248

6

Industry: DRAM memory demand to pick up in Q2 next year

DRAM memory demand is expected to pick up in the second quarter of 2023, while NAND flash demand is unlikely to see a recovery in the second half of the year, according to memory module company Ten Ambrose Technology.

Ten Ambrose Technology said DRAM prices have fallen by nearly half since 2022, and the decline is expected to slow, according to Taiwanese media outlet Electronic Times. As more chipmakers cut production, the DRAM market's supply-demand balance is expected to recover in the first quarter of 2023, and the recovery in DRAM prices will precede that of NAND flash prices.

Overall DRAM demand is reportedly low this year, with analysis by semiconductor data consultancy IC Insights pointing out that weak economic conditions and high inflation have slowed global demand for personal computers, mainstream smartphones and other consumer electronics. As a result, DRAM demand is spiraling downward, with sales now expected to fall 40 percent to $29.3 billion in the second half of 2022, compared to $49 billion in the first half of 2022. The DRAM market is expected to decline by 18 percent for the full year 2022.

source:aijiwei

wanda

/include/upload/kind/image/20221219/20221219174033_2963.jpg

DRAM memory demand is expected to pick up in the second quarter of 2023, while NAND flash demand is unlikely to see a recovery in the second half of the year, according to memory module company Ten Ambrose Technology.

Ten Ambrose Techn

2022/12/19 17:41:13

2022/12/19 17:41:13

297

0

247

6

Marvell's product price increase of 10% is rumored to take effect on Jan. 1 next year

According to a recent industry outflow of Marvell's price increase letter, the company will increase the price of its products by 10% effective January 1, 2023, according to Science and Technology Daily.

Marvell noted that while supply chain dynamics remain challenging and unpredictable, we have seen some improvements, reducing lead times to 26 weeks for most products starting in December 2022. The 16-week lead time for Fibre Channel HBAs will not change. In addition, due to increased costs and additional fees on the vendor side, the company will increase the price of its products by 10% effective January 1, 2023.

However, Marvell did not specify the relevant products and models, nor did it make clear whether the price increase was for the entire line.

Marvell, founded in 1995 and headquartered in Silicon Valley with R&D centers in Shanghai, Nanjing, Chengdu and Beijing, China, is a leading global semiconductor vendor providing a full suite of broadband communications and storage solutions for the high-speed, high-density, digital data storage and broadband digital data networking markets, engaging in the design, development and delivery of mixed-signal and digital signal processing integrated circuits. The company is a global leader in the design, development and supply of mixed-signal and digital signal processing integrated circuits for the high-speed, high-density, digital data storage and broadband digital data networking markets.

At the end of October, Marvell China was rumored to be laying off a large number of employees, and Marvell insiders confirmed the news to Tibco. The sources said that Marvell's China layoffs involve all departments and will give the laid-off employees a two-month buffer period, with compensation rumored to be N+3.

source:aijiwei

wanda

/include/upload/kind/image/20221216/20221216170138_3145.jpg

According to a recent industry outflow of Marvell's price increase letter, the company will increase the price of its products by 10% effective January 1, 2023, according to Science and Technology Daily.

Marvell noted that while supply

2022/12/16 17:02:05

2022/12/16 17:02:05

295

0

246

6

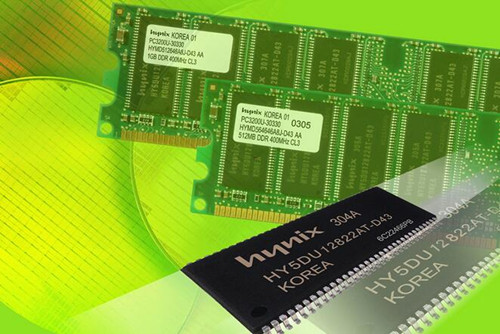

Samsung Q3 DRAM sales fell 34.2%

According to Yonhap News Agency, Samsung's dynamic random access memory (DRAM) sales fell 34.2% in the third quarter of this year from a year earlier against the backdrop of a cold market for memory chips due to the global economic downturn.

Market research agency Omdia data show that global DRAM sales in Q3 this year fell 29.8% from a year earlier to $17.548 billion. Analysts believe that the global economic recession has led to shrinking demand, combined with customer adjustments to inventory and falling prices, the semiconductor storage market has entered a full-scale winter.

Specifically, Samsung Q3 DRAM sales fell 34.2% to $7.133 billion, SK Hynix was $5.246 billion, down 25.3%, and Micron sales fell 26.3% to $4.35 billion.

According to a previous report released by Eugene Investment & Securities with little difference from Omdia, shows Q3 global DRAM market sales of $17.973 billion, down 29.3% from Q2's $25.427 billion. Samsung's Q3 market share fell to 41.0%, a record low in eight years.

source:aijiwei

wanda

/include/upload/kind/image/20221215/20221215173856_8761.jpg

According to Yonhap News Agency, Samsung's dynamic random access memory (DRAM) sales fell 34.2% in the third quarter of this year from a year earlier against the backdrop of a cold market for memory chips due to the global economic downturn.

2022/12/15 17:39:17

2022/12/15 17:39:17

279

0

245

6

Agency: Semiconductor materials market expected to grow 8% to $66 billion in 2022, but may decline next year

On December 14, according to VantageHub, strong demand in the semiconductor materials market, coupled with strong sales of CMP abrasive pads, special gases and other materials, research TECHCET expects the market size to exceed $66 billion this year, up 8% from last year. Looking ahead to next year, due to the global economy faces many challenges, sales may recession.

The survey said that this year, grinding pads, special gases, precursor materials, SOI wafers and other market growth is strong, all double-digit growth over last year, next year by the overall economic uncertainty, the semiconductor industry revenue is expected to decline, including storage equipment manufacturers revenue decline is greater.

Research pointed out that the semiconductor materials market revenue is relatively flat this year, but sales will decline compared to this year, is expected to decline next year wafer crop rate, including storage crop rate decline, will make the former body, special gases, cleaning with chemical sales affected.

