Market research firms said in their latest report that although seasonal factors and weaker-than-expected consumer demand affected electronic product sales in the first half of 2024, resulting in a year-on-year decline of 0.8%, electronic product sales are expected to rebound starting in the third quarter of 2024, thanks to a surge in demand for AI chips and high-bandwidth memory (HBM).

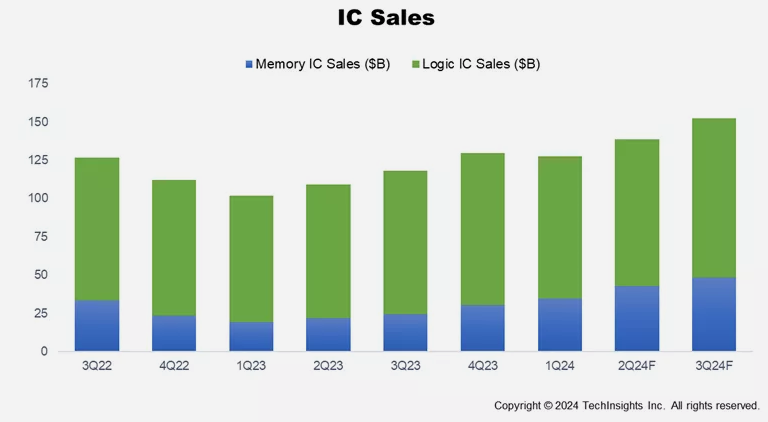

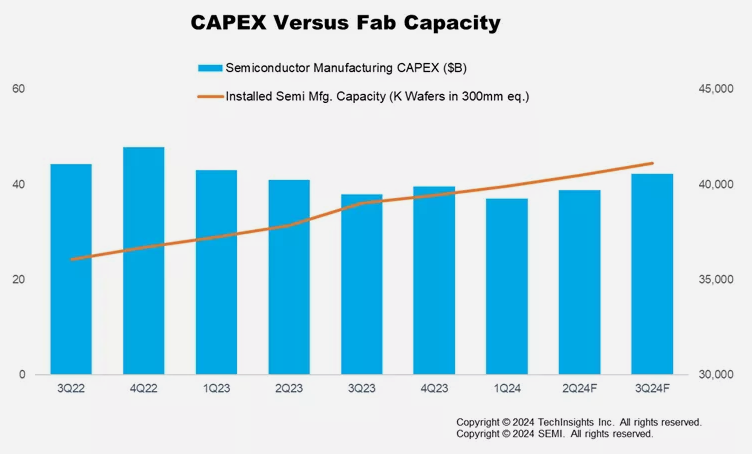

Recently, the SEMI International Semiconductor Industry Association stated in its 2024 Q2 Semiconductor Manufacturing Monitor (SMM) report jointly prepared with TechInsights that the global semiconductor manufacturing industry continued to show signs of improvement in the second quarter of 2024, with a significant increase in IC sales, stabilization of capital expenditures, and increased installed capacity of wafer fabs. Although the slowdown in the recovery of some end markets has affected the growth rate in the first half of this year, the surge in demand for AI chips and high-bandwidth memory (HBM) has created a strong tailwind for industry expansion. The report pointed out that although seasonal factors and weaker-than-expected consumer demand affected electronic product sales in the first half of 2024, resulting in a year-on-year decline of 0.8%, electronic product sales are expected to rebound from the third quarter of 2024, with a year-on-year increase of 4% and a month-on-month increase of 9%. In the second quarter of 2024, IC sales increased by 27% year-on-year, and are expected to increase further by 29% in the third quarter of 2024, exceeding the record level in 2021, as demand driven by artificial intelligence continues to drive IC sales growth. Improved demand also led to a 2.6% year-on-year decline in IC inventory levels in the first half of 2024. Installed fab capacity reached 40.5 million wafers per quarter (300mm equivalent) in 2Q24 and is expected to grow 1.6% in 3Q24. Foundry and logic-related capacity grew more strongly in 2Q24 at 2.0% and is expected to grow 1.9% in 3Q24, driven by capacity additions at advanced nodes. Memory capacity grew 0.7% in 2Q24 and is expected to grow 1.1% in 3Q24, driven by strong HBM demand and improved memory pricing conditions. Installed capacity increased in all tracked regions in 2Q24, with China the fastest growing region despite mediocre fab utilization.

