572

6

Down quarter for ST

ST had Q1 net revenues down 18.4% y-o-y at $3.47 billion for a gross profit down 31.6% y-o-y at $1.44 billion, a gross margin of 41.7%, an operating margin of 15.9% and net income of $513 million.

Q1 free cash was $134 million after Net Capex of $967 million

For Q2, net revenues of $3.2 billion and gross margin of 40% are expected.

For the full year, revenues of $14-15 billion are expected, down from a previous expectation of $15.9 billion to $16.9 billion.

“Q1 net revenues and gross margin both came in below the midpoint of our business outlook range, driven by lower revenues in Automotive and Industrial, partially offset by higher revenues in Personal Electronics,” said CEO Jean-Marc Chery (pictured) , “on a year-over-year basis, Q1 net revenues decreased 18.4%, operating margin decreased to 15.9% from 28.3% and net income decreased 50.9% to $513 million.”

“During the quarter, Automotive semiconductor demand slowed down compared to our expectations, entering a deceleration phase, while the ongoing Industrial correction accelerated,” added Chery, “our second quarter business outlook, at the mid-point, is for net revenues of $3.2 billion, decreasing year-over-year by 26.0% and decreasing sequentially by 7.6%; gross margin is expected to be about 40%.”

“We will now drive the Company based on a revised plan for FY24 revenues in the range of $14 billion to $15 billion. Within this plan, we expect a gross margin in the low 40’s,” said Chery, “we plan to maintain our Net Capex plan for FY24 at about $2.5 billion focusing on our strategic manufacturing initiatives.”

Quarterly Financial Summary (U.S. GAAP)

Net revenues totalled $3.47 billion, representing a year-over-year decrease of 18.4%. Year-over-year net sales to OEMs and Distribution decreased 11.5% and 30.8%, respectively. On a sequential basis, net revenues decreased 19.1%, 320 basis points lower than the mid-point of ST’s guidance.

Gross profit totaled $1.44 billion, representing a year-over-year decrease of 31.6%. Gross margin of 41.7%, 60 basis points below the mid-point of ST’s guidance, decreased 800 basis points year-over-year, mainly due to the combination of sales price and product mix, unused capacity charges and reduced manufacturing efficiencies.

Operating income decreased 54.1% to $551 million, compared to $1.20 billion in the year-ago quarter. ST’s operating margin decreased 1,240 basis points on a year-over-year basis to 15.9% of net revenues, compared to 28.3% in the first quarter of 2023.

Jayce

/include/upload/kind/image/20240425/20240425181801_7750.png

ST had Q1 net revenues down 18.4% y-o-y at $3.47 billion for a gross profit down 31.6% y-o-y at $1.44 billion, a gross margin of 41.7%, an operating margin of 15.9% and net income of $513 million.

Q1 free cash was $134 million

2024/4/25 18:18:04

2024/4/25 18:18:04

0

0

571

6

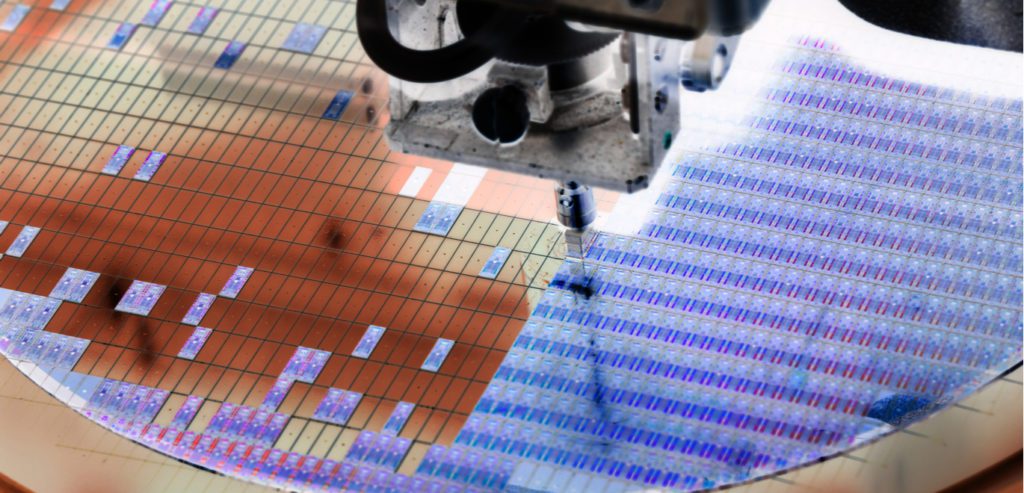

Samsung in mass production of 286-layer NAND; next comes 400 layer

Samsung is in mass production of its 9th gen, 286-layer, 1Tbit, TLC NAND flash memory and says the 10th gen will have 400 layers.

Compared with the 236-layer 8th gen memory, the 286-layer device increases bit density by 50%, data input and output speeds by 33% and reduces power consumption by 10%.

Innovations include cell interference avoidance and cell life extension and eliminating dummy channel holes has significantly reduced the planar area of the memory cells.

Samsung’s “channel hole etching” technology creates electron pathways by stacking mold layers and maximises fabrication productivity as it enables simultaneous drilling of the industry’s highest cell layer count in a double-stack structure.

As the number of cell layers increase, the ability to pierce through higher cell numbers becomes essential, demanding more sophisticated etching techniques.

The 9th-generation V-NAND is equipped with the Toggle 5.1 interface which supports increased data input/output speeds by 33% to up to 3.2 Gbps.

Jayce

/include/upload/kind/image/20240424/20240424175508_3647.jpeg

Samsung is in mass production of its 9th gen, 286-layer, 1Tbit, TLC NAND flash memory and says the 10th gen will have 400 layers.

Compared with the 236-layer 8th gen memory, the 286-layer device increases bit density by 50%, data inp

2024/4/24 17:55:37

2024/4/24 17:55:37

1

0

570

6

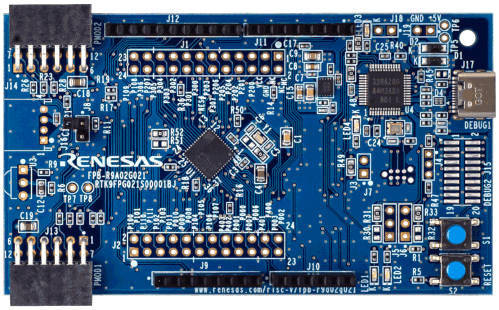

Micron to get $6.1bn in Chips Act money

Micron will get $6.1 billion in US Chips Act grants to help build fabs in New York and Idaho.

Senator Chuck Schumer of New York announced the award and said the money would go towards building two fabs in New York by 2030 and one in Idaho.

US President Joe Biden is expected to make an announcement about the award on Thursday when he visits Syracuse, New York.

Syracuse is where Micron has said it intends to build up to four fabs over the next two decades at a cost of $100 billion.

Last week New York Governor Kathy Hochul said funding from the Chips Act would secure a $100 billion investment in the state.

Major Chips Act awards have now gone to Intel, TSMC, Samsung and Micron. In addition to the grants, the firms qualify for a 25% tax credit on the cost of building fabs.

Jayce

/include/upload/kind/image/20240423/20240423175118_8256.jpg

Micron will get $6.1 billion in US Chips Act grants to help build fabs in New York and Idaho.

Senator Chuck Schumer of New York announced the award and said the money would go towards building two fabs in New York by 2030 and o

2024/4/23 17:51:35

2024/4/23 17:51:35

2

0

569

5

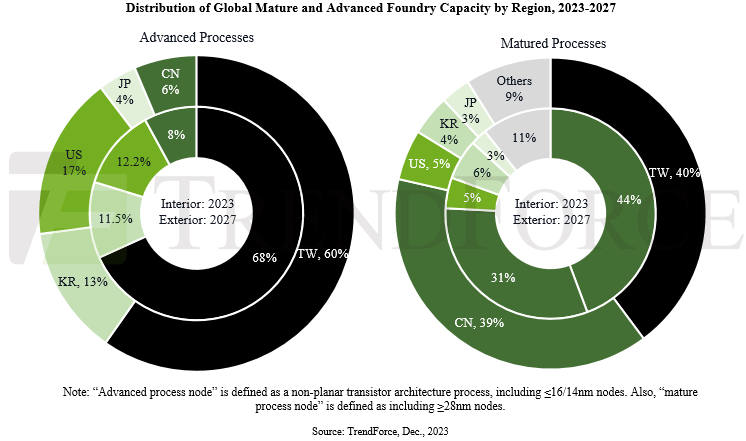

Flyking Weekly Industry Express

Jayce

/include/upload/kind/image/20240422/20240422173954_4743.jpg

2024/4/22 17:40:15

2024/4/22 17:40:15

8

0

568

6

TSMC Q1 Profit Up 8.9%

Earlier today TSMC announced Q1 revenue up 12.9% y-o-y at $18.87 billion and profit up 8.9% y-o-y at $6.96 billion.

Compared to Q4, the Q1 revenue was down 5.3% and net income was down 5.5%.

Gross margin for the quarter was 53.1%, operating margin was 42.0%, and net profit margin was 38.0%.

In Q1, shipments of 3-nanometer accounted for 9% of total wafer revenue; 5-nanometer accounted for 37%; 7-nanometer accounted for 19%.

Advanced technologies, defined as 7-nanometer and more advanced technologies, accounted for 65% of total wafer revenue

Jayce

/include/upload/kind/image/20240418/20240418220445_3569.jpg

Earlier today TSMC announced Q1 revenue up 12.9% y-o-y at $18.87 billion and profit up 8.9% y-o-y at $6.96 billion.

Compared to Q4, the Q1 revenue was down 5.3% and net income was down 5.5%.

Gross margin for the

2024/4/18 22:05:14

2024/4/18 22:05:14

5

0

567

6

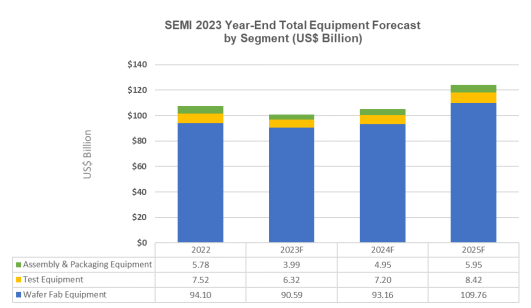

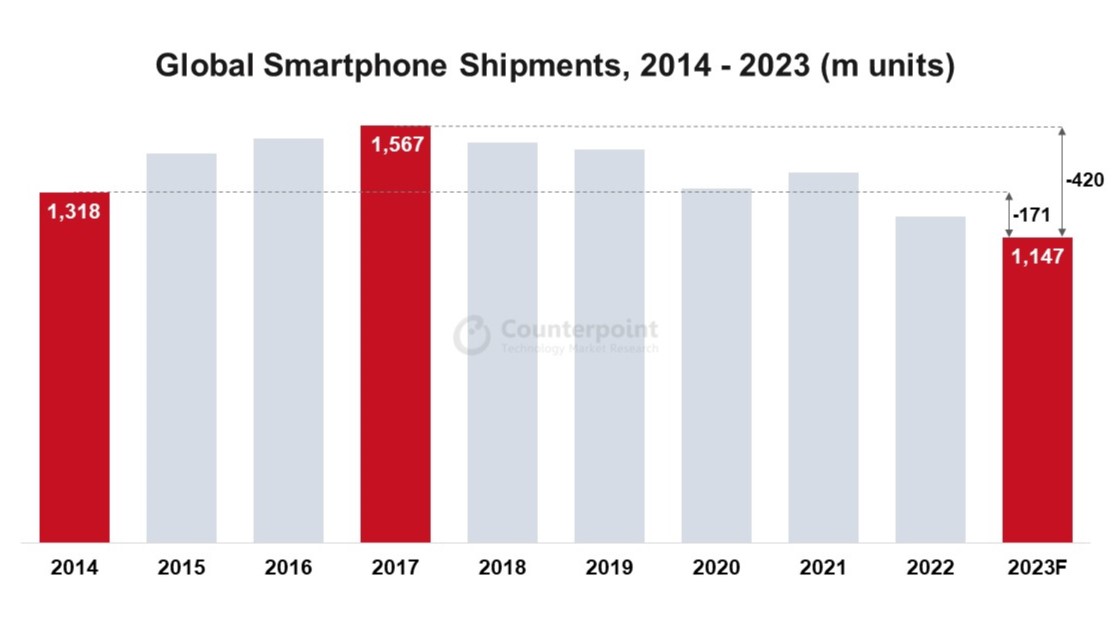

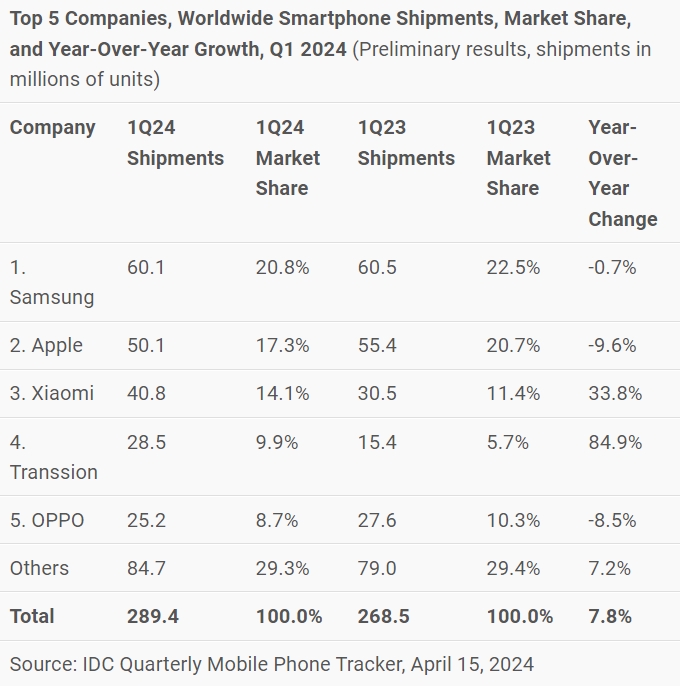

Apple Loses Phone Crown as Q1 Market Grows 7.8%

The Q1 smartphone market grew 7.8% q-o-q to 289.4 million units, says IDC. It was the third consecutive quarter of market growth,

Notes:

? Data are preliminary and subject to change.

-

Company shipments are branded device shipments and exclude OEM sales for all vendors.

-

The “Company” represents the current parent company (or holding company) for all brands owned and operated as a subsidiary.

-

Figures represent new shipments only and exclude refurbished units.

Jayce

/include/upload/kind/image/20240416/20240416174142_5644.jpg

The Q1 smartphone market grew 7.8% q-o-q to 289.4 million units, says IDC. It was the third consecutive quarter of market growth,

Notes:

• Data are preliminary and subject to change.

2024/4/16 17:42:41

2024/4/16 17:42:41

9

0

566

5

Flyking Weekly Industry Express

Jayce

/include/upload/kind/image/20240415/20240415173854_3551.jpg

2024/4/15 17:39:52

2024/4/15 17:39:52

20

0

565

6

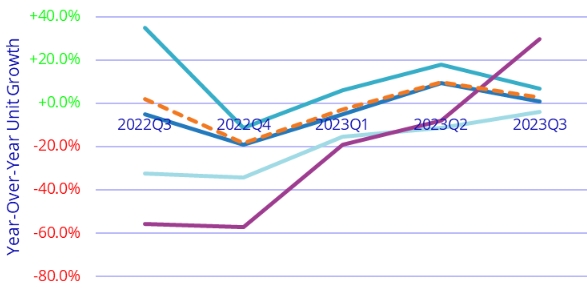

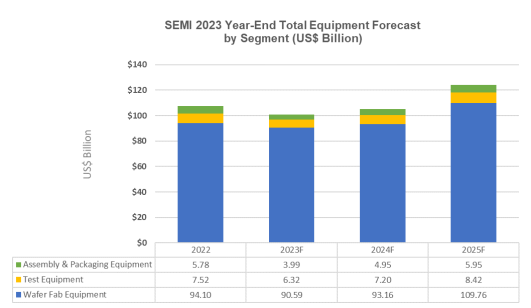

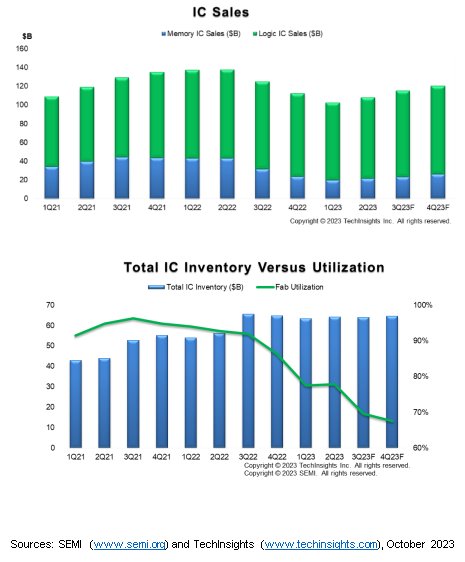

Semi Manufacturing Equipment Sales Fell 1.3% Last Year, Says SEMI.

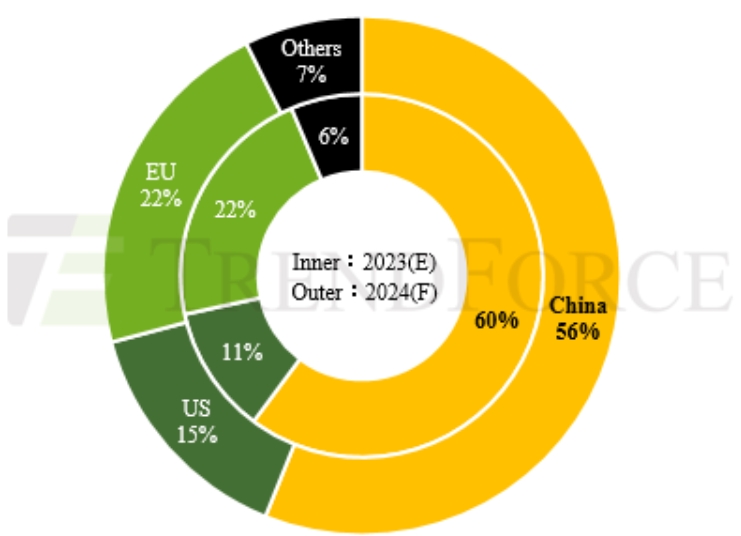

2023 sales of semiconductor manufacturing equipment fell 1.3% to $106.3 billion from 2022’s record $107.6 billion, says SEMI.

China was the biggest market, growing 29% y-o-y to $36.6 billion, followed by Korea which fell 7% to $19.9 billion and Taiwan which fell 27% to $19.6 billion.

The US market rose 15%, the EU fell 3%, Japan fell 5% and RoW fell 39%.

“Despite a slight dip in global equipment sales, the semiconductor industry continues to show strength, with strategic investments fueling growths in key regions,” says SEMI CEO Ajit Manocha, “the overall results for the year were better than anticipated by most industry followers.”

Wafer processing equipment sales rose 1%, other front-end segment billings increased by 10%, assembly and packaging equipment fell 30% and test equipment fell 17%.

Jayce

/include/upload/kind/image/20240412/20240412175142_3554.jpg

2023 sales of semiconductor manufacturing equipment fell 1.3% to $106.3 billion from 2022’s record $107.6 billion, says SEMI.

China was the biggest market, growing 29% y-o-y to $36.6 billion, followed by Korea whi

2024/4/12 17:52:08

2024/4/12 17:52:08

12

0

564

6

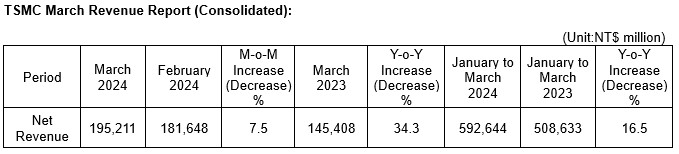

TSMC Q1 Up 16.5% Y-o-Y

TSMC had Q1 revenue up 16.5% y-o-y at $18.54 billion up from $16.72 billion Q1 2023.

For March, TSMC had revenues that were 34.3% up y-o-y and 7.5% up m-o-m at $6.2 billion.

It was the biggest m-o-m rise since November 2022.

Jayce

/include/upload/kind/image/20240411/20240411171106_4468.jpg

TSMC had Q1 revenue up 16.5% y-o-y at $18.54 billion up from $16.72 billion Q1 2023.

For March, TSMC had revenues that were 34.3% up y-o-y and 7.5% up m-o-m at $6.2 billion.

It was the biggest m-o-m rise since Nove

2024/4/11 17:12:24

2024/4/11 17:12:24

14

0

563

6

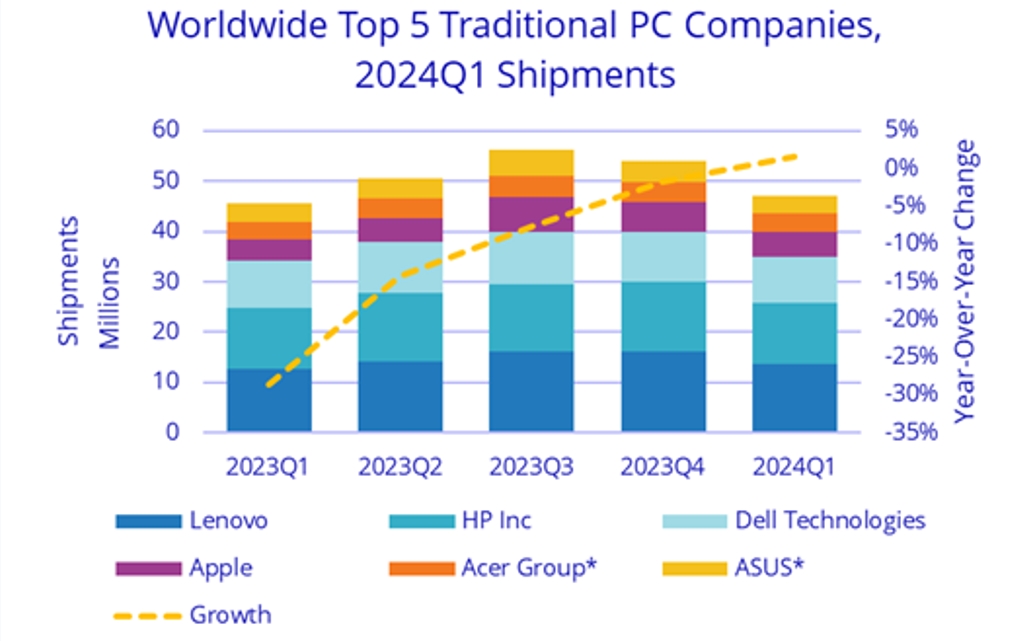

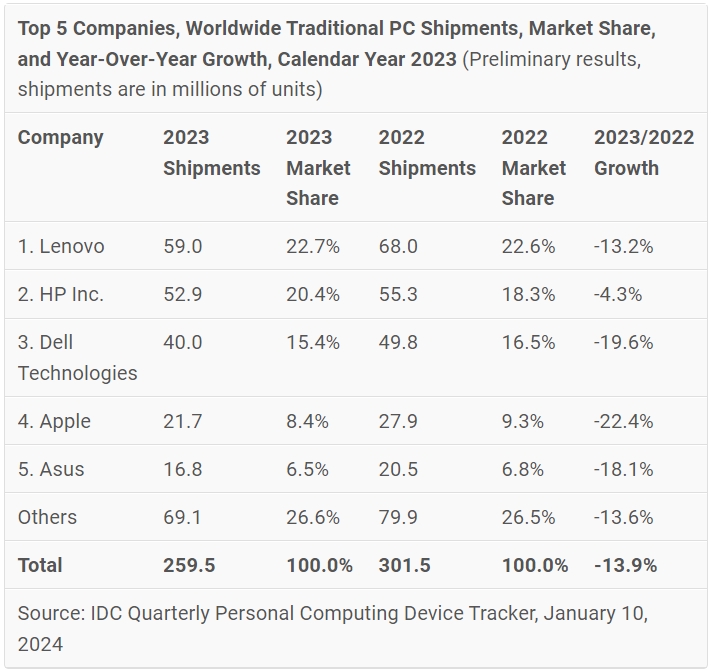

PC Shipments Back to Pre-Covid Levels

After two years of decline, the worldwide traditional PC market returned to growth during the first quarter of 2024 (1Q24) with 59.8 million shipments, growing 1.5% year over year, according to IDC

RECOMMENDED ARTICLESHMI claims smallest SIM card level translatorNordic into tracking with GoogleCurren steps down as CEO of SondrelTSMC gets $11.6bn funding and ups US spend to $65bnIn Q1 2023, the market declined 28.7% – the biggest drop in PC history.