However, the advanced process semiconductor materials next year is still more than 5% growth than this year. Overall, despite the recessionary concerns, but in the United States under the chip bill to promote the second half of next year, there will be more money betting on the semiconductor market, driving the materials market back to the growth track in the third quarter of next year.

source:aijiwei

wanda

/include/upload/kind/image/20221214/20221214172747_6562.jpg

On December 14, according to VantageHub, strong demand in the semiconductor materials market, coupled with strong sales of CMP abrasive pads, special gases and other materials, research TECHCET expects the market size to exceed $66 billion this yea

2022/12/14 17:28:22

2022/12/14 17:28:22

372

0

244

6

Intel B760 motherboard pricing will be higher than the B660 series, roughly 10% higher

Intel has now released the 13th generation Core desktop processors with "K" and "KF" suffixes, as well as the Z790 chipset. Its positioning is relatively high-end, mainly for overclockers and gaming enthusiasts. Previously it was reported that Intel plans to launch more Raptor Lake processors and H770/B760 chipsets on January 3, 2023, mainly for mainstream gamers and general user products, closer to the needs of the general user community.

BoBoard Hall said that the brand manufacturers of B760 motherboard will probably reach the channel at the end of the month, in accordance with Intel's new pricing, this new motherboard compared to the previous generation of B660 series products is about 10% higher, depending on the specific product to its cost. According to the motherboard manufacturers previously exposed Intel's 13th generation Core desktop processor lineup, there will be a total of 22 models, there are 16 models yet to be released.

It is worth noting that the Core i5-13400 and Core i5-13400F may exist in two versions of the chip, B-0 and C-0, with B-0 being Raptor Lake and C-0 being Alder Lake, and there may be some differences, while Intel is not ruled out from releasing a product like the Core i5-12490F in some regions to provide a version. In addition, the 13th generation Core desktop processors will also be compatible with the original Z690, H670, B660 and H610 motherboards.

source:chaonengwang

wanda

/include/upload/kind/image/20221213/20221213171837_7192.jpeg

Intel has now released the 13th generation Core desktop processors with "K" and "KF" suffixes, as well as the Z790 chipset. Its positioning is relatively high-end, mainly for overclockers and gaming enthusiasts. Previously it was reported that Inte

2022/12/13 17:19:03

2022/12/13 17:19:03

300

0

243

6

Spain to focus on producing mid-range semiconductors after failed bid to make chips for domestic auto industry

Spain will focus on producing less advanced semiconductors used in domestic industry after its ambition to make cutting-edge microchips has so far failed to attract investment, according to people familiar with the government's plans, Bloomberg reported.

The Spanish prime minister is focusing Spain's 12.3 billion euro ($12.9 billion) plan on mid-range semiconductors after losing bids for production facilities to Germany and the United States this year, said the person familiar with the matter, who requested anonymity because the strategy was not made public.

"Spain has not changed its position. From the beginning, the top priority of our strategy has been to attract companies that can design or produce microchips, and part of the value chain," a statement from the prime minister's press office said.

Spain has now scaled back its desire to produce the most technologically advanced chips and is adjusting its plans to take advantage of growing global demand for 10- to 28-nanometer chips that could supply Spain's automotive industry.

When Spain first announced its strategic plan, funded by EU recovery funds, more than half of the budget was earmarked to subsidize chips smaller than 5nm. These top-of-the-line semiconductors will require facilities costing tens of billions of dollars to develop.

Even before the plan was officially announced, Spanish officials considered changing their strategy after U.S. tech giant Intel Corp. chose Germany to build a 17 billion euro European complex in March, according to people familiar with the matter. Then, a major U.S. manufacturer pulled out of advanced negotiations for an investment deal in Spain after the Biden administration announced $50 billion in subsidies for chipmakers.

"We will subsidize chip manufacturing in Spain, which may be thinner or more mature, based on innovation and in line with the EU chip bill," the press office statement said. "We have a clear strategy, but we will adjust as the market evolves."

This coincides with a shift in European policy, after the European Commission earlier this year proposed a Chip Bill that would allow subsidies for the production of "first-of-a-kind" semiconductors.

Countries with large automotive industries, including France, have pushed to subsidize the less advanced chips needed for car production, arguing that if the EU wants to achieve its 20 percent target, it can't just focus on cutting-edge chips.

EU countries last week adopted their own version of the chip bill, and slightly expanded the scope of subsidies.

source:aijiwei

wanda

/include/upload/kind/image/20221212/20221212172009_7443.jpg

Spain will focus on producing less advanced semiconductors used in domestic industry after its ambition to make cutting-edge microchips has so far failed to attract investment, according to people familiar with the government's plans, Bloomberg rep

2022/12/12 17:20:40

2022/12/12 17:20:40

455

0

242

6

Supply shortage, price hike for photomask film used in chip production

As China continues to emerge fabless chip design startups, resulting in a short supply of photomask shields (pellicle) for wafer fabrication Arf and Krf lithography processes, prices are rising.

Photomask film used to protect the photomask, according to Korean media The Elec reported that South Korea's only photomask film manufacturer FST mask export revenue ratio this year is expected to increase from 30% last year to 40% this year.

Earlier this year, 3M, an upstream raw material supplier, had to close its plant in Belgium to comply with local environmental protection laws, and higher raw material prices have led to higher photomask shroud prices.

In addition, several photomask film manufacturers are also developing new films for advanced process nodes such as EUV, resulting in an overall decline in production.

source:aijiwei

wanda

/include/upload/kind/image/20221208/20221208165726_7208.png

As China continues to emerge fabless chip design startups, resulting in a short supply of photomask shields (pellicle) for wafer fabrication Arf and Krf lithography processes, prices are rising.

Photomask film used to protect the photo

2022/12/8 16:58:01

2022/12/8 16:58:01

296

0

241

6

Automotive chip supply likely to remain short until 2024

Despite recent improvements, the automotive chip shortage is unlikely to be fully resolved until 2024, as supply growth cannot keep up with the rapid growth in demand, according to automotive supply chain sources, Digitimes reported.

In response to the ongoing chip crunch, some automakers have begun adjusting their 2023 vehicle designs so that chips with the same functionality can be sourced from more than two suppliers, or chips from the same supplier can accept different pins. In this way, they can respond more flexibly to shortages of automotive chips, mainly MCUs, MPUs and IGBT chips and modules, the sources said.

The shortage of some chips and components made it difficult to assemble as a whole in the short term, affecting the normal production of cars and instead leading to an increase in the inventory of other components instead of a shortage. This has led automotive customers to adjust their order schedules or slow down shipments from customers with sufficient supply, the sources continued.

Automotive semiconductors will continue to be supply-constrained due to two major factors. One is the limited growth in the supply of automotive chip process capacity. If the foundry's capacity has been validated by automotive customers, it will take at least six months to convert their process capabilities to manufacture automotive chips, and for process capabilities that have not yet been certified for automotive chip production, they will need to spend another 2-3 years to complete validation.

