AEC-Q102 Qualified Device Combines Industry’s Fastest Switching Times and Highest Open Circuit Output Voltage of 8.5 V

MALVERN, Pa., June 07, 2023 (GLOBE NEWSWIRE) -- Vishay Intertechnology, Inc. (NYSE: VSH) today introduced a new Automotive Grade photovoltaic MOSFET driver that is the first such device to offer an integrated turn-off circuit in the space-saving SOP-4 package. Designed to deliver high performance for automotive applications — while increasing design flexibility and lowering costs — the Vishay Semiconductors VOMDA1271 features the industry’s fastest switching times and highest open circuit output voltage.

The integrated turn-off circuit of the optocoupler released today enables a turn-off time of 0.7 ms typical, which is the fastest for a MOSFET driver in the compact SOP-4 footprint. In addition, the VOMDA1271 provides a turn-on time of 0.05 ms — twice as fast as competing devices — and is the only driver in this package size to offer an isolation voltage of 3750 V and a typical open circuit output voltage of 8.5 V, which allows it to drive a variety of MOSFETs.

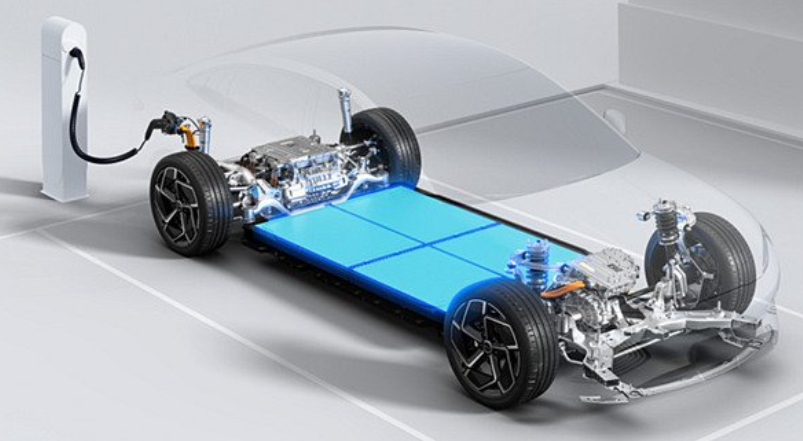

The AEC-Q102 qualified device is intended for use in pre-charge circuits, wall chargers, and battery management systems (BMS) for electric (EV) and hybrid electric (HEV) vehicles. To generate the higher voltages needed to drive IGBTs and SiC MOSFETs in these applications, two VOMDA1271 optocouplers can be used in series. In addition, the driver enables designers to create custom solid-state relays to replace legacy electromechanical relays in next-generation vehicles.

The optically isolated VOMDA1271 features an AIGaAs infrared LED (IRLED), which emits light that is absorbed by a photovoltaic gate array, generating the voltage used to turn on a MOSFET. This construction simplifies designs and lowers costs by eliminating the need for an external power supply. For even greater design flexibility, the device can be driven by a microcontroller’s GPIO pin. The optocoupler is RoHS-compliant, halogen-free, and Vishay Green.

Samples and production quantities of the VOMDA1271 are available now, with lead times of eight weeks.

TrendForce reports that May proved to be a turning point in the lithium salt market, highlighting a notable surge in prices. The price of battery-grade lithium carbonate and lithium hydroxide in China skyrocketed from less than CNY 200,000/ton (~USD 28,000) to over CNY 300,000/ton (~USD 43,000). Notably, the ASP of battery-grade lithium carbonate surged by more than 28%, hitting CNY 254,300/ton. In contrast, battery-grade lithium hydroxide, while slower to respond, saw a 4% drop, with its ASP at approximately CNY 254,900/ton in May. Interestingly, the price differential between these two types of lithium salts has now been significantly reduced.

Despite the sharp increase in lithium salt prices boosting battery cell costs, this hike hasn’t yet translated into an immediate rise in li-ion battery prices. Alongside this, the prices of other crucial li-ion battery materials, such as cathode precursor materials, anode materials, separators, electrolytes, and PVDF, continue to trend downwards. This combination of factors has led to a continued decline in li-ion battery prices throughout May.

May saw a 9% price drop in EV square ternary cells, LFP cells, and pouch ternary power cells, settling at CNY 0.75/Wh, CNY 0.67/Wh, and CNY 0.79/Wh, respectively, as EV markets gradually regained their footing. In the energy storage cell market, prices dropped by a significant 12.6% to CNY 0.65/Wh, with demand in the LFP storage cell market rebounding well, particularly due to the noticeable increase in orders from leading companies. In the consumer battery cell market, prices fell by 11.5%, with LCO cells pried at CNY 7.55/Ah. However, with consumer markets picking up and an expected surge in e-commerce sales in June owing to the 618 shopping day festival, LCO cells are likely to see a price rebound.

TrendForce posits that after a strong rebound in lithium salt prices in mid-May, the market started to stabilize towards the end of the month. While the Chinese EV battery market was slowly recuperating in May, the surge in lithium salt prices partly stemmed from the suppliers’ reluctance to lower prices. Another contributing factor was the increased demand from downstream battery manufacturers looking to replenish their stocks in anticipation of a price rebound.

TrendForce asserts that the Chinese EV battery industry is currently on a recovery path. In May, lithium salt prices began surging dramatically—at its peak rising by CNY 10,000/ton per day. Multiple factors contributed to this irrational price increase, which is not a result of a rapid surge in actual demand, but a steady recovery. June is expected to be a period of peak market demand. However, it’s important to monitor changes in actual downstream demand to prevent dramatic fluctuations in lithium salt prices due to market expectation psychology, which could potentially worsen market conditions.

EINDHOVEN, The Netherlands, June 06, 2023 (GLOBE NEWSWIRE) -- NXP Semiconductors (NASDAQ: NXPI) announced today a family of top-side cooled RF amplifier modules, based on a packaging innovation designed to enable thinner and lighter radios for 5G infrastructure. These smaller base stations can be more easily and cost-effectively installed, and blend more discretely into their environment. NXP’s GaN multi-chip module series, combined with the industry’s first top-side cooling solution for RF power, helps to reduce not only the thickness and weight of the radio by more than 20 percent, but also the carbon footprint for the manufacture and deployment of 5G base stations.

“Top-side cooling represents a significant opportunity for the wireless infrastructure industry, combining high power capabilities with advanced thermal performance to enable a smaller RF subsystem,” said Pierre Piel, Vice President and General Manager for Radio Power at NXP. “This innovation delivers a solution for the deployment of more environmentally friendly base stations, while also enabling the network density needed to realize the full performance benefits of 5G.”

NXP’s new top-side cooled devices deliver significant design and manufacturing benefits, including the removal of the dedicated RF shield, use of cost-effective and streamlined printed circuit board, and separation of thermal management from RF design. These features help networking solution providers create slimmer and lighter 5G radios for mobile network operators, while reducing their overall design cycle.

NXP’s first top-side cooled RF power module series is designed for 32T32R, 200 W radios covering 3.3 GHz to 3.8 GHz. The devices combine the company’s in-house LDMOS and GaN semiconductor technologies to enable high gain and efficiency with wideband performance, delivering 31 dB gain and 46 percent efficiency over 400 MHz of instantaneous bandwidth.

The A5M34TG140-TC, A5M35TG140-TC and A5M36TG140-TC products are available today. The A5M36TG140-TC will be supported by NXP’s RapidRF reference board series. For more information, see our fact sheet at NXP.com/TSCEVBFS or contact NXP Sales worldwide.

Per IPC’s May 2023 Economic Outlook report, the global economy continues to cool, but not quite as severely as expected at the start of the year. Stronger-than-expected growth in 2023 will come at the cost of weaker growth in 2024.

Labor markets remain extremely strong, despite the widely held view that recession is imminent. Both the United States and Europe are enjoying record low levels of unemployment. Strong labor markets and solid wage growth are likely to keep inflationary pressures stubbornly high.

“Consumer confidence fell sharply in the last month, erasing half of the gains since the all-time low levels of June 2022. Business confidence has also been weak. Manufacturers report a subdued outlook in both the U.S. and Europe,” said Shawn DuBravac, IPC chief economist. “Leading economic indicators continue to suggest a high risk of recession this year, even if the timing continues to push later into the year,” DuBravac added.

Additional data in the May 2023 IPC Economic Outlook show:

View May 2023 IPC Economic Outlook. For more information on IPC’s industry intelligence program including current research and reports, visit www.ipc.org/advocacy/industry-intelligence.

Source: EMS Now

The proposed IPEF Supply Chain Agreement would make our supply chains more resilient and competitive, and would establish a framework for lasting cooperation on issues like workforce development, supply chain monitoring, investment promotion, and crisis response.

Completing negotiations on the IPEF Supply Chain Agreement is a major achievement in support of the President’s Indo-Pacific Strategy and a win for consumers, workers, and businesses in the United States and throughout the region.

The IPEF partners will now take steps, including further domestic consultations and a comprehensive legal review, to prepare a final text for signature.

Today, the United States joined its IPEF partners – Australia, Brunei, Fiji, India, Indonesia, Japan, Republic of Korea, Malaysia, New Zealand, the Philippines, Singapore, Thailand, and Vietnam – in announcing the substantial conclusion of negotiations on a landmark IPEF Supply Chain Agreement.

The proposed IPEF Supply Chain Agreement seeks to ensure that American workers, consumers, and businesses benefit from resilient, reliable, and efficient supply chains. It would support the President’s effort to revitalize U.S. manufacturing, facilitating the steady supply of the materials, components, and inputs that U.S. companies rely on to compete effectively on the world stage.

