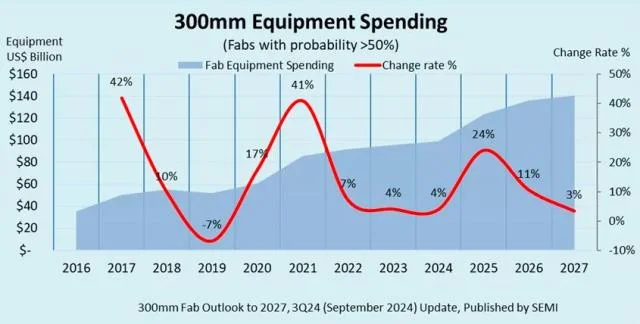

Industry association SEMI said semiconductor manufacturers will spend $400 billion on computer chip-making equipment in 2025-2027.

Spending on 300mm fab equipment is being driven by regionalization of semiconductor fabs and the increasing demand for artificial intelligence (AI) chips used in data centers and edge devices, SEMI report indicated.

Key equipment vendors include ASML, Applied Materials, KLA and Lam Research, and Tokyo Electron.

In 2024, spending on 300mm fab equipment is projected to grow by 4 percent to $99.3 billion.

In 2025, spending on 300mm fab equipment is projected to increase by 24 percent to $123.2 billion.

In 2026, spending on 300mm fab equipment is forecast to achieve 11 percent growth to $136.2 billion.

In 2027, spending on 300mm fab equipment is projected to grow by 3 percent to $140.8 billion.

“The world’s need for chips is boosting spending on equipment for both leading-edge technologies addressing AI applications and mature technologies driven by automotive and IoT applications,” Ajit Manocha, SEMI President and CEO, said.

China is projected to invest over $100 billion on 300mm equipment in the next three years driven by its national self-sufficiency policies. China’s spending on 300mm equipment is anticipated to decrease from a peak of $45 billion in 2024 to $31 billion by 2027.

South Korea, home to memory chip makers Samsung and SK Hynix, is estimated to invest $81 billion on 300mm equipment in three years to enhance its dominance in memory segments including DRAM, high-bandwidth memory (HBM), and 3D NAND Flash.

Taiwan, home to top contract chipmaker TSMC, is forecast to spend $75 billion on 300mm equipment over the next three years as the region’s chipmakers build some new fabs overseas.

Americas is projected to invest $63 billion on 300mm equipment from 2025 to 2027.

Japan, Europe & Mideast, and SE Asia are expected to spend $32 billion, $27 billion, and $13 billion, respectively, on 300mm equipment.

Stay up to date with the latest in industry offers by subscribing us. Our newsletter is your key to receiving expert tips.

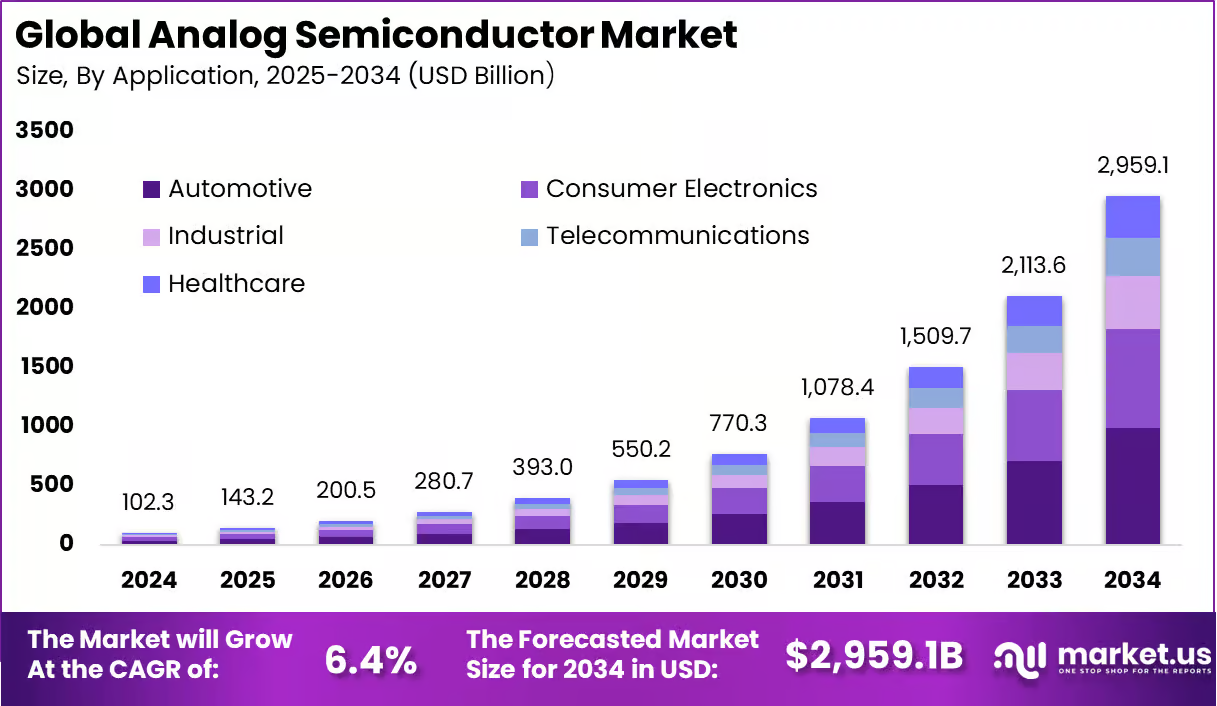

The market size of analog semiconductors was recorded at USD 102.3 billion in 2024 and is projected to register consistent expansion, rising from USD 143.2 billion in 2025 to approximately USD 2,959.1

On 27 July 2025, European Union and United States of America reached a political agreement on tariffs and trade. The transatlantic partnership is a key artery of global commerce and is the most signif

Samsung Electronics will raise contract prices for DRAM and NAND flash in the fourth quarter of 2025, industry sources told Newdaily.co.kr. The move reflects shrinking output of legacy products and su