Chinese listed semiconductor equipment and materials companies released their 2024 annual financial reports in late April, revealing strong revenue growth but a decline in overall profitability. Despite intensified US sanctions, the sector demonstrated resilience through increased capital investments and strategic restructuring, signaling China's determination to bolster its semiconductor industry.

Growth slows while profitability declines

The 13 major listed Chinese semiconductor equipment and materials firms reported a combined revenue increase of 26.47% in 2024, reaching significant levels but falling short of the 36.5% growth recorded in 2023. However, total net profit for these companies declined by 4.61%, a stark contrast to the 29.79% net profit growth in 2023. This divergence highlights challenges posed by global trade restrictions and rising operational costs, even as demand for domestic equipment remains strong.

Market leaders show uneven performance

Naura Technology, the sector's largest player by market capitalization, posted a 35.14% revenue increase and a 44.17% surge in net profit, solidifying its leadership. Advanced Micro-Fabrication Equipment Inc. China (AMEC), the second-largest by market cap, saw revenue climb to CNY9.065 billion, but its net profit slipped from CNY1.79 billion in 2023 to CNY1.61 billion. Hangzhou Chang Chuan Technology emerged as the standout, with revenue soaring 105.18% to CNY29.8 billion and net profit skyrocketing 917.78% to CNY5.6 billion, driven by strong demand for its testing equipment.

Conversely, National Silicon Industry Group Co. Ltd. reported a modest 6.21% revenue rise but a drastic 619.25% drop in net profit, demonstrating uneven performance across the sector.

Sanctions drive domestic investment surge

US sanctions, tightened in 2024, have restricted China's access to advanced semiconductor technologies, prompting a surge in domestic investment. Morgan Stanley estimates that China's capex on wafer fabrication equipment reached US$410 billion in 2024, a 29% increase from 2023, accounting for roughly 40% of global spending.

This growth reflects preemptive equipment stockpiling ahead of further restrictions and investments in mature process technologies by firms like SMIC and Hua Hong Semiconductor. The push for self-reliance has bolstered domestic equipment makers, though profitability remains under pressure due to high R&D costs and supply chain constraints.

Industry consolidation accelerates

In response to external pressures, the Chinese government is reportedly pursuing a major restructuring of its semiconductor equipment sector. According to South Korean media sources, China aims to consolidate over 200 domestic equipment firms into approximately 10 leading enterprises. This policy seeks to concentrate resources, enhance technological capabilities, and elevate the global competitiveness of Chinese manufacturers. The move, still in early stages, aligns with broader efforts to counter US restrictions and reduce reliance on foreign technology, though details on implementation remain limited.

Stay up to date with the latest in industry offers by subscribing us. Our newsletter is your key to receiving expert tips.

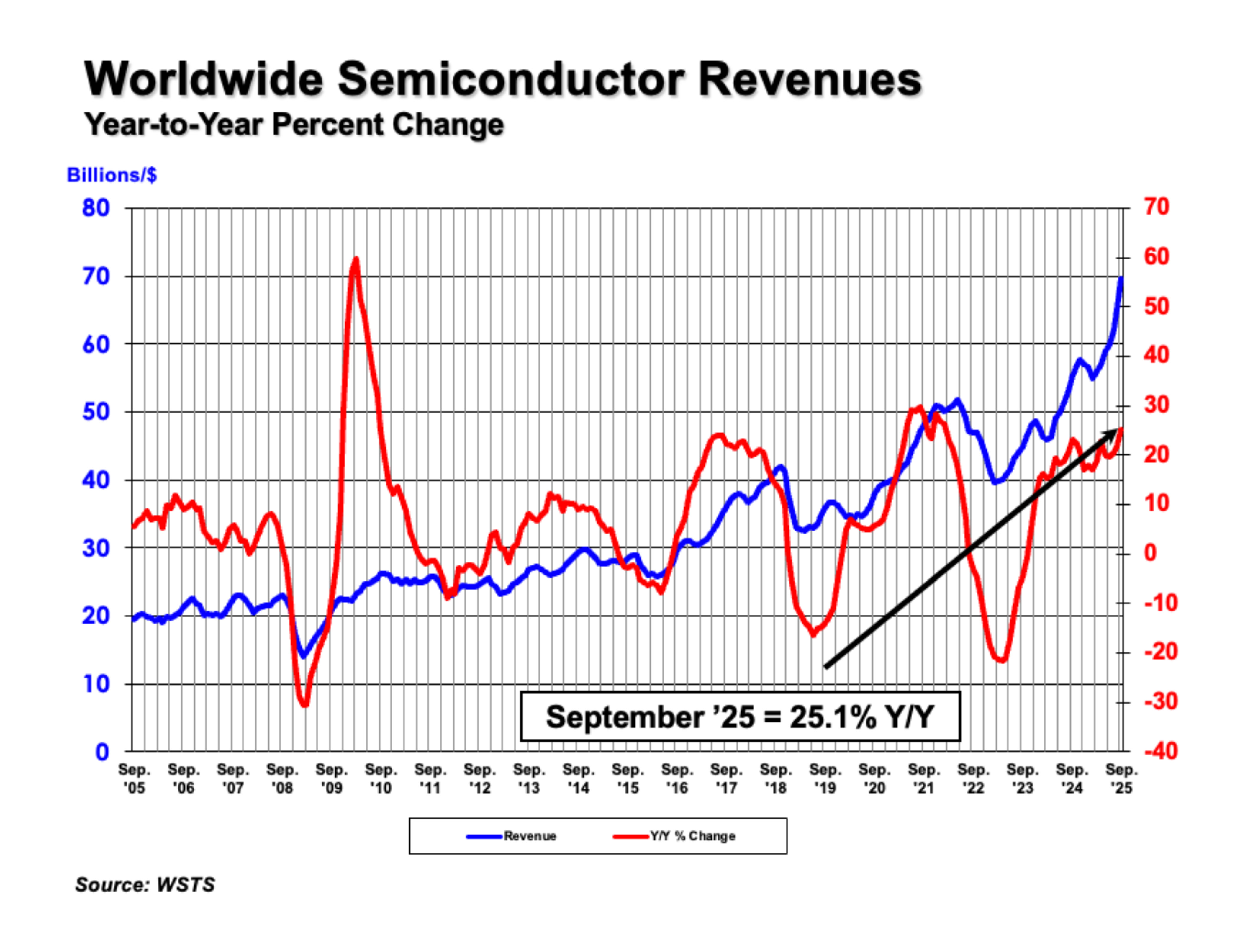

WASHINGTON—November 3, 2025—The Semiconductor Industry Association (SIA) today announced global semiconductor sales were $208.4 billion during the third quarter of 2025, an increase of 15.8% compared

Samsung Electronics is transforming its Pyeongtaek Campus Line 4 (P4) in South Korea into a manufacturing base focusing on HBM4 production. Analysts indicate that Samsung is increasing the proportion

Samsung scores another major foundry victory, expanding its roster of high-profile clients on advanced nodes. After Tesla selected the company in July to produce its AI6 processor under a $16.5 billio