The agreement would foster coordination to identify potential supply chain challenges before they become widespread disruptions. Moreover, through the Agreement, partners would work collaboratively to increase the resilience, efficiency, productivity, sustainability, transparency, diversification, security, fairness, and inclusivity of our supply chains.

The IPEF Supply Chain Agreement would create an IPEF Supply Chain Council to oversee the development of sector-specific action plans designed to build resilience and competitiveness in critical sectors, including by helping companies identify and address supply chain vulnerabilities before they become significant bottlenecks.

Through the proposed agreement, the IPEF partners would also create an IPEF Supply Chain Crisis Response Network that can serve as an emergency communications channel when one or more partners faces an acute supply chain crisis, facilitating more effective responses that can benefit American workers, businesses and consumers.

The proposed Agreement would also establish an innovative tripartite IPEF Labor Rights Advisory Board to help identify areas where labor rights concerns pose risks to the resilience and competitiveness of the partners’ supply chains. The proposed Agreement would also create a mechanism to cooperate with partners to address facility-specific allegations of labor rights inconsistencies.

The IPEF partners will now take steps, including further domestic consultations and a comprehensive legal review to prepare a final text for signature and then ratification, acceptance, or approval. However, the United States and its Partners will begin work immediately to realize the benefits of cooperation on supply chains, including through private sector engagement and the utilization of technical assistance and capacity building activities to increase investment in critical sectors, key goods, physical and digital infrastructure, transportation, and workforce projects.

“The proposed IPEF Supply Chain Agreement would be a win for American consumers, workers, and businesses. It shows that an innovative approach to economic policy that is focused on meeting the challenges of the 21st century in close coordination with partners can deliver meaningful results,” said Secretary of Commerce Gina Raimondo. “By having a network in place ahead of time, we can respond more effectively to supply chain challenges. That is what will make this agreement so unique and so important for the American people.”

In support the goals of the proposed Agreement:

As part of the Biden-Harris Administration’s Indo-Pacific Strategy, President Biden launched IPEF one year ago in Tokyo Japan. IPEF is a new platform for sustained economic cooperation with a group of like-minded countries that are aiming to address many of the unique challenges we have faced in recent years because of an increasingly global economy, rapidly changing technology, and an increase in competition. IPEF will help the United States and its partners shape the future of economic cooperation and trade in a region that is home to 40 percent of global gross domestic product (GDP) and a key source of inputs for American manufacturers – as well as a key export market for American-made goods.

President Biden has overseen a revitalization of the American manufacturing base. The Administration has made generational investments in new manufacturing capacity with a focus on industries of the future, with $400 billion of new private sector investment in major manufacturing projects in sectors like clean energy, semiconductor fabrication, and biotechnology, since President Biden took office. This has resulted in nearly 800,000 new manufacturing jobs and the most robust manufacturing growth since the 1950s.

Source: EMS Now

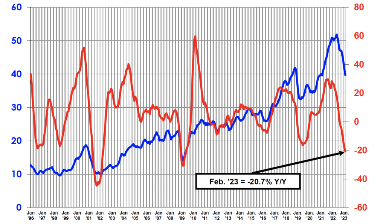

April factory shipments fell 33% while production was cut by 20%.

In March, Korea’s chip inventory rose 28% on February – the biggest m-o-m increase since February 1996,

March inventory was up 39.5% y-o-y.

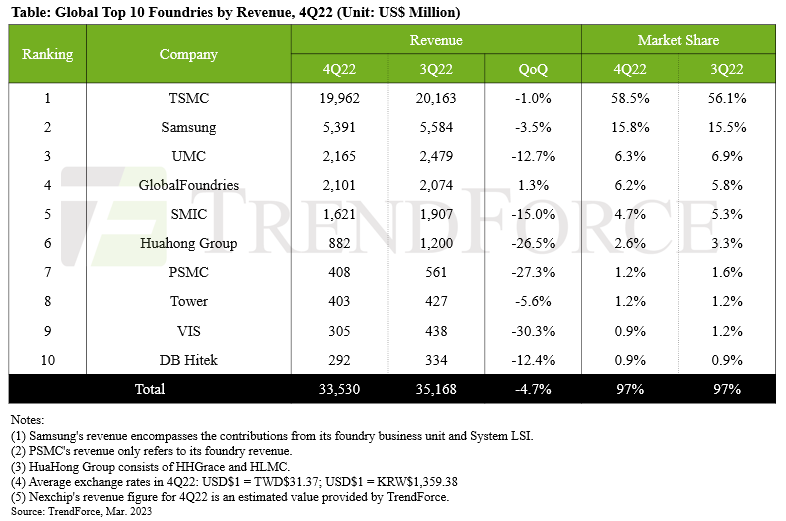

Global Q4 DRAM revenue fell by 32.5% QoQ to $12.3 billion, says TrendForce.

The Q4 QoQ decline was larger than the QoQ decline of 28.8% for Q322 and comes close to the QoQ decline of 36% for the final quarter of 2008, when the global economy was in the middle of a major financial crisis

Source: Electronicsweekly

An enterprise establishes in society and benefits from society, then when it takes on its responsibility to feedback to the society that nourishes it, a positive cycle would be made between the enterprise and the society which helps both grow faster. Flyking believes in such a cycle and insists on doing charity every year.

At the beginning of this summer, from May 25th to 27th, Flyking assembled our executives and outstanding employees together as a 10 people team to go on an education-supporting charity tour.

This is the second year that Flyking brings our love to the students and families in Baise City, Guangxi Zhuang Autonomous Region. We were to visit families in need, donate our living supplies, and provide education grants. Moreover, we have prepared 250 sets of school uniforms for a local primary school named Naba, and books, art tools, stationeries, and sporting goods for four families which we visited last year. Through this charity tour, we hope we can help them to build up a well-resourced education not only to reduce education difficulties but also to enrich students’ extracurricular life.

On the 26th, Fred Wang, the VP of Flyking, Chen, the principal of Naba Primary School, and the other 9 Flyking colleagues, attended the donation ceremony together. During the ceremony, Flyking donated prepared 250 sets of school uniforms. We all regarded this donation as not only material assistance but also spiritual support, with the wish to study hard and fight for better lives.

After that, Flyking team visited Naba Primary School accompanied by Principal Chen. Chen introduced the curriculum of the school as well as the current environment of education and life situation. Flyking team brought our sincere greetings and blessings to all the teachers and also had a cordial conversation with the students, hoping that all the children there can grow up in a better environment and the teachers there can work wholeheartedly and happily.

The next day, the Flyking team visited 4 families we have been supporting and, brought them living and study supplies. We had serious and profound communications with each family, hoping that we could keep our enthusiasm for life in encouraging each other. In the course of our conversation, we also realized that what we were doing was of immense significance. This reinforces the idea that we want to help more people in the future.

With the perfect ending of our charity tour, Flyking Technology will continue to pay attention to the growth of students, and consistently build a bridge to link with young blood who are in need. We will better serve society and the public while practicing our company culture and core values.

SIA CEO John Neuffer today joined fellow members of the Task Force on American Innovation (TFAI)—an alliance of industry, scientific societies, and university organizations—in urging congressional appropriators to fund the investments in scientific research, innovation, and workforce authorized by the bipartisan CHIPS and Science Act. Signatories on the letter included SIA Board members Lisa Su (AMD), Dario Gil (IBM), and Pat Gelsinger (Intel), and SIA members Lawrence Loh (MediaTek), Jinman Han (Samsung), as well as corporate leaders and TFAI members Kent Walker (Google), Brad Smith (Microsoft), Mark Becker (APLU) and Barbara Snyder (AAU).

In the letter sent to Senate Appropriations Committee Chairwoman Patty Murray (D-Wash.) and Vice Chair Susan Collins (R-Maine), House Appropriations Committee Chairwoman Kay Granger (R-Texas) and Ranking Member Rosa DeLauro (D-Conn.), TFAI highlighted the importance of investments in innovation to America’s future:

Funding for critical research and education is an investment in our future competitiveness. Our country will reap the benefits of this investment for generations to come … Innovation has driven significant growth over the last 50 years with America’s GDP growing from $550 billion to more than $23 trillion. Federal research funding is a down payment on our nation’s future success.

The CHIPS and Science Act, landmark legislation enacted last year, provides $52 billion in government investments to reinvigorate domestic semiconductor production and innovation. The law also authorized a larger amount of federal funding for research and innovation, but these authorized amounts must still be appropriated by Congress. Failing to do so, the letter states, would “hamper our ability to meet global challenges and may result in the U.S. falling behind our competitors in critical technologies such as artificial intelligence and quantum computing.”

The letter also points out that the governments of global competitors are investing heavily in research, while U.S. government investments have fallen behind: “Between 2000 and 2022, U.S. funding for federal research actually fell as a percentage of GDP. Meanwhile, China is increasing its spending on research and development and is expected to continue this increase at an average yearly rate of 7% until 2025.”

SIA looks forward to continuing to work with U.S. policymakers to ensure consistent, ambitious investment in initiatives that strengthen U.S. scientific research and America’s future technology workforce.

Source: SIA

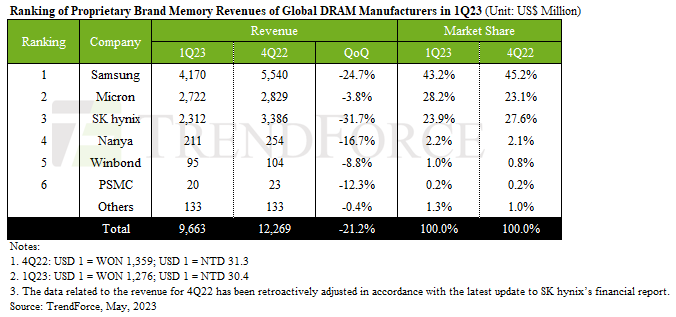

Micron was the only supplier to increase shipments. The Big Three all had ASP declines.