Another factor is the lack of transparency in the uneven supply of chips and components. Two years ago, some channel players tried to consolidate the uneven supply of components faced by supply chain participants to achieve the best ratio of overall supply, but did not succeed, the sources said. idm, tier-one suppliers and automakers usually treat which components are in short supply as confidential.

According to research firm Yole Development, the value of semiconductors used in vehicles is estimated to grow from $550 in 2021 to $912 by 2027, with the corresponding number increasing from 820 to 1,100 chips, due to the growing popularity of electric and self-driving cars.

source:aijiwei

wanda

/include/upload/kind/image/20221207/20221207172457_6447.jpg

Despite recent improvements, the automotive chip shortage is unlikely to be fully resolved until 2024, as supply growth cannot keep up with the rapid growth in demand, according to automotive supply chain sources, Digitimes reported.

I

2022/12/7 17:26:21

2022/12/7 17:26:21

339

0

240

6

Intel: customer inventory digestion is expected to continue until 2023

According to foreign media Seeking Alpha this 6th news, Intel CFO David Zinsner said at the UBS event, customers digesting inventory should not end at the end of this year, is likely to continue until 2023.

Zinsner also pointed out that the world is facing economic downturn. In view of this, Intel can not be clear that the semiconductor industry in 2023 Q1 there are signs of recovery. Intel is still dealing with customers to clean up inventory actions, perhaps not at the end of this year, will continue into next year, "coupled with the general headwinds in almost all regions, should not be better than the same period in the past".

Mizuho Securities technology analyst Jordan Klein believes that Zinsner's remarks may be a precautionary shot in advance, implying that Intel's 1Q next year may be about 5% lower than analysts' estimates, with gross margins and profits likely to be less than expected. He believes that Intel shares will encounter downside risk in the coming weeks.

It is reported that Intel announced its fiscal year 2022 third-quarter earnings in October, lowering its capital expenditure forecast for the fiscal year to $25 billion from the previous $27 billion and warning of job cuts.

source:aijiwei

wanda

/include/upload/kind/image/20221206/20221206171016_6354.jpg

According to foreign media Seeking Alpha this 6th news, Intel CFO David Zinsner said at the UBS event, customers digesting inventory should not end at the end of this year, is likely to continue until 2023.

Zinsner also pointed out tha

2022/12/6 17:10:44

2022/12/6 17:10:44

277

0

239

6

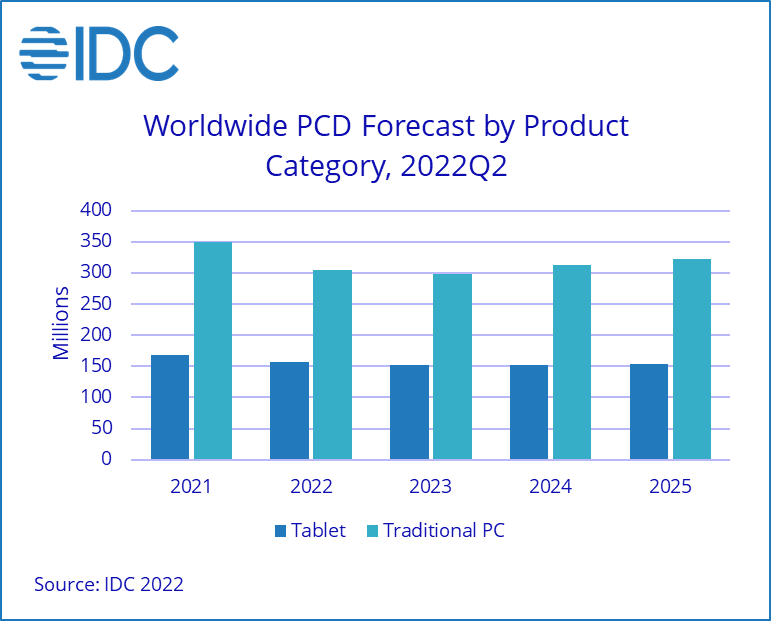

SSD prices continue to fall to new lows due to weak PC market

According to a recent report by Nikkei News, the impact of global inflation and other factors has led to a decrease in consumer purchasing power, sluggish demand in the PC market, and a drop in the price of core chip NAND Flash, making the price of SSDs for PCs continue to fall and reach new lows.

According to the report, the wholesale price (bulk price) of TLC 256GB, an SSD indicator product, was around $29.5 each during October-December 2022, down 6% (down $2) compared to the previous quarter (July-September), the fifth consecutive quarterly decline and the third consecutive quarter to set a new record low; a 21% decrease (down $8) compared to the same period last year.

Market research firm Gartner pointed out that the global PC shipments during July-September 2022 fell by 19.5% to 67.996 million units compared with the same period last year, the largest decline in history since the survey began in the mid-1990s, which is a historic slowdown for the PC market.

In addition to weak PC demand, falling NAND Flash prices are also the reason for the continued decline in SSD prices. The price of TLC 256Gb, an indicator NAND Flash product, will be around $2.40 per unit during October-December 2022, down 14% from the previous quarter (July-September).

The report points out that although entering the year-end season, but because of inflation pressures on household consumption, the market is generally expected this winter PC sales fear weak, and storage chip manufacturers began to NAND Flash production reduction measures, but it is estimated that the effect of production cuts will not begin to appear until after the spring of 2023, the current NAND Flash prices are afraid of continued decline, so SSD prices are also afraid of further The current NAND Flash prices are likely to continue to fall, so SSD prices are likely to go down further.

source:xinzhixun

wanda

/include/upload/kind/image/20221205/20221205172922_6180.png

According to a recent report by Nikkei News, the impact of global inflation and other factors has led to a decrease in consumer purchasing power, sluggish demand in the PC market, and a drop in the price of core chip NAND Flash, making the price of

2022/12/5 17:30:00

2022/12/5 17:30:00

307

0

238

6

Institutions: storage prices will plunge more than 50% next year

According to the Economic Times, Nomura, JP Morgan and other institutions warned that the storage industry will be more gloomy in the first half of next year, with prices set to plunge by more than 50%. Although storage manufacturers and channel operators to actively go to inventory, but the results will not gradually appear until Q1 next year. Among the various types of storage, coded flash storage (NOR Flash) related manufacturers will outperform pure DRAM manufacturers.

