Latest research from IDC, titled Worldwide Semiconductor Integrated Device Manufacturing Market: Top 10 Vendor Ranking and Insight, 1Q24, reveals significant trends in the semiconductor industry during the first quarter of 2024. The report highlights the normalization of memory applications and inventory levels, driven by a stabilizing device market and the demand for AI training and inference in data centers. This recovery follows the fading of the COVID-19 pandemic. This normalization propelled the development of the integrated device manufacturing (IDM) market in the first quarter of 2024 (1Q24), where high-bandwidth memory (HBM) played a pivotal role.

The growing demand of HBM, priced four to five times higher than traditional memory, squeezed the capacity of DRAM in the device market and pushed up its price, significantly boosting the overall memory market revenue. Meanwhile, newly released AI PCs and AI smartphones required more memory content than traditional devices, which also drove the development of the memory market. Three of the top five IDM vendors for this quarter were memory-related, capturing nearly half of the top 10 vendors' revenue.

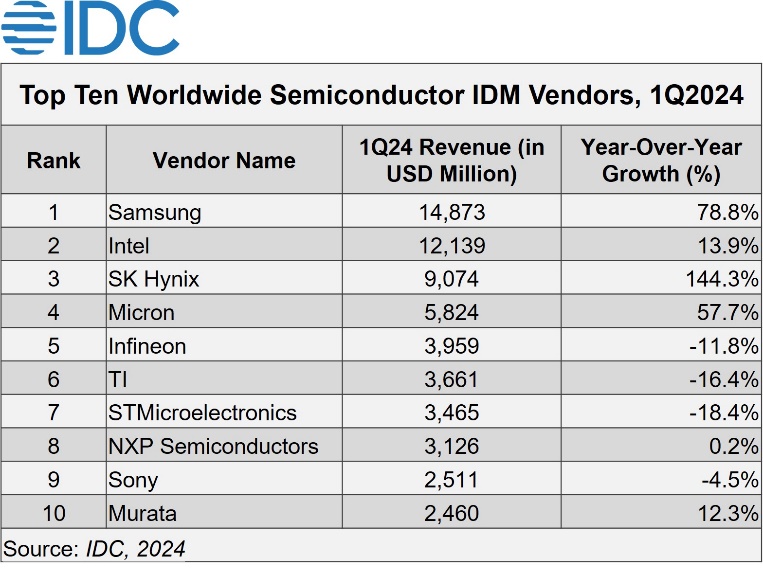

The top 10 vendors were Samsung, Intel, SK Hynix, Micron, Infineon, Texas Instruments, STMicroelectronics, NXP, Sony, and Murata. With the rising demand for AI in datacenters and the device market, memory is projected to remain an important driver for the development of the IDM in the second half of 2024 (2H24):

Computing remained the leading IDM application field in 1Q24, accounting for 35% of the total share, up from 29% in the same period last year. It was followed by the wireless communication market. The automotive market showed signs of sluggishness under the weight of mounting chip inventories, while the industrial market focused on de-inventory as customers double-ordered and stockpiled goods in response to the supply chain disruptions in the previous year. As a result, these two markets saw a sharp drop in their share compared to the same period last year. They are forecast to prioritize inventory adjustment in 1H24 and witness a rebound in the third quarter.

"In 2024, memory makers will continue to be key players in the global IDM market. As inventory levels gradually normalize, the demand in the automotive and industrial fields is projected to rebound in the second half of the year, which will contribute to the growth of the IDM market," said Helen Chiang, Head of Semiconductor Research, IDC Asia/Pacific.

Stay up to date with the latest in industry offers by subscribing us. Our newsletter is your key to receiving expert tips.

The global semiconductor industry is undergoing a seismic shift, driven by the explosive growth of artificial intelligence (AI) infrastructure. By 2025, the semiconductor market is projected to reach

Nvidia's H20 AI chip, once expected to anchor its sales in China, now faces an uncertain future as reports surface of halted production orders amid Beijing's push for local alternatives. The b

Gallium nitride (GaN) semiconductors are on the brink of a major transformation. Once hailed as the rising star among third-generation semiconductors, this technology has fallen from grace due to inte