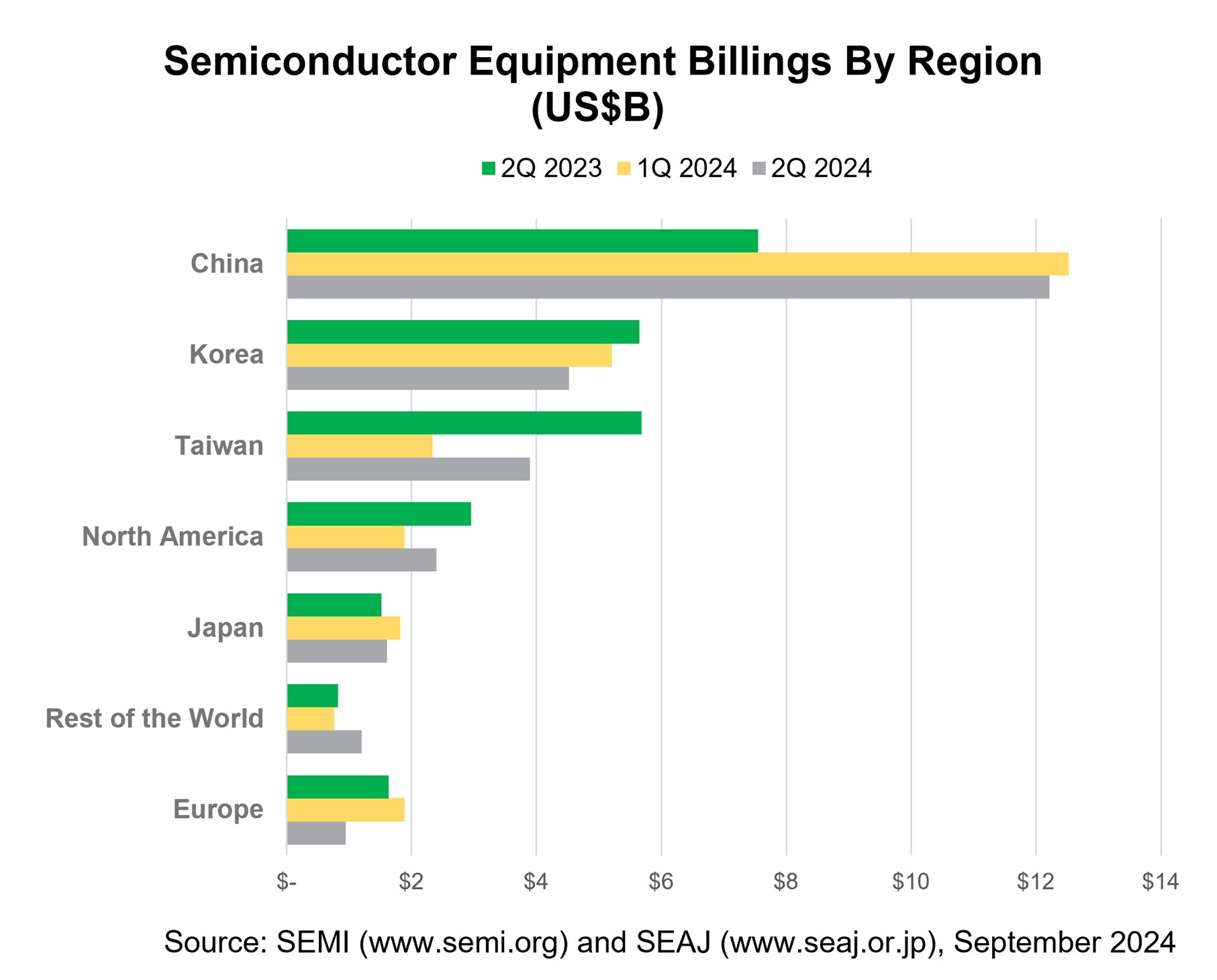

Global semiconductor equipment billings increased 4% year-over-year to US$26.8 billion in the second quarter of 2024, while quarter-over-quarter billings edged up 1% during the same period, SEMI announced today in its Worldwide Semiconductor Equipment Market Statistics (WWSEMS) Report.

"Global semiconductor equipment billings totaled $53.2 billion for the first half of 2024, reflecting a healthy year so far for the industry overall," said Ajit Manocha, SEMI President and CEO. "The semiconductor equipment market has returned to growth driven by strategic investments to support continued strong demand for advanced technologies and regions seeking to bolster their chipmaking ecosystems."

Compiled from data submitted by members of SEMI and the Semiconductor Equipment Association of Japan (SEAJ), the WWSEMS Report is a summary of the monthly billings figures for the global semiconductor equipment industry.

Following are quarterly billings data in billions of U.S. dollars with quarter-over-quarter and year-over-year changes by region:

Stay up to date with the latest in industry offers by subscribing us. Our newsletter is your key to receiving expert tips.