According to the news, JPMorgan Chase issued a report after visiting Nanya Technology, Lixin, Huabang, Macronix and other storage manufacturers in Taiwan, most of them expect demand will not rebound rapidly, but will recover gradually. Mainly due to the increase in supply chain inventories and the longer time required to consume inventories in the overall global economic downturn, it is estimated that the overall situation will not start to turn better until Q2 or the second half of next year. In addition, NOR Flash related vendors will outperform pure DRAM vendors due to strong demand for high density NOR chips in the automotive/industrial sector.

Affected by the global economic downturn and the new crown epidemic, foreign media reports expect the global semiconductor market to shrink by 4% to $557 billion in 2023, the first annual contraction since 2019. Another World Semiconductor Trade Statistics (WSTS) organization said the memory market, which accounts for more than one-fifth of the total, will decline by 17 percent.

source:aijiwei

wanda

/include/upload/kind/image/20221130/20221130172721_0948.jpg

According to the Economic Times, Nomura, JP Morgan and other institutions warned that the storage industry will be more gloomy in the first half of next year, with prices set to plunge by more than 50%. Although storage manufacturers and channel op

2022/11/30 17:27:44

2022/11/30 17:27:44

300

0

237

6

Customers have already placed orders! NVIDIA to export low-spec AI GPUs to China

NVIDIA has launched its A800 AI GPU, a downgraded version of its A100 and H100 series, to Chinese customers and already has orders in place, according to industry sources, Electronic Times reported.

The U.S. ban on high-end GPU exports to China is said to have affected NVIDIA's A100 and H100 AI chips exported to China, prompting it to launch the lower-spec A800 series to comply with new U.S. control regulations on Chinese exports of advanced chips. The new U.S. export control regulations limit the rate to 600 GB per second and above, and NVIDIA's A800 chips have a data transfer rate of 400 GB per second, down from 600 GB per second in the previous generation.

NVIDIA still needs to obtain a U.S. export license for its A800 series AI GPUs sold in China, the sources said, adding that the processor supplier should be able to start shipping chips to Chinese customers in a few months.

NVIDIA disclosed in early November that the A800 GPU, a replacement for the A100 model, went into production in the third quarter. It also said it met clear tests for the new U.S. regulatory rules.

Sources close to the matter said the 7nm A800 will still be manufactured and packaged by TSMC, with China's Taiwan-based Jinyuan Electronics in charge of test operations and IC test interface solutions to come from Chunghwa Precision Test Technology and Yingwei Technology. TSMC's 7nm capacity utilization has declined recently, and the launch of NVIDIA's A800 GPU may help boost TSMC's 7nm process capacity utilization.

source:aijiwei

wanda

/include/upload/kind/image/20221129/20221129173712_7455.jpg

NVIDIA has launched its A800 AI GPU, a downgraded version of its A100 and H100 series, to Chinese customers and already has orders in place, according to industry sources, Electronic Times reported.

The U.S. ban on high-end GPU exports

2022/11/29 17:37:37

2022/11/29 17:37:37

299

0

236

6

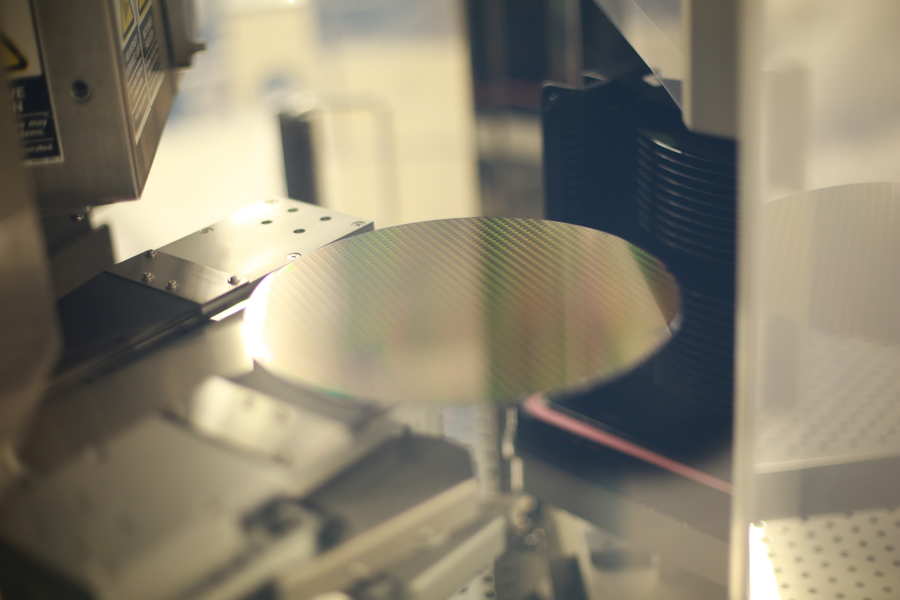

Poor market conditions, rumors that silicon wafer fabs agreed to delay customer shipments

According to the "Economic Daily News" reported that the logic IC de-stocking and storage manufacturers a large number of production cuts resulting in weakening demand for silicon wafers, silicon wafer fabs are rumored to have begun to agree with customers to delay the pull, the previous attitude of holding fast to the offer has also changed, some manufacturers loose mouth willing to cooperate with market conditions and customers to negotiate prices, said "I'm afraid the first half of next year will be a little tougher ".

The recession in the semiconductor industry in the foundry reflected in the capacity utilization rate decline, storage plants have been reducing capital expenditure and production cuts for the winter, IC design houses are actively de-stocking and reduce the amount of investment, even at the expense of paying a breach of contract to cancel the foundry long contract, but the previous performance of the silicon foundry is still relatively supportive, and now it is rumored that the silicon foundry agreed to delay the customer pull, highlighting that the market situation is even more critical.

It is understood that a few customers in Taiwan, China, silicon wafer factory agreed to delay shipments, the schedule delayed about one or two months; another silicon wafer factory is to negotiate with customers, from the first quarter of next year can be slightly delayed pull; a silicon wafer factory business said that the semiconductor market is really bad now, the inventory level of long-term contract customers has been increasing, the current silicon wafer shipping conditions actually do not match the actual market demand.

Previously rumored that TSMC to the supply chain cut orders, Global Crystal pointed out that "the order has a long contract protection and no customer default", is expected to 8-inch and 12-inch silicon wafer capacity utilization rate to maintain strong.

