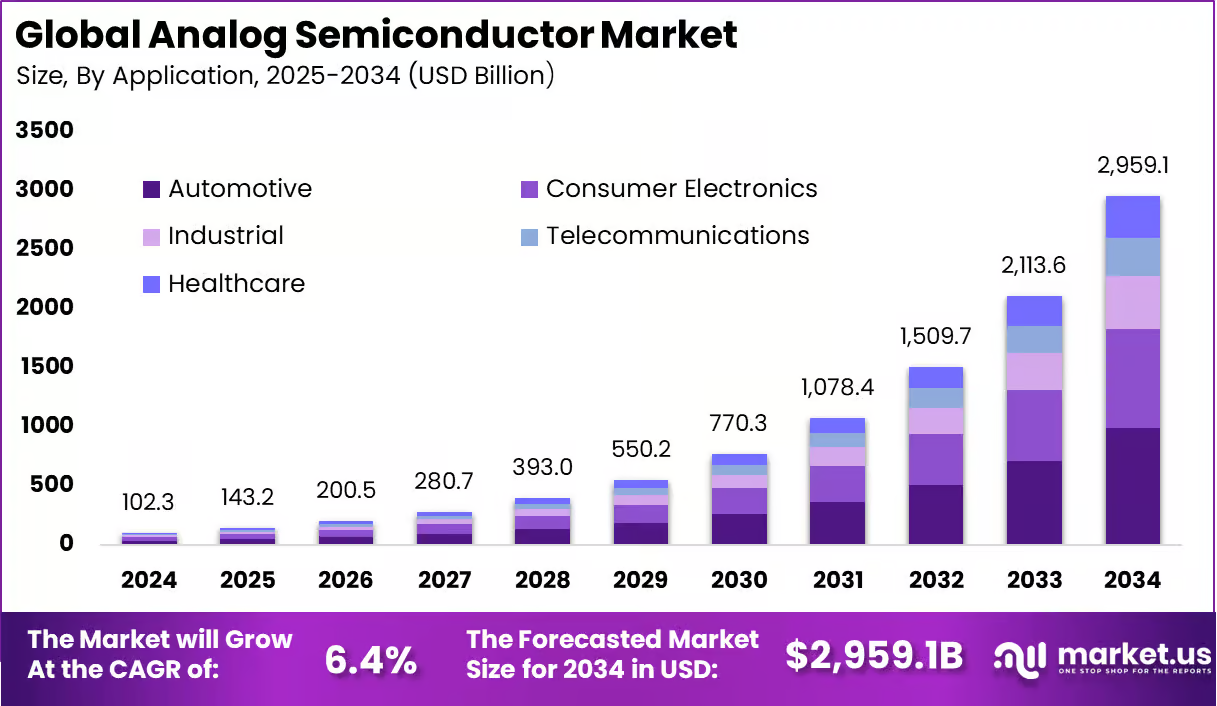

The market size of analog semiconductors was recorded at USD 102.3 billion in 2024 and is projected to register consistent expansion, rising from USD 143.2 billion in 2025 to approximately USD 2,959.1

On 27 July 2025, European Union and United States of America reached a political agreement on tariffs and trade. The transatlantic partnership is a key artery of global commerce and is the most signif

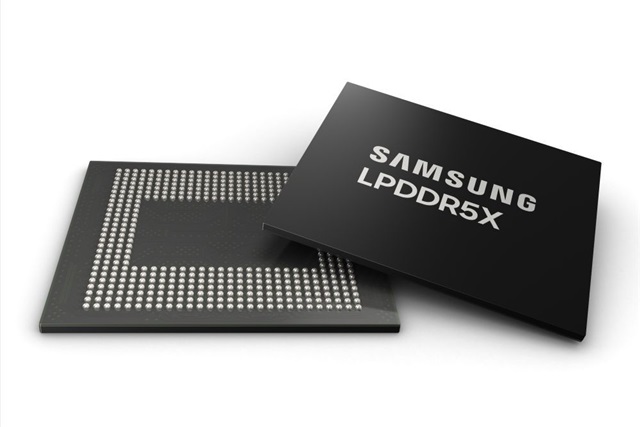

Samsung Electronics will raise contract prices for DRAM and NAND flash in the fourth quarter of 2025, industry sources told Newdaily.co.kr. The move reflects shrinking output of legacy products and su