In Q1 2024, global PC shipments finally returned to pre-pandemic levels as volumes rivaled those seen in 1Q19 when 60.5 million units were shipped.

With inflation numbers trending down, PC shipments have begun to recover in most regions, leading to growth in the Americas as well as Europe, the Middle East, and Africa (EMEA). However, the deflationary pressures in China directly impacted the global PC market.

As the largest consumer of desktop PCs, weak demand in China led to yet another quarter of declines for global desktop shipments, which already faced pressure from notebooks as the preferred form factor.

“Despite China’s struggles, the recovery is expected to continue in 2024 as newer AI PCs hit shelves later this year and as commercial buyers begin refreshing the PCs that were purchased during the pandemic,” says IDC’s Jitesh Ubrani.

Among the top 5 companies, Lenovo once again held the top spot and outgrew the market largely due to the steep decline in shipments experienced in 1Q23.

Apple’s strong growth was also due to an outsized decline in the prior year.

Notes:

* IDC declares a statistical tie in the Personal Computing Device market when there is a difference of one tenth of one percent (0.1%) or less in the shipment shares among two or more vendors.

-

Traditional PCs include Desktops, Notebooks, and Workstations and do not include Tablets or x86 Servers. Detachable Tablets and Slate Tablets are part of the Personal Computing Device Tracker but are not addressed in this press release.

-

Shipments include shipments to distribution channels or end users. OEM sales are counted under the company/brand under which they are sold.

Jayce

/include/upload/kind/image/20240409/20240409180932_6610.png

After two years of decline, the worldwide traditional PC market returned to growth during the first quarter of 2024 (1Q24) with 59.8 million shipments, growing 1.5% year over year, according to IDC

RECOMMENDED ARTICLESHMI claim

2024/4/9 18:11:11

2024/4/9 18:11:11

16

0

562

5

Flyking Weekly Industry Express

Jayce

/include/upload/kind/image/20240408/20240408170139_9600.jpg

2024/4/8 17:02:26

2024/4/8 17:02:26

19

0

561

6

TSMC Hit by Quake

Earlier today, TSMC evacuated some of its fabs in Taiwan after an earthquake and is evaluating the loss of production.

“TSMC’s safety systems are operating normally,” says the company, “to ensure the safety of personnel, some fabs were evacuated according to company procedure. We are currently confirming the details of the impact.”

TSMC said construction sites were normal upon initial inspection, but the company decided to suspend work at the sites for the day.

Staff evacuated from some plants have started to return to work.

The earthquake measured 7.4 on the Richter Scale – the worst quake Taiwan has suffered for 25 years.

Jayce

/include/upload/kind/image/20240403/20240403181726_4570.jpg

Earlier today, TSMC evacuated some of its fabs in Taiwan after an earthquake and is evaluating the loss of production.

“TSMC’s safety systems are operating normally,” says the company, “to ensure the safety of personnel, some fab

2024/4/3 18:17:27

2024/4/3 18:17:27

19

0

560

6

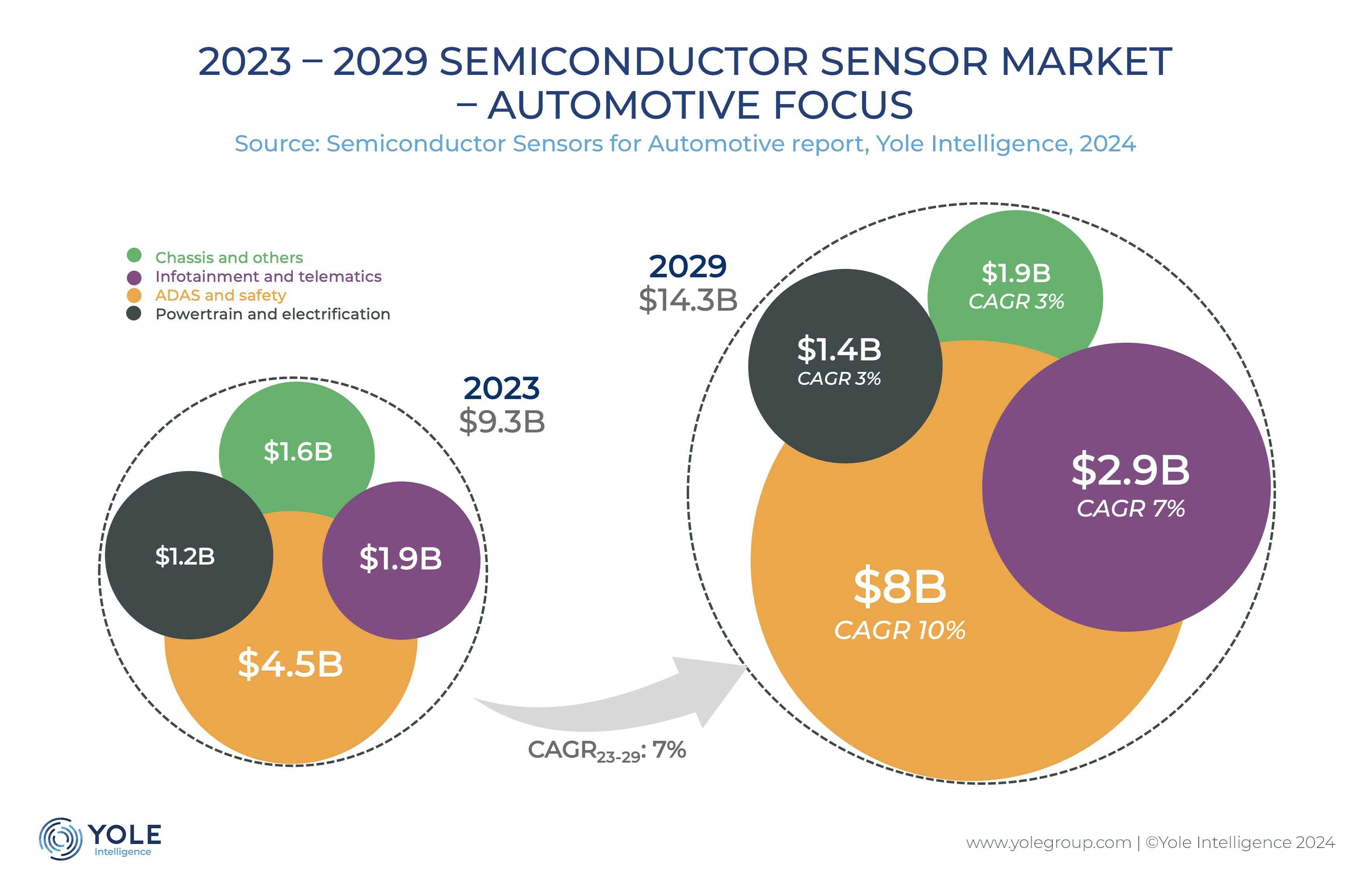

Sensor Market Soaring

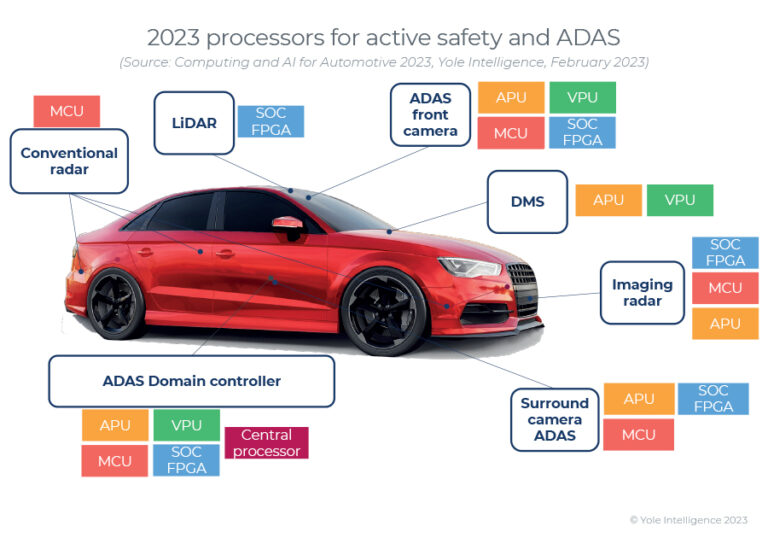

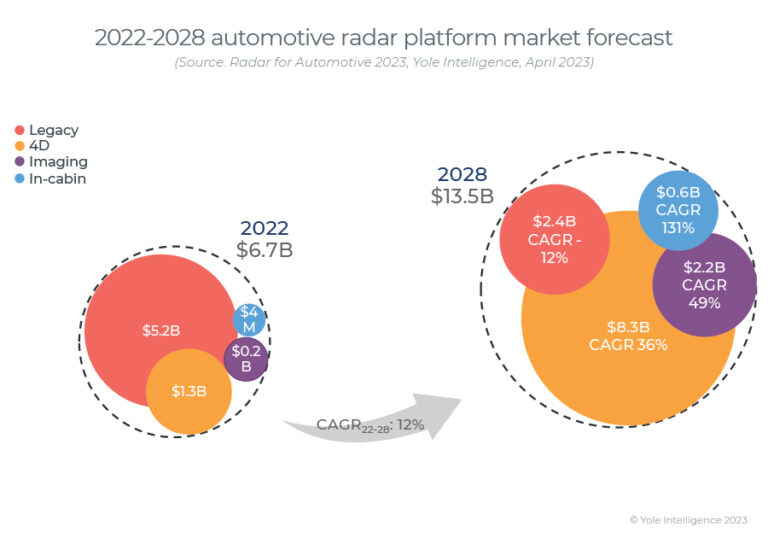

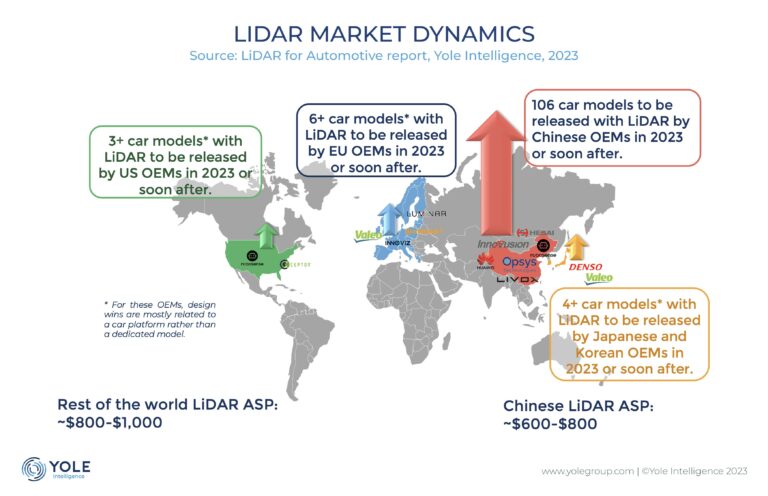

Sensors for electrification and ADAS are showing remarkably strong growth between 2019 and 2029, with 24% and 17% CAGR, respectively, reports Yole Developpement.

6.5 billion semiconductor sensors for automotive applications were shipped last year generating revenue of $9.3 billion and demand is pointing to a 9 billion unit market with revenue of $14.3 billion by 2029 at a 7% CAGR between 2023 and 2029.

“The upcoming years are poised to witness a dynamic transformation in automotive sensor technology driven by advancements in ADAS, autonomous driving, electrification, and the widespread adoption of sensors across global car fleets,” says Yole’s Pierrick Boulay, “consequently, substantial reorganization within the industry and its supply chain is anticipated.”

The biggest segments are radars and CIS, with more than $4 billion and more than $3 billion, respectively, in 2029. LiDARs will have the biggest growth at 48% to $649 million during the 2019-29 period.

Bosch, leads the market due to strong revenue in MEMS (pressure, accelerometer, IMU) and radar.

During these coming years, the automotive industry is expected to go through massive transformations in all four car domains:

In powertrain and electrification, the automotive industry is transitioning from cars based on internal combustion engines (ICE) to electrified cars, which are expected to represent 43% of production in 2029.

In terms of sensors, this segment will grow with a 3% CAGR between 2023 and 2029. In the long term, the electrification of cars will induce critical changes in the sensor landscape by giving birth to new applications while removing others.

In the ADAS and safety segment, cars are becoming more intelligent, enhancing safety while driving autonomously. Revenue is by far the largest of all segments and Yole forecasts about $8 billion in revenue by 2029.

Infotainment and telematics: with customers demanding greater entertainment options for both drivers and passengers, this sector is projected to achieve a favorable 7% CAGR from 2023 to 2029. This segment should exceed $2.9 billion by 2029.

In the chassis domain, OEMs strive to improve passenger safety, send valuable data to the ADAS computing unit, and even remove hydraulic systems in the car. In this context, the global sensorization of cars is driving sensor volumes to a 3% CAGR between 2023 and 2029. In terms of revenue, Yole Group expects almost $1.9 billion to be generated in 2029.

Jayce

/include/upload/kind/image/20240402/20240402174139_3502.jpg

Sensors for electrification and ADAS are showing remarkably strong growth between 2019 and 2029, with 24% and 17% CAGR, respectively, reports Yole Developpement.

6.5 billion semiconductor sensors for automotive applications were ship

2024/4/2 17:42:39

2024/4/2 17:42:39

18

0

559

5

Flyking Weekly Industry Express

Jayce

/include/upload/kind/image/20240401/20240401171832_9783.jpg

2024/4/1 17:19:57

2024/4/1 17:19:57

34

0

558

6

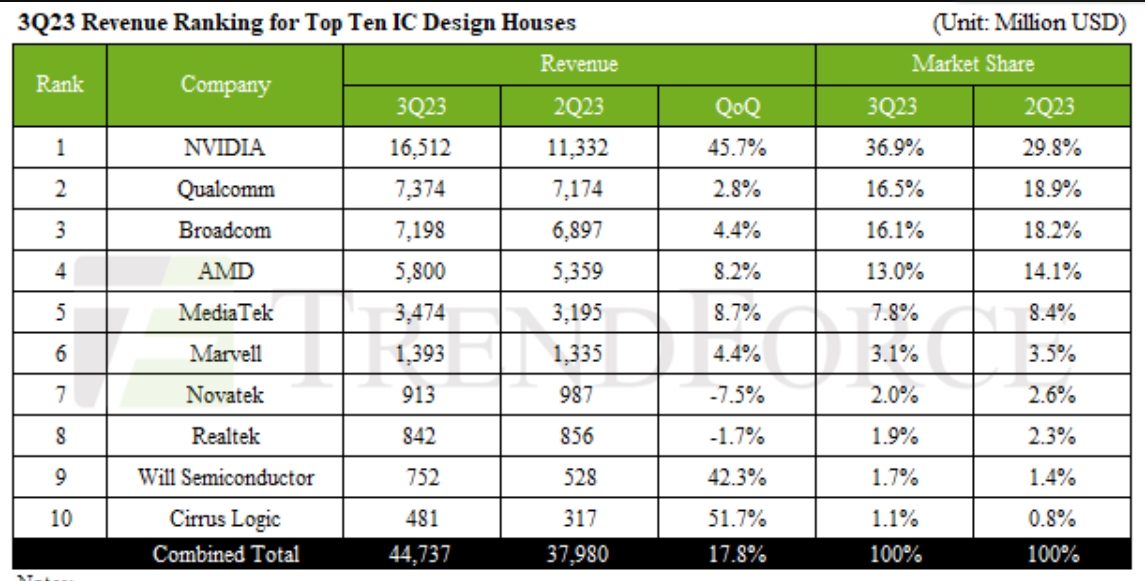

As the Market Fell Last Year, A Winner Emerged

As the industry fell 9% from $597.7 billion in 2022 to $544.8 billion last year, a new growth driver emerged – AI, says Omdia, with NVIDIA dominating the AI chip space so comprehensively that it took the No.2 slot in the overall semiconductor market.

NVIDIA more than doubled its semiconductor revenue from 2022 to $49 billion in 2023. Before the pandemic, in 2029, NVIDIA’s semiconductor revenue was under $10 billion.

High bandwidth memory (HBM) integrated with GPUs to facilitate AI is also seeing strong demand, with SK Hynix leading this segment and other major memory manufacturers venturing into this space.

The memory market had a down year in 2023 overall, while the HBM market had growth of 127% year-over-year in terms of 1Gb equivalent units, throughout 2023. Omdia forecasts that HBM is likely to record 2024 growth rates of 150-200%.

In 2023, the automotive segment exerted greater influence in the semiconductor market as it increased its revenue growth to over 15% in 2023 to over $75 billion. The demand for semiconductors in automotive accounts for approximately 14% of the entire semiconductor market.

The downturn has notably affected major memory makers, traditionally among the top semiconductor companies by revenue. Previously, from 2017 to 2021, Samsung Electronics, SK Hynix, and Micron Technology were all ranked in the top five companies by revenue.

However, amidst the challenging memory market conditions, Samsung Electronics is now ranked third, SK Hynix is ranked sixth, and Micron Technology is ranked twelfth in 2023.

Jayce

/include/upload/kind/image/20240329/20240329180512_2811.jpg

As the industry fell 9% from $597.7 billion in 2022 to $544.8 billion last year, a new growth driver emerged – AI, says Omdia, with NVIDIA dominating the AI chip space so comprehensively that it took the No.2 slot in the overall

2024/3/29 18:05:58

2024/3/29 18:05:58

22

0

557

6

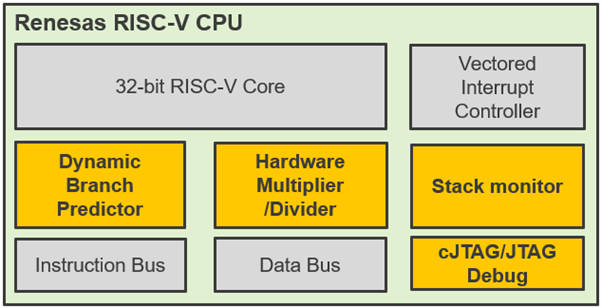

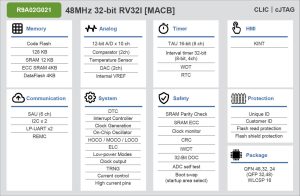

Renesas Dips Toes Into Few-Pin RISC-V MCUs

Resasas has put its in-house developed 32bit RISC-V core into a few-pin general-purpose MCU series, following earlier RISC-V projects with Anders and SiFive.

Announced last November, the core implementation can accommodate various standard RISC-V options, to which Renesas has added its own options including: a stack monitor register to protect against rogue software, a dynamic branch prediction unit improve the average execution throughput, and a context-saving register bank to speed interrupt response.

Two-wire compact JTAG debug can be implemented for low pin-count packages, and performance monitor registers can be added for benchmarking, as well as an instruction tracing unit.

The new microcontrollers, called the R9A02G021 group, come in packages with between 16 and 48pads: 2 x 2mm 16pad WLCSP and QFNs from 4 x 4 to 7 x 7mm with 24, 32 or 48pads – there is one part number for each of the four packages.

They implement the RV32I instruction set and include two-wire JTAG and the company’s core-local interrupt controller (CLIC)

Clocking is at up to 48MHz, delivering 3.27Coremark/MHz, and consumption is 162μA/MHz, or 300nA in stand-by with 4μs wake. Operation is over 1.6 to 5.5V and -40 to 125°C.

There is 128kbyte of instruction flash, 4kbyte of data flash and 16kbyte of ram, plus a 12bit ADC, an 8bit DAC and serial communication including UART, SPI and I2C.

The company’s ‘SAU’ peripheral is also included to implement up to six simplified SPI interfaces, up to three more UARTs or up to six simplified I2C interfaces, depending on package size.

To tempt potential adopters from more familiar architectures, Renesas has lined up plenty of support from the start, with the its e2 studio Eclipse-based IDE (integrated development environment) providing a code configurator and the LLVM compiler.

“Complete development environments are also available from IAR with its Embedded Workbench IDE and I-jet debug probe, and Segger with the Embedded Studio IDE, J-Link debug probes and Flasher production programmers,” it said.

FPB-R9A02G021 is the hardware development board (right).

No less than 18 application notes have been prepared to go along with the product launch, covering state-switching, boot firmware and many of the peripherals.

Jayce

/include/upload/kind/image/20240327/20240327174207_5562.jpg

Resasas has put its in-house developed 32bit RISC-V core into a few-pin general-purpose MCU series, following earlier RISC-V projects with Anders and SiFive.