TSMC said that this year will still be full production and full sales, looking ahead to next year, customers continue to comply with the long-term contract, the company will cooperate with customers, flexible adjustment of product mix.

Wafer Works pointed out that the next negotiation with customers in the first half of next year prices will be adjusted according to market conditions.

source:aijiwei

wanda

/include/upload/kind/image/20221128/20221128165103_3650.jpg

According to the "Economic Daily News" reported that the logic IC de-stocking and storage manufacturers a large number of production cuts resulting in weakening demand for silicon wafers, silicon wafer fabs are rumored to have begun to agree with c

2022/11/28 16:51:24

2022/11/28 16:51:24

334

0

235

6

Rumor that the world advanced or will get power management IC transfer orders from mainland China

According to news, according to industry sources, China's Taiwan foundry World Advanced is in talks with Qualcomm, MPS, ADI and other potential customers for orders for power management ICs. These customers are looking to shift orders from their foundries in mainland China after the U.S. introduced a series of new export restrictions.

According to Taiwan's Electronic Times, the foundry's long-term growth prospects remain strong, despite short-term macro headwinds that pose a challenge to World Advanced's operations.

Earlier World Advanced Chairman and General Manager Fang Liao talked about the impact of U.S. export controls at a legal conference, and he believes that it currently appears to be in advanced processes and AI, HPC applications such as 16nm and even more advanced processes, so there is no negative impact on the company in the short term. At the same time, there are IDM companies in some cases to transfer part of the foundry to the world advanced, from the special process related to Power to mature processes have felt the relevant demand, so the overall opportunity outweighs the negative impact.

It is reported that the world advanced currently has five eight-inch fabs, located in Taiwan, China and Singapore. World Advanced continues to expand eight-inch wafer foundry capacity, with an average monthly capacity of about 241,000 8-inch wafers in 2021.

source:aijiwei

wanda

/include/upload/kind/image/20221124/20221124174022_0933.png

According to news, according to industry sources, China's Taiwan foundry World Advanced is in talks with Qualcomm, MPS, ADI and other potential customers for orders for power management ICs. These customers are looking to shift orders from their fo

2022/11/24 17:40:53

2022/11/24 17:40:53

373

0

234

6

TrendForce: Original factory price reduction for sales hit Q3 NAND Flash industry revenue, down as much as 24.3%

TrendForce reports that the third quarter NAND Flash market is still defeating the impact of weak demand, with shipments in both consumer electronics and servers falling short of expectations, leading to an 18.3% drop in NAND Flash prices in the third quarter.

According to the report, vendor bit shipments decreased by 6.7% YoY in Q3, and the average unit sales price continued to fall, resulting in overall NAND Flash industry revenue of approximately $13.71 billion (approximately RMB 97.889 billion), a 24.3% YoY decline.

IT Home learned that TrendForce said that the most obvious changes in the NAND Flash revenue ranking in the third quarter were in two areas, firstly, SK Group's revenue dropped the most by 29.8% year-over-year to $2.54 billion (about RMB 18.136 billion), relegating it to the third place. This is mainly due to the weak demand for PCs and smartphones, while the relatively robust demand for servers also impacted Solidigm's sales performance as companies cut back on spending and entered the inventory adjustment cycle, resulting in an 11.1% decline in bit shipments and a sharp drop of more than 20% in average unit sales price.

Secondly, Armor Man has gradually gotten rid of the impact of raw material pollution at the beginning of the year, and its revenue and market share have returned to the second place. Despite the sluggish consumer demand, the average unit price declined sharply, but bit shipments benefited from the seasonal pull of smartphone customers to support the third quarter revenue growth of 23.5% YoY to $2.83 billion (about 20.206 billion yuan), revenue fell by only 0.1% YoY.

As for other manufacturers, Samsung, Western Digital and Micron all faced volume and price declines, with revenue down by a similar margin, with sluggish terminal demand being one of the main factors dragging down revenue performance.

The company's revenue is expected to drop to 20-25% in the fourth quarter, and the revenue is expected to drop by nearly 20% from the previous quarter.

source:ITzhijia

wanda

/include/upload/kind/image/20221123/20221123165522_8267.jpg

TrendForce reports that the third quarter NAND Flash market is still defeating the impact of weak demand, with shipments in both consumer electronics and servers falling short of expectations, leading to an 18.3% drop in NAND Flash prices in the th

2022/11/23 16:55:52

2022/11/23 16:55:52

356

0

233

5

ELECTRONICA 2022 was successfully concluded

From November 15th to 18th, Electronica 2022 was held in Munich. It is the world’s leading trade fair of electronic components industry, and it is also an excellent platform for FLYKING to show our innovative capability and comprehensive strength.

Flyking displayed the full set of Integrated Circuit solutions and provide customers with shortage electronic components service with our professional supply chain capability, which has been welcomed by customers from all over the world.

ELECTRONICA 2022 was successfully concluded. FLYKING at the Eletconica 2022 has gained a lot. We also visited the exhibitors from many countries and regions around the world, we had deep communication with each other, and had reached preliminary strategic cooperation. We look forward to more in-depth cooperation in the coming days!

wanda

/include/upload/kind/image/20221122/20221122163443_8925.jpg

From November 15th to 18th, Electronica 2022 was held in Munich. It is the world’s leading trade fair of electronic components industry, and it is also an excellent platform for FLYKING to show our innovative capability and comprehensive strength.

2022/11/22 16:36:18

2022/11/22 16:36:18

439

0

232

6

IC Insights: Global DRAM Market Expected to Decline 18 Percent by 2022

According to the news, the DRAM market usually sells strongly in the second half of the year as system manufacturers order memory chips for the next generation of products they plan to release during the year-end holidays. But that hasn't been the case this year.

Weak economic conditions and high inflation have slowed global demand for personal computers, mainstream smartphones and other consumer electronics, according to analysis by IC Insights, a semiconductor data consultancy. As a result, DRAM demand is spiraling downward, with sales now expected to fall 40 percent to $29.3 billion in the second half of 2022, compared with $49 billion in the first half of 2022. The DRAM market is expected to decline by 18 percent for the full year 2022.

The DRAM market saw strong sales in the first few months of the year, although the first signs of a DRAM market correction began to appear in late 2Q22. Micron, for example, reported an 11 percent increase in sales for its fiscal 3Q22 (ending in May). But then the company guided for -17% sales for its fiscal Q4 (ending August). Micron's actual sales for the fourth quarter of 2022 were down 23 percent, well above its expectations. Later this year, Micron also said it expects its annual DRAM bit volume to decline by 1%, further evidence that the DRAM market is in a rapid and severe downturn.

