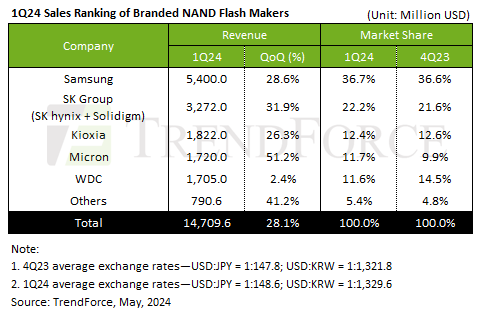

Q1 saw NAND revenues rise by 28.1% to $14.71 billion, says TrendForce.

Micron overtook Western Digital to claim the fourth spot with 51.2% QoQ revenue growth to $1.72 billion.

Samsung remained No.1 with a 28.6% QoQ revenue jump to $5.40 billion. It expects 20% growth in Q2.

NAND revenues rising; Q2 prices to grow 10%

Hynix saw a 31.9% QoQ increase in revenue to $3.27 billion in Q1, and also expects a 20% growth in Q2.

Kioxia had a 26.3% QoQ rise in revenue to $1.82 billion and expects to grow Q2 revenue by approximately 20%.

Western Digital had a 2.4% QoQ revenue increase, reaching $1.71 billion and expects Q2 revenue to remain flat.

The surge in large enterprise SSD orders continues to drive up the ASP of NAND Flash by 15%. TrendForce forecasts Q2 NAND revenue to increase by nearly 10% QoQ.

Stay up to date with the latest in industry offers by subscribing us. Our newsletter is your key to receiving expert tips.

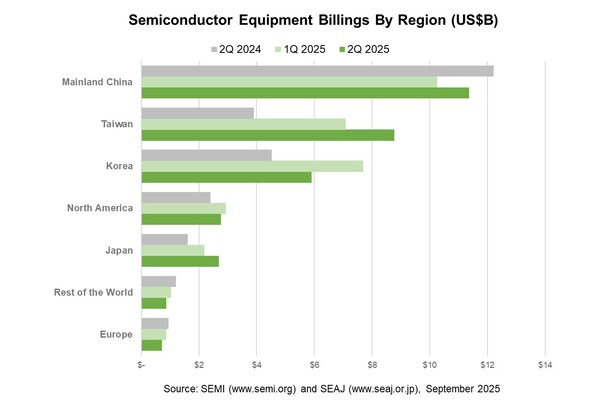

SEMI, the industry association serving the global semiconductor and electronics design and manufacturing supply chain, today announced in its Worldwide Semiconductor Equipment Market Statistics (WWSEM

TSMC's CoWoS capacity remains in high demand, securing its dominant position in advanced semiconductor packaging with rumored gross margins nearing 80%. However, TSMC is proceeding cautiously with

The global semiconductor industry is undergoing a seismic shift, driven by the explosive growth of artificial intelligence (AI) infrastructure. By 2025, the semiconductor market is projected to reach