Q2 should see a rise in shipments, predicts TrendForce, but further declines in ASP won’t increase revenues.

The Big Three all reported a drop in quarterly revenue. Samsung saw a decline in both shipment volumes and ASP, resulting in a QoQ decrease in revenue of 24.7%, amounting to about $4.17 billion.

Micron climbed to the second position in Q1 but suffered a 3.8% revenue decline, taking its total down to $2.72 billion.

Hynix had a 15% drop in both units and ASP, leading to a 31.7% plunge in revenue, amounting to approximately $2.31 billion.

NEEDHAM, Mass. – Worldwide revenues for the 5G and 4G/LTE Enterprise Wireless WAN market (formerly referred to as the 4G/LTE and 5G Router & Gateway Forecast) will reach $5.5 billion in 2027, according to a new forecast from International Data Corporation (IDC). This represents a compound annual growth rate (CAGR) of 23.8% over the 2023–2027 forecast period. Worldwide market revenue in 2022 was just under $1.9 billion.

Enterprise Wireless WAN, the new naming convention of this market, has matured greatly over the last five years, with LTE evolving in its own right and 5G solutions bringing an enhanced set of reliability to wireless WAN offerings. Indeed, IDC has observed Enterprise Wireless WAN evolve beyond simply a fail-over for other access technologies to become a primary connectivity solution, in many cases.

“5G Enterprise Wireless WAN solutions scaled rapidly in 2022 across both the branch and mobile markets. Internet of Things (IoT) use lagged a bit in comparison but saw double-digit growth as well. Overall, Enterprise Wireless WAN has moved from not just a supporting technology, but to a critical capability in its own right,” said Patrick Filkins, research manager, IoT and Telecom Network Infrastructure at IDC. “Beyond simply connectivity, 4G/LTE and 5G solutions are playing an increasingly important role in SD-WAN and enterprise edge initiatives as well as being deployed en masse to connect public safety vehicles, public and private transportation, and across industrial environments where mobile solutions are required.”

The report, 5G and 4G/LTE Enterprise Wireless WAN Forecast, 2023-2027 (IDC #US50622523), presents IDC’s annual forecast for the 5G and 4G/LTE Enterprise Wireless WAN Market. Revenue is forecast for both routers and gateways. The report also provides a market overview, including drivers and challenges for technology suppliers.

Source: EMS Now

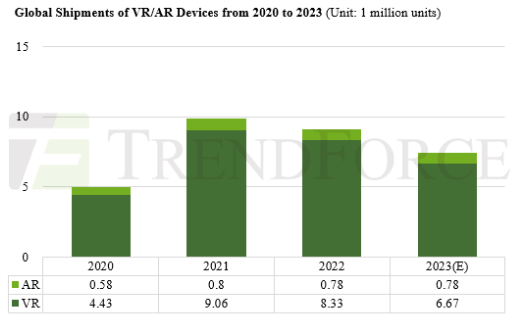

AR unit shipments will stay stable at 780,000 units.

The predicted fall for VR units is because of weaker-than-expected sales of newly released high-end devices.

Consequently, manufacturers are likely to pivot their sales strategies, shifting their focus to more cost-effective offerings.

While Apple’s latest offerings could stimulate some demand, the high price tags attached to these units continue to pose a significant barrier to broader market growth.

MetaQuest 2 continues to maintain its status as this year’s market-leading VR product as the release of Meta Quest 3 has been pushed back to 2024.

Although Apple is projected to launch a new product in 2023, this release is primarily targeted at developers, signifying an accompanying escalation in specifications, features, and, most importantly, cost.

TrendForce anticipates that a significant rise in the VR and AR market, potentially nearing a 40% annual increase in shipments, might not be realized until 2025

IDC reckons the 2023 European AR/VR market will be worth $1.1 billion and $3.4 billion respectively rising, by 2027, to a collective $10.5 billion, with a 2022-6 CAGR of 24.9%.

Source: Electronics Weekly

The CHIPS and Science Act, landmark legislation enacted last year to reinvigorate domestic semiconductor production and innovation, has already sparked substantial company investment announcements that will create jobs and strengthen America’s economy, national security, and global competitiveness. As part of our ongoing effort to provide input to government leaders during the implementation of this critical new law, SIA today submitted comments on the proposed rule of the Internal Revenue Service (IRS) and the Treasury Department to implement the CHIPS Act “advanced manufacturing investment credit.” In the filing, SIA commends Treasury for adopting a holistic approach to implementing the tax credit, while seeking clarifications or technical changes to provide taxpayers with more certainty and flexibility.

The tax credit, an integral part of the CHIPS Act incentives to strengthen the semiconductor ecosystem in the U.S., complements the grant program implemented by the Commerce Department to promote semiconductor manufacturing. The complex, technologically advanced processes of designing and manufacturing semiconductors and semiconductor manufacturing equipment require high levels of investment in facilities and equipment due to the complexity of the technology and the rigorous and exacting standards needed for construction, equipment, and infrastructure. Congress adopted the advanced manufacturing investment credit as part of the CHIPS Act to act as a powerful incentive to advance the goal of making the U.S. a competitive place for semiconductor manufacturing. The proposed regulations from Treasury and the IRS set forth the parameters of eligible investments for companies seeking to claim the credit.

The proposed regulations generally adopt a sound approach to implement the credit. Consistent with congressional intent to provide a credit for qualified investments “integral to the operation” of the facility, Treasury proposes to provide taxpayers with a credit for a wide range of investments necessary to manufacture semiconductors and semiconductor manufacturing equipment. In other words, the credit applies not only to the clean room where fabrication is conducted, but accompanying equipment and infrastructure needed to make the process work. However, SIA calls on Treasury to clarify that the qualified investments listed in the proposal are illustrative and not an exhaustive list. Treasury also sets forth reasonable rules governing the eligibility for the credit for projects that commence construction prior to December 31, 2026, but continue after that date. This is important since many projects will take years to complete.

SIA’s comments provide feedback on various technical aspects of the proposal, such as clarifying the definition of the term “semiconductor” to include semiconductor grade polysilicon, semiconductor silicon wafers, and compound semiconductors. Similarly, the comments seek clarification on the application of the credit for leased property, refurbished equipment, and other issues. SIA also comments on the “recapture” provision – a part of the CHIPS Act that restricts tax beneficiaries from engaging in certain transactions in China or another foreign country of concern. The Commerce Department proposed largely similar regulations to implement “guardrails” applicable to funding recipients of CHIPS grants. SIA also filed comments today on that proposal. In that filing, SIA urges Commerce and Treasury to align the rules, where applicable, in order to facilitate compliance with the grant program and credit recapture requirements and reduce administrative burdens, particularly for companies who participate in both the direct funding program and the tax credit.

The advanced manufacturing investment credit will be a driving force of investments in semiconductor manufacturing and equipment manufacturing facilities in the U.S., and SIA looks forward to the prompt implementation of final regulations to provide certainty and flexibility to the semiconductor industry.

Source: SIA

For first-quarter 2023, AmpliTech Group Inc of Hauppauge, NY, USA – which designs and makes signal-processing radio frequency (RF) microwave components for satellite communications, telecoms (5G & IoT), space, defense and quantum computing markets – has reported revenue of $4.1m, down on $5.1m a year ago. Core low-noise amplifier (LNA) sales continued to grow, but semiconductor distribution sales fell due to softer international demand.

Gross margin was 44%, down only slightly from 45.6% a year ago despite inflationary pressures.

Compared with net income of $3.63m a year ago, net loss was $619,000, attributed largely to a combination of corporate expenses, continuing R&D efforts in new product development, and a temporary downturn in sales in the Spectrum Division.

As of end-March, cash, cash equivalents and marketable securities totaled $10.6m (down from $16m a year ago). Working capital was $18m. AmpliTech says that this still gives it ample capital to finance all of its strategic growth initiatives.

With the AmpliTech MMIC Design Center (AGMDC) division completing design releases and ready to manufacture monolithic microwave integrated circuit (MMIC) products, in Q2/2023 an intense marketing campaign has begun, with expected bookings to occur during Q2 and shipments of MMIC-related products expected to contribute to sales in Q3/2023.

AmpliTech says that, by utilizing its Customer Relationship Management (CRM) engine, implementing artificial intelligence (AI)-powered sales prospecting techniques and leveraging increased attendance at trade shows, it achieved a 70% surge in request for quotes (RFQs) for its low-noise amplifier and 5G systems. CRM currently has $66m in the opportunity funnel, some of which the firm expects to turn into sales over the next Q3 and Q4 quarters.

AmpliTech is participating as a gold sponsor at the IEEE International Microwave Symposium (IMS 2023) in San Diego, CA, USA (11–16 June).

“Our team has been working relentlessly to develop the lowest-noise, lowest-power-dissipating amplifiers on the market and these are included in our new 5G and wireless infrastructure products and MMIC designs for the satellite, wireless and 5G markets, including the advanced military and commercial markets,” says CEO Fawad Maqbool.

“We have also recently expanded into the design of full-service, true5G Open Radio Access Network (O-RAN) front ends. These offerings are cutting-edge, end-to-end solutions and also backwards-compatible and retrofittable with existing obsolete 3G, and 4G systems,” he adds.

