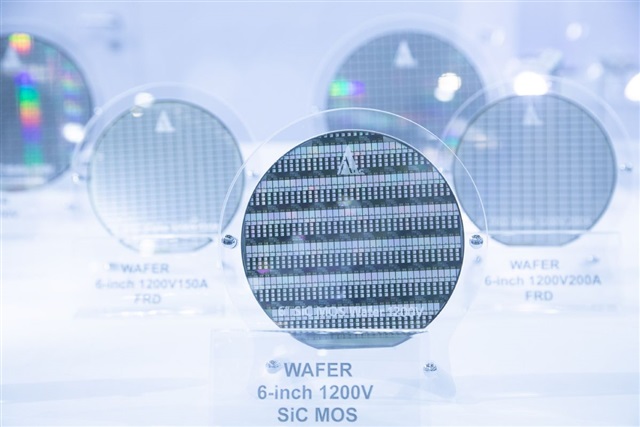

China's SiC industry faces oversupply as 6-inch substrate prices plunge, prompting a strategic pivot to 8-inch wafers

The silicon carbide (SiC) semiconductor industry in China is undergoing a major transformation as the rapid expansion of 6-inch SiC substrate capacity leads to a supply glut and sharp price declines. After nearly two years of losses and internal turmoil, the market is adjusting through capacity consolidation and a renewed focus on the more profitable 8-inch segment.

Signs of market bottoming and order recovery

Leading Chinese SiC epitaxy foundries showed notable improvement in orders during the second quarter of 2025, doubling quarterly growth compared to previous periods, even though year-over-year growth remained flat. Most of this recovery has benefited first-tier players, while second- and third-tier manufacturers continue to face stagnant contract manufacturing prices and limited order volumes. Despite the previous market downturn, new applications for SiC are emerging rapidly, helped by low substrate costs and improved supply stability.

Industry insiders report that several top Chinese SiC crystal growth companies are adopting two critical strategic adjustments starting from mid-2025. Firstly, they are scaling back excess 6-inch production by mothballing surplus lines and focusing only on supplying longstanding customers under contract, thereby reducing willingness to accept new low-priced orders. Secondly, these firms are intensifying efforts to develop their 8-inch wafer manufacturing capabilities, which remain profitable amid rising demand from domestic fabs. This shift is supported by a select group of government-approved companies with licenses to operate 8-inch SiC wafer fabs.

Government controls shape 8-inch market landscape

Currently, only about eight to nine Chinese companies—including SICC, Tankeblue Semiconductor, Synlight, SEMI SiC, Sanan Optoelectronics, Summit Crystal Semiconductor, and JingSheng—hold licenses for 8-inch fab operations. These licenses not only authorize technical production but are also essential for securing government contracts and financial support, effectively restricting market competition in this segment. This policy aims to stabilize the industry by protecting license holders from intense competition faced in the oversupplied 6-inch market.

At present, prices for 6-inch SiC MOS-grade substrates hover around US$350 per piece, significantly below the approximately US$400 breakeven point, while Schottky-grade prices fall near US$250, meaning most suppliers remain unprofitable. The prevailing view is that the aggressive price wars are nearing their end, and the market may have established a price floor. Meanwhile, the 8-inch segment is positioned as the strategic growth area with greater potential for scaling and profitability.

Global SiC market restructuring intensifies competition

Internationally, the SiC landscape is also evolving. Taiwanese companies have minimized investment in 6-inch technologies, prioritizing 8-inch development to compete head-to-head with Chinese manufacturers. However, the global market remains volatile. Notably, Wolfspeed, once a leader in 8-inch SiC mass production in the US, filed for bankruptcy protection in July 2025 due to poor manufacturing yields and significant asset write-downs. Meanwhile, Japan's Renesas Electronics Corp. reportedly withdrew from SiC production altogether, dissolving its teams and becoming a creditor to Wolfspeed after earlier high-cost supply agreements.

The convergence of government policy, evolving industry capacity, and shifting global dynamics suggests that the Chinese SiC sector is entering a new phase. The expansion and consolidation in 6-inch substrates combined with strategic focus on 8-inch wafers will shape the competitive landscape for years to come, as domestic players seek to capitalize on emerging opportunities while weathering economic pressures.

Stay up to date with the latest in industry offers by subscribing us. Our newsletter is your key to receiving expert tips.

Samsung Electronics is transforming its Pyeongtaek Campus Line 4 (P4) in South Korea into a manufacturing base focusing on HBM4 production. Analysts indicate that Samsung is increasing the proportion

Samsung scores another major foundry victory, expanding its roster of high-profile clients on advanced nodes. After Tesla selected the company in July to produce its AI6 processor under a $16.5 billio

Texas Instruments, a leading analog IC maker, has released its Q3 2025 results, with its cautious Q4 outlook sparking concerns over the broader semiconductor market. According to Reuters, the company