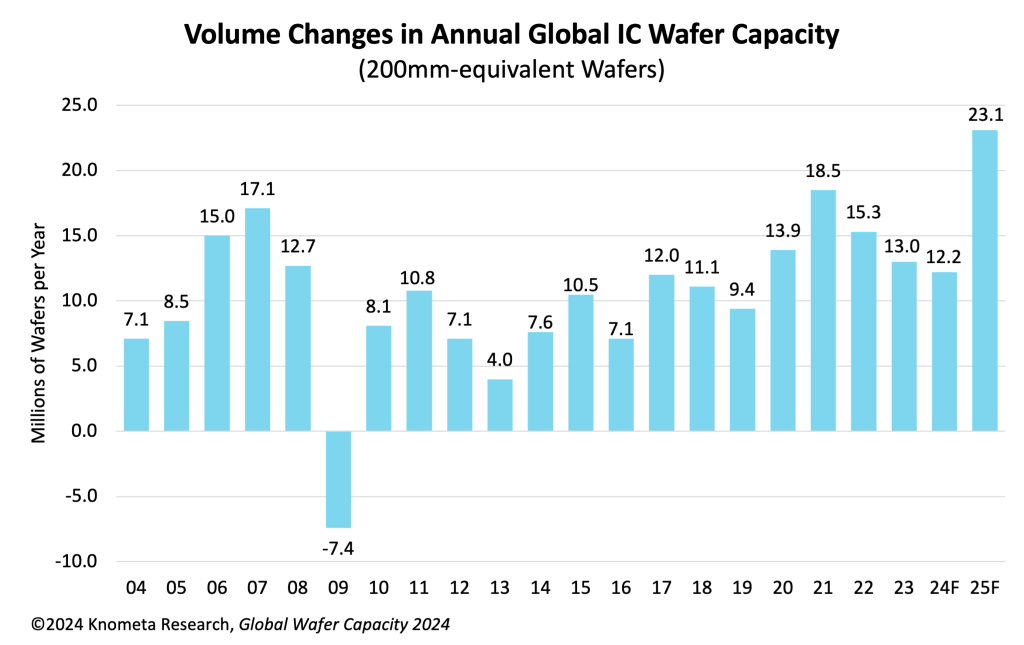

The expansion of fab capacity in 2024 is expected to be relatively low at 4% as manufacturers let capacity utilization rates recover from the low levels experienced in 2023, according to the Global Wafer Capacity 2024 report from Knometa Research

Construction started in 2022 on many fabs originally scheduled to begin operations in 2024, but the market downturn that began that year caused the start date for some fabs to be pushed out to 2025, joining many other fabs already scheduled to open during that year.

The result is predicted to be a record volume of capacity brought online in 2025.

The report shows that 23.1 million 200mm-equivalent wafers per year of capacity is projected to be put into production in 2025, surpassing the previous high of 18.5 million wafers in 2021.

When expressed in 300mm wafer equivalents, there will be 10.3 million wafers per year of capacity brought online in 2025. In terms of growth rate, this is an 8% increase compared to the 2024 capacity level.

Seventeen new fab lines for IC production are scheduled to begin operations in 2025. These include the following:

HH Grace – Wuxi, China – 300mm wafers for foundry services

Intel – New Albany, Ohio, USA – 300mm wafers for adv. logic and foundry

JS Foundry – Ojiya, Niigata, Japan – 200mm wafers for ICs (and discretes)

Kioxia – Kitakami, Iwate, Japan – 300mm wafers for 3D NAND

Micron – Boise, Idaho, USA – 300mm wafers for DRAM

Pengxin Micro – Shenzhen, China – 300mm wafers for foundry

Samsung – Pyeongtaek, S. Korea (P4 fab) – 300mm wafers for 3D NAND and DRAM

SK Hynix – Dalian, China (Fab 68 expansion) – 300mm wafers for 3D NAND

SMIC – Shanghai, China (SN2 fab) – 300mm wafers for foundry

TI – Sherman, Texas, USA – 300mm wafers for analog and mixed-signal

TSMC – Tainan, Taiwan (Fab 18, Phase 8) – 300mm wafers for foundry

UMC – Singapore (Fab 12i, Phase 3) – 300mm wafers for foundry

Stay up to date with the latest in industry offers by subscribing us. Our newsletter is your key to receiving expert tips.

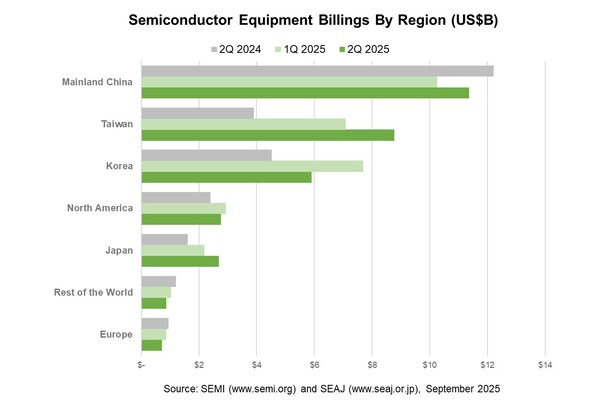

SEMI, the industry association serving the global semiconductor and electronics design and manufacturing supply chain, today announced in its Worldwide Semiconductor Equipment Market Statistics (WWSEM

TSMC's CoWoS capacity remains in high demand, securing its dominant position in advanced semiconductor packaging with rumored gross margins nearing 80%. However, TSMC is proceeding cautiously with

The global semiconductor industry is undergoing a seismic shift, driven by the explosive growth of artificial intelligence (AI) infrastructure. By 2025, the semiconductor market is projected to reach