The 5G infrastructure market will rise at a compound annual growth rate (CAGR) of 37% to $99bn by 2030, forecasts Precedence Research. “This tremendous growth outlook reaffirms our belief in the significant potential of our product line to serve this market,” continues Maqbool.

“Despite weakening economic trends and the expected 11% decline in the semiconductor market for 2023, as reported by Gartner, we remain optimistic about semiconductors, which are integral to modern technology, and why we have invested heavily in our AGMDC semiconductor division in Texas. We anticipate that global demand will bounce back as market conditions improve,” says Maqbool.

“The second-quarter launch of the MMIC line under the AmpliTech Inc division, coupled with our recent distribution deal with NGK, are important developments that are expected to drive future growth, in addition to our diversified portfolio, strategic investments, and the unwavering commitment of our team,” concludes Maqbool.

Source: Semiconductor today

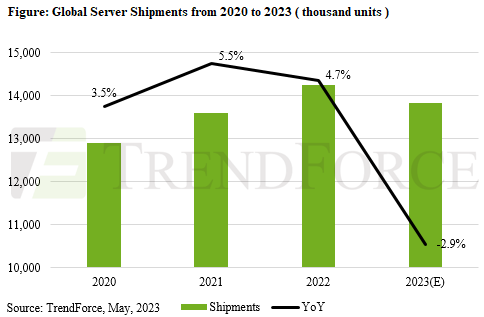

TrendForce reveals that alongside the four major CSPs reducing their procurement volumes, OEMs like Dell and HPE have also scaled back their annual shipment volume forecasts at some point between February and April, predicting YoY declines of 15% and 12%, respectively. Furthermore, server demand in China is facing headwinds due to geopolitical and economic challenges. Consequently, TrendForce projects a downward revision in global server shipment volumes for this year—a 2.85% YoY decrease at 13.835 million units.

TrendForce emphasizes that the server market in 1H23 remains pessimistic, with 1Q23 shipments experiencing a 15.9% QoQ decrease due to off-season factors and end-user inventory adjustments. The expected industry boom in 2Q23 failed to materialize, leading to a modest QoQ growth estimate of only 9.23%. Persistent influences on server shipments include OEMs lowering shipment volumes, subdued domestic demand in China, and continuous supply chain inventory adjustments. ESG issues have also led CSPs to prolong server lifecycles and reduce procurement volume. Moreover, OEMs are lengthening supports period for older platforms as businesses seek to control capital expenditures, further contributing to market strain.

Concurrently, with the growing excitement surrounding ChatBOTs this year, AI server shipments have witnessed a significant boost, driven by the proactive investments of industry giants such as Microsoft and Google. TrendForce anticipates a remarkable 2023 growth rate surpassing 10% for AI server shipments. However, as AI servers currently account for a relatively small portion (<10%) of total server shipments, their impact on revitalizing the sluggish server market remains fairly restricted.

Whether the server market can rebound this year hinges upon the rate of inventory reduction. Given current estimates, this turnaround could materialize as early as late 2023 or extend into the first half of 2024. Meanwhile, the rate of inventory depletion will also affect the schedule for introducing new platforms and may temper suppliers’ eagerness to transition to DDR5 and lower prices. Taking into account present market conditions, TrendForce does not rule out the possibility of further downward revisions to annual server shipment forecasts.

Source: EMS Now

Power semiconductor IC supplier onsemi of Phoenix, AZ, USA has signed a memorandum of understanding (MOU) for an $8m strategic collaboration that includes the establishment of the onsemi Silicon Carbide Crystal Center (SiC3) at Penn State University’s Materials Research Institute (MRI). onsemi will fund SiC3 with $800,000 per year over the next 10 years.

In addition to conducting SiC research at SiC3, Penn State and onsemi aim to raise awareness about the increasing demand for tech jobs in the semiconductor industry as part of their efforts to enhance the USA’s share of global semiconductor manufacturing. They will also partner on workforce development initiatives such as internship and cooperative programs and include SiC and wide-bandgap crystal studies in Penn State’s curriculum. The relationship with Penn State is part of onsemi’s commitment to promoting STEAM (Science, Technology, Engineering, Arts and Mathematics) education, ranging from helping K-12 students in underserved communities to university collaborations that support the development of the workforce.

“onsemi is a proven innovator, delivering a comprehensive portfolio of intelligent power and sensing technologies to enable and accelerate sustainable solutions across multiple markets,” comments Lora Weiss, Penn State senior VP of research. “At the same time, as per the National Science Foundation’s research expenditure rankings, Penn State is ranked first in materials science and second in materials engineering. We have world-class nanofab and characterization facilities that support research on thin films, silicon carbide and other materials used in semiconductors and other technologies. These complementary capabilities between onsemi and Penn State will have a strong impact on research and development, economic growth, and workforce development,” she believes.

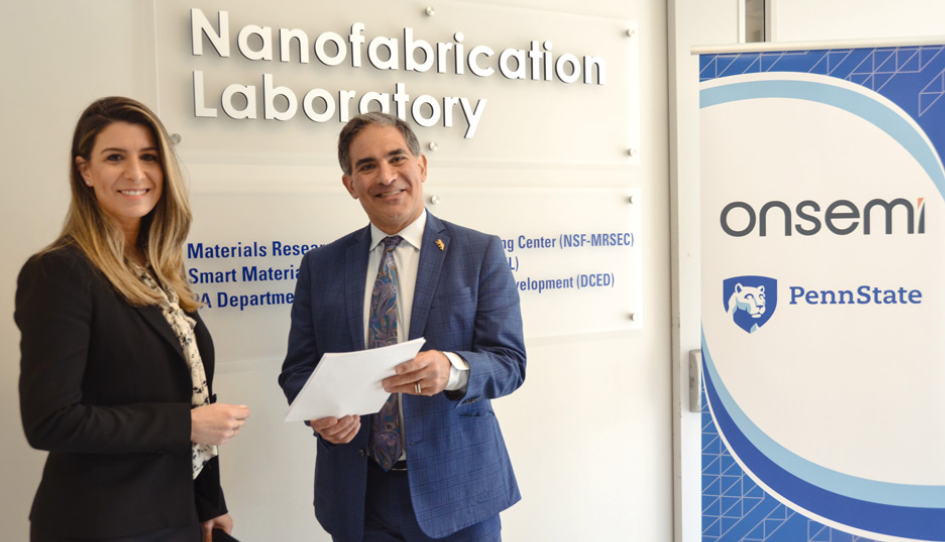

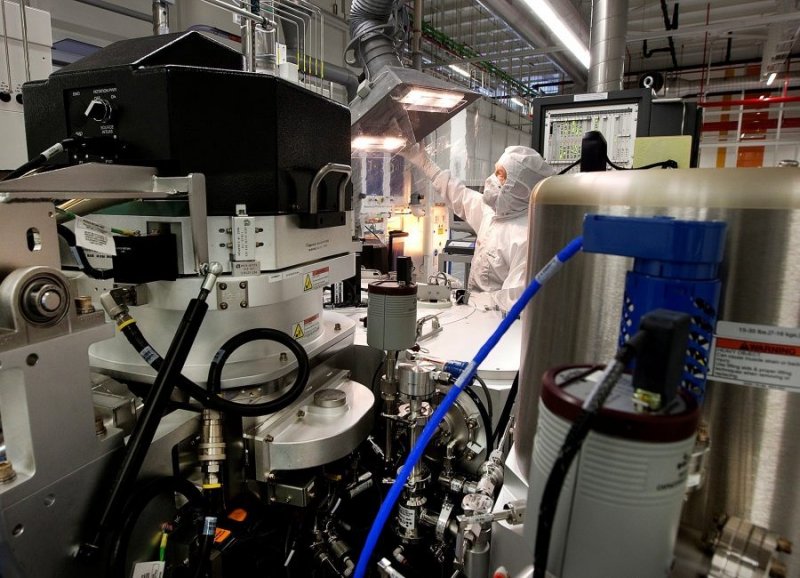

Picture: Catherine C?té, VP & chief of staff to onsemi’s CEO, and Penn State executive VP & provost Justin Schwartz, after signing the MOU.

“Penn State is uniquely positioned to rapidly establish a silicon carbide crystal growth research program,” comments Pavel Freundlich, chief technology officer of onsemi’s Power Solutions Group. “The university offers a wide breadth of capability based on its current materials research, wafer processing capabilities in its nanofab facility, and a comprehensive, world-class suite of metrology instrumentation,” he adds.

“Over the next decade, this collaboration will enable Penn State to become the nation’s leading resource for semiconductor crystal science and workforce development,” believes Justin Schwartz, Penn State executive VP & provost. “This would not be possible without the relationship-building efforts of Priya Baboo, senior director of corporate and industry engagement, and the technical expertise of Joshua Robinson, professor of materials science and engineering, and their counterparts at onsemi,” he adds.

“Penn State’s expansion of its curriculum to offer specialty courses in SiC and wide-bandgap technology will play a key role in meeting onsemi’s strategic workforce development goals and help to meet American semiconductor workforce goals as outlined in the recently signed CHIPS and Science Act,” concludes Scott Allen, vice president, University Relations, at onsemi.

Source: Semiconductor Today

EINDHOVEN, The Netherlands, May 01, 2023 (GLOBE NEWSWIRE) -- NXP Semiconductors N.V. (NASDAQ: NXPI) today reported financial results for the first quarter, ended April 2, 2023.

“NXP delivered quarterly revenue of $3.12 billion, with all our focus end-markets performing better than anticipated, which resulted in total company revenue above the high end of guidance. Solid first-quarter results, guidance for the second quarter, and our early views into the second half of the year underpin a cautious optimism that NXP is successfully navigating through the cyclical downturn in our consumer-exposed businesses, while we see continued strength in our automotive and core-industrial businesses,” said Kurt Sievers, NXP President and Chief Executive Officer.

