Taiwan remained the largest buyer of semiconductor production materials for the 15th consecutive year in 2024, with a total procurement amount of US$20.1 billion, according to the Semiconductor Equipment and Materials Institute (SEMI).

Global semiconductor material spending grew by 3.8 percent from a year earlier to US$67.5 billion in 2024, the United States-based SEMI said in a report issued Monday.

Following Taiwan in materials procured was China, which spent US$13.5 billion on semiconductor production materials in 2024, and South Korea with US$10.5 billion in purchases, the report said.

SEMI attributed the 2024 global growth to the recovery of the overall semiconductor market as well as the increasing demand for advanced materials for the high-performance computing and high-bandwidth memory sectors.

Worldwide, spending on wafer fabrication materials grew 3.3 percent from a year earlier to US$42.9 billion in 2024, while spending on packaging materials rose 4.7 percent to US$24.6 billion, the report said.

The growth was due to a strong double-digit increase in procurement of materials used in advanced DRAM, 3D NAND flash and leading-edge logic integrated circuits (ICs), it said.

Demand for silicon remained weak in 2024, however, as the industry continued to work through excess inventory, resulting in a 7.1 percent decline in silicon consumption, according to SEMI.

Stay up to date with the latest in industry offers by subscribing us. Our newsletter is your key to receiving expert tips.