SK Hynix and Samsung also announced sharp declines in their memory sales for the third quarter of 2022, and both expect the DRAM market weakness to continue through the end of this year and into at least the first quarter of '23.

In their earnings calls, the three memory makers noted that inflation has eroded consumer discretionary spending at a time of year when sales typically heat up. Combined with ongoing supply chain disruptions and bloated inventory levels, a DRAM market correction is almost inevitable.

Over the past 30 years, the DRAM market has been characterized by periods of phenomenal growth and years of great decline (e.g., 2022) with high volatility.

IC Insights notes that in the past four years alone, the DRAM market has declined 37% in 2019, grown 42% in 2021, and is expected to decline 18% in 2022. With such extreme volatility, it's no wonder that the number of DRAM suppliers in this number has decreased from more than 25 30 years ago to the top three suppliers today.

source:aijiwei

wanda

/include/upload/kind/image/20221122/20221122162752_3103.jpg

According to the news, the DRAM market usually sells strongly in the second half of the year as system manufacturers order memory chips for the next generation of products they plan to release during the year-end holidays. But that hasn't been the

2022/11/22 16:28:12

2022/11/22 16:28:12

364

0

231

6

Micron: will reduce memory chip supply by 20% and cut capital expenditures again

Storage major Micron recently said it is taking further action to address storage market conditions, including reducing DRAM and NAND wafer production by about 20% this quarter compared to the previous quarter, and plans to further cut capital expenditures, according to the Economic Times.

In a statement released yesterday, Micron said it is reducing DRAM and NAND wafer production, which will be about 20 percent lower than in Q4 of fiscal year 2022, which ended Sept. 1.

Micron said in September that it would reduce its capital expenditures by 30 percent this year, and in the new statement Micron said it would further reduce capital expenditures.

Wedbush analyst Bryson pointed out that the widespread reduction in supply and capital spending, which usually means that the storage industry falls to the bottom, is a good sign, but there is the possibility of a longer-term demand downturn that will put pressure on the entire technology industry.

According to research data from TrendForce, global DRAM industry revenue for the third quarter of 2022 was $18.19 billion, down 28.9% QoQ, the second highest decline since 2008 due to the financial tsunami. Throughout the market, the fundamental reason for the decline in DRAM revenue is the weakness on the consumer side. The demand for consumer electronics continues to shrink, and the contract price decline has not only expanded to 10-15%, but even server DRAM clients, which originally shipped relatively stable volumes, have begun to adjust their inventories, resulting in a significant decline in pulling power.

source:aijiwei

wanda

/include/upload/kind/image/20221117/20221117163915_8342.jpg

Storage major Micron recently said it is taking further action to address storage market conditions, including reducing DRAM and NAND wafer production by about 20% this quarter compared to the previous quarter, and plans to further cut capital expe

2022/11/17 16:39:39

2022/11/17 16:39:39

366

0

230

6

Semiconductor industry weakness industry chain performance worst case may fall in this year Q4 and next year Q1

According to Electronic Times, due to the slow process of de-stocking, demand has not seen a significant uptick, many semiconductor industry chain companies choose to announce all the bad news in Q4, looking forward to a quick bottom and then revive the flag. The industry expects that the worst case scenario of semiconductor and electronics industry chain performance may fall in 2022 Q4 and 2023 Q1.

By the global economic downturn inflation and other factors, the semiconductor industry chain demand is weak. Although many companies are not in the loss, but in the customer to stop pulling goods, cut orders and the impact of price drops, Q4 revenue will decline significantly. Industry estimates, semiconductor, electronics industry operations are expected to fall in the worst case in 2022 Q4 and 2023 Q1, many manufacturers have been in advance in the second quarter, the third quarter has shown weakness. Among them, the terminal PC, cell phone brands and IC design manufacturers and other supply chain performance quickly reversed downward, a number of major manufacturers have warned that inventory down to normal levels at least a few quarters of time to digest.

In the third quarter, the supply chain has been revealing plummeting earnings, and the financial test has been continuously revised downward, while the international makers Intel (Intel) and Meta are very conservative in their future outlook and have started layoff plans.

Such as Intel in late October on the revision of 2022 full-year earnings estimates, revenue from the beginning of the year estimated at $ 76 billion, reduced to $ 63 billion to $ 64 billion, and decided to cut $ 3 billion in operating costs in 2023, up to $ 10 billion before 2025. Qualcomm has also significantly revised its 2022 global smartphone shipment forecast, and announced that it will freeze personnel and cut expenses, while MediaTek estimates that Q4 revenue will be reduced by more than 20% quarterly.

Yesterday, Samsung warned that inventory continues to rise. Because of weak product demand, Samsung inventory assets increased in the third quarter, more than 57 trillion won. To reduce supply chain risk, Samsung had increased raw material purchases, but the global demand for its products did not recover in the ongoing recession.

source:aijiwei

wanda

/include/upload/kind/image/20221116/20221116170839_8767.jpg

According to Electronic Times, due to the slow process of de-stocking, demand has not seen a significant uptick, many semiconductor industry chain companies choose to announce all the bad news in Q4, looking forward to a quick bottom and then reviv

2022/11/16 17:08:44

2022/11/16 17:08:44

376

0

229

6

Samsung SDI speeds up construction of joint venture battery plant with GM, Volvo

Samsung SDI is pushing to establish joint venture electric vehicle battery plants in the U.S. with each of the two global automakers, sources said.

The total cost of the two joint ventures is estimated at $8 billion, of which Samsung SDI is expected to invest $4 billion. Some analysts believe that this massive investment plan of Samsung Group indicates that the conservative attitude of Samsung Group towards electric vehicle battery business is changing.

They plan to build a plant with an annual capacity of 50 GWh to meet the demand for power batteries for 670,000 electric vehicles with a range of 500 km. To do so, Samsung SDI and GM will each invest about $2 billion.

IT House learned that GM has previously purchased soft pack batteries from LG Energy Solution, but Samsung SDI does not produce such batteries. Samsung mainly specializes in prismatic and cylindrical batteries. This could signal a change in GM's battery form factor strategy.

The type of batteries to be produced at the joint plant has not yet been determined. However, some industry insiders speculate that the plant will launch square batteries.

