Memory prices are declining across all segments and are expected to continue their downward trajectory in the first quarter of 2025, according to industry sources.

The memory market has experienced softening demand since the fourth quarter of 2024, a trend that is expected to persist through the first half of 2025. While industry stakeholders maintain cautious optimism about market recovery, the lack of urgent specification upgrade requirements in applications has dampened the adoption of high-end memory products.

A significant supply-demand imbalance has emerged in the first quarter of 2025, largely due to industry-wide reluctance to build inventory. This has compelled upstream memory manufacturers to reduce prices in both spot and contract markets, sources indicated.

Despite overall weak channel demand, the industrial control memory segment witnessed unexpected demand growth in the fourth quarter of 2024. Sources attribute this to concerns about potential import tax increases under the Trump administration, prompting related companies to begin early inventory stockpiling.

The networking and gaming segments have shown signs of improvement, with some PC OEM clients placing short-notice orders for inventory replenishment. Sources suggest that clear indicators of genuine market demand will emerge after the Lunar New Year in February 2025.

Production adjustments

While upstream memory manufacturers have acknowledged production cuts, they remain reluctant to disclose the exact scale of these reductions. Micron stands alone in announcing specific plans during its recent earnings call, stating its intention to strictly control NAND capital expenditure and reduce NAND capacity utilization by 15% compared to previous forecasts.

Industry observers note that despite persistent weakness in consumer and channel demand over several quarters, these segments represent only about 10% of total memory applications, making their impact on overall market dynamics relatively limited. The more significant factor has been the slowdown in order momentum from other OEMs and major server manufacturers during the second half of 2024.

The traditional seasonal lull has further accelerated price declines in the first quarter of 2025, leading upstream companies to implement strategic production cuts to mitigate downward pricing pressure.

Market outlook

While AI servers emerged as a bright spot in 2024, manufacturers are increasingly focusing on higher-value products such as DDR5, HBM, and enterprise-grade SSDs to protect margins. However, industry experts caution that the strong AI server demand may not be sustainable, potentially leading to oversupply in the first half of 2025.

The consumer market lacks compelling applications to drive specification upgrades. Despite significant production cuts announced by upstream memory manufacturers, experts doubt this will replicate the market recovery seen in 2023.

Price movements

In the spot market, 256Gb TLC flash wafer prices declined to US$1.40 in mid-December before recovering to US$1.45 by month's end. Prices for 512Gb wafers remained around US$3, though actual transaction prices fell to approximately US$2.50.

The inventory correction is approaching completion, supported by China's extensive flash inventory clearance during the second and third quarters, along with manufacturers' deliberate production adjustments. Some low-priced products became scarce in the channel market, triggering slight price increases.

The discontinuation of low-capacity legacy-process NAND by original manufacturers has particularly affected embedded products, leading to supply constraints and price increases for low-capacity eMMC devices.

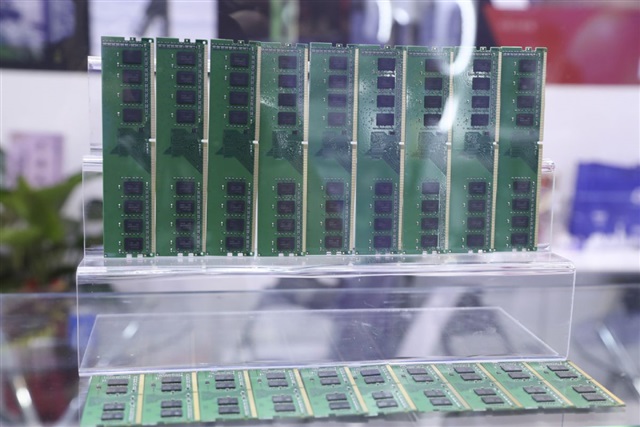

The DRAM spot market remained sluggish through December, with memory module manufacturers still holding substantial DDR4 inventory. DDR4 prices continued to decline, with 8Gb DDR4 memory experiencing recent drops of 4-5%.

DDR5 sales have also faced pressure, particularly in the mainstream frequency range of 6000-6400 MT/s. The entry of Chinese memory module makers into the consumer DDR5 market has contributed to a 2-3% price decline in December's spot market.

Contract market prices for the first quarter of 2025 show significant weakness. PC memory prices are forecast to decline by more than 10%, while average DRAM prices are expected to fall by high single-digit percentages. NAND quarterly contract prices are projected to decrease by more than 10%, reflecting cautious client inventory management and seasonal factors.

Stay up to date with the latest in industry offers by subscribing us. Our newsletter is your key to receiving expert tips.

Samsung Electronics is transforming its Pyeongtaek Campus Line 4 (P4) in South Korea into a manufacturing base focusing on HBM4 production. Analysts indicate that Samsung is increasing the proportion

Samsung scores another major foundry victory, expanding its roster of high-profile clients on advanced nodes. After Tesla selected the company in July to produce its AI6 processor under a $16.5 billio

Texas Instruments, a leading analog IC maker, has released its Q3 2025 results, with its cautious Q4 outlook sparking concerns over the broader semiconductor market. According to Reuters, the company