Key Highlights for the First Quarter 2023:

●Revenue was $3.12 billion, down 0.5 percent year-on-year;GAAP gross margin was 56.7 percent,

●GAAP operating margin was 26.4 percent and GAAP diluted Net Income per Share was $2.35;

●Non-GAAP gross margin was 58.2 percent, non-GAAP operating margin was 34.8 percent, and non-GAAP diluted Net Income per Share was $3.19;

●Cash flow from operations was $632 million, with net capex investments of $251 million, resulting in non-GAAP free cash flow of $381 million;

●During the first quarter of 2023, NXP paid cash dividends of $219 million. The interim dividend for the first quarter 2023 was paid in cash on April 5, 2023 to shareholders of record as of March 15, 2023;

●Beginning with the first quarter 2023 financial guidance, NXP began to apply an estimated annual tax rate to its GAAP and non-GAAP income before tax;

●On January 4, 2023, NXP announced the i.MX 95 family of applications processors, which delivers high performance safety and security features, developed in compliance with automotive ASIL-B and industrial SIL-2 functional safety standards and including an integrated EdgeLock? secure enclave;

●On January 5, 2023, NXP announced the SAF85xx, the automotive industries first 28nm, single chip RFCMOS radar family for next generation ADAS and autonomous driving systems. The SAF85xx radar family reinforces NXP’s leading radar portfolio, built on more than 15 years of technology leadership;

●On February 17, 2023, NXP was named one of the Top 100 Global Innovators? 2023 by Clarivate? for the sixth time. The award identifies organizations at the pinnacle of the global innovation landscape by measuring excellence focused on exceptional consistency and scale in innovativeness;

●On February 22, 2023, NXP announced the EdgeLock SE051H, a single chip secure element designed for Matter, adding to the industry’s broadest portfolio of Matter devices; and

●On March 29, 2023, NXP announced the UCODE? 9xm family of RFID tag solutions, providing high-capacity, flexible memory and industry-leading read/write performance. The UCODE? 9xm family, enables smaller tag antennas, supporting the tagging of smaller objects in supply chain tracking applications.

For the full Semiconductors Reports, please visit: https://media.nxp.com/news-releases/news-release-details/nxp-semiconductors-reports-first-quarter-2023-results

Source: NXP

The bipartisan Protecting Circuit Boards and Substrates Act of 2023 introduced by Representatives Blake Moore (R-UT-1) and Anna Eshoo (D-CA-16) finishes the job the CHIPS Act began by incentivizing investment in the domestic printed circuit board (PCB) industry.

This bill is a necessary follow-on to the CHIPS Act: without a trusted, reliable domestic source of PCBs and substrates, computer chips don’t connect to end use electronic devices.

Domestic PCB production shrunk over the past 20 years, falling from 30% to barely 4%of the world’s supply.

Ninety percent of the world’s supply now comes from Asia…56% in China alone.

Major provisions of the bill:

· $3 billion to fund factory construction, workforce development and R&D

· A 25% tax credit for purchasers of American-made PCBs and substrates

“Now is the moment for Congress to take decisive action by furthering robust legislation to reshore our manufacturing, strengthen our supply chains, and prioritize national security,” said Congressman Blake Moore. “The Protecting Circuit Boards and Substrates Act provides a tried and true approach to incentivizing American companies to produce printed circuit boards here at home, which will maintain the integrity of military and national security commercial materials, boost our economy and workforce, and usher in a new era of American manufacturing. The progress we have made on semiconductors is a significant step in the right direction, but congressional support for the entire microelectronics ecosystem is needed to reduce reliance on China. I am grateful to reintroduce this bill with Congresswoman Eshoo and am hopeful this bipartisan effort will successfully move through the legislative process.”

“Printed circuit boards (PCBs) are critical components of almost every piece of electronics used today. However, over the past two decades, a vast majority of PCB manufacturing has moved offshore, making PCBs vulnerable to tampering by foreign adversaries, and only 4% of PCBs are manufactured in the United States. If we want to ensure technological superiority across the global stage and strengthen national security, we need to bring PCB production back to America, which is exactly what my bipartisan bill does,” said Rep. Eshoo.

“Remember, chips don’t float. They need PCBs to connect to any electronic device. With production of American-made semiconductors ramping up, PCBs are a key ingredient in revitalizing the nation’s microelectronics ecosystem. Without a robust domestic supply chain, we have become almost entirely reliant on foreign suppliers for the PCBs we need,” said Travis Kelly, Chairman of the Printed Circuit Board Association of America.

PCBAA President Will Marsh said, “Our industry is grateful for this bipartisan support for American-made microelectronics. This is the right response to years of offshoring and a dangerous dependence on foreign sourcing.”

PCBAA Executive Director David Schild said, “From F-35s to F-150s, the modern world is built on printed circuit boards, and we need to make more of them in America. This bill will lead to new factories, high paying jobs and an ecosystem to support the work being done by our colleagues in the semiconductor industry.”

Source: EMS Now

JASPER, Ind. — Kimball Electronics, Inc. (Nasdaq: KE) announced financial results for the third quarter ended March 31, 2023.

·Net sales in the third quarter of fiscal 2023 totaled $484.7 million, an all-time quarterly high and up 32% year-over-year; foreign currency had a 2% unfavorable impact on net sales compared to the third quarter of fiscal 2022.

·Operating income of $25.2 million, or 5.2% of net sales, compared to $20.3 million, or 5.5% of net sales, in the same period last year

·Adjusted operating income of $25.6 million, or 5.3% of net sales, compared to $19.6 million, or 5.3% of net sales, in the same period last year

Net income of $16.4 million, or $0.65 per diluted share, compared to net income of $13.6 million, or $0.54 per diluted share, in the third quarter of fiscal 2022“I am very pleased with my first quarter as CEO of Kimball Electronics, and the opportunity to share strong results for Q3,” said Richard D. Phillips Chief Executive Officer. “The Company has been on a path of unprecedented growth, and for the fifth consecutive quarter, revenue reached an all-time record high. Throughout this journey, operating margin has improved as we ramp-up new and existing programs, and leverage our recent facility expansions in Thailand and Mexico. While the macro environment remains challenging, we are forecasting a solid finish in the fourth quarter, and we are updating our outlook for fiscal year 2023, with sales expected at the high-end and adjusted operating margin in the mid-to-low end of our guidance range. We also have been updating our Strategic Plan, which includes review of the positioning, and growth opportunities, within the vertical markets we support. The learnings from this review are encouraging and the path to $2 billion in annual revenue is within our sights. After a fast-paced onboarding, I’m even more excited about our future.”

Source: EMS Now

A preferred partnership between NuCurrent and Infineon aims to achieve more use cases for near-field communication (NFC), with cellphones powering contactless, wireless smart locks, Tim Tumilty, executive VP of business development at NuCurrent, said.

This is the same technology at work when using a cellphone to open a hotel room door or Tap to Pay. The key difference: Infineon’s energy-harvesting actuator collects the phone’s energy to power the transaction—minimizing or even eliminating the need for batteries and the costs associated with those batteries, Tumilty said.

“One of the challenges of deploying smart locks is the batteries,” he said. “Home-lock manufacturers put 9-V battery terminals on the outside of the lock. If the battery goes dead, the homeowner has to find a 9-V battery. Many companies and industries—schools, hospitals and manufacturers—want to replace traditional keyed locks with smart locks. But batteries cost time and money to replace. Eliminating the dead battery problem is driving the demand.”

Infineon was looking for a wireless-charging expert to complement its single-chip technology on the system side, said Qi Zhu, Infineon’s director of marketing and business development.

“Infineon and NuCurrent are bringing together complementary capabilities that are paving the way for new solutions eliminating batteries in locks, sensors and other applications via contactless energy transfer,” Doris Keitel-Schultz, VP of contactless power and sensing at Infineon, said in a press release. “We are providing a reliable, low-maintenance and secure replacement for batteries that significantly reduces e-waste. Our energy-harvesting technology via a mobile phone NFC field enables the digitization of the passive world and connects [that world] to the mobile phone ecosystem.”The companies, which announced their partnership this year, expect to see the technology deployed to customers ahead of next year, with scaling afterward, Tumilty said.

“We’ve shipped evaluation kits to some customers,” he said. “The technology is ready to go for certain applications.”

The energy-harvesting technology comes from Infineon. NuCurrent is using its optimization tools and intellectual property around magnetics, circuit design and system integration to speed up the energy-harvesting process and to improve user experience, especially in highly metallic environments, such as locks, Tumilty said.

In the meantime, Infineon’s NFC tag-side controllers with integrated H-bridge and energy harvesting enable a way to develop more cost-effective, miniaturized actuation and sensing applications that operate in both passive and active mode, the companies said.

In the past, companies have used microcontrollers, but that required more components and was difficult to manage, Zhu said. “We’re the only company to provide single-chip solutions for this use case,” he added.

New potential use cases include locked cabinets to store power tools, locked storage units for delivered packages and drug delivery carts, Tumilty said. The application can also work with sensors and could eliminate batteries on the medical patches that some people wear.

Others include employee lockers, outdoor locks where frigid temperatures will damage batteries and medical wound care, Zhu said.

Zhu said he expected that new use cases would come from the traditional lock market finally making a switch to wireless locks. Meantime, Tumilty said the greatest interest is from lock manufacturers for both consumer and industrial applications whose users complain about dead batteries.