In addition, Samsung SDI is pushing for a separate joint venture with Volvo, which Korean media said will be announced in December.

The joint venture is said to be similar in size to the Samsung-GM joint venture, with each company investing about $2 billion in the joint plant to produce 50GWh of batteries per year.

According to Volvo's strategy, the brand will use cylindrical batteries in the future, while the EX90 will use square batteries, and Samsung SDI is well positioned to produce both types of batteries. Samsung SDI will now partner with the world's top three automakers -- General Motors, Volvo and Stellantis.

Source:ITzhijia

wanda

/include/upload/kind/image/20221115/20221115170557_5717.jpg

Samsung SDI is pushing to establish joint venture electric vehicle battery plants in the U.S. with each of the two global automakers, sources said.

The total cost of the two joint ventures is estimated at $8 billion, of which Samsung S

2022/11/15 17:06:36

2022/11/15 17:06:36

458

0

228

6

Sources said the car companies and foundries 2023 price negotiations still have not reached agreement

According to the Taiwan media "Electronic Times" reported, sources said that most of the car companies and semiconductor foundries 2023 price negotiations still have not reached agreement process "is not as smooth as expected".

Automotive supply chain sources pointed out that most car companies are still negotiating prices with foundries recently, from the core to TSMC, UMC, world advanced and other foundries are still negotiating, a small part is near the end. Foundries, IDMs and Tier 1 suppliers are considering whether they each need to take a step back, with manufacturing prices expected to increase by single-digit percentages in 2023.

For most in the automotive industry, negotiations are not going as well as expected, especially as fabs' automotive chip capacity growth remains unimpressive. Suppliers also hinted that the difficult part of the negotiations with fabs is to agree on advance payments, and both sides are not sure whether they should invest in a common future or just pay a deposit for the order.

For automakers, they want upfront payments to support investments by fabs to expand or convert their capacity to automotive use so that their supply can increase quickly. The automotive side can guarantee orders and deliveries, during which time the fab can maintain stable prices and expand into the industrial/automotive market. Simply put, the fabs want to build a long-term future that is mutually beneficial to both parties, represented by the mainstream IDM model, including Infineon, NXP, Renesas, Texas Instruments, STMicroelectronics or Tier 1.

With ongoing macro changes, especially inflation, likely to affect the market's spending power in 2023, the automotive industry is still searching for the best way to work together.

Source:aijiwei

wanda

/include/upload/kind/image/20221114/20221114162845_2508.jpg

According to the Taiwan media "Electronic Times" reported, sources said that most of the car companies and semiconductor foundries 2023 price negotiations still have not reached agreement process "is not as smooth as expected".

Automot

2022/11/14 16:29:23

2022/11/14 16:29:23

308

0

227

5

FLYKING IS EXHIBITING AT ELECTRONICA 2022

The Electronica trade fair is one of the most important events in the electronics industry. It is held every two years in Munich, Germany, and is usually attended by more than 80,000 professionals from over 50 countries. The fair covers all aspects of the electronics industry, from semiconductors to electronic components and systems.

Flyking Technology Co.,Limited,a well-known global one-stop electronic component service provider, will be attending the electronica 2022 from November 15 to 18. The full set of Integrated Circuit solutions will be brilliantly displayed at booth 124 in Hall C3.

And Flyking will set up a brands exhibition area to comprehensively display our independent distribution brands. At the same time, we will exhibit a series of IC-related industrial contents, show the technology and achievements of global IC industry, and discuss the innovation and development of global semiconductor industry with electronic people.

At this exhibition, Flyking will have a deep communication and learning with various enterprises in the electronics industry, contribute to the the development of the world's semiconductor supply chain, and show a different style of the industry.

November 15-18, 2022, we are looking forward to your arrival at Munich International Electronics Fair, Hall C3, No. 124, Germany!

wanda

/include/upload/kind/image/20221109/20221109174220_2455.jpg

The Electronica trade fair is one of the most important events in the electronics industry. It is held every two years in Munich, Germany, and is usually attended by more than 80,000 professionals from over 50 countries. The fair covers all aspects

2022/11/9 17:42:47

2022/11/9 17:42:47

441

0

226

6

A number of manufacturers of automotive chips may be a small price increase

According to the "Electronic Times" reported that the recent car companies and foundries for 2023 offer consultation into the climax, in which a small part of the foundry for the car with a small price increase is expected to succeed, the price increase ratio is still under negotiation.

Sources said that some manufacturers tend to foundry and IDM and Tier 1 each step back, it is estimated that the year 2023 foundry offer single-digit percentage increase, but still depends on the customer, the size of the order varies. In fact, the initial negotiations with customers that, as long as the supply is smooth, the price can be "with the line on the market". It is understood that the automotive chip foundry offer in the past few years soared, because the demand sharply exceeded the supply. But inflationary pressures and other factors have clouded the outlook for demand next year, prompting automakers to re-examine risks and costs.

This comes on the heels of news that TSMC, the leading foundry, may have uncertainty about price increases next year, and that automotive chip customers are already considering renegotiating their prices.

Due to the impact of the epidemic, geopolitics, inflation and other factors, the market demand for PCs and other consumer electronic devices is rapidly slowing down, foundries are facing customer cut orders, capacity utilization has declined significantly. Automotive chip IDMs are also experiencing a shortfall in fab utilization and are likely to scale back outsourcing. Previously due to chip shortages, head down not to ask the price only to have capacity car manufacturers and chip makers seized the opportunity to renegotiate prices with foundries in the fourth quarter. Foundries due to weak demand for consumer electronic devices caused by the capacity gap, but also plans to industrial and automotive chips to make up.

Source:aijiwei

wanda

/include/upload/kind/image/20221103/20221103165842_3417.jpeg

According to the "Electronic Times" reported that the recent car companies and foundries for 2023 offer consultation into the climax, in which a small part of the foundry for the car with a small price increase is expected to succeed, the price inc

2022/11/3 16:59:20

2022/11/3 16:59:20

396

0

225

6

NXP CEO: automotive and industrial chip demand is still resilient

NXP recently released Q3 earnings, total revenue increased 20.4% year-on-year, net profit increased 42.2% year-on-year. CEO Kurt Sievers (Kurt Sievers) said he is cautious about the development prospects of the chip industry in the coming months, pointing out that market demand is divided into two kinds of chips needed for consumer products and automotive chips, demand from consumer electronics such as game consoles and personal computers is declining, but the demand for automotive and industrial chips is still "resilient. Automotive and industrial chip demand is still "resilient".