Semiconductor capex remained conservative in the first half of 2024, down 9.8% year-over-year. With growing demand for AI chips and rapid adoption of HBM, the trend is expected to turn positive starting in the third quarter of 2024, with storage capex increasing 16% quarter-over-quarter and non-storage-related capex increasing 6% quarter-over-quarter.

"Despite the modest first half of the year in semiconductor capex, we expect a positive trend to begin in the third quarter of the year, led by memory capex," said Clark Tseng, senior director of market intelligence at SEMI. "Strong demand for AI chips and HBM is driving performance across all segments of the semiconductor manufacturing ecosystem."

"The entire semiconductor supply chain is recovering this year as the market prepares for a surge in 2025," said Boris Metodiev, director of market analysis at TechInsights. "AI will certainly continue to drive high-value integrated circuits into the market, while also supporting the capex required for capacity expansion of AI chips, especially HBM. As consumer demand recovers and new technologies such as AI are brought to the forefront, unit production and especially revenue will recover and support the broader semiconductor manufacturing industry."

Stay up to date with the latest in industry offers by subscribing us. Our newsletter is your key to receiving expert tips.

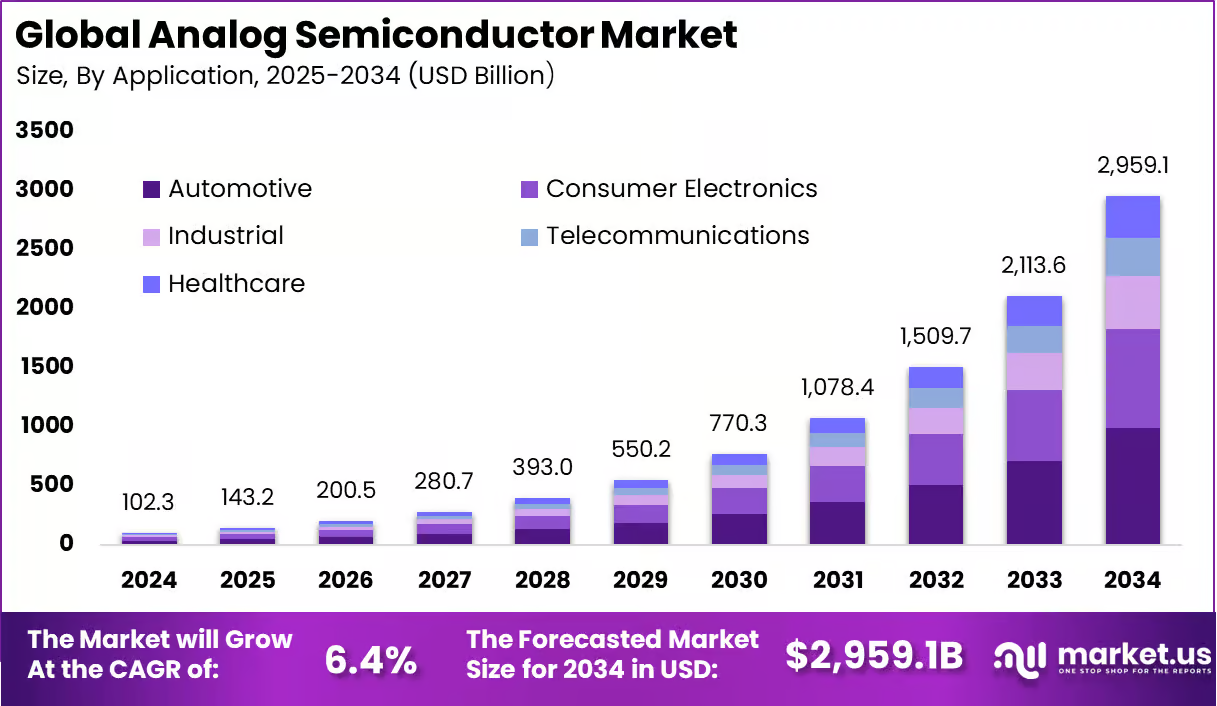

The market size of analog semiconductors was recorded at USD 102.3 billion in 2024 and is projected to register consistent expansion, rising from USD 143.2 billion in 2025 to approximately USD 2,959.1

On 27 July 2025, European Union and United States of America reached a political agreement on tariffs and trade. The transatlantic partnership is a key artery of global commerce and is the most signif

Samsung Electronics will raise contract prices for DRAM and NAND flash in the fourth quarter of 2025, industry sources told Newdaily.co.kr. The move reflects shrinking output of legacy products and su