Remote access sites, such as cellphone towers and industrial maintenance areas, are another big potential market, Tumilty said: “Being able to manage locks and credentials for that industrial infrastructure through a cellphone is huge. Keys can get lost. Then you have to replace those remote locks. All of those kinds of costs can be eliminated.”

Improving sustainability by avoiding or limiting battery disposal is a factor for decision-makers at many companies, he said.

Improving response/unlocking time and user experience remain major hurdles.

The energy harvesting already takes less than a minute, Tumilty said. But most users are not patient enough to wait that long.

“Our goal is to at least double the performance time,” he added. “It takes three to five seconds to open a [standard] padlock. Reducing time is huge.”

Improving the antenna to harvest energy as fast as possible is important, Zhu said. Besides improving the antenna performance, optimizing the mechanical design to reduce the energy demand is also important for a better user experience.

“We also need to inform customers that this is a battery-free, green product, and they may need to wait a little longer,” Zhu said.

Another goal is to improve spatial freedom, enabling the technology to work with less precise placement of the cellphone, Tumilty said.

“We want to get the same experience as Tap to Pay,” he said. “That gives you more flexibility to the types of other products you can add.”

“NFC wireless energy harvesting and charging are game-changing technologies from various perspectives: product design, environmental sustainability and user experience,” NuCurrent CEO Jacob Babcock said in prepared remarks. “NFC is in billions of devices today, but the capabilities of energy harvesting are expanding such that it’ll deliver entirely new features to product developers.”

Source: EE Times

Per IPC’s April 2023 Global Sentiment of the Electronics Supply Chain Report, last month delivered a mixed bag of industry sentiment: cost pressures are receding; industry demand appears to be slowing; and industry expects growth in some sectors.

Survey results show:

54 percent of respondents reported that labor and material costs are rising, but the number of companies experiencing rising costs continues to decline.

The Orders Index slipped to 105. While this is still in expansionary territory, it is the lowest it has been since the start of the survey.

Industry believes the military sector will grow 16 percent on average this year, followed by the aerospace sector and the communications sector which are both expected to grow by roughly 11 percent. The medical sector is expected to rise 10 percent.

The automotive sector and industrial electronics sector are both expected to rise 5.6 percent. The consumer electronics sector is expected to decline 3 percent and the computer sector is expected to decline 7 percent in 2023.

“Over the next six months, electronics manufacturers expect to see continued increase in both labor and material costs,” said Shawn DuBravac, IPC chief economist. “Meanwhile, backlogs, ease of recruitment, and profit margins are expected to contract.”

For the report, IPC surveyed hundreds of companies from around the world, including a wide range of company sizes representing the full electronics manufacturing value chain.

Source: EMS Now

Silicon carbide (SiC) technology is well into the power electronics mainstream, and it’s been apparent at the APEC 2023 show in Orlando, California. SiC semiconductors, which complement silicon in many applications, are now enabling new solutions by facilitating high power and high switching frequency in the 650 V to 3.3 kV range.

Keynote speakers and seminar presenters at APEC 2023 explained how SiC devices are uniquely positioned to serve the next-generation power electronics. They emphasized that know-how and learning cycles need to be developed and that there is a growing need for a trained workforce to skillfully insert SiC devices into power electronics systems.

There has also been a consensus that cost is a major issue for SiC components. At the same time, however, there is a broad agreement that cost is application-specific, and it can be reduced at the system level via clever engineering. “Meanwhile, SiC technology will continue to decrease cost at the component level,” said Peter Friedrichs, senior director for wide bandgap at Infineon Technologies.

Source: EE Times

First quarter 2023 results:

“Our first quarter results include double-digit year-over-year product shipment growth despite the pause in Semi-Cap spending, demonstrating the power of our sector diversification,” said Jeff Benck, Benchmark’s President and CEO.

Benck continued “While 2023 has already been a dynamic year, we are encouraged by the demand trends we are experiencing across the majority of our sectors. Coupled with our continued execution, we remain confident in our outlook for the current year as well as our ability to execute to our long-term targets.”

Source: EMS Now

Volkswagen is working with onsemi, a developer of intelligent power and sensing technologies, to produce a next-generation front and rear traction inverter for electric-vehicle powertrains. Execs at the companies say the inverters are part of a system optimization that will improve range, reliability and performance.

Onsemi has developed a power module around its EliteSiC 1200, Pietro Scalia, senior director of automotive traction solutions at onsemi, told EE Times. The module is designed with high levels of integration, scalability and flexibility. A 3D design structure enables a family of products with a common interface, he said.

The modules scale in terms of current and voltage ratings, with minimum changes for electrical, thermal and mounting interfaces, Scalia said. Flexibility comes from providing a half-bridge circuit; scalability comes from the ability of the same package to accommodate different chip quantities and sizes.onsemi’s Pietro Scalia“This makes our modules very scalable and modular for different customer platforms,” Scalia said. “Reliability and high-efficiency performance make it a top performer in the market, enabling the extra miles in the EV, which our customers value. Scalability and flexibility are essential because OEMs typically don’t just design one powertrain for an EV. They develop platforms that scale to cover multiple types of vehicles with different performance and price points.

“Drivers don’t necessarily care about the chip technology or module package, but they do experience the benefits, but drivers do notice vehicle response and the excitement that comes with it, a lack of range anxiety, as well as reliability and a good value for their money,” he added.VW’s electric sports utility vehicle, the ID.4, has an estimated range per charge for 2023 of 275 miles, according to VW.

For customers who prefer to minimize the use of rare Earth metals and avoid permanent magnet motors, onsemi also offers exciter modules as an accompanying module to accommodate externally excited motors, Scalia said.

While the current strategic collaboration was announced this year, teams from the two companies have collaborated for more than a year on optimization of the power modules, the companies told the press. Teams are now developing and evaluating prototypes for a new inverter. As part of the agreement, onsemi will deliver its EliteSiC 1,200-V traction inverter power modules, which are pin-to-pin–compatible to easily scale to different power levels and types of motors, the companies said.

“The superior performance and quality of onsemi’s traction inverter modules, together with our joint efforts to create the best system solution, enable us to deliver the outstanding driving experience and quality that customers expect from a VW Group vehicle,” Karsten Schnake, head of the operative and strategic semiconductor taskforce Compass at Volkswagen, told the press. “Onsemi’s broad portfolio of intelligent power and sensing solutions further allows us to offer cutting-edge technologies and features in our EVs, from the traction inverter and beyond. Besides this milestone, onsemi, with its balanced production-facility layout in the U.S., Asia and Europe, including the plant in the Czech Republic, is the perfect match to support our strategic markets with all high-voltage solutions and more.”

VW declined to comment further for this story.

With 19 wafer fabrication and packaging manufacturing sites, onsemi provides VW with more than 500 devices, including insulated-gate bipolar transistors, metal-oxide–semiconductor field-effect transistors, image sensors and power-management integrated circuits, the company told the press.

“Our broad manufacturing footprint, including a resilient end-to-send SiC supply chain, empowers onsemi to deliver the supply assurance that OEMs demand,” Simon Keeton, executive VP and general manager of onsemi’s power solutions group, said in prepared remarks. “Our investments in ramping production globally, especially in silicon carbide, further allow us to support VW’s rapidly scaling EV production.”