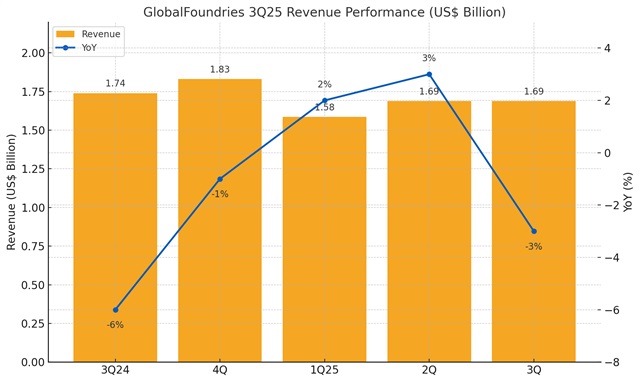

GlobalFoundries forecasts stronger results for the fourth quarter of 2025, saying robust demand from automotive and data center customers is expected to offset continued weakness in the smartphone mar

Infineon Technologies expects moderate growth in fiscal 2026 as geopolitical uncertainties, tariff risks, and currency fluctuations weigh on near-term performance. CEO Jochen Hanebeck said the company

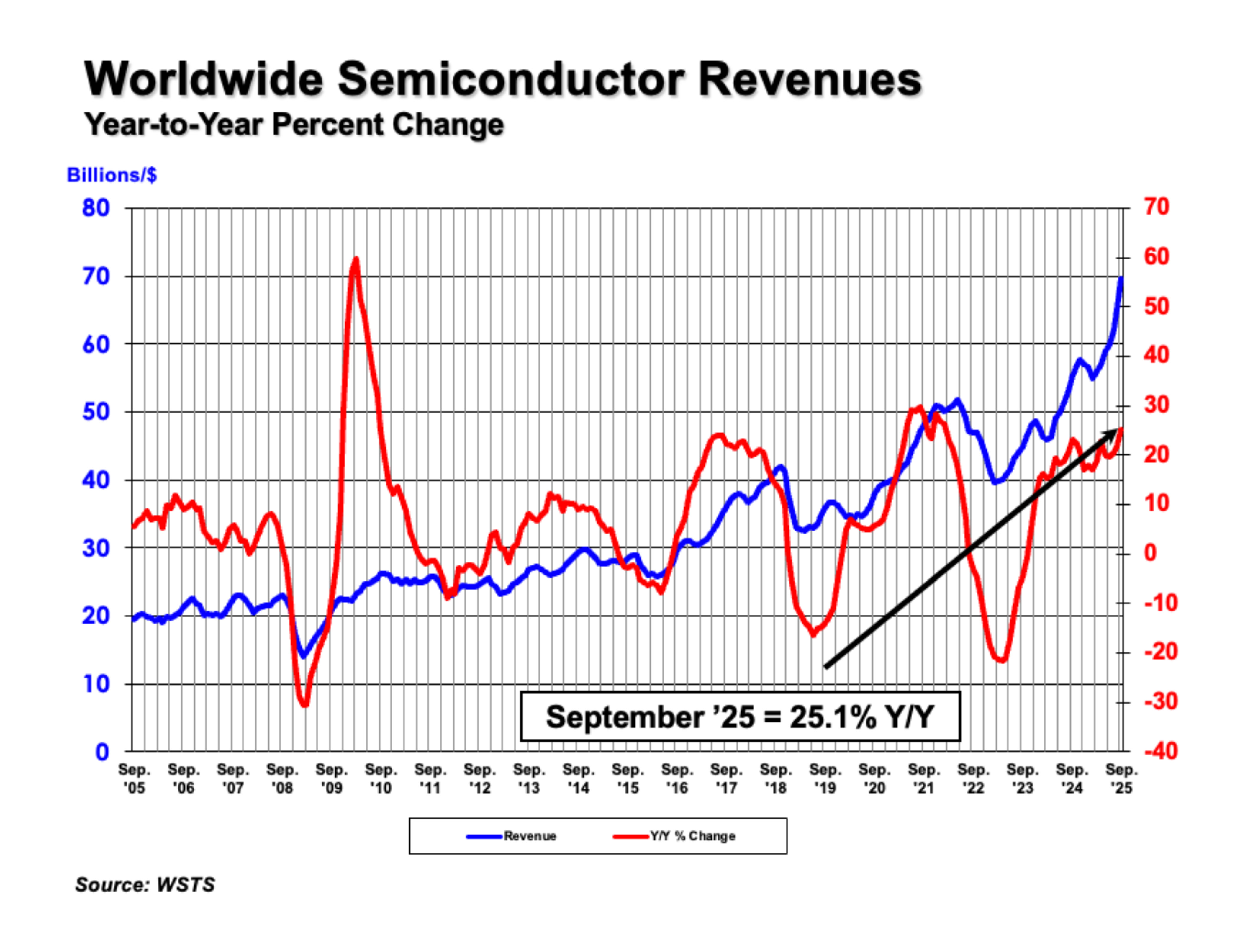

WASHINGTON—November 3, 2025—The Semiconductor Industry Association (SIA) today announced global semiconductor sales were $208.4 billion during the third quarter of 2025, an increase of 15.8% compared