SK Hynix's strategic focus on high-end NAND memory, coupled with rising AI-driven demand, is expected to push its annual market share above 20% in 2024, bringing it closer to industry leader Samsung Electronics.

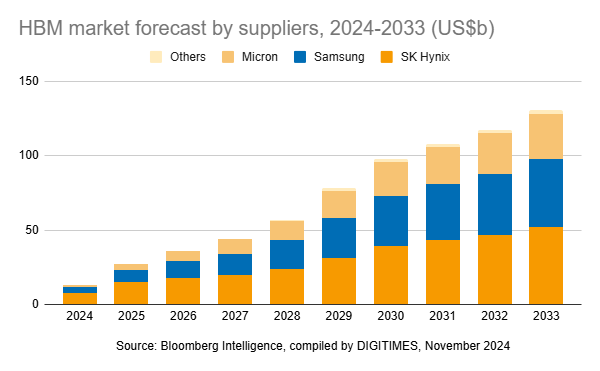

HBM market set for explosive growth

The global HBM market is projected to grow from US$4 billion in 2023 to US$130 billion by 2033, achieving a 42% annual growth rate, fueled by AI infrastructure investments from hyperscalers and tier-2 cloud providers, according to Bloomberg Intelligence.

By 2033, AI chips utilizing HBM are anticipated to grow 17% annually to over 19 million units, with per-chip HBM demand rising at the same rate due to increasing AI model complexity. This growth is expected to push total HBM demand from 372 million gigabytes in 2023 to 8.7 billion gigabytes, representing a 37% annual increase.

HBM pricing is expected to rise by 4% annually until 2031, before gradually declining by 2% annually.

SK Hynix expected to maintain 40% HBM market share

SK Hynix leads the HBM market with a 55-60% share, according to Bloomberg Intelligence. While competition from Micron and Samsung may reduce this to 40% by 2033, the company is expected to retain its leadership position.

Samsung's HBM3E performance challenges have allowed SK Hynix to maintain its edge while enabling Micron to grow its market share from 5% in 2023 to the low 20% range by 2026, a level Micron is projected to sustain.

Samsung is expected to regain technological parity with HBM4 by 2026-2028, reclaiming a 35% market share by 2033, while Chinese suppliers and smaller competitors will likely remain limited to low single-digit shares.

SK Hynix holds a 1-2 year lead over Samsung in HBM technology, having started HBM3 mass production in June 2022, two years ahead of Samsung's late 2023 launch. The company began HBM3E production in March 2024, maintaining a 6-12 month advantage over Samsung, which is expected to follow by late 2024, according to the WSJ.

SK Hynix to surpass 20% NAND market share

IDC data cited by Money Today and Businesskorea reveals that SK Hynix's global NAND market share increased from 11.7% in 2020 to 22.5% in the second quarter of 2024.

BS BusinessWorld and Blocks and Files report Samsung as the NAND market leader with a 36.9% share, while SK Hynix and Solidigm together hold 22.1%. Meanwhile, Kioxia and Western Digital have seen notable declines in market share.

If this trend continues, SK Hynix's annual market share is expected to surpass 20% for the first time in 2024.

SK Group tackles NAND market challenges

In 2021, SK Hynix acquired Intel's NAND and SSD business, forming the US-based subsidiary Solidigm to oversee the assets. However, expected market share gains have fallen short.

SK Hynix's NAND flash market share grew from 13.5% in the third quarter of 2021 to 19.0% in the fourth quarter of 2022, generating approximately US$720 million in enterprise SSD (eSSD) revenue, according to TrendForce, Yonhap News, and Money Today. However, this growth stagnated in 2023, with market share rising only marginally to 19.2%. The semiconductor market downturn has led to continued losses for Solidigm, weighing on SK Hynix's overall financial performance.

As of the second quarter of 2024, SK Hynix and Solidigm jointly captured a 22.1% market share, establishing themselves as the second-largest NAND flash supplier, according to BW BusinessWorld and CB Insights.

Solidigm powers growth in SK Hynix's QLC eSSDs

Rising AI data center investments have driven surging demand for high-capacity eSSDs, strengthening Solidigm's competitiveness. In the second quarter of 2024, Solidigm returned to profitability.

Samsung and SK Hynix are the only players globally equipped with quad-level cell (QLC) NAND technology, enabling high capacity and efficient production—a strategic priority for SK Hynix.

Although PC and mobile demand softened, leading to a decline in SK Hynix's NAND shipments in the third quarter of 2024, a 10% quarterly increase in eSSD average selling prices (ASP) sustained profitability. eSSDs accounted for over 60% of SK Hynix's total NAND revenue.

Solidigm recently launched the industry's highest-capacity NAND solution, a QLC-based 122TB product—twice the size of its previous 61.44TB model, according to Maeil Business Newspaper. When deployed in network-attached storage (NAS) systems, it reduces memory storage space by 75% and power consumption by 84% compared to hybrid HDD and SSD setups.

Samsung holds an estimated 30% share of the NAND market. SK Hynix is focusing on high-value, high-capacity eSSDs to narrow the competitive gap. SK Group chairman Tae-won Chey's appointment as chairman of Solidigm's board of directors is expected to further strengthen the company's NAND business expansion.

Stay up to date with the latest in industry offers by subscribing us. Our newsletter is your key to receiving expert tips.

Samsung scores another major foundry victory, expanding its roster of high-profile clients on advanced nodes. After Tesla selected the company in July to produce its AI6 processor under a $16.5 billio

Texas Instruments, a leading analog IC maker, has released its Q3 2025 results, with its cautious Q4 outlook sparking concerns over the broader semiconductor market. According to Reuters, the company

Global semiconductor sales reached $64.9 billion in August 2025, marking a remarkable 21.7% increase compared to the same period the previous year. This performance underscores the strength of a secto