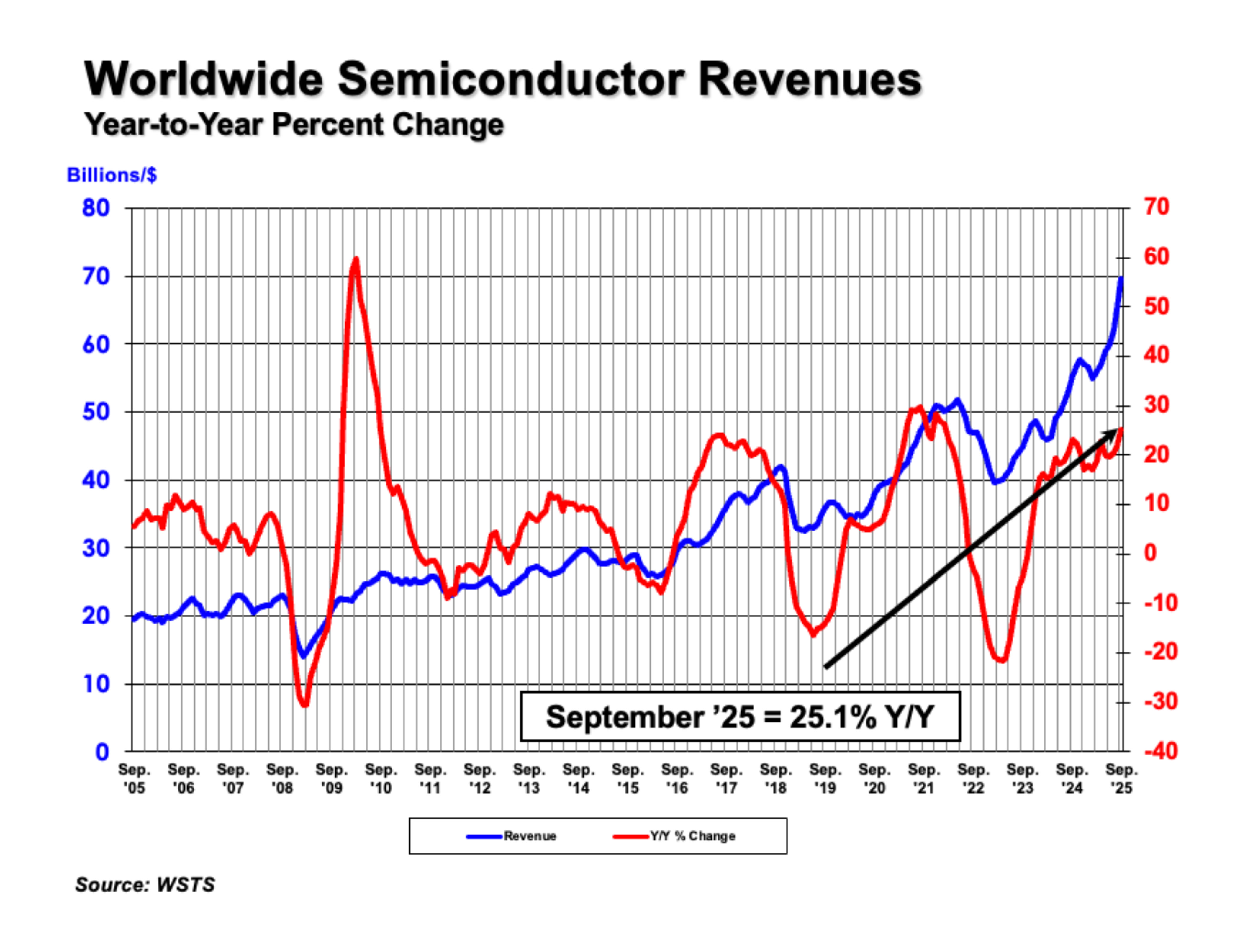

WASHINGTON—November 3, 2025—The Semiconductor Industry Association (SIA) today announced global semiconductor sales were $208.4 billion during the third quarter of 2025, an increase of 15.8% compared

Samsung Electronics is transforming its Pyeongtaek Campus Line 4 (P4) in South Korea into a manufacturing base focusing on HBM4 production. Analysts indicate that Samsung is increasing the proportion

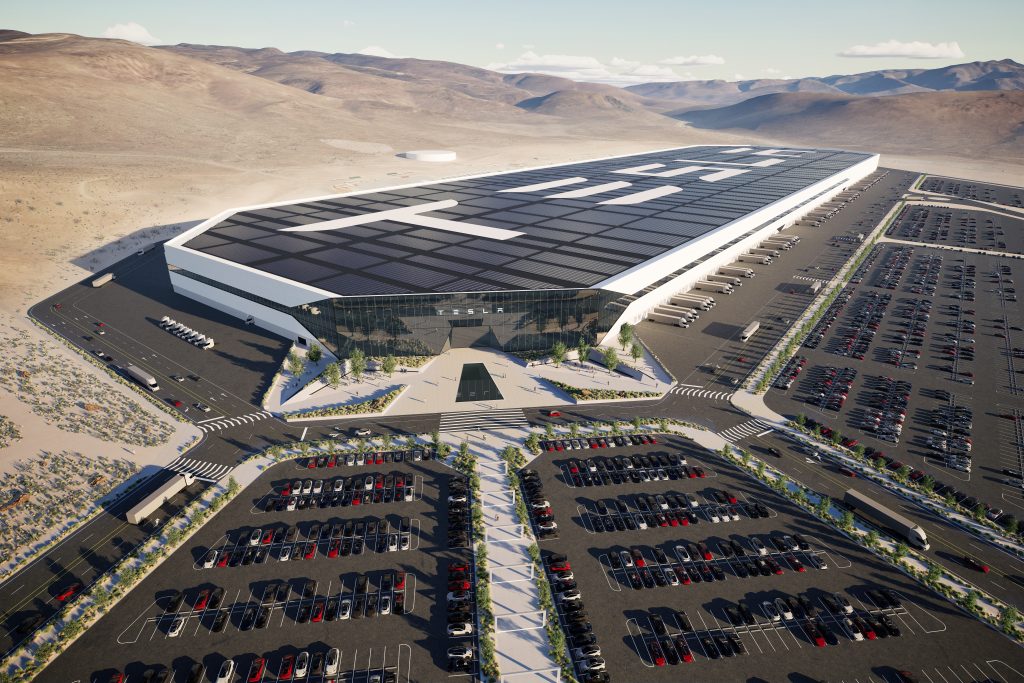

Samsung scores another major foundry victory, expanding its roster of high-profile clients on advanced nodes. After Tesla selected the company in July to produce its AI6 processor under a $16.5 billio