Announced last November, the core implementation can accommodate various

2024/3/27 17:43:57

2024/3/27 17:43:57

22

0

556

5

Flyking Weekly Industry Express

Jayce

/include/upload/kind/image/20240325/20240325181238_0633.jpg

2024/3/25 18:12:59

2024/3/25 18:12:59

36

0

555

6

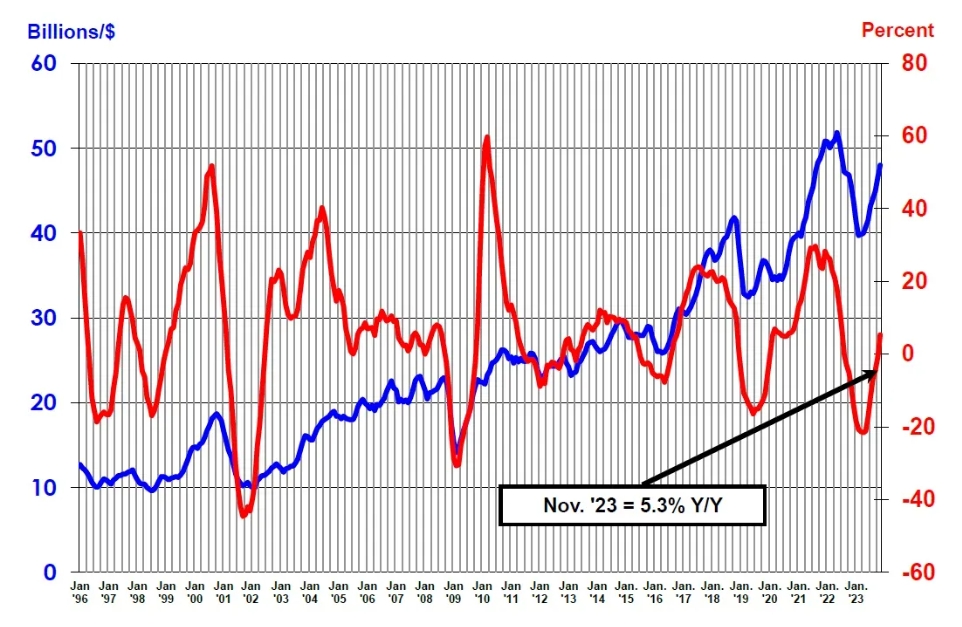

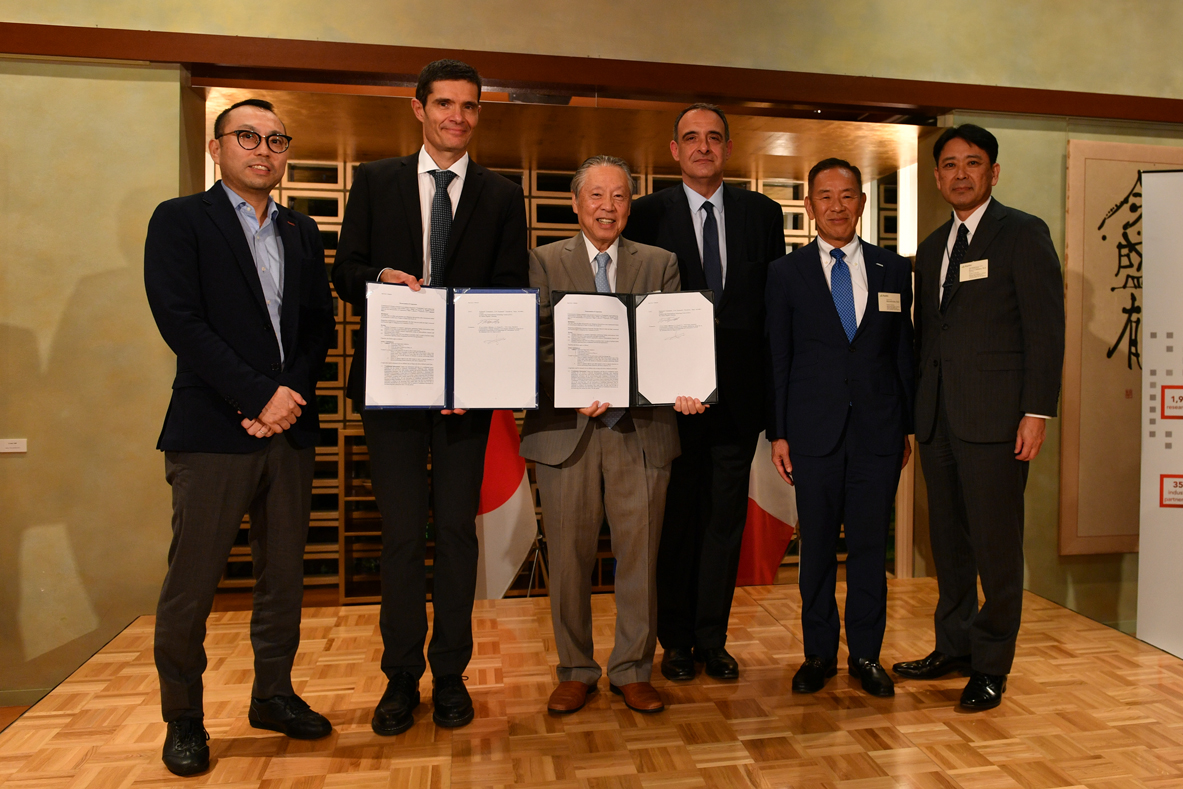

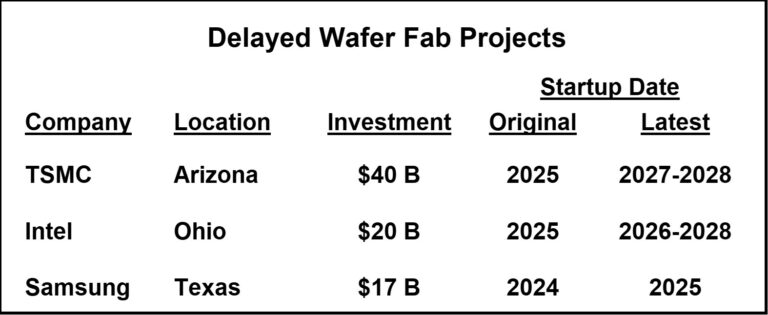

Financing the Chip Business

U.S. President Biden announced on Wednesday an agreement to provide Intel with $8.5 billion in direct funding and $11 billion in loans under the CHIPS and Science Act, reports Semiconductor Intelligence (SI). Intel will use the funding for wafer fabs in Arizona, Ohio, New Mexico, and Oregon.

As SI reported in its December 2023 newsletter, the CHIPS Act provides a total of $52.7 billion for the U.S. semiconductor industry, including $39 billion in manufacturing incentives.

Prior to the Intel grant, the CHIPS Act had announced grants totaling $1.7 billion to GlobalFoundries, Microchip Technology, and BAE Systems, according to the Semiconductor Industry Association (SIA).

Grants under the CHIPS Act have been slow in coming, with the first grants announced over a year after passage. Some major fab projects in the U.S. have been delayed due the slow disbursement. TSMC also cited difficulties in finding qualified construction personnel. Intel said the delay was also due to slowing sales.

Other nations have also allocated funds to promote semiconductor production. The European Union in September 2023 passed the European Chips Act which provides for 43 billion euro (US$47 billion) of public and private investment in the semiconductor industry.

In November 2023, Japan allocated 2 trillion yen (US$13 billion) for semiconductor manufacturing.

Taiwan in January 2024 enacted a law to provide tax breaks for semiconductor companies.

South Korea in March 2023 passed a bill to provide tax breaks to strategic technologies including semiconductors.

China is expected to create a $40 billion fund backed by the government to subsidize its semiconductor industry.

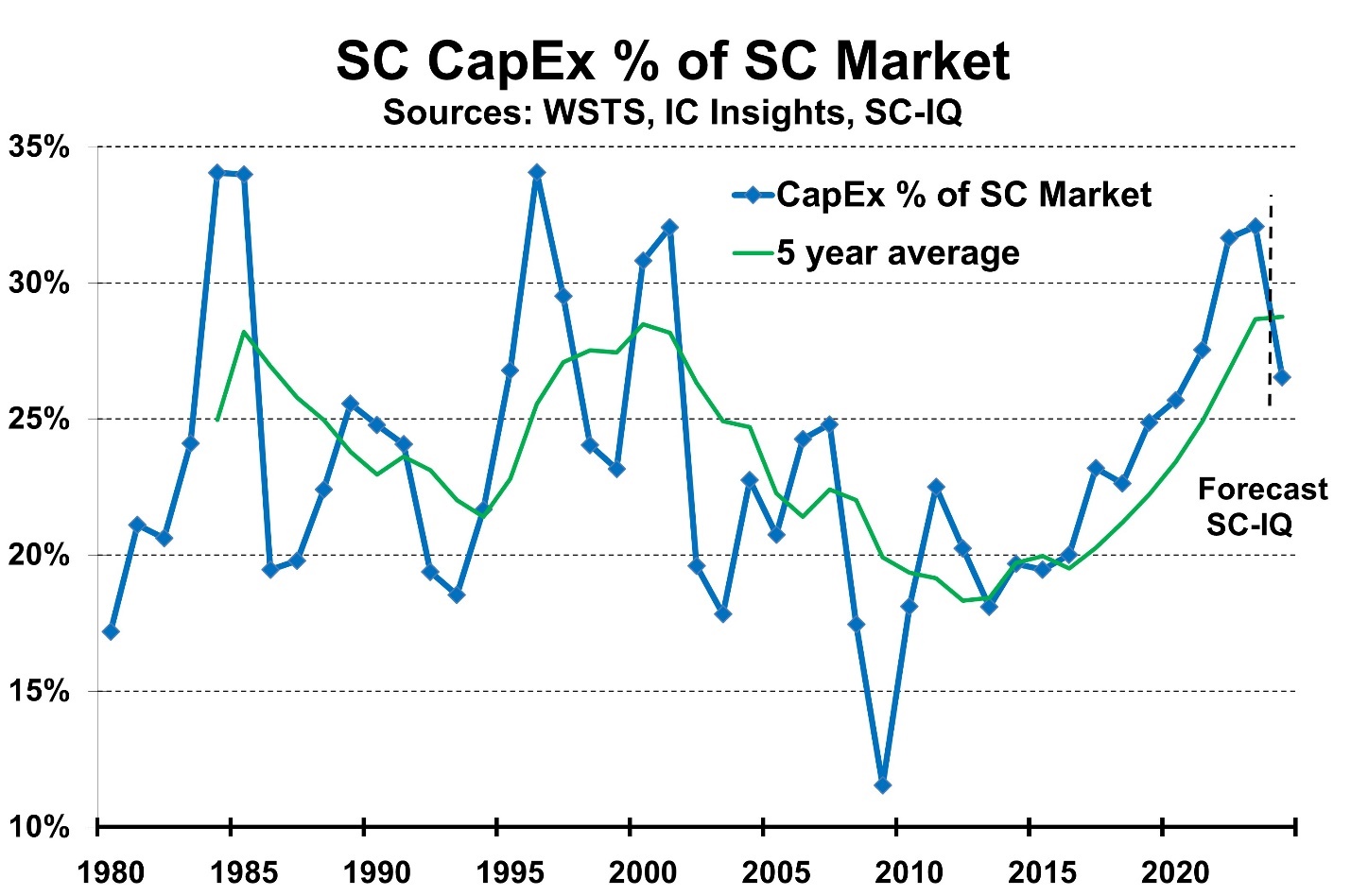

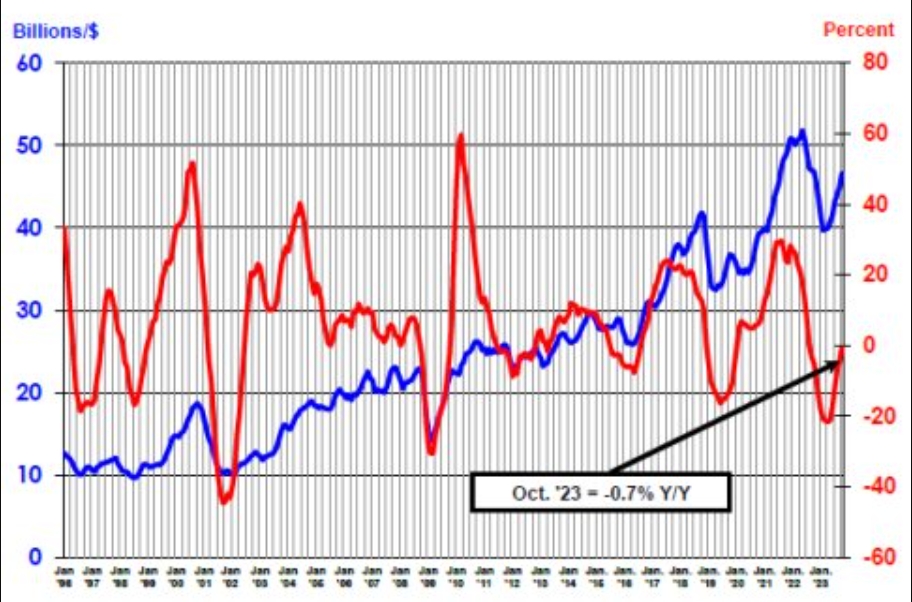

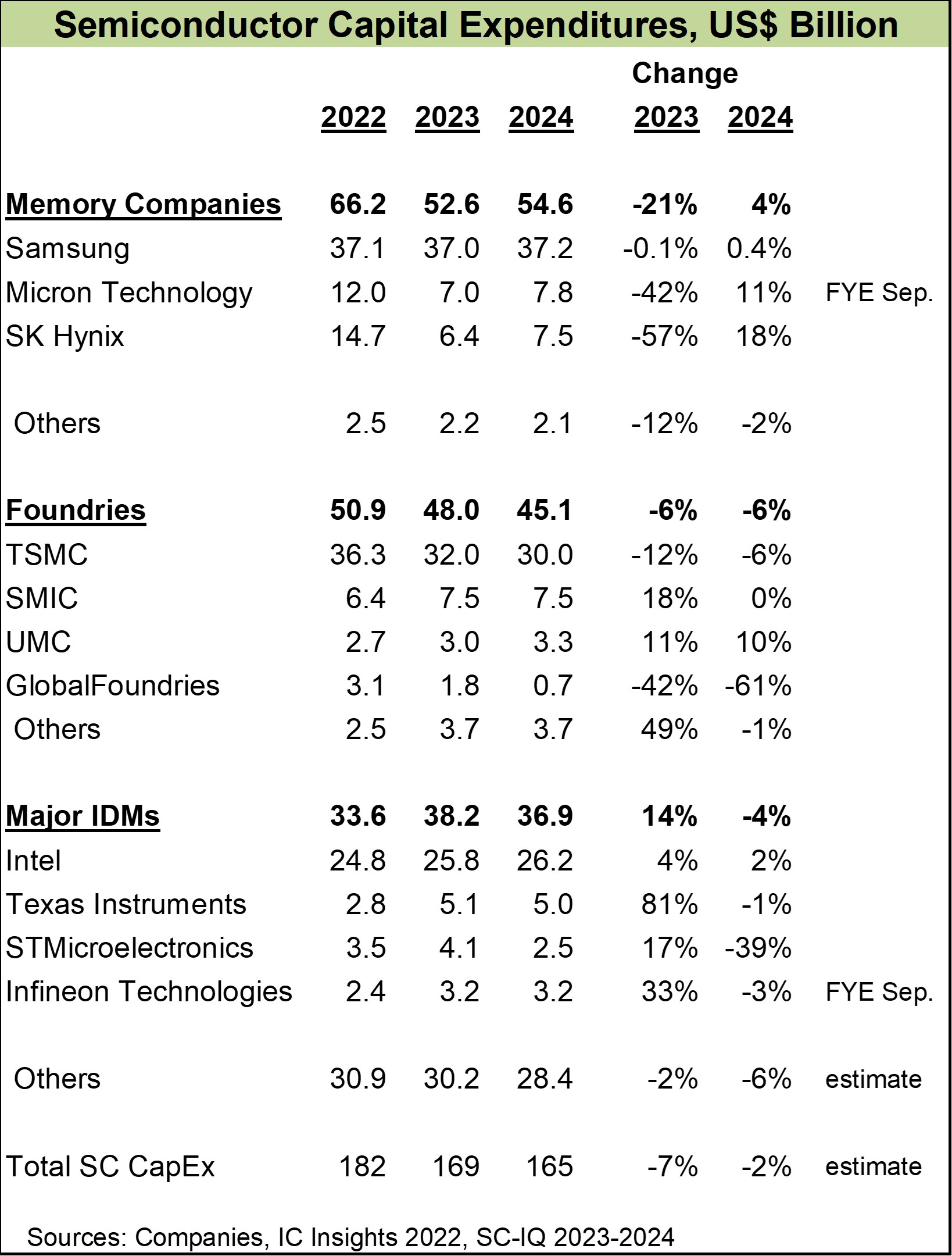

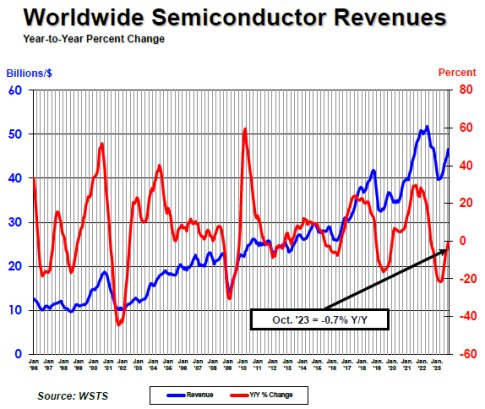

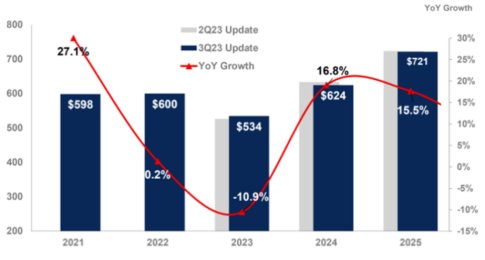

What is the outlook for capital expenditures (CapEx) in the semiconductor industry this year?

The CHIPS Act was designed to spur CapEx, but much of the effect will not occur until after 2024.

After a disappointing 8.2% decline in the semiconductor market last year, many companies are cautious about CapEx in 2024.

SI estimates total semiconductor CapEx in 2023 was $169 billion, down 7% from 2022. Our forecast is a 2% decline in CapEx in 2024.

The major memory companies are generally increasing CapEx in 2024 as the memory market recovers and new applications such as AI are expected to increase demand.

Samsung plans relatively flat spending in 2024 at $37 billion but did not cut CapEx in 2023.

Micron Technology and SK Hynix cut back CapEx significantly in 2023 and are planning double-digit increases in 2024.

The largest foundry, TSMC, plans to spend about $28 billion to $32 billion in 2024, with the midrange of $30 billion down 6% from 2023.

SMIC is planning flat CapEx while UMC plans a 10% increase.

GlobalFoundries expects a 61% cut in 2024 CapEx but will ramp up spending in the next few years as it builds a new fab in Malta, New York.

Among IDMs, Intel plans to increase CapEx in 2024 by 2% to $26.2 billion. Intel will increase capacity for foundry customers as well as for internal products.

Texas Instruments’ CapEx is roughly flat. TI plans to spend about $5 billion a year through 2026, primarily for its new fabs in Sherman, Texas.

STMicroelectronics will cut CapEx 39% while Infineon Technologies will cut by 3%.

The three largest spenders – Samsung, TSMC and Intel – will account for 57% of semiconductor industry CapEx in 2024.

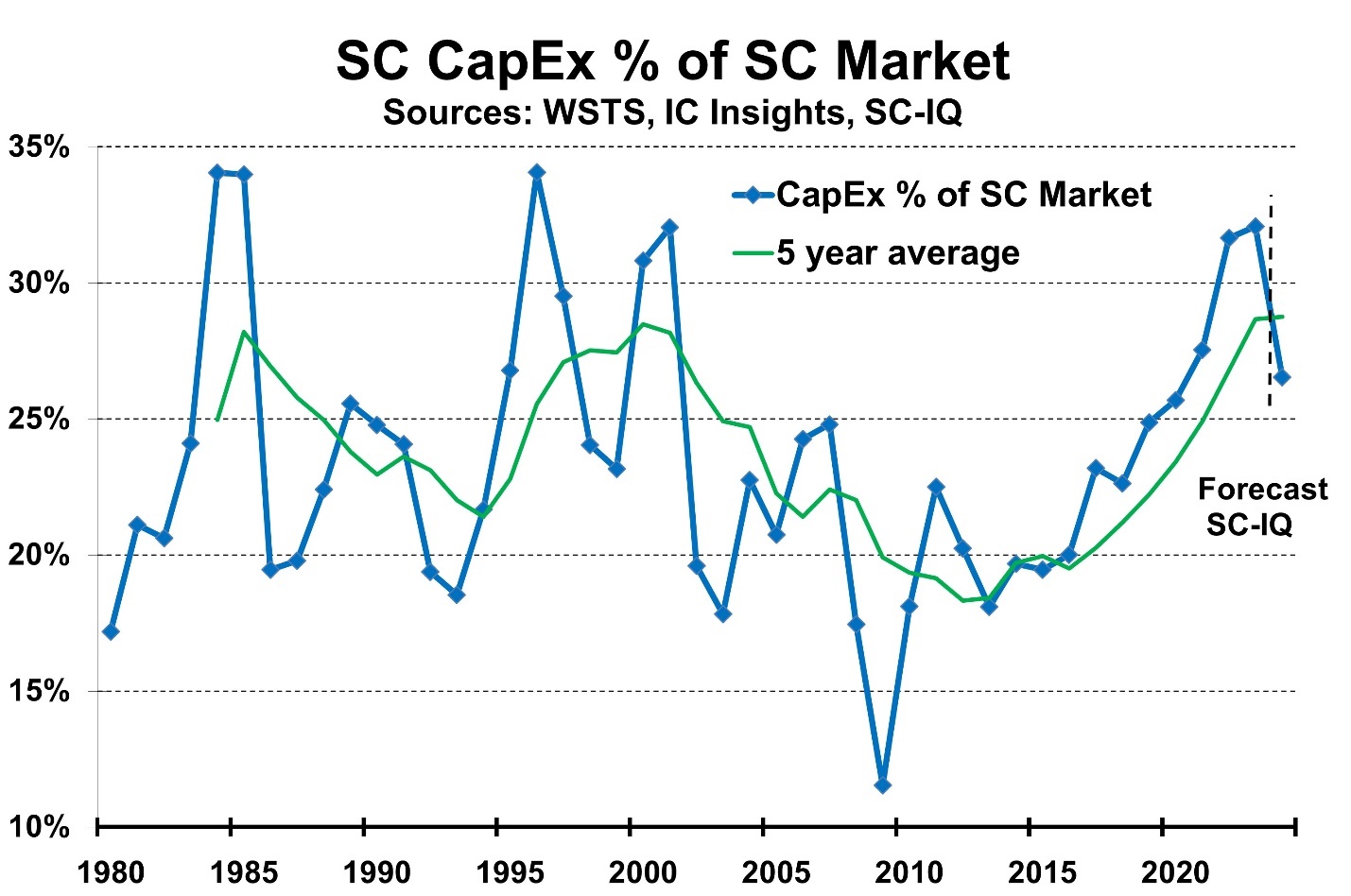

What is the appropriate level of CapEx relative to the semiconductor market?

The semiconductor market is notoriously volatile. Over the last 40 years, annual change has ranged from 46% growth in 1984 to a 32% decline in 2001. Although the industry has become somewhat less volatile as it has matured, in the last five years it has shown a 26% increase in 2021 and a 12% decrease in 2019.

