Q1-shipments of augmented reality and virtual reality (AR/VR) headsets declined 67.4% y-o-y, says IDC

The decline in shipments was expected as the market transitions to include new categories – Mixed Reality (MR) which occludes the user’s vision but provides a view of the real world with outward-facing cameras, and Extended Reality which employs a see-though display but mirrors content from another device or offers a simplistic heads-up display.

The ASP rose to over $1000 as Apple entered the market and incumbents such as Meta focused on premium headsets such as the Quest 3.

Meta again led the market in 1Q24 in terms of share, while Apple’s recent entry into the market enabled it to capture the second position.

ByteDance, Xreal, and HTC rounded out the top 5. Both the Quest 3 and the Vision Pro helped educate users and enticed developers to create mixed reality content, blending the digital and physical worlds. Unfortunately, this has come at a premium for users.

IDC forecasts headset shipments will return to growth later this year with volume growing 7.5% over 2023.

Newer headsets and lower price points will help with the turnaround expected later this year. Beyond that, headset shipment volume is expected to see a CAGR of 43.9% from 2024–2028.

Stay up to date with the latest in industry offers by subscribing us. Our newsletter is your key to receiving expert tips.

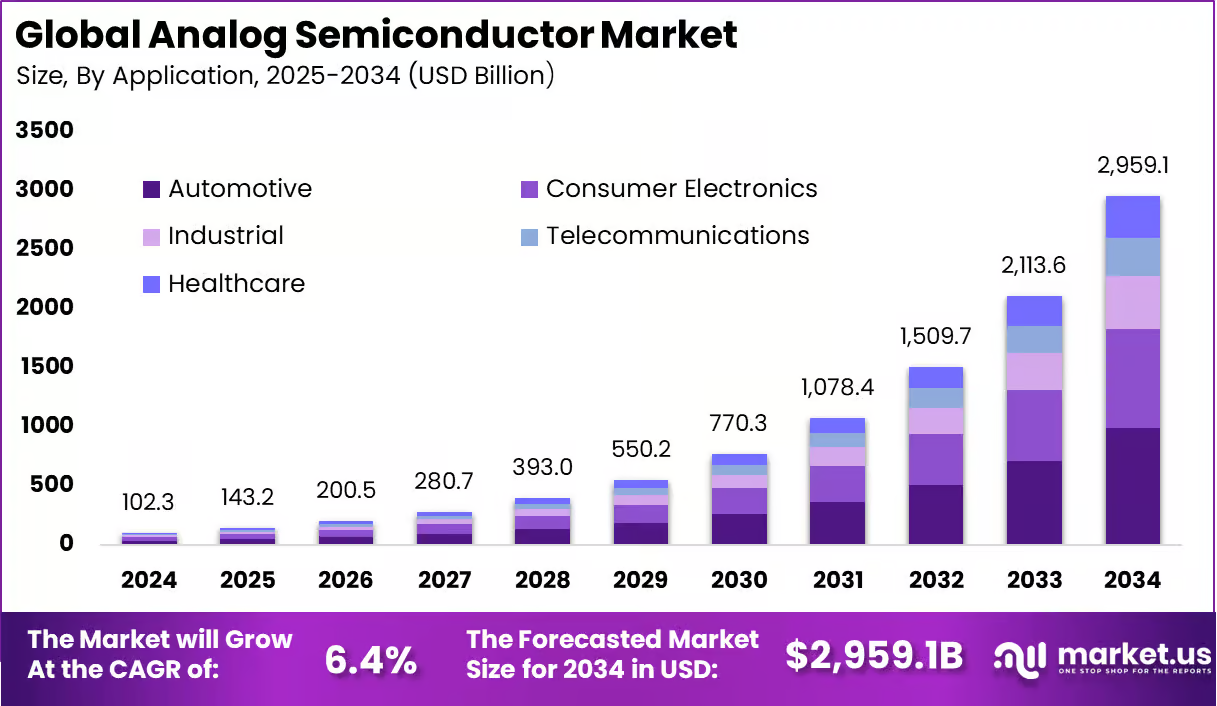

The market size of analog semiconductors was recorded at USD 102.3 billion in 2024 and is projected to register consistent expansion, rising from USD 143.2 billion in 2025 to approximately USD 2,959.1

On 27 July 2025, European Union and United States of America reached a political agreement on tariffs and trade. The transatlantic partnership is a key artery of global commerce and is the most signif

Samsung Electronics will raise contract prices for DRAM and NAND flash in the fourth quarter of 2025, industry sources told Newdaily.co.kr. The move reflects shrinking output of legacy products and su