Source: EE Times

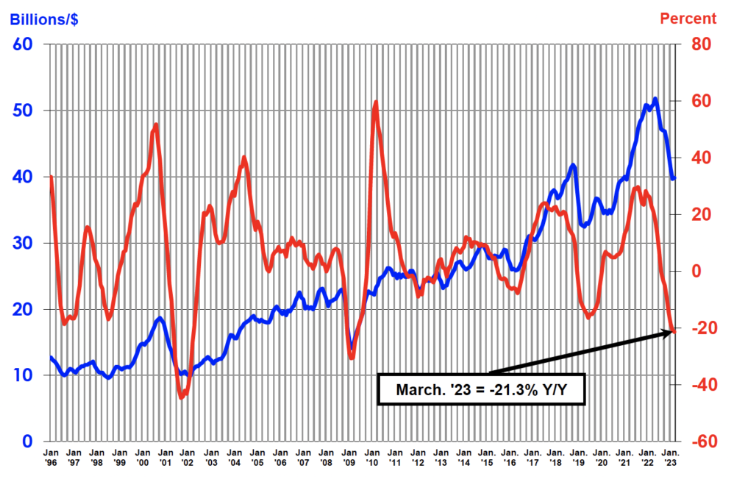

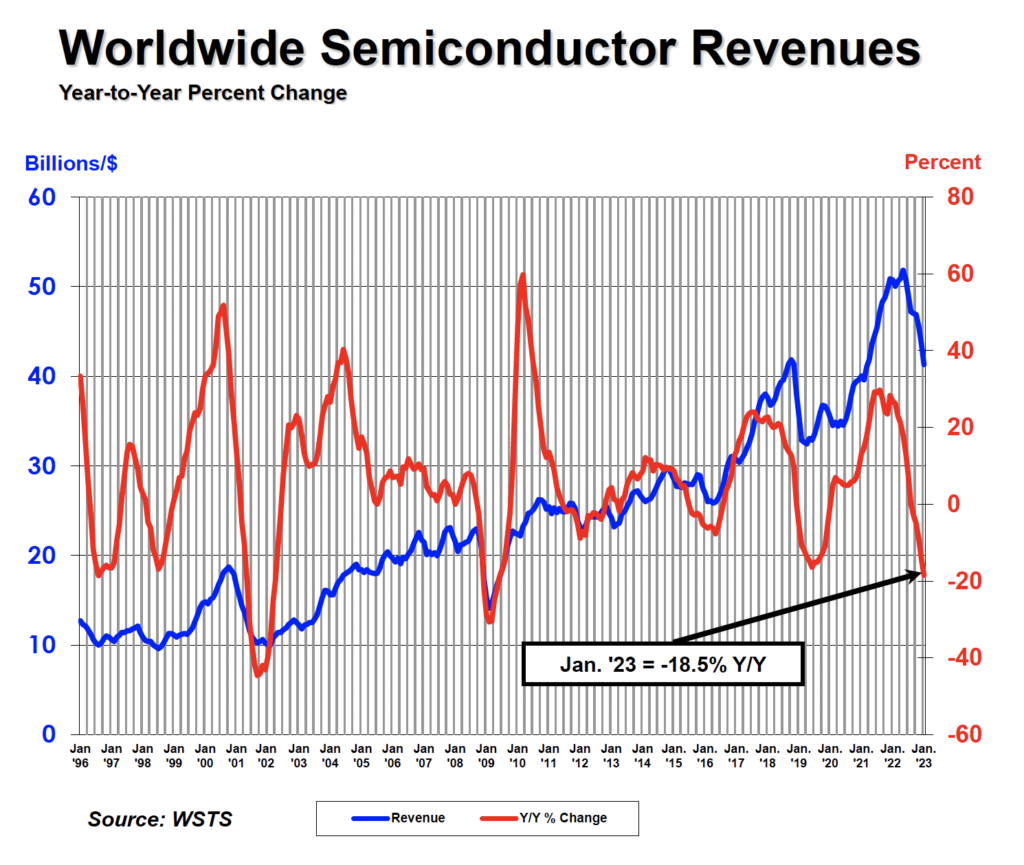

WASHINGTON—May 1, 2023—The Semiconductor Industry Association (SIA) today announced worldwide sales of semiconductors totaled $119.5 billion during the first quarter of 2023, a decrease of 8.7% compared to the fourth quarter of 2022 and 21.3% less than the first quarter of 2022. Sales for the month of March 2023 increased 0.3% compared to February 2023. Monthly sales are compiled by the World Semiconductor Trade Statistics (WSTS) organization and represent a three-month moving average. SIA represents 99% of the U.S. semiconductor industry by revenue and nearly two-thirds of non-U.S. chip firms.

“Semiconductor sales continued to slip during the first quarter of 2023 due to market cyclicality and macroeconomic headwinds, but month-to-month sales were up in March for the first time in nearly a year, providing optimism for a rebound in the months ahead,” said John Neuffer, SIA president and CEO.

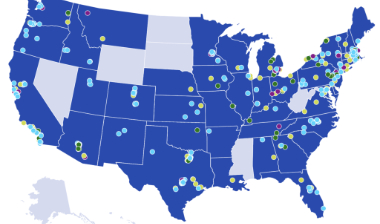

Regionally, month-to-month sales increased in Europe (2.7%), Asia Pacific/All Other (2.6%), and China (1.2%), but decreased in Japan (-1.1%) and the Americas (-3.5%). Year-to-year sales decreased across all regions: Europe (-0.7%), Japan (-1.3%), the Americas (-16.4%), Asia Pacific/All Other (-22.2%), and China (-34.1%).

Source: SIA

Worldwide smartphone shipments declined 14.6% year over year to 268.6 million units in the first quarter of 2023 (1Q23), according to preliminary data from the International Data Corporation (IDC) Worldwide Quarterly Mobile Phone Tracker. This marks the seventh consecutive quarter of decline as the market continues to struggle with lukewarm demand, inflation, and macro uncertainties. While the decline is more than the 12.7% IDC previously forecasted, the results aren’t surprising. Inventory has remained elevated across regions, however it is in significantly better shape compared to six months ago thanks to reduced shipments and heavy promotional activities.

“The industry is going through a period of inventory clearing and adjustment. Market players remain cautious deploying a conservative approach rather than dumping more stock into channel to chase temporary gains in share. I think is the smart thing to do if we want to avoid an unhealthy situation like 2022,” said Nabila Popal, research director with IDC’s Worldwide Tracker team. “While we are optimistic about recovery by the end of the year, we still have a tough 3-6 months ahead. Everyone is anxious about exactly when the tide will turn and wants to be first to ride the wave of recovery. However, it’s a tricky situation. Anyone who jumps in too soon will drown in excess inventory. Now more than ever, it’s important to keep a close pulse of market. Barring unforeseen elements, IDC expects the market to cross into positive territory in the third quarter and see healthy double-digit growth by the holiday quarter.”

Almost all the regions suffered double digit decline in 1Q23. China witnessed close to 12% drop, which was slightly more than expected despite the recent reopening of the market. Consumers are prioritizing travel and entertainment over smartphone purchases and uncertainty still lingers, which is dampening consumer sentiment. Developed markets like the USA and Western Europe fared better than others with declines of 11.5% and 9.4% respectively. Emerging markets like APeJC, CEE and MEA saw larger 17- 20% declines.

“On a positive note, based on recent discussions we’ve had with OEMs and supply chain it appears the smartphone industry is collectively gaining confidence that we’ll see return to growth late this year, and into 2024,” said Ryan Reith, Group VP with IDC’s Worldwide Tracker team . “The largest supply side pullback in recent months was primarily those brands that serve the mid to low end of the market. This is usually where competition is high, and margins are low. Typically, these players are more hesitant to ramp back up again, and while this may still be the case, we are starting to see signs that optimism is growing amongst this crowd.”

Source: EMS Now

STMicroelectronics has released its annual sustainability report detailing 2022 performance, strategy, and ongoing action plans.

“We provide our customers with the key enabling products and technologies for decarbonization and a more sustainable society through digitalization and electrification. We are committed to doing so through a secure and responsible supply chain that prioritizes our people and the planet,” said Jean Marc Chery, President and CEO, STMicroelectronics. “Our strong commitment to sustainability is clear from the important progress we are making in all areas and from our ambition to drive further improvement to achieve all our sustainability goals, including our goal to be carbon neutral by 2027.”

The identification of ST’s priority sustainability topics is formalized through a regular multistakeholder materiality exercise and the company’s reporting is aligned with Global Reporting Initiative (GRI) Standards for stakeholder inclusiveness, sustainability context, materiality, and completeness.

ST’s performance across many areas was recognized again by multiple ESG rankings, indices and international certifications including, among others, Dow Jones Sustainability Index World and Europe, EuroNext VIGEO Europe 120, FTSE4Good, ISS ESG Corporate Rating and MSCI.

ST’s 2022 ESG achievements and progress include:

Sustainable Technology

ST technologies and products enable its customers to boost sustainability and seize opportunities with continued improvement of the Company’s social and environmental footprint at every stage of the product lifecycle (Sustainable technology). In 2022: 77% of new products were identified as responsible (responsible sourcing, eco-design, advanced EHS standards of manufacturing, responsible products, and applications) (vs 69% in 2021); and 23% of total revenue derived from responsible products (vs 20% in 2021).

Sustainable Way

ST is on track to become carbon neutral by 2027 (Energy and climate change) and, while continuing to expand manufacturing capacity, actively worked in 2022 to further reduce its environmental footprint, including the following achievements: a 40% decrease in GHG emissions for scopes 1 and 2 since 2018 in absolute terms (vs a 34% decrease in 2021); an increased sourcing of electricity coming from renewable sources to 62% (from 51% in 2021); and the reuse, recovery, or recycling of 95% of the Company’s waste (vs 90% in 2021), reaching the 2025 target ahead of time.

ST also continued to put people first, with actions and training to support a more diverse and inclusive culture, along with continued progress on health and safety, and talent attraction and engagement, including the following achievements:

? Sustainability performance is now part of the incentive program for over 21,000 employees.

? Over 19,000 employees trained in 2022 on the new leadership model designed to support the transformation journey of the company.

? 86% of employees recommend ST as a great place to work (+3 points vs 2021) (Talent attraction and engagement).

? A further decrease in the recordable case rate for employees (work-related injuries per 100 employees per year) to 0.10 (from 0.12 in 2021), a best-in-class performance.

? Reached the target of hiring 30% women for exempt positions for the second year in a row.

Sustainable Company

Innovation is the driving force that fuels ST’s growth and helps achieve the Company’s business objectives. ST has a collaborative approach for profitable growth, working across ecosystems and communities and with academic, private, and public partners, to create market-leading products and solutions that enable the Company’s customers to tackle tomorrow’s challenges and fuel their future growth:

? 12% of net revenues (US$1.9 billion) invested in R&D to support innovation.

? Involved in 186 active R&D partnerships worldwide.

? More than 450 STEM (Science, Technology, Engineering, and Mathematics) events and initiatives reaching over 100,000 students and teachers (Community and education).

The 26th annual report contains highlights and details of ST’s sustainability performance in 2022 and presents the Company’s ambitions and longer-term goals in alignment with both the United Nations Global Compact Ten Principles and Sustainable Development Goals and the Science Based Targets initiative (SBTi). It is aligned with Global Reporting Standards (GRI), Sustainability Accounting Standards Boards (SASB), and Task Force on Climate-Related Financial Disclosures (TCFD). A third party has verified this report.

More information on ST’s sustainability efforts can be found at https://www.st.com/content/st_com/en/about/sustainability.html.

Source: EE Times

The European Institutions recently reached provisional agreement on the European Chips Act, paving the way for the region’s introduction of an important framework to build out innovation in the European semiconductor ecosystem and security of supply for Europe’s industries.