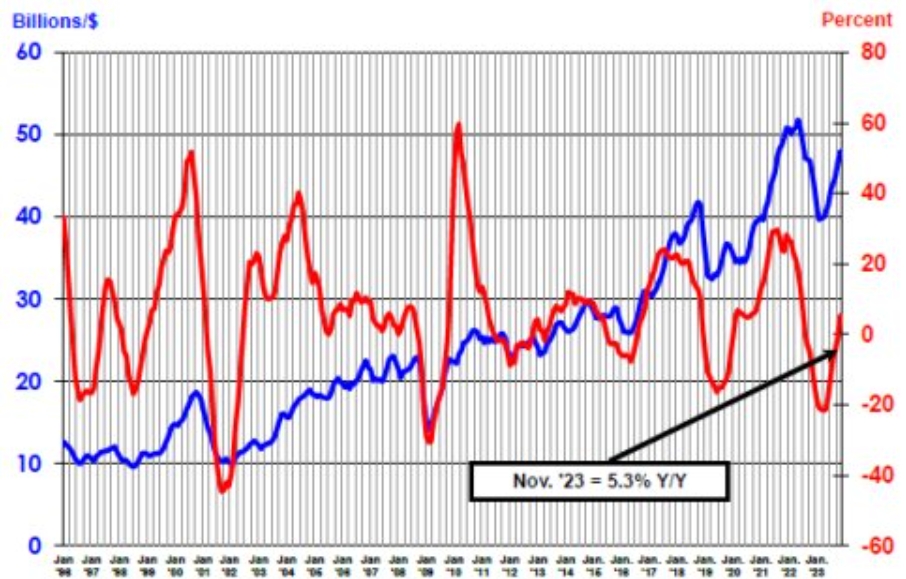

Semiconductor companies need to plan their capacity several years out. It takes about two years to build a new wafer fab and additional time for planning and financing. As a result,the ratio of semiconductor CapEx to the semiconductor market varies greatly, as shown below.

The semiconductor CapEx to market size ratio has varied from a high of 34% to a low of 12%. The five-year average ratio ranges between 28% and 18%. Over the total period of 1980 to 2023, the total CapEx was 23% of the semiconductor market. Despite the volatility, the long-term trend of the ratio has been fairly consistent.

Based on expected strong market growth and a drop in CapEx, SI expects the ratio to drop from 32% in 2023 to 27% in 2024.

Most forecasts for semiconductor market growth in 2024 are in the range of 13% to 20%. SI’s forecast is 18%.

Jayce

/include/upload/kind/image/20240323/20240323144522_7523.jpeg

U.S. President Biden announced on Wednesday an agreement to provide Intel with $8.5 billion in direct funding and $11 billion in loans under the CHIPS and Science Act, reports Semiconductor Intelligence (SI). Intel will use the funding for wafer fa

2024/3/23 14:47:37

2024/3/23 14:47:37

22

0

554

6

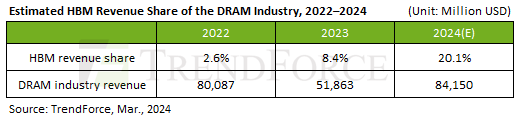

HBM to be 14% of DRAM Industry This Year

By the end of 2024, the DRAM industry is expected to have allocated approximately 250K/m (14%) of total capacity to producing HBM TSV, with an estimated annual supply bit growth of around 260%, says TrendForce svp Avril Wu.

HBM’s revenue share within the DRAM industry—around 8.4% in 2023—is projected to increase to 20.1% by the end of 2024.

The die size of HBM is generally 35–45% larger than DDR5 of the same process and capacity (for example, 24Gb compared to 24Gb).

The yield rate (including TSV packaging) for HBM is approximately 20–30% lower than that of DDR5, and the production cycle (including TSV) is 1.5 to 2 months longer than DDR5.

HBM has a longer production cycle than DDR5 – over two quarters from wafer start to final packaging.

Samsung’s total HBM capacity is expected to reach around 130K (including TSV) by year-end; Hynix’s capacity is around 120K.

Jayce

/include/upload/kind/image/20240320/20240320175145_2512.jpeg

By the end of 2024, the DRAM industry is expected to have allocated approximately 250K/m (14%) of total capacity to producing HBM TSV, with an estimated annual supply bit growth of around 260%, says TrendForce svp Avril Wu.

HBM’s re

2024/3/20 17:53:24

2024/3/20 17:53:24

24

0

553

6

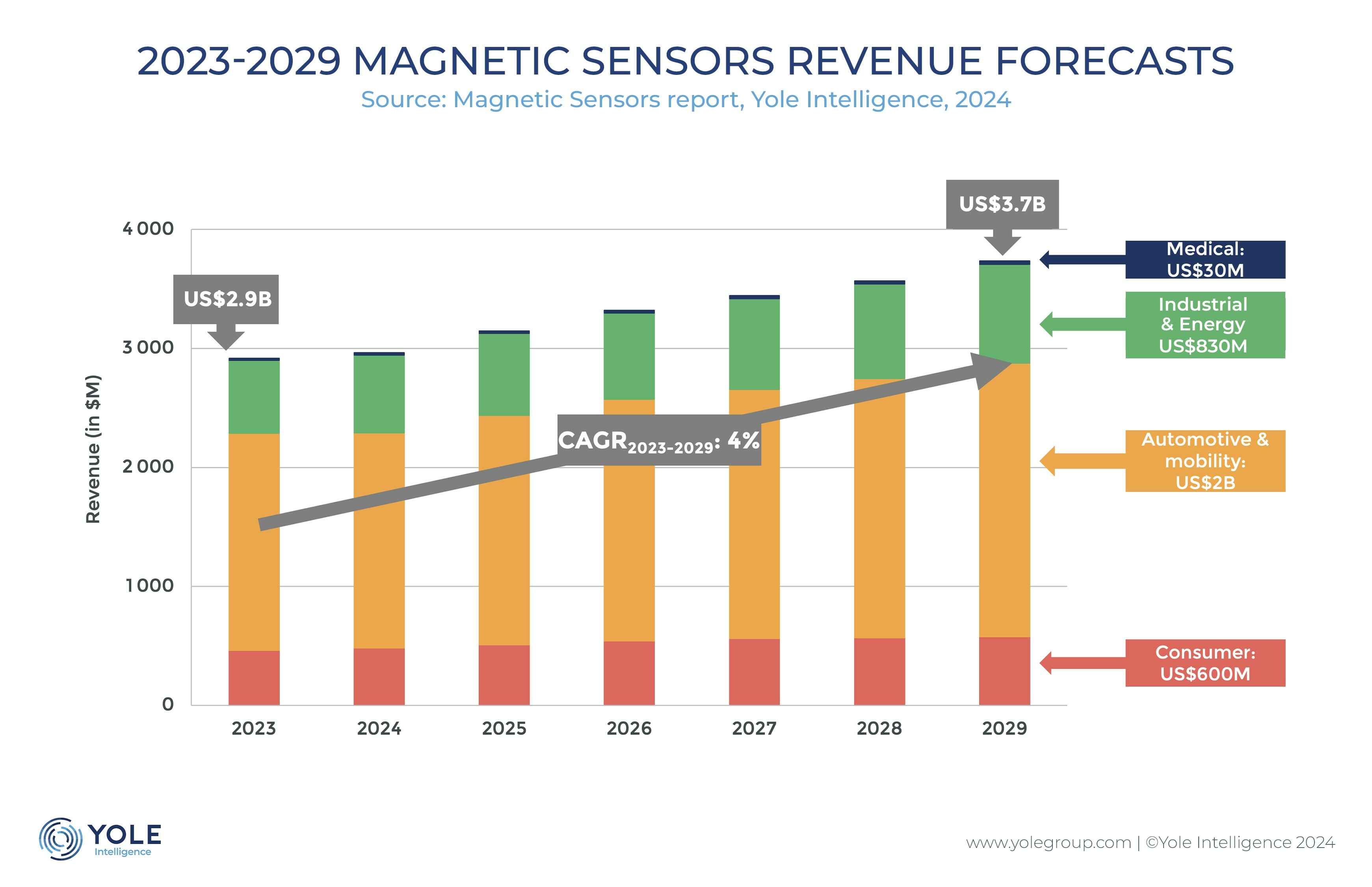

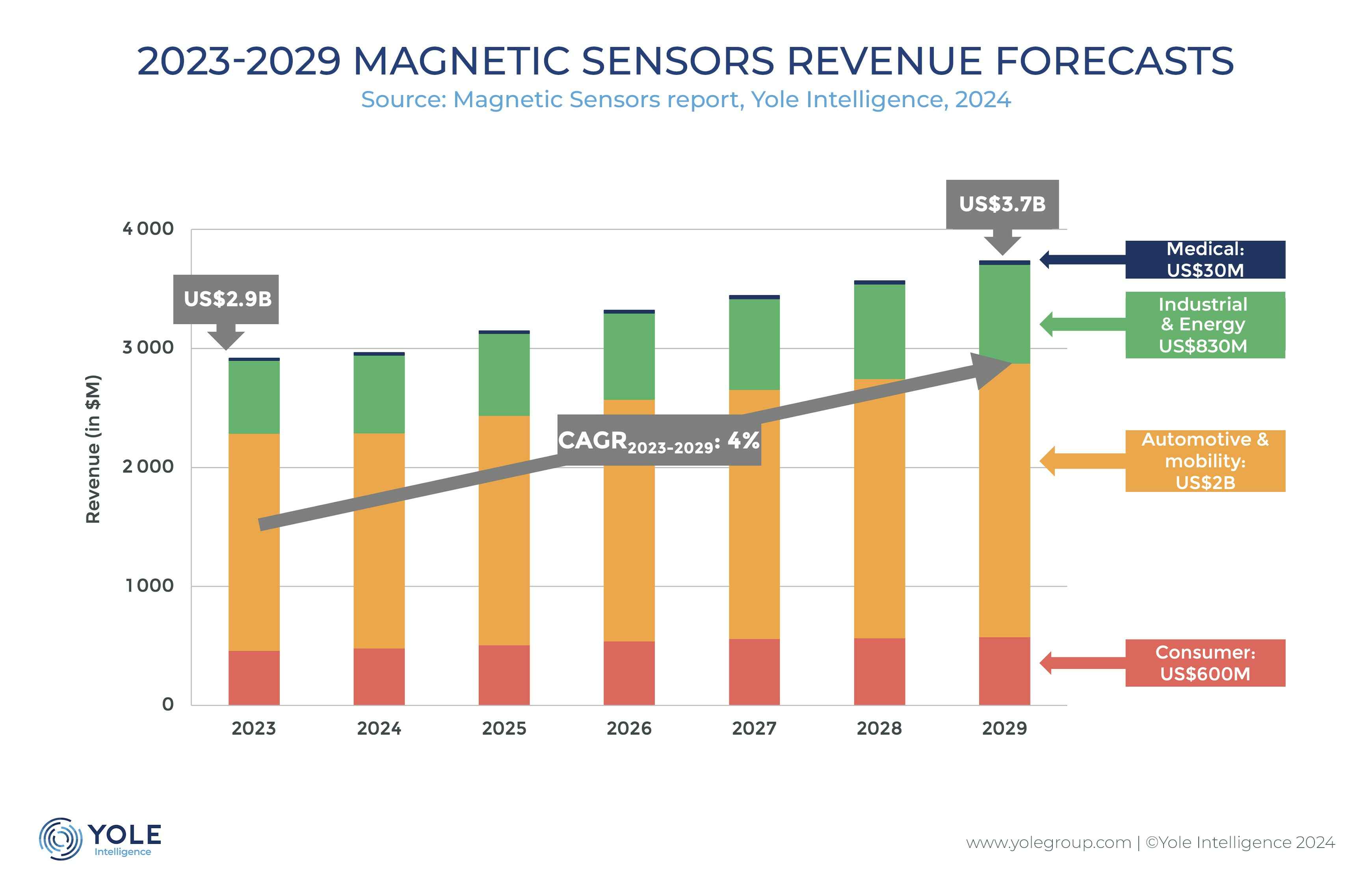

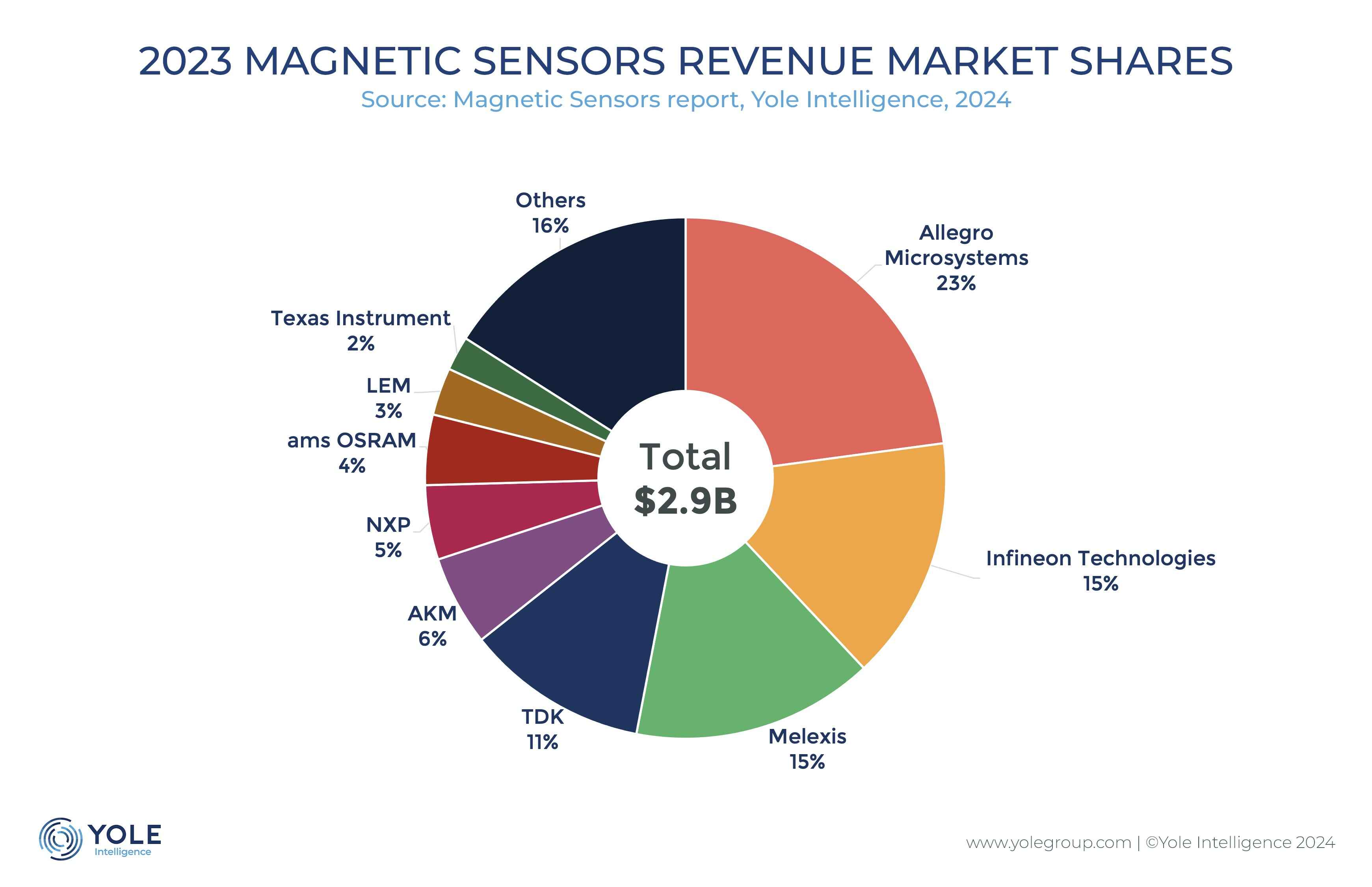

Magnetic sensors market has 4% CAGR 2023-29 to reach $3.7bn

The magnetic sensor market is expected to reach $3.7 billion in 2029, with an estimated 4% CAGR from 2023 to 2029, says Yole Developpement.

RECOMMENDED ARTICLESHBM to be 14% of DRAM industry this yearUS strategy for microelectronics research publishedTelecom equipment sales fell 5% in 2023, set to fall again in 2024Smartphones bounce backAllegro Microsystems leads in revenue, TDK leads in volume.

A $1 billion investment surge from players like Allegro, TDK, Bosch, LEM etc. is leveraging the technology’s sensitivity, bandwidth, and low power consumption to sense position and current.

Magnetic sensors find widespread application across automotive, mobility, industrial, energy, medical, and consumer sectors. Their versatility has led to their adoption in various fields, propelling the market to a value of $2.9 billion in 2023.

“The automotive & mobility segment significantly dominates the market with sales of more than $2 billion by 2029,” says Yole’s Pierre Delbos, “this segment is driven by important shifts such as vehicle electrification and sensor integration. Conversely, consumer applications lead in terms of volume. At Yole Group, we anticipate a nearly $600 million market by 2029, also growing at a 4% CAGR between 2023 and 2029”.

The evolving landscape of magnetic sensor applications extends to the industrial & energy and medical sectors. By 2029, these sectors are expected to reach $830 million and $30 million, respectively.

Factors such as the proliferation of DC-charging stations with integrated current sensors due to vehicle electrification, the demand for position sensors, switches, and latches driven by Industry 4.0, and the potential implementation of predictive maintenance using current sensors contribute to the promising outlook in these sectors.

Jayce

/include/upload/kind/image/20240319/20240319175909_2918.jpg

The magnetic sensor market is expected to reach $3.7 billion in 2029, with an estimated 4% CAGR from 2023 to 2029, says Yole Developpement.

RECOMMENDED ARTICLESHBM to be 14% of DRAM industry this yearUS strategy for microelectronics

2024/3/19 18:00:31

2024/3/19 18:00:31

24

0

552

5

Flyking Weekly Industry Express

Jayce

/include/upload/kind/image/20240318/20240318173637_6121.jpg

2024/3/18 17:36:55

2024/3/18 17:36:55

42

0

551

6

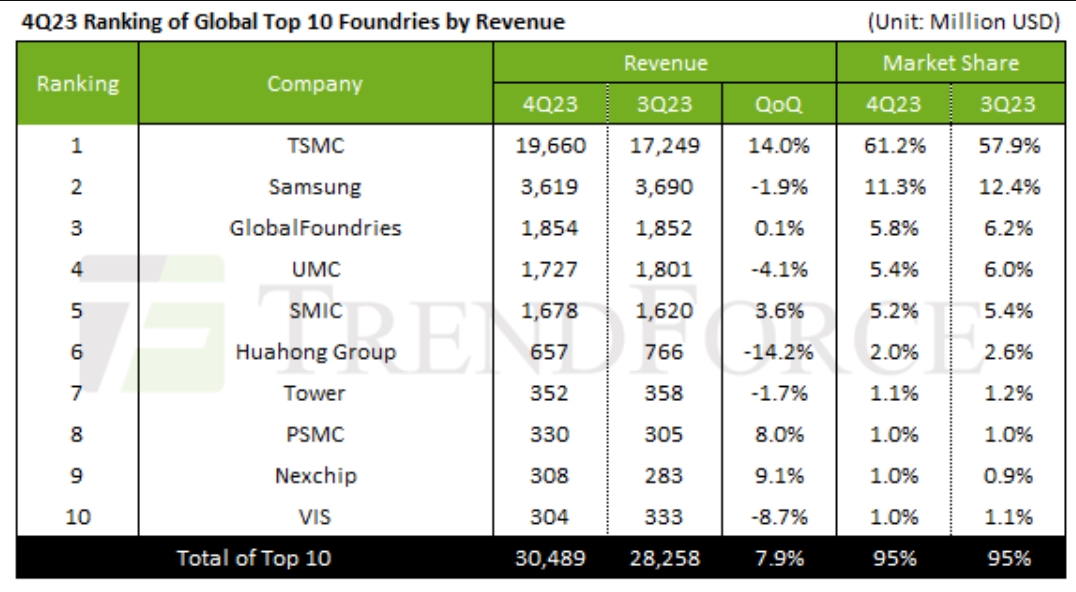

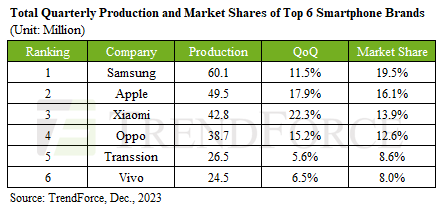

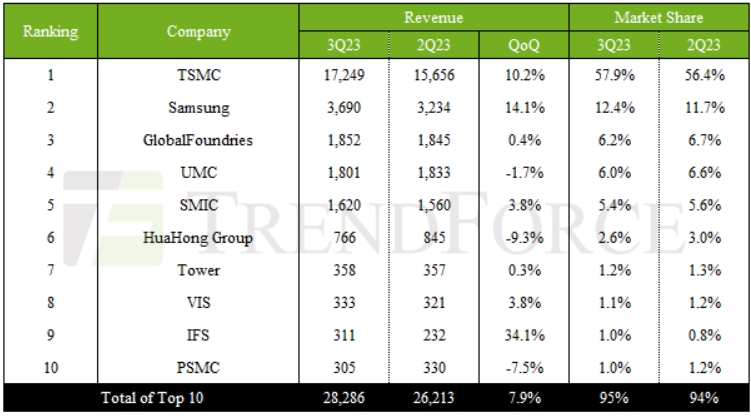

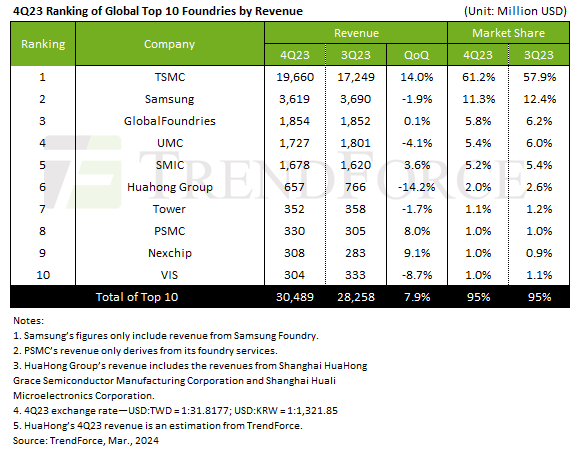

Q4 Foundry Revenues up 7.9%

Q4 foundry revenues rose 7.9% to $30.49 billion, says TrendForce, primarily driven by demand for smartphone components, such as mid and low-end smartphone APs and peripheral PMICs.

The launch season for Apple’s latest devices also significantly contributed, fueling shipments for the A17 chipset and associated peripheral ICs, including OLED DDIs, CIS, and PMICs. TSMC’s premium 3nm process notably enhanced its revenue contribution, pushing its global market share past the 60% threshold this quarter.

Last year the foundry market suffered a 13.6% fall witnrevenue reaching $111.54 billion.

2024 promises better, says TendForce, with AI-driven demand expected to boost annual revenue by 12% to $125.24 billion.

In Q4, top 5 foundries expanded market share to 88.8% with TSMC taking 60%.

TSMC’s wafer shipments rose in 4Q23 thanks to demand from smartphones, notebooks, and AI-related HPC and its revenue jumped 14% over the quarter to $19.66 billion.

Revenue shares from processes 7nm and below climbed from 59% in Q3 to 67% in Q4, underscoring TSMC’s dependency on cutting-edge technologies. With the progressive ramp-up of 3nm production, the share of revenue from advanced processes is expected to surpass 70%.

