Global semiconductor sales surged to $53.1 billion in August, a record for the month, driven by booming demand from the AI wave, according to Semiconductor Industry Association (SIA). This marks a 20.6% year-on-year increase, the highest since April 2022, signaling continued momentum in the semiconductor industry.

Money DJ, citing the Semiconductor Industry Association (SIA), reported that global semiconductor sales in August reached $53.1 billion, up from $44 billion in the same period last year. Data compiled by the World Semiconductor Trade Statistics (WSTS) and published by SIA also showed a 3.5% month-on-month increase from July’s $51.3 billion.

“The global semiconductor market continued to grow substantially in August, hitting its highest-ever sales total for the month of August, and month-to-month sales increased for the fifth consecutive month,” said John Neuffer, SIA president and CEO. “Year-to-year sales increased by the largest percentage since April 2022, driven by a 43.9% year-to-year sales increase into the Americas, and month-to-month sales were up across all regions for the first time since October 2023.”

Regionally, the Americas led the growth in August with a 43.9% year-on-year jump in semiconductor sales, followed by China at 19.2%, the Asia-Pacific and other regions at 17.1%, and Japan at 2%. Europe was the only region to post a decline, down 9%.

On a monthly basis, semiconductor sales increased across all regions. The Americas posted a 7.5% rise, followed by Japan at 2.5%, Europe at 2.4%, China at 1.7%, and the Asia-Pacific and other regions at 1.5%.

Commercial Times reports that WSTS recently raised its global semiconductor sales forecast for 2024 to $611 billion, reflecting a 16% increase from last year, driven by strong demand in computing end markets over the past two quarters. Sales in the Americas and Asia-Pacific are expected to grow significantly this year, with annual increases of 25.1% and 17.5%, respectively. In contrast, Europe is forecast to grow by just 0.5%, while Japan is expected to see a 1.1% decline.

For 2024, WSTS predicts global semiconductor sales will rise further to $687 billion, though growth is expected to slow to 12.5%. All regions, however, are forecast to see positive growth.

Stay up to date with the latest in industry offers by subscribing us. Our newsletter is your key to receiving expert tips.

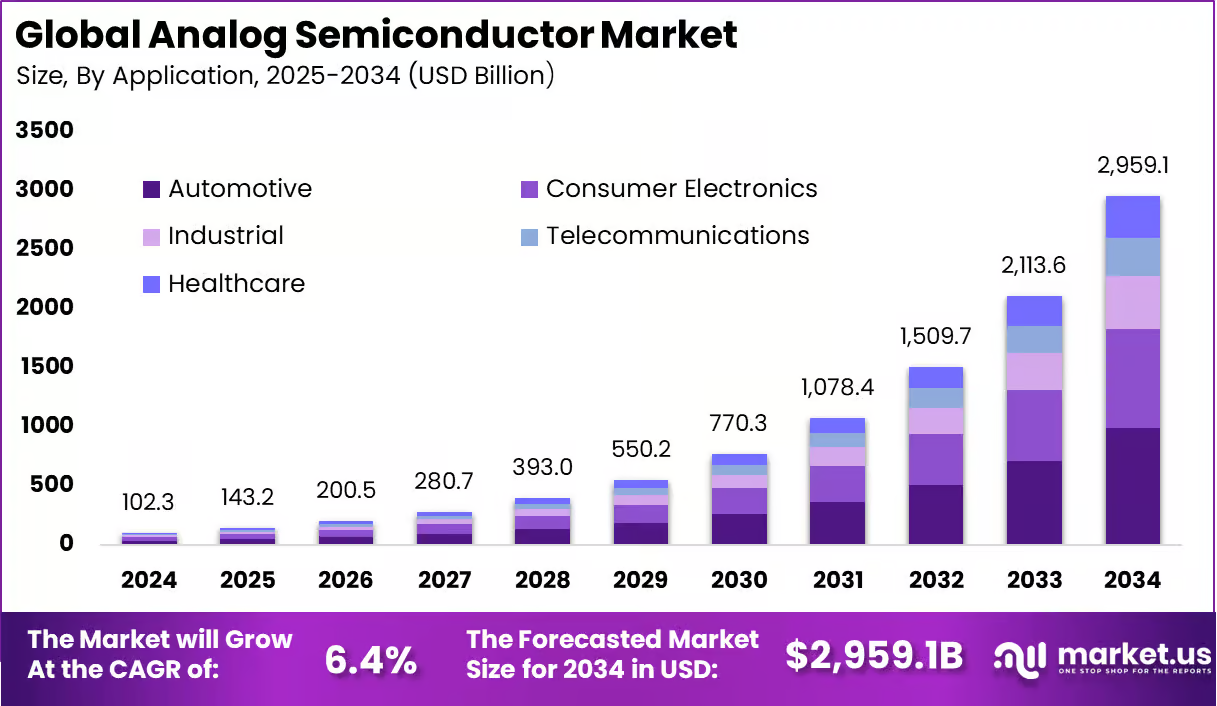

The market size of analog semiconductors was recorded at USD 102.3 billion in 2024 and is projected to register consistent expansion, rising from USD 143.2 billion in 2025 to approximately USD 2,959.1

On 27 July 2025, European Union and United States of America reached a political agreement on tariffs and trade. The transatlantic partnership is a key artery of global commerce and is the most signif

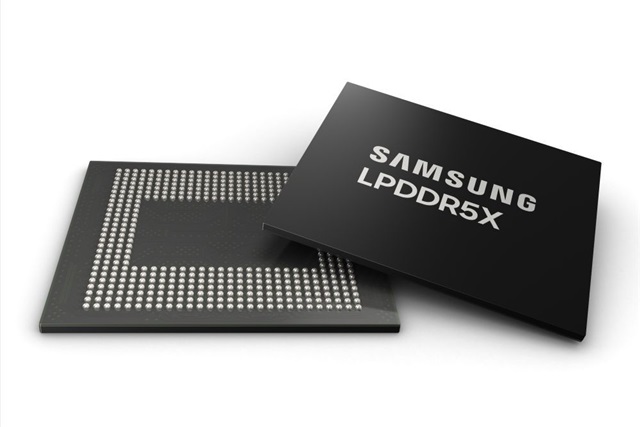

Samsung Electronics will raise contract prices for DRAM and NAND flash in the fourth quarter of 2025, industry sources told Newdaily.co.kr. The move reflects shrinking output of legacy products and su