The European Chips Act, proposed by the European Commission in February 2022, has been the subject of negotiation with the European Parliament and the EU Council (Member States). While this week’s agreement must still be finalized, endorsed and formally adopted by both institutions, it sets the wheels in motion for the roll-out of Europe’s own Chips Act. Formally, following adoption, the EU Council will pass an amendment for the establishment of the Chips Joint Undertaking under Horizon Europe. Both legal texts will be published at that time.

IPC welcomes the European Chips Act as an important step towards strengthening European leadership in innovation and secure and resilient supply chains. In the negotiation process, IPC strongly welcomed fresh emphasis brought by the European Parliament to strengthening European semiconductor packaging capability and enabling a more robust electronics ecosystem. Throughout the process, IPC has urged the adoption of a final package that reflects the strategic role of advanced packaging in driving semiconductor innovation and ensures needed funding is allocated accordingly (see our position on the initial draft legislation).

In an executive meeting with European Government officials organized by IPC and iMAPS on April 13th, industry leaders welcomed the imminent adoption of the Chips Act and its inclusion of packaging in scope. They discussed next steps needed to enable European leadership in back-end segments of the value chain, including IC substrate fabrication and semiconductor assembly & test. The meeting also included leading European EMS and Printed Circuit Board companies that underscored the next steps needed to support a more resilient European electronics manufacturing ecosystem “silicon-to-systems.”

A silicon-to-system strategy would enhance the region’s capabilities and capacities to package semiconductors into advanced components but also include the assembly of those components onto printed circuit boards. This entire silicon to systems ecosystem is necessary to support Europe’s digital and green transitions.

IPC applauds the dedicated work of the European institutions in their negotiation process on the Chips Act. We remain committed to working with the EU Institutions, the industry and other key stakeholders in the Chips Act implementation, as well as the region’s broader initiatives to realign industrial policies to address vital vulnerabilities and ensure a more competitive, resilient and sustainable electronics industry.

Source: EMS Now

The world’s fastest-growing industry, Electronics System Design and Manufacturing (ESDM) continues to transform lives, businesses, and economies across the globe. The global electronic devices market is estimated to be $ 2.9 Tn in 2020. India’s share in the global electronic systems manufacturing industry has grown from 1.3% in 2012 to 3.6% in 2019.SOURCE: Invest India

Technology transitions such as the rollout of 5G networks and IoT are driving the accelerated adoption of electronics products. Initiatives such as ‘Digital India’ and ‘Smart City’ projects have raised the demand for IoT in the electronics devices market and will undoubtedly usher in a new era for electronic products.India is expected to have a digital economy of $1 Tn by 2025.India committed to reach $300 Bn worth of electronics manufacturing and exports by 2025-26.One of the largest electronic devices industries in the world anticipated reaching $ 300 Bn by FY 2025-26.India’s exports are set to increase rapidly from $10 Bn in FY21 to $120 Bn in FY26.India’s domestic production in electronics has increased $ 29 Bn in 2014-15 to $ 67 Bn in 2020-21.Production of mobile handsets is further slated to increase in value from $30 Mn in FY 21 to $ 126 Mn in FY 26.India produces roughly 10 mobile phones per second which amounts to ~$950 worth of production every second.India’s semiconductor market is expected to increase from ~$15 Bn in FY20 to ~$110 Bn in FY30, growing at a CAGR of 22%.100% FDI is allowed under the automatic route. In the case of electronics items for defence, FDI up to 49% is allowed under automatic route and beyond 49% through government approval.

SOURCE: Invest India, EMS Now

The SEMPER X1 LPDDR Flash provides safer, more reliable, and real-time code execution which is deemed critical for automotive domain and zone controllers. According to Infineon, the device delivers 8 times the performance of current NOR Flash memories and achieves 20 times faster random read transactions for real-time applications, enabling software-defined vehicles to deliver advanced features with enhanced safety and architectural flexibility.

Intelligence, connectivity, and complexity, along with safety and dependability requirements means that next-generation vehicles are increasingly reliant on state-of-the-art multi-core processors developed on advanced manufacturing processes.

Consequently, higher density embedded non-volatile memories are no longer seen as a viable cost option at these advanced nodes, and system architects need to consider using external NOR for code storage. These complex automotive real-time processors, however, demand more performance than current memories available on the market.

To address this, Infineon developed the SEMPER X1 with an LPDDR4 interface operating at 3.2 GBytes/sec and a multi-bank architecture to meet the performance and density requirements of domain and zone controllers.

“With the drive towards semi-autonomous vehicles and more sophisticated engine control, real-time decisions are critical to the dependability and safety of the vehicle and driver,” said Jim Handy, General Director of the semiconductor market research firm Objective Analysis. “Infineon’s LPDDR Flash memory should address these needs well in next-generation vehicles, providing real-time execute-in-place (XiP) memory and enabling it to scale independently of the processor.”

Source: New Electronic

The European Council and the European Parliament has reached an agreement on a deal that will invest $3.6 billion in EU funds — with the aim of attracting a further $43.7 billion in private investment — to build out the continent’s semiconductor manufacturing capabilities.

Europe, like the U.S., is grappling with a fast-changing semiconductor marketplace, as governments around the world increasingly adopt more restrictive policies on the import and use of chips from overseas.

The EU’s Chips Act is broadly similar in its goals to the US CHIPS and Science Act, which was signed into law by President Joe Biden in August 2022. Both the US and EU measures are meant as a response to post-pandemic supply chain issues that the semiconductor market has faced in recent years and to the US’ ongoing “chip war” with China, over security concerns posed by close governmental oversight of major silicon manufacturers in that country.

Meanwhile, the new EU deal reached between the Parliament and the Council of Ministers, announced Tuesday, has three central “pillars.” The first is the “Chips for Europe Initiative,” which centers on building out manufacturing capacity through knowledge transfer and the establishment of “competence centers” around Europe. These centers will be designed to provide access to experimental data and technical expertise, letting subject-matter experts improve their skills and help create new designs.

The second policy pillar centers on attempts to attract new investment by granting fast-track permitting to “first-of-its-kind” facilities in Europe and designating additional centers of excellence.EU Chips Act Call For Monitoring Supply ChainFinally, the Chips Act provides for a monitoring and crisis response system for the supply chain, which is designed to alleviate the supply shortages that resulted from the COVID pandemic and the war in Ukraine. The European Commission welcomed the news that an agreement had been reached in an official statement, saying that semiconductors are a critical geostrategic concern and that the Chips Act would buttress both Europe’s economic competitiveness in the area and its strategic position, by increasing the share of chips produced in the EU.

“Recent shortages of semiconductors have highlighted Europe’s dependency on a limited number of suppliers outside of the EU, in particular Taiwan and South-East Asia for manufacturing of chips, and the United States for their design,” the Commission statement said.Margrethe Vestager, executive vice president of the EC, tweeted her own approval, as well, saying that boosting Europe’s ability to produce chips domestically makes it a bigger partner in the global supply chain, and helps enable societal advances.

“We need chips to power digital and green transitions or healthcare systems,” she said.

The Chips Act dates back to a European Commission proposal first issued in February 2022, and adopted by the European Council in December of that year. The European Parliament approved it this February, and the measure will now go back to the Council and the Parliament for formal ratification and adoption.

Source: EMS Now

WASHINGTON—April 18, 2023—The Semiconductor Industry Association (SIA) today released the following statement from SIA President and CEO John Neuffer commending the introduction in the House of Representatives of bipartisan legislation to restore full tax deductibility of R&D investments. The legislation, the American Innovation and R&D Competitiveness Act, was introduced in the House today by Reps. Ron Estes (R-Kan.) and John Larson (D-Conn.), along with more than 60 bipartisan supporters. A similar bill to restore R&D expensing was introduced in the Senate on March 16 by Sens. Maggie Hassan (D-N.H.) and Todd Young (R-Ind.) and has garnered 20 bipartisan cosponsors.

“R&D is the driving force behind semiconductor innovations that have advanced modern technology and made the world smarter, more efficient, and better connected. U.S. semiconductor companies invest an average of one-fifth of their revenues in R&D annually, among the largest shares of any sector. Restoring the longstanding policy of allowing the immediate, full deduction of R&D investments would help expand U.S.-based R&D and innovation, spur economic growth and job creation, and strengthen America’s tech workforce.

“We commend Reps. Estes and Larson for introducing the American Innovation and R&D Competitiveness Act and look forward to working with bipartisan leaders in Congress to swiftly pass this critical legislation.”

Since 1954, R&D expenditures were treated as an immediate deduction. For decades, the immediate deduction for U.S. R&D expenditures provided a longstanding incentive for chip companies to make those investments, helping to maintain U.S. leadership in this vital technology. As of 2022, however, U.S. R&D expenses must now be amortized over five years, making it less attractive to perform R&D in the U.S. and harming competitiveness of the domestic semiconductor industry.

Even prior to the amortization requirement, the U.S. R&D incentive trailed those offered by global competitors, and without action to restore immediate deductibility of R&D expenses, the U.S. ranking for incentivizing research is projected to fall to the bottom quarter of OECD countries.

In addition, R&D costs are rising exponentially, with the most advanced semiconductor node costing more than $500 million to design, double the cost to design the previous leading-edge chips. Full and immediate expensing is necessary to spur R&D investments in the U.S. semiconductor industry and allow companies to further innovate and expand the domestic R&D workforce.

Source: SIA

Incap estimates that its revenue and operating profit (EBIT) for 2023 will be lower than in 2022. The decrease in the revenue and operating profit estimate is related to Incap’s largest customer, who has decided to reduce inventory levels and is therefore postponing some orders from 2023 to 2024.

With the current change in the market dynamics including improved component availability as well as a recession in some key markets, the customer has built up too high inventory levels, as growth is smaller than they initially projected.