Samsung also received orders for various new smartphone components, predominantly in mature processes above 28nm. Meanwhile, demand for advanced process main chips and modems saw steadier demand due to early procurement by clients, leading to a slight 1.9% QoQ drop in Samsung’s foundry revenue to $3.62 billion.

GlobalFoundries saw a modest 5% revenue growth in the automotive segment, primarily attributed to a surge in LTAs signed by numerous automotive clients and slight optimizations in ASP. However, shipments in key application areas such as smart mobile devices, communication, and home/industrial IoT witnessed declines, resulting in overall revenue reaching approximately $1.85 billion in Q4.

UMC experienced occasional spikes in orders from the smartphone and PC sectors, but a weak global economy, conservative wafer start decisions by clients, and inventory adjustments in the automotive sector led to a downturn in wafer shipments, resulting in a 4.1% decrease in Q4 revenue to about $1.73 billion.

SMIC enjoyed a 3.6% quarterly increase in revenue to roughly $1.68 billion, mainly due to urgent orders related to smartphones and notebooks/PCs, while shipments for network communications, general consumer electronics, and automotive/industrial control sectors saw declines.

Three significant changes occurred in rankings were, PSMC moved up to eighth place, benefiting from the recovery in specialty DRAM wafer outputs and urgent orders for smartphone components, Nexchip reentered the top ten and secured the ninth spot, thanks to urgent TDDI orders and high-volume shipments of new CIS products, and VIS dropped to tenth place due to a slowdown in TV-related orders and inventory adjustments by automotive and industrial control customers.

IFS, which entered the top ten for the first time in 3Q23, was pushed out of the rankings by PSMC and Nexchip due to factors such as the transition between new and old generations of CPUs and lackluster inventory momentum at Intel.

Other companies, such as HuaHong Group and Tower, saw their revenue decrease by 14.2% and 1.7%, respectively. The minor decline in revenue for Tower is attributed to its long-term focus on niche markets like RFFEM, automotive, and industrial control, which shielded it from the impacts felt by companies primarily in the consumer electronics sector. However, as automotive and industrial control clients also began adjusting their inventories, the utilization rate of Tower further decreased in the fourth quarter

Jayce

/include/upload/kind/image/20240314/20240314183135_2542.png

Q4 foundry revenues rose 7.9% to $30.49 billion, says TrendForce, primarily driven by demand for smartphone components, such as mid and low-end smartphone APs and peripheral PMICs.

The launch season for Apple’s latest devices also

2024/3/14 18:33:21

2024/3/14 18:33:21

28

0

550

6

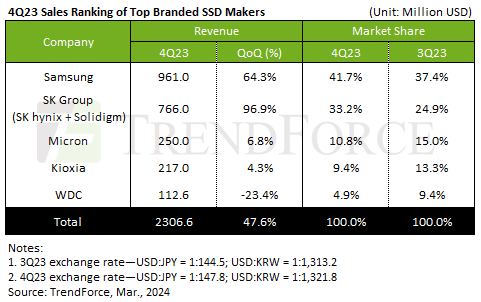

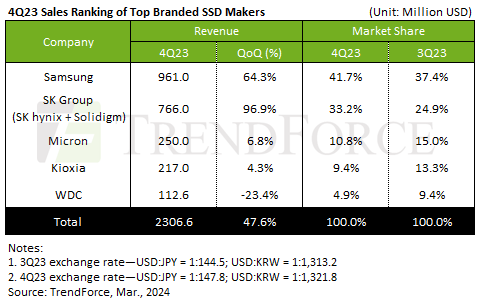

Resurgence in Enterprise SSD Market

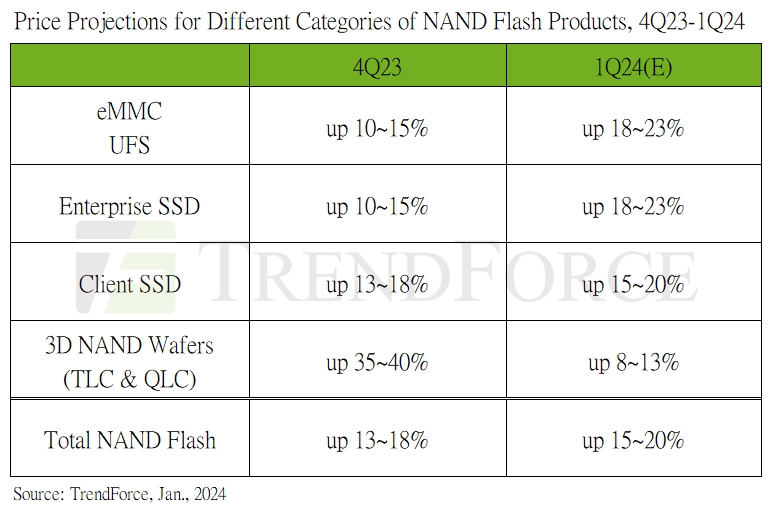

In Q3 2023 enterprise SSD suppliers cut production leading to a 15% Q4 surge in contract SSD prices, says TrendForce

This produced a 47.6% QoQ increase for Q4 enterprise SSD industry revenues which hit $23.1 billion.

Contract prices are now expected to increase by over 25% delivering 20% revenue growth in Q1.

SK Group recorded the highest growth rate in the enterprise SSD segment for 4Q23, with revenues hitting $766 million —a 96.9% jump.

Samsung secured the second-highest growth at 64.3%, reaching $961 million.

Micron saw a 6.8% rise to $250 million.

Kioxia had a 4.3% revenue increase in 4Q23 to $217 million.

Western Digital’s revenues fell to $113 million — a 23.4% decline.

Jayce

/include/upload/kind/image/20240312/20240312174202_6293.png

In Q3 2023 enterprise SSD suppliers cut production leading to a 15% Q4 surge in contract SSD prices, says TrendForce

This produced a 47.6% QoQ increase for Q4 enterprise SSD industry revenues which hit $23.1 billion.

2024/3/12 17:42:43

2024/3/12 17:42:43

29

0

549

5

Flyking Weekly Industry Express

Jayce

/include/upload/kind/image/20240311/20240311180611_3901.jpg

2024/3/11 18:06:30

2024/3/11 18:06:30

38

0

548

6

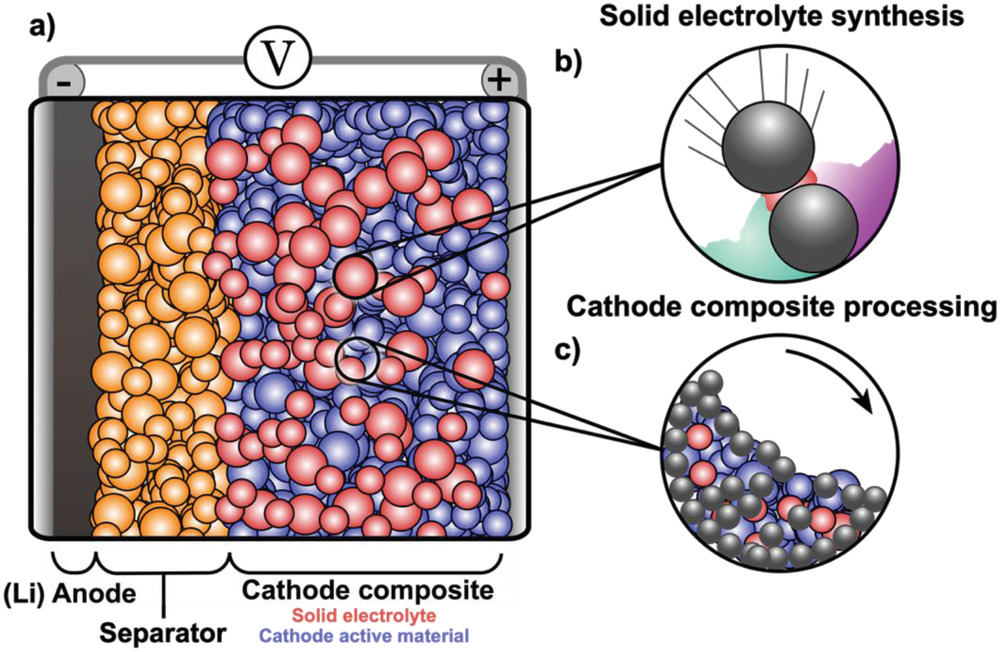

Samsung sampling solid state batteries

Samsung says it has begun sampling solid state batteries to car manufacturers and will begin mass production of the batteries for EVs and other applications in 2027.

Last year, the company set up a pilot line in Suwon and is using it to,refine the product and improve yields

The company says that its solid-state batteries will have an energy density of 900 watt-hours per litre which is 40% better than from its lithium-ion batteries.

As well as high energy density solid-state batteries have short charging times of around ten minutes and are lighter and safer than lithium-ion batteries.

Hyundai is also targeting 2027 for mass-production of solid state batteries and Toyota says it will start selling cars with solid state batteries in 2027-8.

Jayce

/include/upload/kind/image/20240308/20240308181129_5144.jpeg

Samsung says it has begun sampling solid state batteries to car manufacturers and will begin mass production of the batteries for EVs and other applications in 2027.

Last year, the company set up a pilot line in Suwon and is us

2024/3/8 18:11:52

2024/3/8 18:11:52

43

0

547

5

Celebrating International Women's Day at Flyking Technology

As we approach International Women's Day on March 8th, we at Flyking Technology prepared a special celebration dedicated to all the incredible women who contribute to our company's success every day.

International Women's Day is a global day celebrating the social, economic, cultural, and political achievements of women. It's also a day to raise awareness about gender equality and women's rights. At Flyking Technology, where a significant portion of our workforce comprises talented women, we're taking this opportunity to stand in solidarity with them.

Watch Flyking's Women's Day Special

Best Wishes from Gentlemen

We believe it's essential to hear from our male colleagues on this special occasion. We've invited them to share their thoughts and well-wishes for ladies in Flyking. Through a series of interviews, our male colleagues expressed their appreciation and support for ladies from the deep of their hearts.

In addition to verbal expressions of gratitude, we're providing a more tangible way for our male colleagues to convey their best wishes. We've prepared special greeting cards where they can write personalized messages of encouragement and appreciation for their female colleagues.

Sincere Gifts for Ladies

On the morning of March 8th, we invited our ladies of Flyking Technology to randomly select greeting cards prepared by the gentlemen, and they also received the Women's Day gifts prepared by our HR team.

We believe that even if a little concern can make a significant impact. Seeing the joy and excitement on the faces of our ladies as they receive these tokens of appreciation would be a testament to the supportive and inclusive culture we strive to cultivate at Flyking Technology.

Let's come together to celebrate the achievements, resilience, and boundless potential of the women who make Flyking Technology the incredible place it is. Happy International Women's Day!

Jayce

/include/upload/kind/image/20240308/20240308180553_0086.png

As we approach International Women's Day on March 8th, we at Flyking Technology prepared a special celebration dedicated to all the incredible women who contribute to our company's success every day.

International Women's Day is a glo

2024/3/8 18:09:36

2024/3/8 18:09:36

61

0

546

6

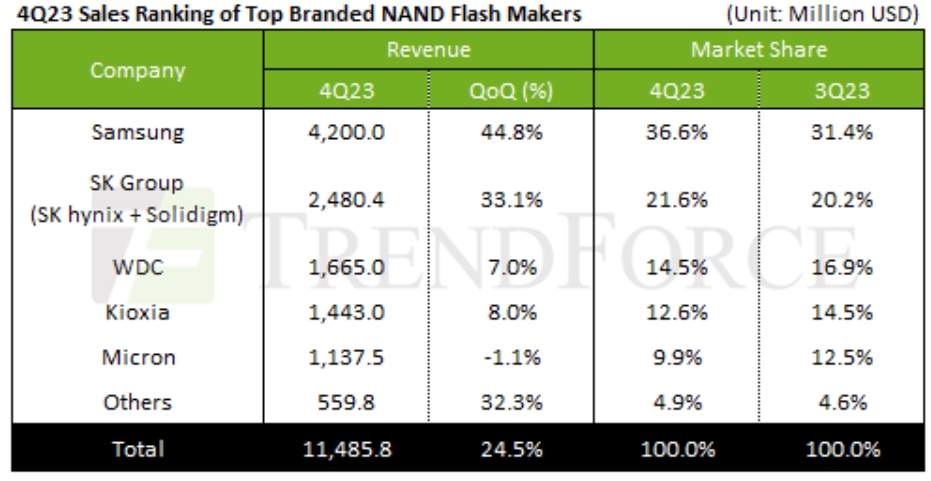

Q4 24.5% q-o-q leap for NAND

Q4 saw a 24.5% QoQ increase in NAND revenue reaching $11.49 billion, reports TrendForce.

Q1 is forecast to see a further 20% increase in revenues and a 25% increase in contract prices.

Samsung’s bit shipment volume increased by 35% QoQ, coupled with a 12% increase in ASP, boosting its revenue to $4.2 billion—a 44.8% QoQ growth.

Hynix had a 33.1% revenue jump to $2.48 billion.

Western Digital had 2% dip in shipment volume but a 10% increase in ASP, leading to a 7% revenue increase to $1.67 billion.

Kioxia had an 8% revenue increase to $1.44 billion in Q4.

Micron reduced its supply significantly to improve profitability, leading to a more than 10% QoQ decrease in bit shipments and a 1.1% decrease in revenue to $1.14 billion.

Jayce

/include/upload/kind/image/20240307/20240307171719_4992.png

Q4 saw a 24.5% QoQ increase in NAND revenue reaching $11.49 billion, reports TrendForce.

Q1 is forecast to see a further 20% increase in revenues and a 25% increase in contract prices.

Samsung’s bit shipment vol

2024/3/7 17:18:00

2024/3/7 17:18:00

36

0

545

6

Government approves Vishay takeover of Newport Wafer Fab

Government consent for the acquisition of Newport Wafer Fab by Vishay has finally been given by Deputy Prime Minister and Secretary of State in the Cabinet Office Oliver Dowden.

The site has now been renamed Newport Vishay.

Vishay’s $177 million offer for the fab was accepted last November but the government has been dragging its feet for four months over giving a final consent order.

The old Inmos fab, which opened in 1980, had been acquired by Nexperia, which is controlled by a China government-controlled fund called Wingtech. This was seen as a security risk.

Vishay says it will expand operations at the site, including R&D for compound semiconductor development.

Jayce

/include/upload/kind/image/20240305/20240305173333_0885.jpg

Government consent for the acquisition of Newport Wafer Fab by Vishay has finally been given by Deputy Prime Minister and Secretary of State in the Cabinet Office Oliver Dowden.

The site has now been renamed Newport Vishay.

2024/3/5 17:33:40

2024/3/5 17:33:40

32

0

544

5

Flyking Weekly Industry Express

Jayce

/include/upload/kind/image/20240304/20240304180759_0910.jpg

2024/3/4 18:08:12

2024/3/4 18:08:12

46

0

543

6

Q1 lead times mostly stable, says Sourcengine

Sourcengine has published its Q1 lead time report.

Volatile memory is at 11-17 weeks and going up and NV memory is at 13-19 weeks and is mostly going up or, if not, is stable.

Storage is at 10-15 weeks and mostly going up.

Discretes are at 20-47 weeks and stable

Standard logic and linear are at 7-20 weeks and mostly stable

Advanced analogue is at 23-41 weeks and mostly stable

Embedded processors are 15-48 weeks and mostly stable

Programmable logic is at 20-25 weeks and stable

Here is the full report

Jayce

/include/upload/kind/image/20240301/20240301212338_0118.jpg

Sourcengine has published its Q1 lead time report.

Volatile memory is at 11-17 weeks and going up and NV memory is at 13-19 weeks and is mostly going up or, if not, is stable.

