Chinese foundries have experienced a faster recovery in capacity utilisation compared to their peers, says TrendForce, thanks to trends like IC domestic substitution and policies like “China for China”.

Chinese foundries have experienced a faster recovery in capacity utilisation compared to their peers, says TrendForce, thanks to trends like IC domestic substitution and policies like “China for China”.

Some processes are already operating at full capacity and the traditional H2 peak stocking season —combined with delays in expansion due to export controls on US equipment—may extend capacity tightness until the end of the year.

This situation might lead to price increases for specific processes, which is a shift from the previous low-price competition strategy aimed at volume.

Taiwanese foundries are benefiting from increased orders due to out of China demand, leading to better-than-expected capacity utilisation rates for PSMC and Vanguard in H2.

However, overall demand for mature processes remains weak, with average capacity utilisation still around 70–80%—indicating no significant shortages.

Only TSMC is seeing full capacity utilisation in its 5/4nm and 3nm nodes due to strong demand from AI applications, new PC platforms, HPC applications, and high-end smartphones.

Its capacity utilisation is expected to exceed 100% in the second half of the year, with visibility extending into 2025.

Given cost pressures from overseas expansion and rising electricity prices, TSMC plans to raise prices for its advanced processes, which are experiencing strong demand

A significant amount of new capacity is expected to come online in 2025, says TrendForce, including TSMC JASM, PSMC P5, SMIC’s new Beijing/Shanghai plants, HHGrace Fab9, HLMC Fab10, and Nexchip N1A3.

This increase in mature process capacity could intensify competition and impact future pricing negotiations

Stay up to date with the latest in industry offers by subscribing us. Our newsletter is your key to receiving expert tips.

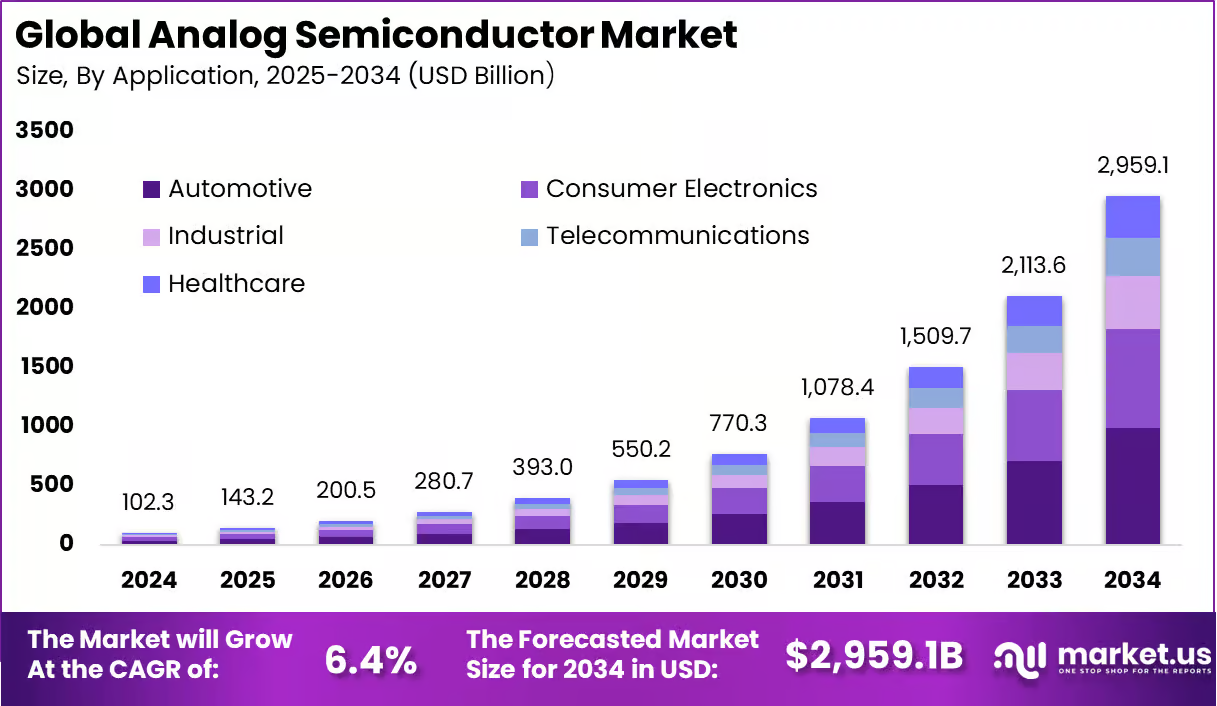

The market size of analog semiconductors was recorded at USD 102.3 billion in 2024 and is projected to register consistent expansion, rising from USD 143.2 billion in 2025 to approximately USD 2,959.1

On 27 July 2025, European Union and United States of America reached a political agreement on tariffs and trade. The transatlantic partnership is a key artery of global commerce and is the most signif

Samsung Electronics will raise contract prices for DRAM and NAND flash in the fourth quarter of 2025, industry sources told Newdaily.co.kr. The move reflects shrinking output of legacy products and su