Storage is at 10-15 weeks and mostly going

2024/3/1 21:25:11

2024/3/1 21:25:11

35

0

542

6

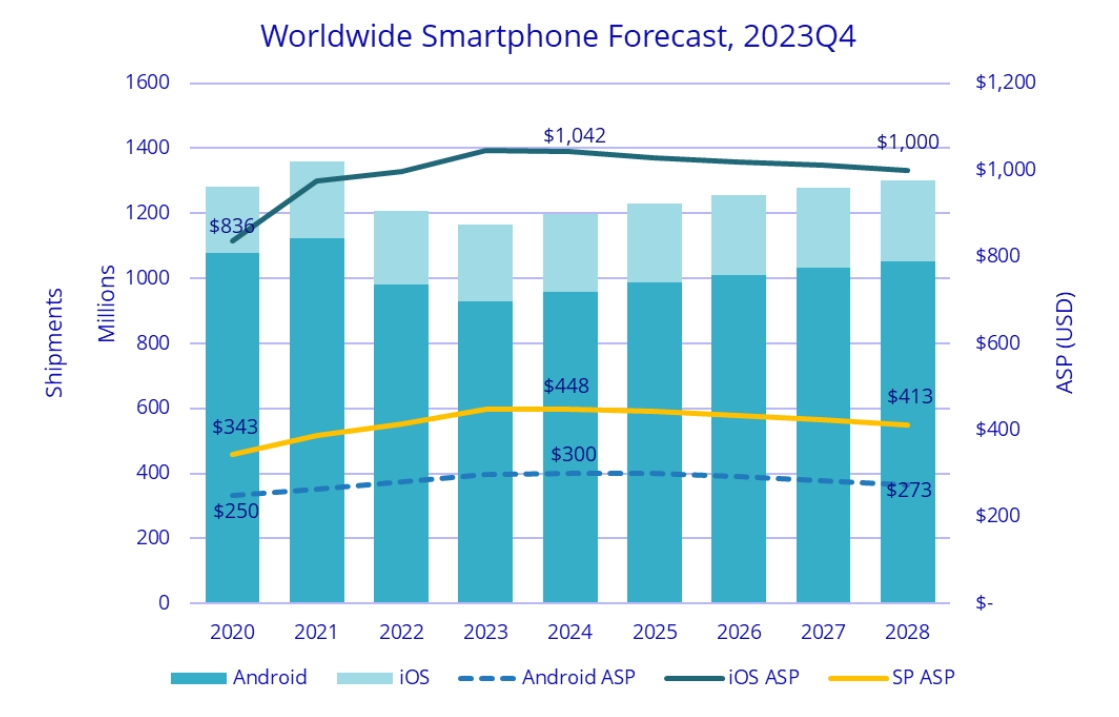

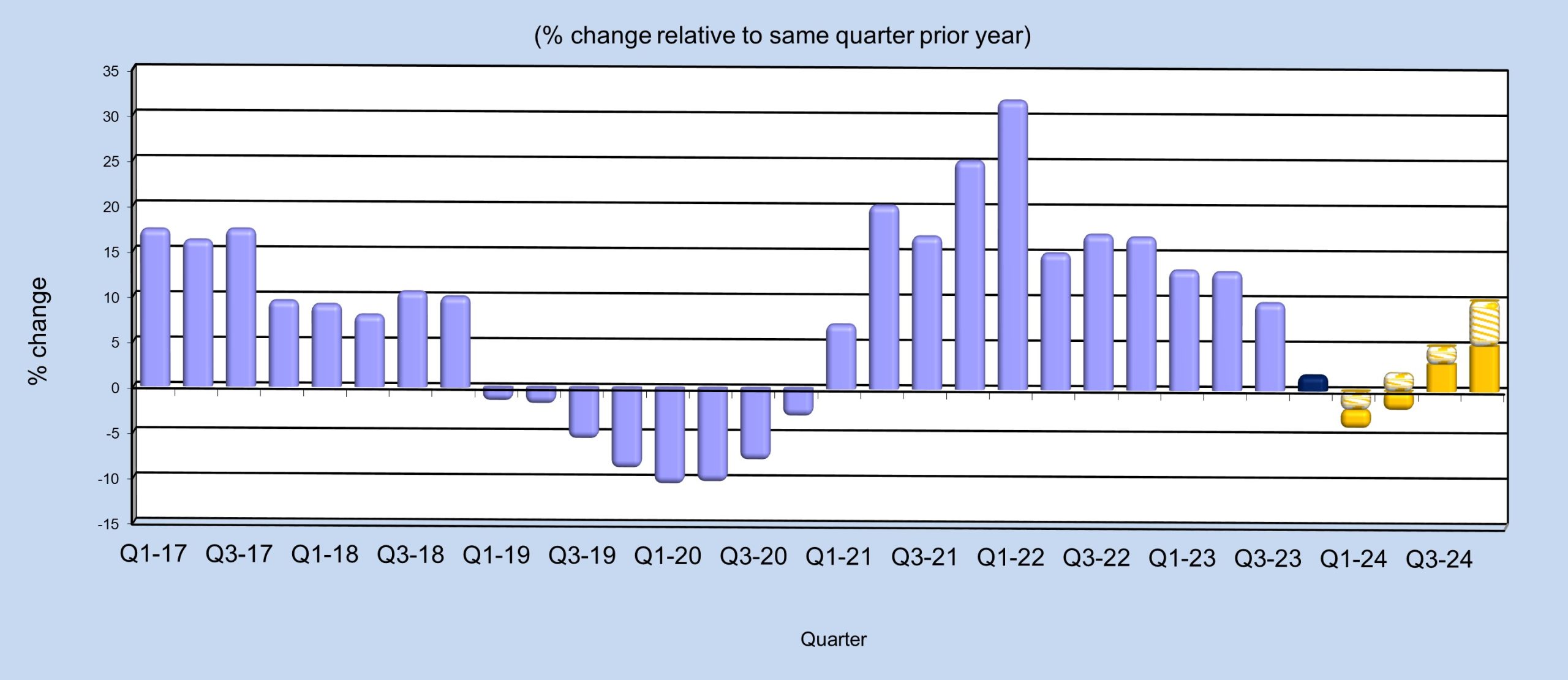

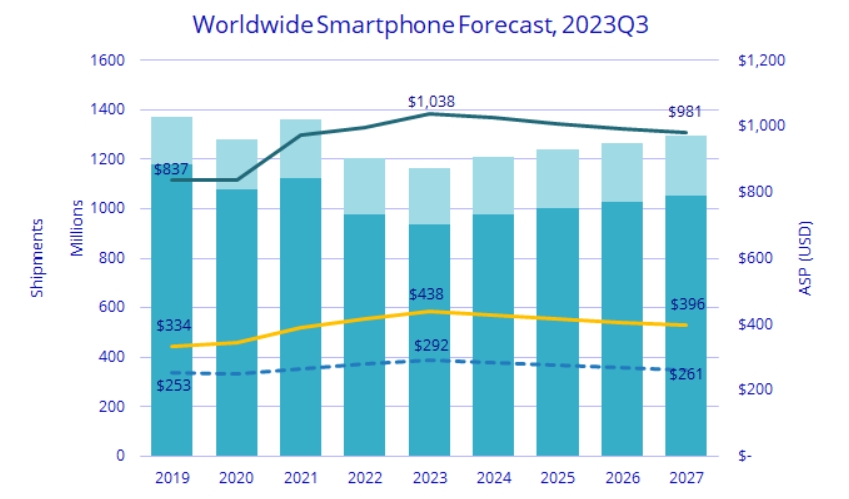

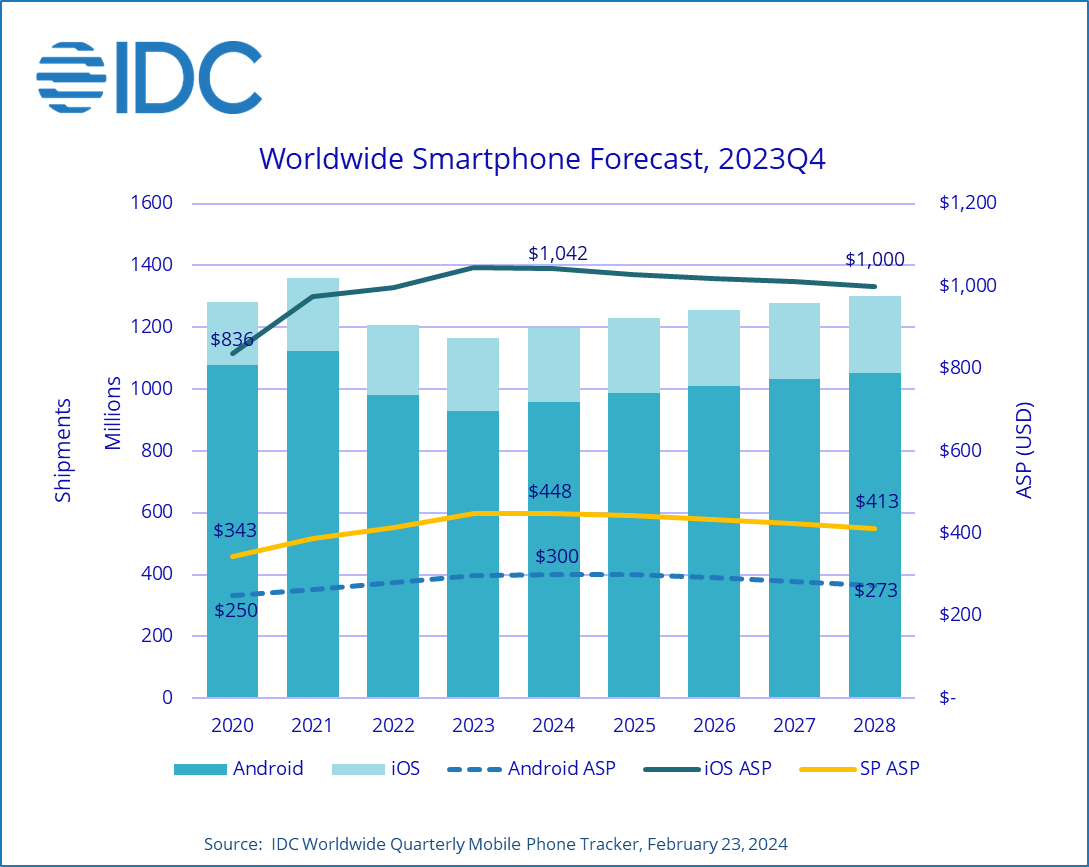

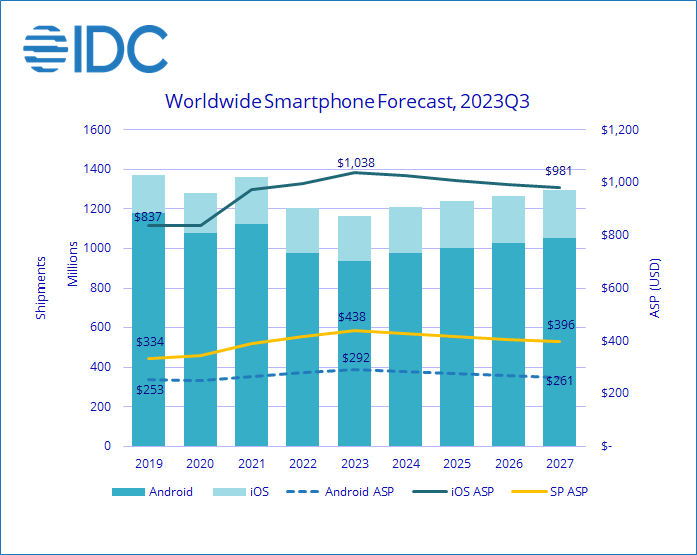

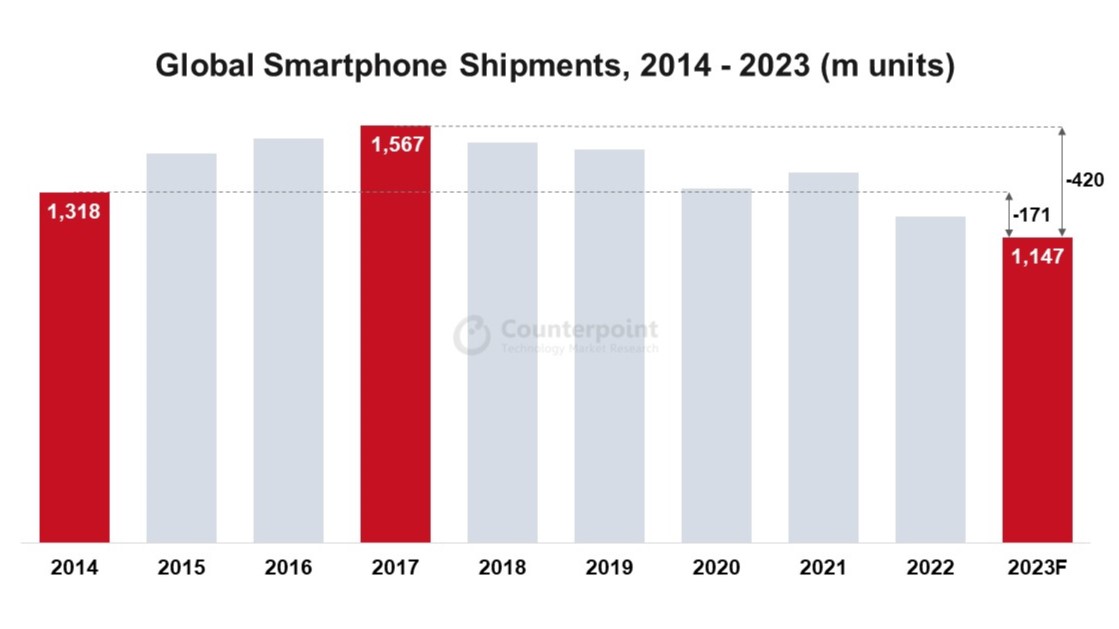

This Is the Year of Smartphone Recovery

Over the past seven years, the smartphone market has contracted six times on an annual basis, however, 2024 is set to be the year when the market returns to growth, says IDC.

2024 smartphone shipments are expected to reach 1.2 billion units – up 2.8% y-o-y followed by low single-digit growth till 2028.

While overall volumes are still below pre-pandemic levels, IDC believes the market has corrected itself and is moving on from the bottom.

Foldable smartphone shipments are expected to grow 37% and shipments will reach 25 million in 2024.

AI has become part of the smartphone discussion, sparking interest in AI experiences on a handheld device.

Jayce

/include/upload/kind/image/20240228/20240228183229_7550.png

Over the past seven years, the smartphone market has contracted six times on an annual basis, however, 2024 is set to be the year when the market returns to growth, says IDC.

2024 smartphone shipments are expected to reach 1.2 billio

2024/2/28 18:33:31

2024/2/28 18:33:31

55

0

541

5

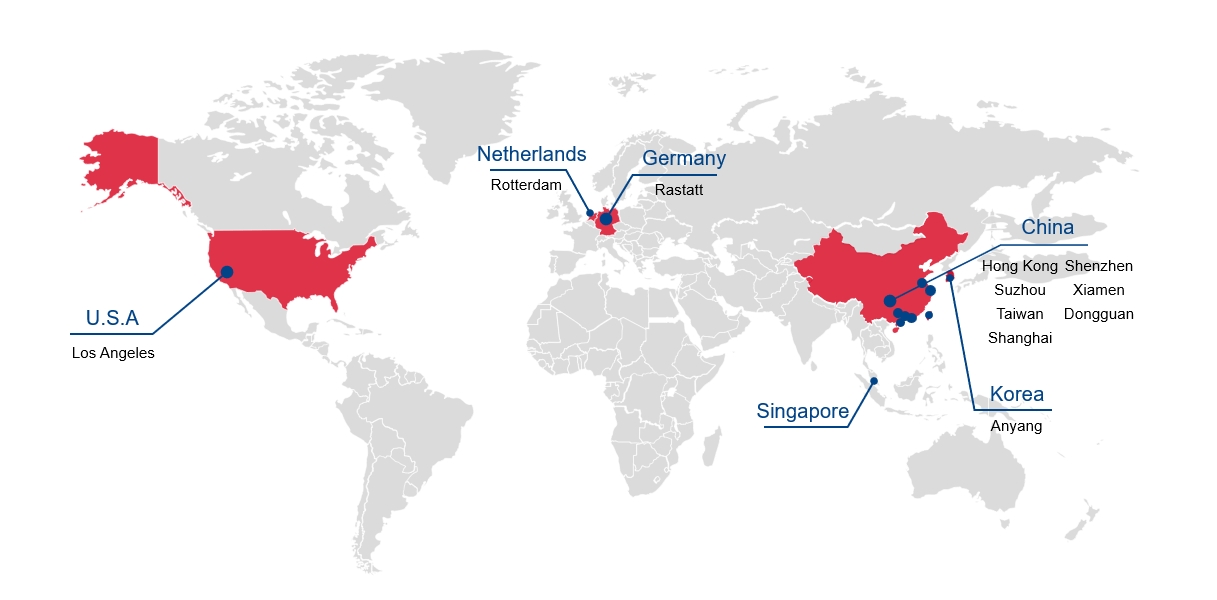

Moving Day Celebration | Flyking Technology Establishes New Office

On February 28, 2024, Flyking Technology’s Asian Franchise Lines Division — Kaimeirui, and Electrical Solution Division — Grand Vision, relocated to a new office together. The new address is below:

Room 606-1, Building T3, Phase I, Hongqiao Wanchuang Center, Lane 500, Xinlong Road, Qibao Town, Minhang District, Shanghai.

This signifies the company's transition to a more robust development path, with a brighter future ahead. Accompanied by cheerful and festive music, the leaders of Flyking Technology cut the red ribbon together, symbolizing the joint office of the two major divisions will unleash even greater power.

The relocation ceremony commenced with speeches from various senior leaders of Flyking Technology, celebrating the establishment of the new office and inspiring confidence in its development.

Kaimeirui——Asian Franchise Alternative Solutions

Looking across the global semiconductor industry market, there is a severe shortage of popular products, and the supply chains of major manufacturers fail to form a closed loop. This has led to unstable lead times and significant price fluctuations for some products of leading semiconductor manufacturers.

Nowadays, Asian semiconductor manufacturing brands have emerged strongly, with many products capable of replacing those of international leading semiconductor manufacturers constantly appearing. This is why we established Kaimeirui Asian Franchise Lines Division, to help customers solve these challenges. So far, Kaimeirui represents over 30 renowned Asian semiconductor brands, offering a wide range of products including sensors, MOS transistors, diodes, SIC diodes, LDOs, DC-DC converters, power modules, resistors, capacitors, oscillators, covering solutions for consumer electronics, industrial electronics, automotive electronics, security surveillance, IoT, high-end power supplies, and more. We are here to meet customers' diverse procurement needs.

We prioritize quality while also caring deeply about our customers' needs. Leveraging manufacturers' technical support, we provide cost-effective product solutions to our customers, assisting them in shortening product development cycles and expediting product delivery processes through efficient logistics and comprehensive after-sales support.

Grand Vision——Power and Electrical Solution Provider

Flyking Technology's Power and Electrical Solution Division, Grand Vision, is a cold-press terminal service provider that integrates solution development, production, and sales. After years of relentless pursuit, we have established a sound customized service process and have obtained industry certificates such as ISO9001 quality system certification, American UL certification, and EU RoHS/REACH environmental certification.

Grand Vision's products include connectors, terminal blocks, relays, contactors, circuit breakers, power capacitors, magnetic cores, ferrite rings, transformers, inductors, reactors, and switches, which can be widely applied in new energy, electric vehicles, rail transportation, and industrial control. Additionally, Grand Vision has been authorized by many well-known manufacturers internationally, providing customers with professional and efficient electrical service solutions.

Starting from understanding and analyzing customer needs, providing technical specifications for different product categories, and proceeding with design confirmation and sample testing. Each step that Grand Vision do is supported by an experienced technical team, all aimed at providing customers with superior solutions.

From an independent distributor to an agent, and now to a power and electrical solution provider, Flyking's visionary strategic layout has built the company's competitive barriers and solidified each step toward internationalization. The step of the joint office is both a testament to customers' trust and support for Flyking and a commitment and assurance from Flyking to its customers.

Jayce

/include/upload/kind/image/20240228/20240228180942_3459.png

On February 28, 2024, Flyking Technology’s Asian Franchise Lines Division — Kaimeirui, and Electrical Solution Division — Grand Vision, relocated to a new office together. The new address is below:

Room 606-1, Building T3, Phase I,

2024/2/28 18:27:11

2024/2/28 18:27:11

54

0

540

6

H2 2023 high end router market down 8%

The High End Router market declined 8% y-o-y in H2 2023, following an abrupt surge in equipment deliveries in the first half of the year, says Dell’Oro Group.

“The disruptions caused by component shortages and supply chain bottlenecks that started over two years ago are still occurring,” says Dell’Oro vp P Jimmy Yu, “once supply freed up, router manufacturers were able to fulfill backlogged orders at a faster pace, driving High End Router revenue up 12 percent year-over-year in the first half of 2023. However, this turned into extra inventory at customer sites, causing them to rationalize future new orders. We believe it may be another two quarters before inventory levels return to normal levels at these service providers,” added Yu.

The High End Router market reached nearly $13 billion in 2023. The top three vendors by revenue share were Cisco, Huawei, and Nokia. The only vendors to gain more than one percentage point of market share were Cisco and Huawei.

Core Router revenue grew 14 percent in 2023. The top three vendors by revenue share were Cisco, Huawei, and Juniper. Cisco gained nearly 6 percentage points of market share and was the only vendor to gain market share in the year.

Edge Router and Aggregation Switch revenue was unchanged from the year ago period.

Jayce

/include/upload/kind/image/20240227/20240227180039_0877.png

The High End Router market declined 8% y-o-y in H2 2023, following an abrupt surge in equipment deliveries in the first half of the year, says Dell’Oro Group.

“The disruptions caused by component shortages and supply chain bottlene

2024/2/27 18:01:17

2024/2/27 18:01:17

35

0

539

6

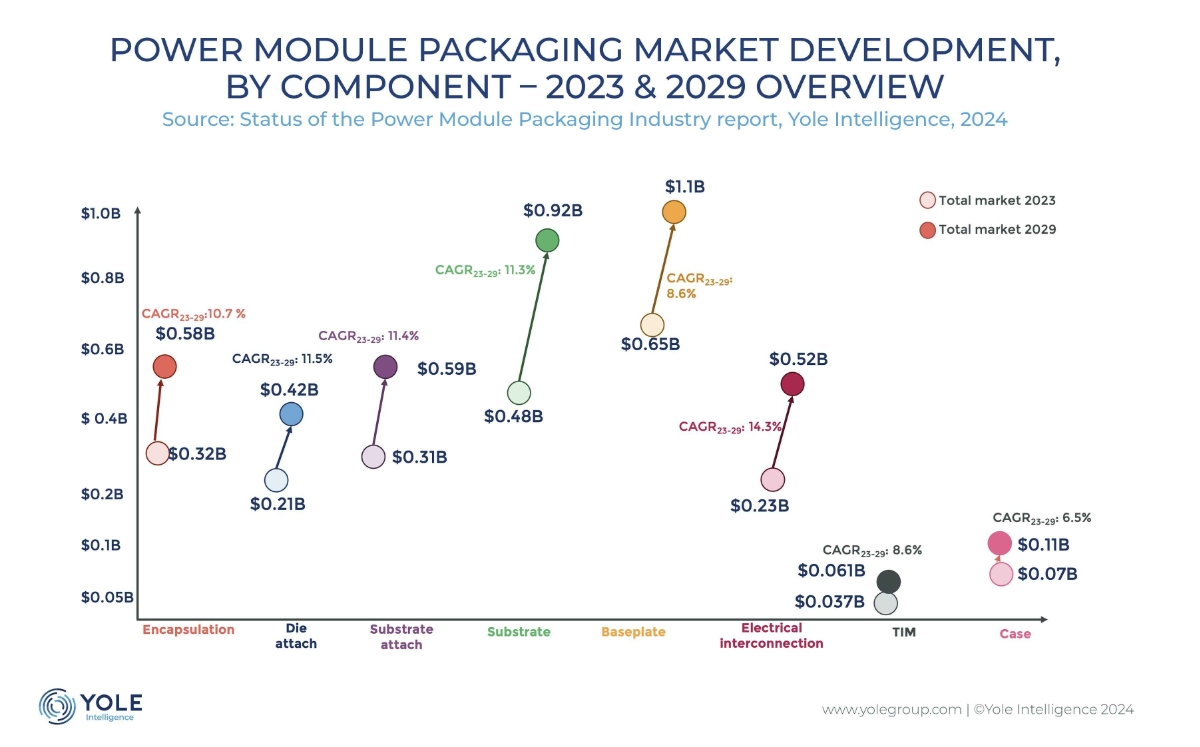

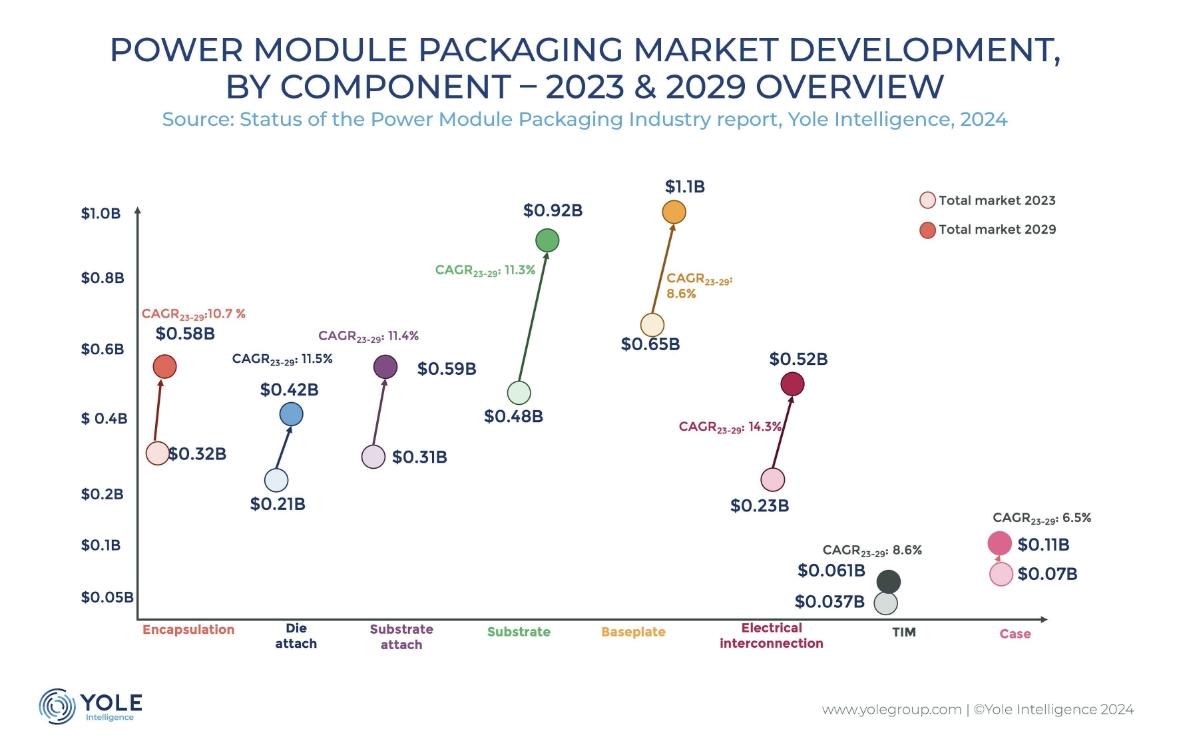

Power module revenue on a 12.1% CAGR 2023-29

Power module revenue will grow from $8 billion in 2023 to $16 billion by 2029 representing a 12.1% CAGR between 2023 and 2029, according to Yole Group.

The power module packaging costs fully depend on the packaging materials, such as die-attach and ceramic substrate materials, and the package size.

In 2023, it represented a $2.3 billion market in 2023, with the cost of materials for power module packaging representing about 30 % of the total power module cost.

Materials cost will have an 11% CAGR between 2023 and 2029, and the market should reach $4.3 billion by 2029.

The largest power module packaging material segment is the baseplate, which will be worth $1,070 million by 2029, against $651 million in 2023. Its CAGR will be 9% between 2023 and 2029, closely followed by the ceramic substrate market segment.

“Today, continuous improvements in module materials and packaging design are needed to take advantage of the benefits of SiC technology,” says Yole’s Shalu Agarwal, “however , the development is simultaneously focused on reducing the costs of power modules through “good enough” performance and reliability.”

“The power module packaging supply chain is continually being reshaped, with new companies entering power module manufacturing,” adds Agarwalm “these companies are expanding their product portfolios and forming new partnerships and M&As. In this dynamic context, the growth of Asian packaging material players puts intense cost pressure on European players.”

The leading power module suppliers are in Europe and Japan, with Infineon Technologies, Semikron Danfoss, Fuji Electric, and Mitsubishi Electric.

Meanwhile, the leading module packaging material suppliers are primarily located in the US, where Yole Group has identified Rogers Corporation, MacDermid Alpha, 3M, Dow, and Indium Corporation, in Europe with Heraeus, Henkel, for example, and in Japan, with FTH (formally known as Ferrotec), Proterial, Kyocera, Dowa, Denka, Tanaka, Resonac, and NGK Insulators.

The geographic expansion of packaging material providers is increasing. Japanese players have a powerful presence in materials but sometimes need help accessing other regions. Therefore, they are trying to grow their presence in China, Europe, and the United States and are investing in developing their businesses within these regions.

For example, Japan’s NGK Insulators is planning to manufacture ceramic substrates in Poland. Similarly, European and U.S. players, such as Heraeus, Henkel, MacDermid Alpha, and Rogers Corporation, are focusing on Asia, mainly China.

At the same time, several companies along the supply chain have either moved or are planning to transfer their production to countries with a lower cost of production to reduce costs, such as Vietnam, Hungary, Malaysia, and Romania.

This leads to more robust competition, increased price pressure, and increasing motivation for partnerships and M&As.

Jayce

/include/upload/kind/image/20240226/20240226181038_2640.png

Power module revenue will grow from $8 billion in 2023 to $16 billion by 2029 representing a 12.1% CAGR between 2023 and 2029, according to Yole Group.

The power module packaging costs fully depend on the packaging materials, s

2024/2/26 18:11:53

2024/2/26 18:11:53

36

0

538

5

Flyking Weekly Industry Express

Jayce

/include/upload/kind/image/20240226/20240226180800_0837.jpg

2024/2/26 18:08:18

2024/2/26 18:08:18

39

0

537

6

Nvidia Astonishes

Nvidia's Q4 proft was $12.3 billion.

It's full year revenue was up 126% y-o-y at $60.9 billion.

Q4 datacentre revenue was up 409% y-o-y at $18.4 billion.

Full year datacentre revenue was up 27% y-o-y at $47.5 billion.

Q1 revenues are forecast to be up 233% y-o-y at $24 billion plus or minus 2%.

At last night’s close, Nvidia’s market cap was $1.7 trillion.

Although its customers are scrabbling to find proprietary or merchant market alternatives, so far Nvidia looks as if it can out-run them on the tech with better chips, while offering them ASIC solutions tailored to their particular needs.

Jayce

/include/upload/kind/image/20240222/20240222175423_7212.jpg

Nvidia’s Q4 revenue was up 265% y-o-y at $22.1 billion.

2024/2/22 17:55:06

2024/2/22 17:55:06

35

0

536

5

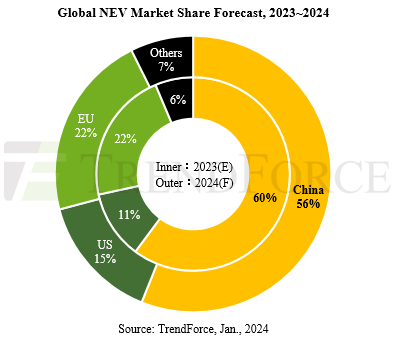

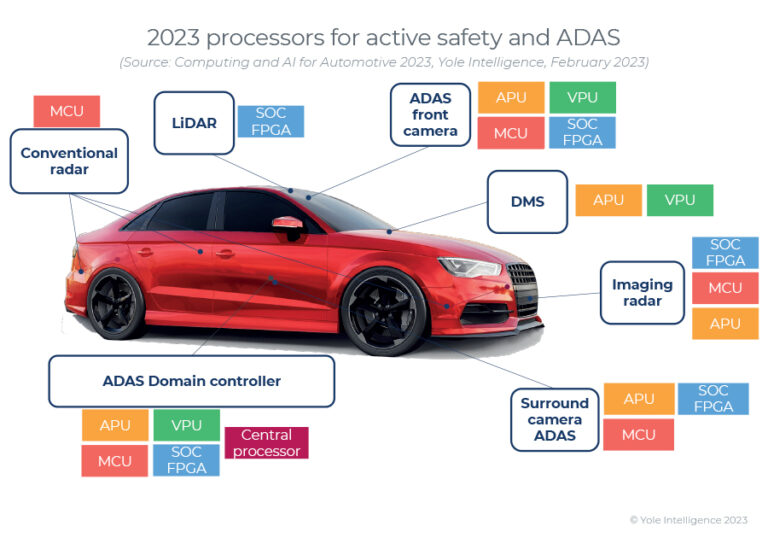

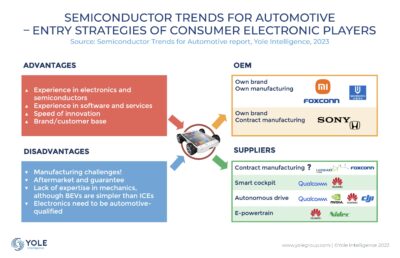

January Market Report: Summary of Automotive Industry

Overview of the Automotive Semiconductor Industry

January 2024 has concluded with a 69% year-over-year increase in global electric vehicle (EV) sales, reaching 1.1 million units, albeit experiencing a 26% decline compared to December. Reductions in subsidies in Germany and France, coupled with seasonal softness in Chinese sales, were primary factors. Sales in Germany and France decreased by approximately 50% compared to December, yet the anticipated 2025 EU emission standards are expected to stimulate supply for pure EVs and hybrid models.

Sales revenues in the U.S. and Canada surged by 41%, nearly doubling in China, and increased by 29% in the EU, European Free Trade Association, and the UK. However, sales declined by 26% before the Chinese Lunar New Year, 32% in Europe, and 14% in the U.S. and Canada compared to December. General Motors' introduction of plug-in hybrid electric vehicles in the North American market marks a strategic reversal in bypassing hybrid systems. Despite consumer hesitancy due to high EV prices and challenges in charging infrastructure, hybrid vehicle sales continue to rise in the United States.

Updates from Automotive Semiconductor Manufacturers

Renesas is set to acquire Transphorm, a designer and manufacturer of gallium nitride (GaN) power devices, for approximately $339 million. GaN, a wide-bandgap technology, finds application in high-voltage applications across various markets, including EVs and fast EV chargers, as well as data centers and industrial applications.

Intel announced its acquisition of Silicon Mobility SAS to integrate artificial intelligence (AI) efficiency into electric vehicle (EV) energy management. The company also stated that the new AI-enhanced software-defined vehicle SoC would enable onboard AI and camera-based driver/passenger monitoring. Additionally, the company plans to offer an open automotive chip platform for customers to integrate their own chips into Intel's automotive products.

Infineon and Aurora Labs introduced an AI-based solution to enhance the reliability and safety of critical automotive components, including steering, braking, and airbags.

NXP expanded its automotive radar single-chip series, integrating high-performance radar transceivers, multicore radar processors, and MACsec hardware engines for secure data communication via automotive Ethernet.

Texas Instruments launched the industry's first single-chip radar sensor designed for satellite architecture, enabling more precise Advanced Driver Assistance Systems (ADAS) decisions and supporting new driver chip systems for battery management or power flow control in other power systems.

Qualcomm and Bosch unveiled a central in-vehicle computer capable of running both infotainment and ADAS functions on a single SoC.

Developments in Automotive Manufacturers

Tesla: Since 2024, Tesla's stock price has seen a significant decline, dropping by 24.6% in January and continuing to fall, currently down by 55.5% from its 2021 peak. Despite a 20% year-over-year increase in fourth-quarter sales, revenue growth was only 3%. To sustain sales momentum, Tesla significantly reduced prices throughout the year and offered discounts. Automotive gross margins plummeted from 30% in Q4 2021 to below 20%. In early 2024, Tesla continued price reductions in China and Europe, with analysts identifying automotive gross margins as a critical revenue concern.

BYD: Influenced by seasonal factors, BYD witnessed a month-over-month sales decline in January but grew by 33.14% year-over-year. Despite a 40.92% decrease in Chinese market sales, BYD achieved a historic high in overseas sales, reaching 36,174 units, a 247.53% year-over-year increase. Since March 2022, BYD has been focusing on producing plug-in hybrid and pure EVs.

BMW: In January, BMW announced its integration of Amazon's Alexa technology into the language assistant of some of its vehicles, starting this year. At CES 2024, BMW and Amazon showcased a voice assistant product based on the Alexa AI model, capable of advanced language processing and generating complex responses. Additionally, BMW stated that starting in 2027, its Munich plant would exclusively produce electric vehicles.

Hyundai: At CES 2024, Hyundai presented the theme "Ease every way," emphasizing human-centric life innovations through advancements in hydrogen energy, software, and AI. Hyundai's HTWO brand will transition into a hydrogen value chain business brand, integrating various industry segments such as hydrogen production, storage, transportation, and utilization. Furthermore, Hyundai introduced the "Software-Defined Everything (SDx)" strategy to accelerate software-centric intelligent mobility development.

Kia: At CES 2024, Kia unveiled its platform "Beyond Mobility," surpassing traditional automotive business, based on the all-new modular vehicle Concept PV5. The strategy aims to revolutionize the mobility industry through its PBV business and support the Hyundai Motor Group's goals in robotics, Advanced Air Mobility (AAM), and autonomous driving technology.

Honda: Honda globally premiered the "Honda 0 Series" electric concept car at CES 2024, previewing a new EV series set to launch in 2026, including Saloon and Space-Hub concept models and a new H logo. Honda aims for carbon neutrality by 2050, planning for electric and fuel cell vehicle sales to reach 100% by 2040.

Forecast for the Automotive Semiconductor Market

The automotive semiconductor industry is projected to grow from $436.629 billion in 2022 to $857.278 billion by 2030, with a Compound Annual Growth Rate (CAGR) of 8.6% (2022-2030).

The trends towards automotive intelligence and electrification will drive semiconductor market growth, with ADAS and infotainment being major drivers. By 2027, ADAS is expected to account for 30% of the automotive semiconductor market, with a growth rate of 19.8%; infotainment will represent 20%, with a growth rate of 14.6%. This indicates a long-term stable growth in chip demand for automotive electronics.

Jayce

/include/upload/kind/image/20240222/20240222172953_7147.png

Overview of the Automotive Semiconductor Industry

January 2024 has concluded with a 69% year-over-year increase in global electric vehicle (EV) sales, reaching 1.1 million units, albeit experiencing a 26% decline compared to December.

2024/2/22 17:31:43

2024/2/22 17:31:43

62

0

535

5

Kick Off the Loong Year: Flyking's New Year Gathering

As the Lucky Dragon Dances into Spring, our brand-new journey has begun. On the ninth day of the first lunar month, Flyking Technology kicks off with vigor!

New Year New Start

On the first day back to work after the Chinese New Year holiday, the joy and excitement of the Spring Festival spread still. Every corner of our offices is filled with a festive atmosphere, with our Chinese knots conveying hopes and aspirations for the new year.

“Happy New Year & Gong Xi Fa Cai”, we bless each other with happiness and peace, we get our lucky money from various red envelopes.

Today's most anticipated event is undoubtedly receiving the red envelopes, symbolizing a prosperous start to the new year for Flyking Technology and conveying our company's best wishes to all employees.

Flyking’s Chairman, Fred, and CEO, Norman send their New Year blessings and best wishes for the start of work.

New Year Kick-off Gathering

In addition to the red envelopes for the New Year, we also organized a lively and thoughtful Kick-off Gathering activity, which is full of fun and surprises. We get together to welcome the first day of work in the new year with a fresh outlook!

During the party, the gaming session was filled with excitement, featuring a thrilling game of "Rolling Fortune" and a music-themed challenge called "Lyric Library." There was also the joyful game of "Fortune Shovel," where we blindfolded ourselves and dug with all of our luck.

The entire gathering was lively and extraordinary, with colleagues enjoying themselves and embracing the new year with full vitality, kicking off a new journey with enthusiasm!

Let’s focus on the journey of the Loong Year. Flyking Technology will continue to uphold every ounce of trust, respond to expectations with quality, fulfill our mission with service, and forge ahead with full vigor amidst the tide of electronic components.

Jayce

/include/upload/kind/image/20240219/20240219180610_8600.png

As the Lucky Dragon Dances into Spring, our brand-new journey has begun. On the ninth day of the first lunar month, Flyking Technology kicks off with vigor!

New Year New Start

On the first day back to

2024/2/19 18:11:51

2024/2/19 18:11:51

36

0

534

6

Smart NICs to Be $5bn Market by 2028

The Smart NIC market will top $5 billion by 2028, says Dell’Oro.

Accelerated computing will continue to push the boundaries in server connectivity, demanding port speeds of 400 Gbps and higher speeds.

“The Ethernet Adapter market is poised for a compound annual growth rate of 13 percent, fueled by the increasing adoption of higher-speed ports and Smart NICs within data center infrastructures,” says Dell’Oro’s Baron Fung, “the hyperscale cloud service providers will drive rapid development in server connectivity, including increasing the adoption of customized Smart NICs and DPUs, and server port speeds reaching 800 Gbps in the next several years for accelerated computing. The rest of the market, which lags the hyperscale market in the deployment of these technologies, will still be an attractive market for the open vendors offering off the shelf solutions.”

Total Ethernet Controller and Adapter market, not counting the AI back-end network market, is forecast to exceed $8 billion by 2028.

The majority of the accelerated servers will have server access speeds of 400 Gbps and higher by 2028.

Smart NICs are expected to cannibalise Standard NICs during the forecast period.

Jayce

/include/upload/kind/image/20240208/20240208144929_7137.jpg

The Smart NIC market will top $5 billion by 2028, says Dell’Oro.

Accelerated computing will continue to push the boundaries in server connectivity, demanding port speeds of 400 Gbps and higher speeds.

“The Ethe

2024/2/8 14:49:36

2024/2/8 14:49:36

71

0

533

6

Skills Report on Chip Industry

The METIS (MicroElectronics Training, Industry and Skills) study has concluded and finds that the Top Five Critical Job Profiles in the microelectronics sector in 2023 are:

-

Data specialist

-

Software engineer

-

Design engineer

-

Process engineer

-

Maintenance technician

The Top Emerging Skills in 2023 are:

-

Machine Learning and Artificial Intelligence

-

Data Analysis

-

Systems Design and System Architecture (SoC, SiP, SoP, complex ASIC)

-

Analog and Mixed-Signal Design

-

Verification

The report considers the current skills gap in the microelectronics industry and provides a list of policy recommendations including:

Increase the involvement of the microelectronics industry in the education process.

Develop communications campaigns to improve the sector’s image.

Develop clusters and networks to encourage greater dialog between industry and education providers.

Read the full report here.

Jayce

/include/upload/kind/image/20240207/20240207215559_3608.jpg

The METIS (MicroElectronics Training, Industry and Skills) study has concluded and finds that the Top Five Critical Job Profiles in the microelectronics sector in 2023 are:

Data specialist

Software engineer

2024/2/7 21:56:15

2024/2/7 21:56:15

45

0

532

6

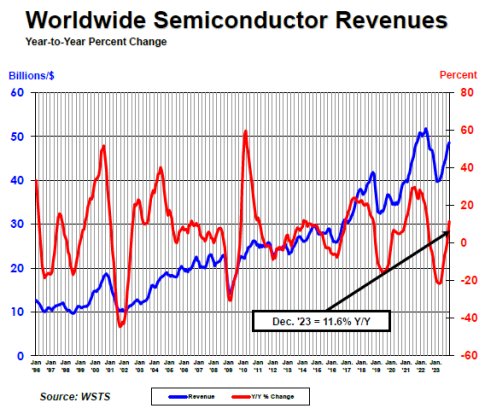

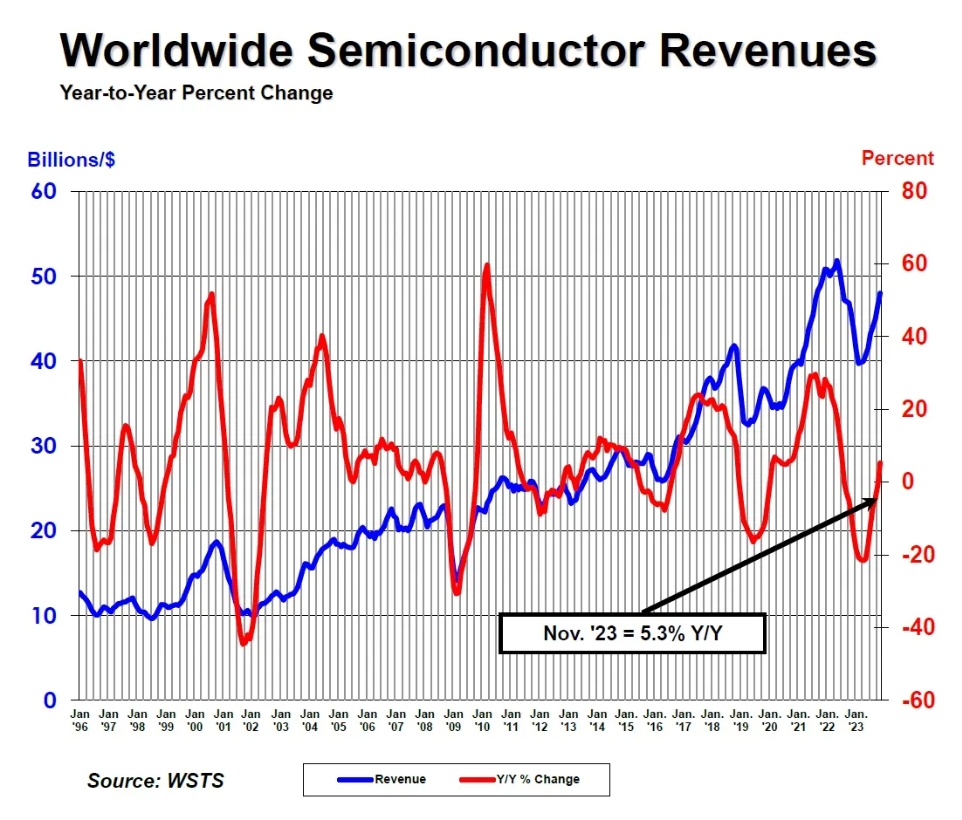

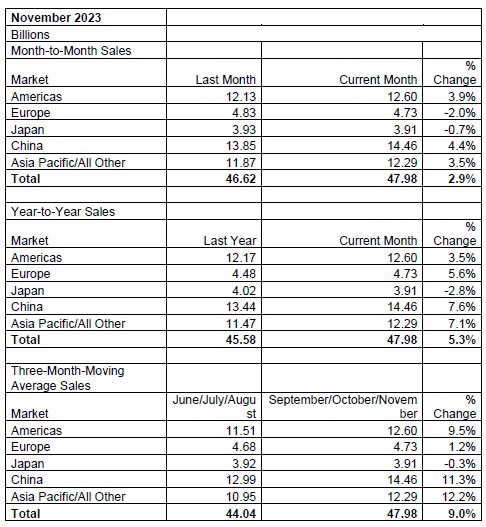

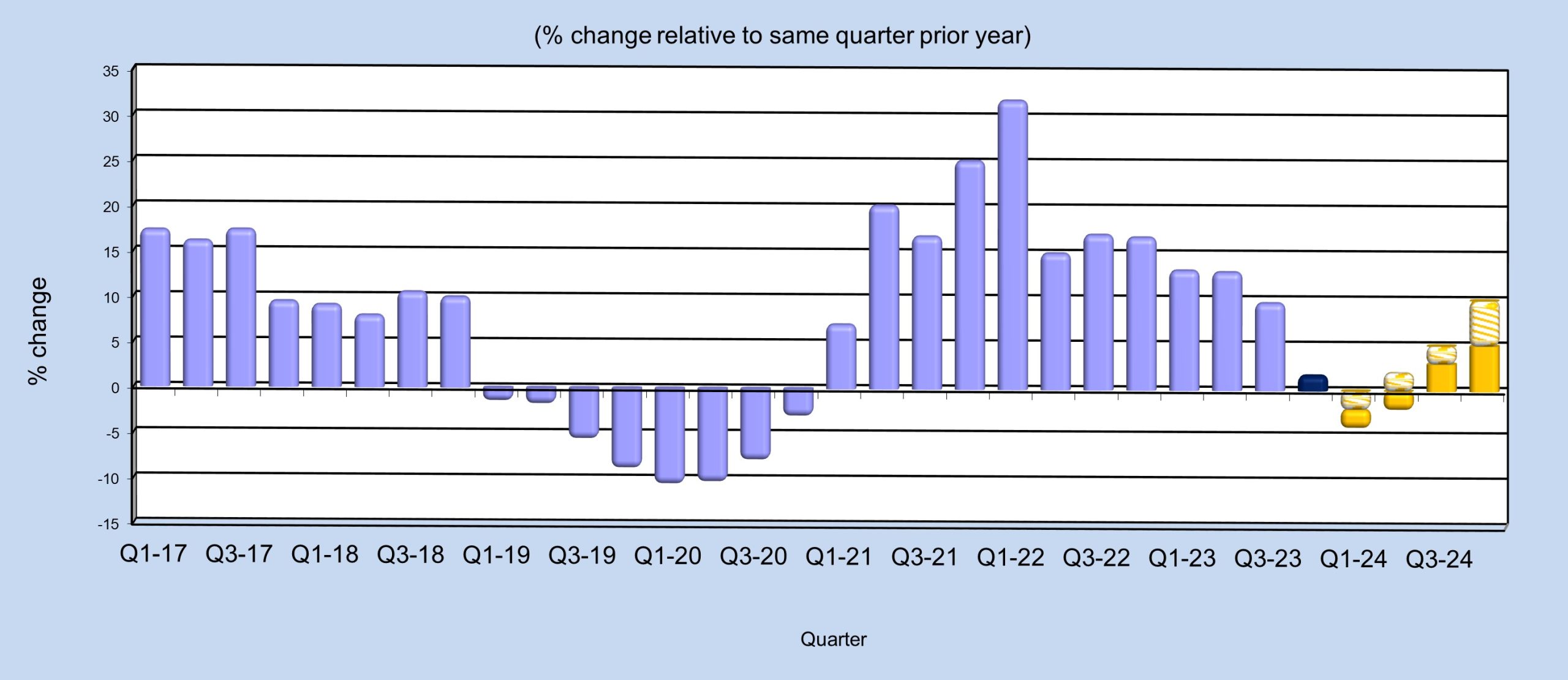

SIA Forecasts 13% Growth This Year

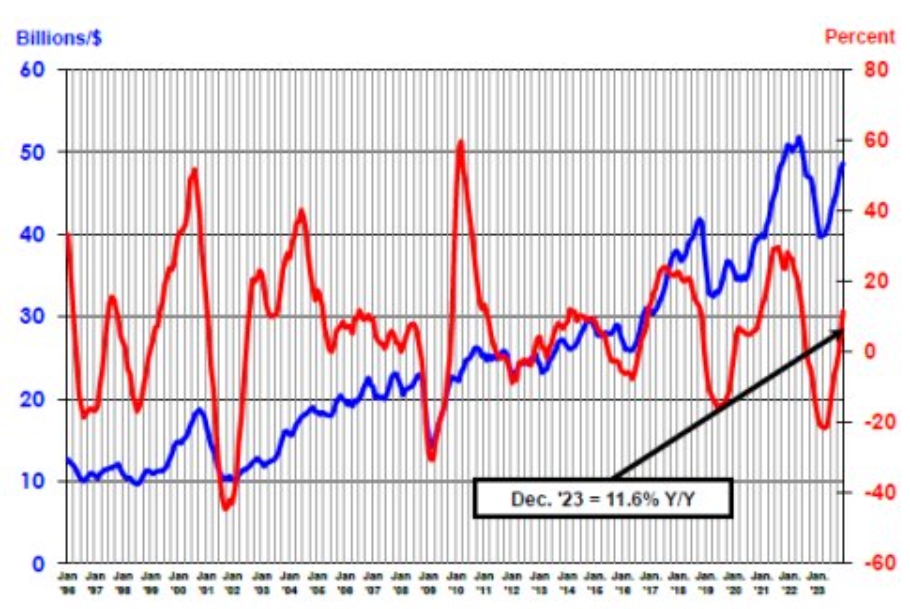

Semiconductor sales of $526.8 billion last year were 8.2% down on 2022’s record-breaking total of $574.1 billion, says the SIA, which forecast a sales rise of 13% this year to almost $600 billion.

Q4 sales of $146 billion were up 11.6% y-o-y and 8.4% m-o-m..

“Global semiconductor sales were sluggish early in 2023 but rebounded strongly during the second half of the year, and double-digit market growth is projected for 2024,” says SIA CEO John Neuffer, “with chips playing a larger and more important role in countless products the world depends on, the long-term outlook for the semiconductor market is extremely strong. Advancing government policies that invest in R&D, strengthen the semiconductor workforce, and reduce barriers to trade will help the industry continue to grow and innovate for many years to come.”

Europe was the only regional market that experienced annual growth in 2023, with sales there increasing 4.0%. Annual sales into all other regional markets decreased in 2023: Japan (-3.1%), the Americas (-5.2%), Asia-Pacific/All Other (-10.1%), and China (-14.0%). Sales for the month of December 2023 increased compared to November 2023 in China (4.7%), the Americas (1.8%), and Asia Pacific/All Other (0.3%), but decreased in Japan (-2.4%) and Europe (-3.9%).

Several semiconductor product segments stood out in 2023. Sales of logic products totaled $178.5 billion in 2023, making it the largest product category by sales. Memory products were second in terms of sales, totaling $92.3 billion. Microcontroller units (MCUs) grew by 11.4% to a total of $27.9 billion. And sales of automotive ICs grew by 23.7% year-over-year to a record total of $42.2 billion.

Jayce

/include/upload/kind/image/20240206/20240206173608_7923.png

Semiconductor sales of $526.8 billion last year were 8.2% down on 2022’s record-breaking total of $574.1 billion, says the SIA, which forecast a sales rise of 13% this year to almost $600 billion.

Q4 sales of $146

2024/2/6 17:36:53

2024/2/6 17:36:53

61

0

531

5

Flyking Weekly Industry Express

Jayce

/include/upload/kind/image/20240205/20240205145429_7460.jpg

2024/2/5 14:54:55

2024/2/5 14:54:55

77

0

530

6

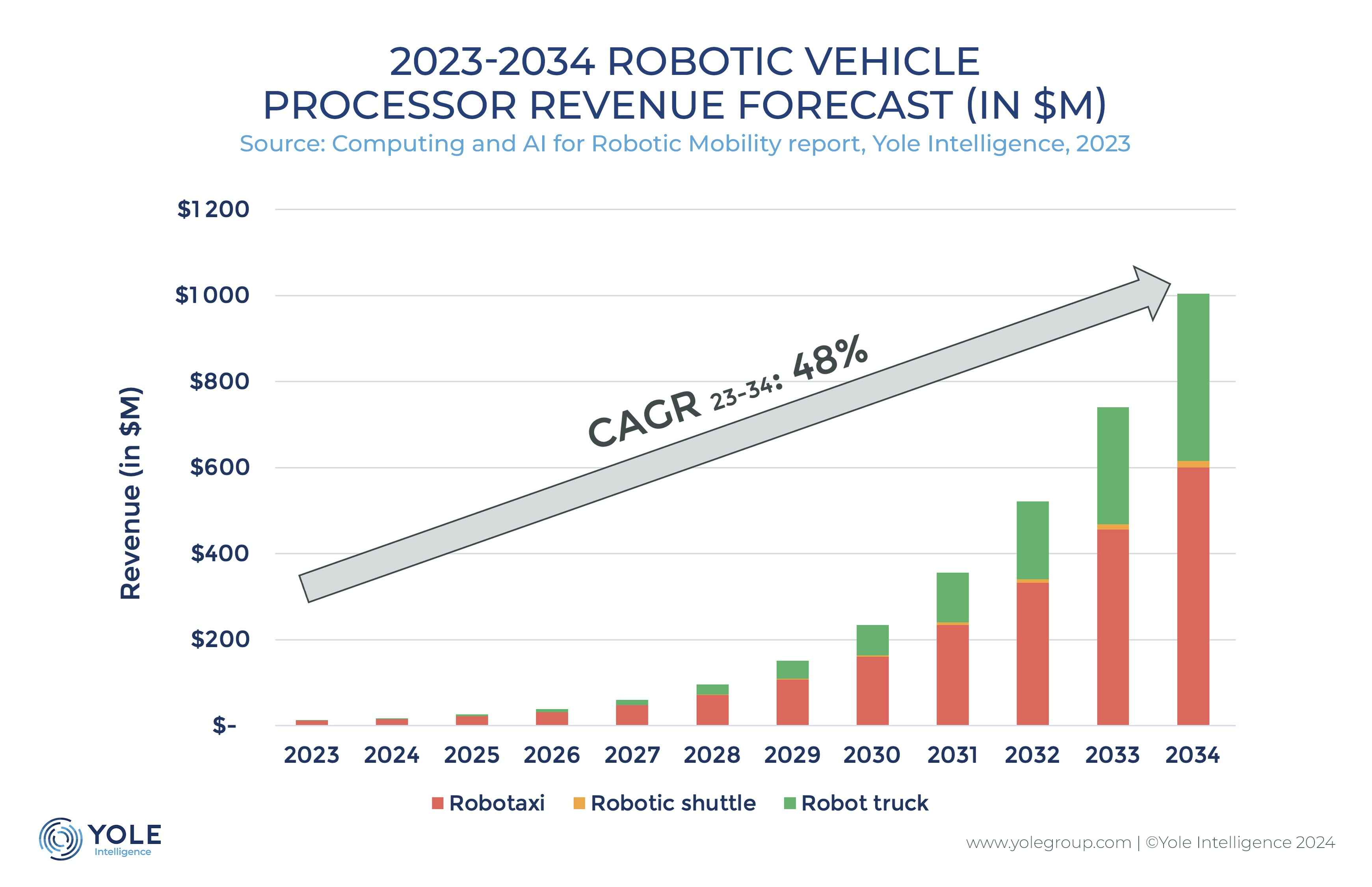

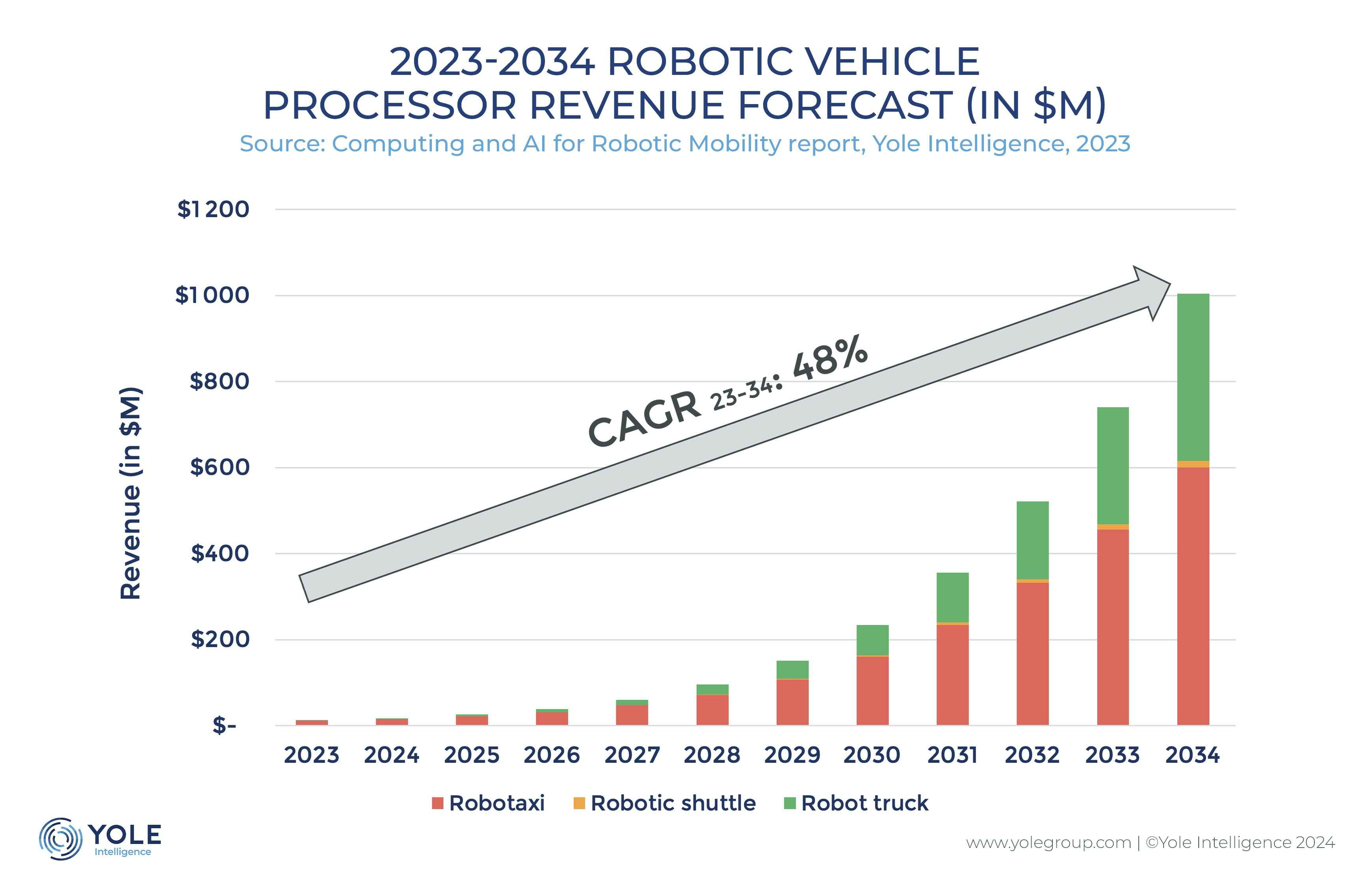

Robot Vehicle Investment Reaches $42.5 Billion

Over the past nine years, the global investment in robotaxis, robot shuttles, and robot trucks has reached nearly $42.5 billion, says Yole Developpement, with the robotic vehicle processor market expected to reach $1 billion in 2034, with an estimated 48% CAGR from 2023 to 2034.

The expanding robotaxi market will see a division between processors tailored for automotive use and those specifically designed for the purpose.

Robotaxis and robot trucks are dominated by the US and China, with Europe trailing behind in robot shuttles.

Essential for achieving autonomy, robotic vehicle processors demand significant computing power for instantaneous decision-making.

Initially, server/PC-grade processors were employed due to their robust computing capabilities.

However, with advancements in the automotive processor market, those tailored for ADAS /AD functions have emerged as more cost-effective and energy-efficient alternatives for robotic vehicles.

“Nvidia, an early player, introduced high-performance processors with the Parker architecture in 2016, now widely utilised in numerous robotic vehicles,” says Yole’s Adrien Sanchez, “however, competition has intensified with the development of ADAS/AD processors, gaining momentum from companies like Mobileye, Qualcomm, and Huawei. Notably, startups such as Horizon Robotic and Black Sesame provide potential solutions, particularly for Chinese companies aiming for secure domestic supply chains.”

On the architectural front, diverse solutions are emerging. Mobileye, for instance, has pioneered a scalable processor family, departing from a fully centralized architecture based on a single processor.

This approach not only reduces development costs but also provides a flexible solution tailored to the specific needs of its customers.

Simultaneously, a prevailing trend among leaders in the robotic industry involves the in-house development of custom processors to precisely address specific requirements.

“The global landscape for robotic vehicles is characterized by three key regions: the United States, China, and Europe,” says Yole’s Hugo Antoine, “in the U.S, active testing of autonomous vehicles is underway, with robotaxi services already available in a few cities, and rapid progress in the deployment of robot trucks connecting the East Coast to the West Coast,”

China has asserted itself as a frontrunner in autonomous technology, with Baidu-Apollo leading in robotaxi and shuttle services, closely followed by dynamic companies like WeRide and Pony.ai.

Europe, too, is actively involved, particularly in robot shuttle companies and testing initiatives.

The Middle East, notably the UAE and KSA, is actively participating in robotic mobility projects through strategic partnerships with European, Chinese, and American companies.

In the autonomous vehicle industry, companies focusing on robotic vehicles initially prioritise their core segments to manage costs and enhance scalability.

Jayce

/include/upload/kind/image/20240202/20240202171041_2638.jpg

Over the past nine years, the global investment in robotaxis, robot shuttles, and robot trucks has reached nearly $42.5 billion, says Yole Developpement, with the robotic vehicle processor market expected to reach $1 billion in 2034, with an estima

2024/2/2 17:12:46

2024/2/2 17:12:46

43

0

529

6

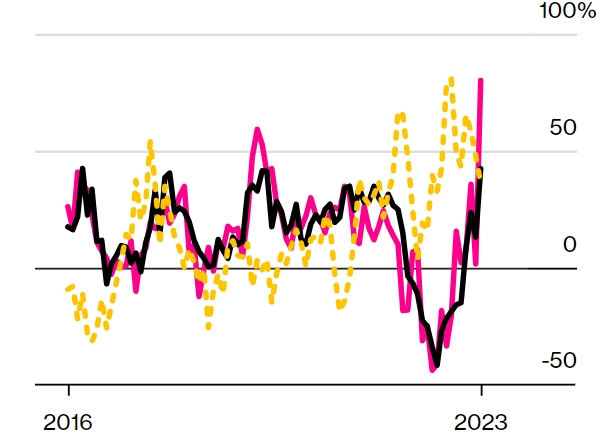

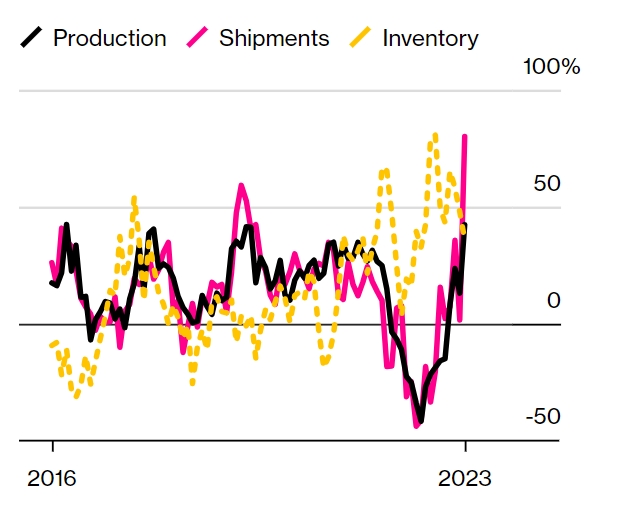

December Jump for Korean Semi Shipments

In December, Korea’s semiconductor factory shipments rose 113.7% y-o-y – the biggest jump in a month since 1997, according to Statistics Korea, the national statistics office.

Inventories rose by 11.6% – the smallest rise since the collapse in demand in late 2022.

Production rose 53.3% y-o-y which was the biggest monthly rise since mid-2016.

Korea supplies two-thirds of global memory production.

Jayce

/include/upload/kind/image/20240201/20240201171745_7339.png

In December, Korea’s semiconductor factory shipments rose 113.7% y-o-y – the biggest jump in a month since 1997, according to Statistics Korea, the national statistics office.

Inventories rose by 11.6% – the smallest rise since

2024/2/1 17:18:39

2024/2/1 17:18:39

45

0

528

6

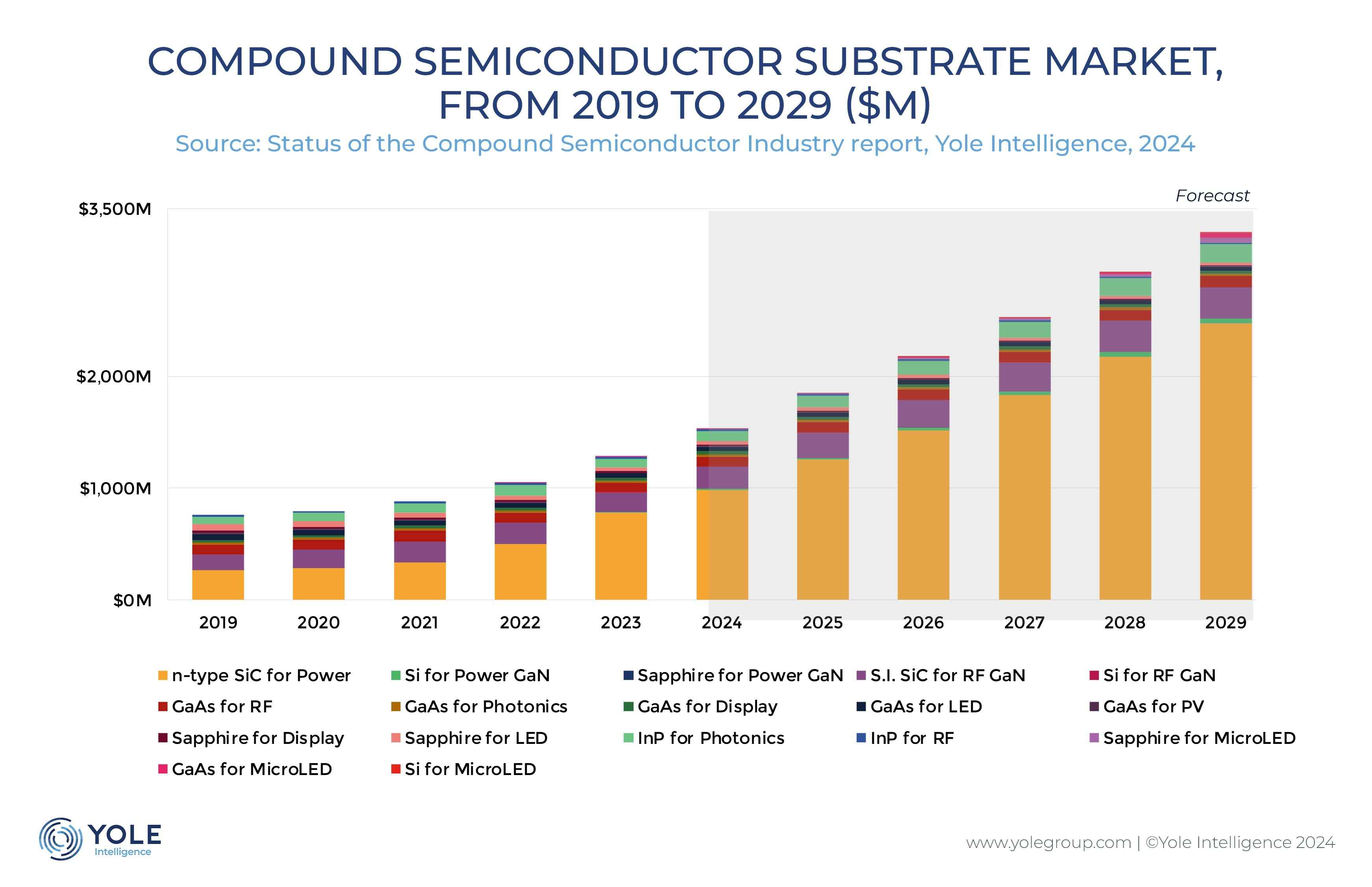

Compound Semi Substrate Market Growing at 17% CAGR 2023-29

The compound semiconductor substrate market is expected to reach $3.3 billion in 2029, with a 17% CAGR between 2023 and 2029, says Yole Developpement.

Substrate players consistently craft new strategies to diversify their product portfolios and enhance their market presence.

Compound semiconductor technologies showcase diverse advancements across sectors:leg. SiC , GaN , InP and. have emerged as a transformative influence across various industries.

SiC’s dominance in the automotive sector, especially in the domain of 800V EVs , drives a billion-dollar market, while GaN power electronics is expanding its presence in both the consumer and automotive fields.

Yole expects a billion-unit opportunity in smartphone OVP (Over Voltage Protection) . In anticipation of a resurgence, RF GaAs aligns itself with 5G and automotive connectivity, while RF GaN establishes its presence in defense, telecommunications, and space industries, targeting high-power applications.

Within the realm of photonics, InP and GaAs take the lead, with InP experiencing a resurgence fueled by AI applications, while GaAs photonics sees more modest growth influenced by various market dynamics. Although MicroLEDs show potential, their widespread adoption is gradual,

“The CS industry is at the corner to transition to larger diameter substrates. In the Photonics sector,” saysYole’s Ali Jaffal, “AI is driving the demand of high-data-rate lasers, which could accelerate the transition to 6” InP substrates.

On the other side of the coin, GaAs explores 8” manufacturing for microLED, which is competing with OLED, facing yield and efficiency challenges, questioning its success but gaining momentum with substantial investments.”

Suppliers of GaAs and InP substrates, including Freiberger, Sumitomo Electric, and AXT, play a central role in the transition to larger diameter substrates. Photonics is part of this story, and the Power and RF markets further complement this narrative.

Wolfspeed is leading the change to supply SiC substrates for power electronics applications. It has recently transitioned to the larger 8” wafer fabs and is expanding its material capacity in line with its strategic vision.

Coherent, another leading player, focuses on photonic devices and dominates the SiC substrate market for both power and RF applications. It has made a number of strategic alliances, for example, with SEDI in RF GaN, to reinforce its position and has started supplying power SiC devices. Following these actions, it covers the whole value chain from substrates to advanced devices.

The landscape is continuously evolving, with multiple innovations on many fronts and strategic partnerships.

“Compound semiconductor technologies are advancing across sectors, notably in the booming SiC industry “ says Yole’s Taha Ayari “while 6” wafers are still standard, Wolfspeed’s $1.2 billion investment in MHV fab is pioneering the transition to 8″ wafer size. Other efforts focus on improving SiC wafer yield and supply, with innovations like engineered substrates from Soitec and Sumitomo Mining. Power GaN sees a shift to 8-inch GaN-on-Si, driven by expansion at Innoscience, STMicroelectronics, and Infineon Technologies”.

“RF GaN-on-Si is benefiting from synergies with the relatively more mature Power GaN to enter the telecom market and compete with established RF GaN-on-SiC technology,” says Yole’s Aymen Ghorbel, additionally, major changes in the RF GaN ecosystem, such as Wolfspeed RF business being acquired by Macom, could impact the RF GaN industry”.

Jayce

/include/upload/kind/image/20240131/20240131173146_0446.jpg

The compound semiconductor substrate market is expected to reach $3.3 billion in 2029, with a 17% CAGR between 2023 and 2029, says Yole Developpement.

Substrate players consistently craft new strategies to diversify their produ

2024/1/31 17:32:38

2024/1/31 17:32:38

49

0

527

5

Flyking Weekly Industry Express

Jayce

/include/upload/kind/image/20240129/20240129215239_4364.jpg

2024/1/29 21:53:21

2024/1/29 21:53:21

86

0

526

6

Hynix Surprises With Q4 Profit

Hynix had a Q4 profit of $260 million on revenues up 47.4% at $8.5 billion compared with a loss of $1.4 billion in Q4 2022.

For the full year of 2023, Hynix had a loss of $5.8 billion on revenues which fell 27% y-o-y to $24.6 billion.

“We achieved a remarkable turnaround in the fourth quarter following a protracted downturn, thanks to our technological leadership in the AI memory space,” said CFO Kim Woohyun.

Hynix is working with Nvidia on HBM memories and is about to start producing the latest iteration – HBM3E.

“We are smoothly preparing for mass production of HBM3E as demand for the chips will occur in earnest this year. We plan to supply them during the first half,” said a Hynix exec on the results call.

Jayce

/include/upload/kind/image/20240126/20240126205448_0759.jpeg