Data show that, according to NXP business division, Q3 automotive revenue of $1.804 billion, up 24% year-on-year, accounting for about 50% of total revenue; industrial and IoT business revenue of $713 million, up 17%; mobile device business revenue of $410 million, up 19%; communications infrastructure and other business revenue of $518 million, up 14% year-on-year.

Because of the large share of revenue from automotive chips, NXP avoided the dilemma of a rapid decline in demand for semiconductors. Like vendors in the automotive end of the market, NXP said there is still a shortage of some products here. Investors are now concerned about how long the automotive-side market can provide a cushion under the widespread decline in demand.

Most of the demand in the chip industry is falling like a rock, and there is an inventory overhang," said Schiff. But the other part "continues to retain a healthy demand, supply and demand is still unbalanced.

Source:aijiwei

wanda

/include/upload/kind/image/20221102/20221102165734_7969.jpg

NXP recently released Q3 earnings, total revenue increased 20.4% year-on-year, net profit increased 42.2% year-on-year. CEO Kurt Sievers (Kurt Sievers) said he is cautious about the development prospects of the chip industry in the coming months, p

2022/11/2 16:58:01

2022/11/2 16:58:01

424

0

224

6

Intel chip foundry business picked up seven major customers

Intel revealed in its third quarter 2022 earnings report that they have signed seven of the world's top 10 semiconductor design vendors. eenewseurope.com tried to analyze the "top seven customers" component and concluded that they include Qualcomm, Broadcom, Marvell and Cirrus Logic, as well as the already Nvidia, MediaTek, and Rexchip were identified.

Eenewseurope website believes that in the global Top 10 manufacturers, Qualcomm, Broadcom, Marvell and Cirrus Logic are all chip companies based in the United States, as the U.S. domestic companies, they signed a foundry cooperation with Intel is very logical. In addition, Nvidia has also expressed interest in Intel foundry before, and is now sure to join, but is currently only involved in a project operated by Intel for the Department of Defense. In addition, the Taiwanese chip factory MediaTek has confirmed the use of Intel foundry, there is a Taiwanese factory RuiYu followed MediaTek, announced the use of Intel foundry. It is reported that one of these seven customers has tested the 18A process for mass production in 2024, and completed the chip flow in the factory.

The analysis that Intel's large customers have been assembled to seven, while AMD, Wing and Weir were excluded.

The analysis points out that Wing and Weir because of the type of chip, almost unlikely to use Intel foundry. AMD's CPU, GPU, FPGA and other chip business is in direct competition with Intel, so the possibility of using Intel foundry is not very likely.

But the site also said that the actual business volume of these seven companies is limited, mostly of specialty processes with 16nm and above process, and not too many advanced process foundry.

As early as March last year, Intel's chief CEO Pat Kissinger announced the "IDM2.0" strategy, announced the development of foundry business. Since then, Intel has continued to announce new moves to prove the feasibility of their "IDM2.0". In February this year, Intel announced that it would buy the Israeli company Tower Semiconductor (Tower) for $5.4 billion, trying to make up for the drawbacks of its single business with the existing customer base of the world's top 10 foundries, Tower Semiconductor. The outside world believes that Intel is determined to develop foundry business, its logic should be running to break the business model.

source:aijiwei

wanda

/include/upload/kind/image/20221101/20221101162926_3940.jpg

Intel revealed in its third quarter 2022 earnings report that they have signed seven of the world's top 10 semiconductor design vendors. eenewseurope.com tried to analyze the "top seven customers" component and concluded that they include Qualcomm,

2022/11/1 16:32:03

2022/11/1 16:32:03

355

0

223

6

Semiconductor analysts: analog chip stocks fear greater downside

Recently, semiconductor analyst BlayneCurtis adjusted the stock ratings of three analog chip makers, AnalogDevices (ADI) and NXP Semiconductor's rating from "plus" to "equal weight", but also down Silicon Laboratories originally revised its "equal weight" rating to "reduce".

and said the three analog chip stocks fear greater downside.

The three shares fell to varying degrees yesterday, ADI fell 1.41%, NXP fell 0.21%, Silicon Laboratories plunged 5.10%.

With the impact of the epidemic and inflation, as well as people's expectations for the future of the economy, the analog chip market has also seen a downturn. Curtis expects that as chip orders begin to decline due to weak demand, ADI will significantly lower its profit expectations for 2023, and although this quarter's earnings may not happen, he believes it will happen sooner rather than later.

The analyst is understood to have lowered his target price for ADI to $140 from $180, lowered his target price for NXP shares to $140 from $200, and lowered his target price for Silicon Laboratories shares to $95 from $140.

source:aijiwei

wanda

/include/upload/kind/image/20221025/20221025164829_6635.jpg

Recently, semiconductor analyst BlayneCurtis adjusted the stock ratings of three analog chip makers, AnalogDevices (ADI) and NXP Semiconductor's rating from "plus" to "equal weight", but also down Silicon Laboratories originally revised its "equal

2022/10/25 16:48:59

2022/10/25 16:48:59

290

0

222

6

Samsung plans to increase outsourced production of non-memory chips to diversify chip supply

According to Korean media reports, Samsung is planning to increase outsourced production of non-memory chips, including display driver ICs and image sensors.

It is understood that China's Taiwan foundry UMC may provide Samsung with more image sensors and display driver IC capacity, while Samsung's foundry division continues to produce more advanced products such as smartphone application processors, which aims to increase the stability of chip procurement by diversifying supply channels, in addition to the force accumulation and world advanced is also expected to become a new partner of Samsung.

At the same time, Samsung foundry division is planning to build a third production line in South Korea's Pyeongtaek and the United States after Tyler, Texas, the location is likely to be in Europe, the European Union has been open to foreign investment since last year, and Europe is also where Samsung can be more closely linked to customers.

In addition, Samsung is also focusing on automotive chip development. With the development of intelligent automotive electronics and autonomous driving, the demand for chips in the automotive industry is soaring.

source:aijiwei

wanda

/include/upload/kind/image/20221020/20221020165553_4238.png

According to Korean media reports, Samsung is planning to increase outsourced production of non-memory chips, including display driver ICs and image sensors.

It is understood that China's Taiwan foundry UMC may provide Samsung with mor

2022/10/20 16:55:58

2022/10/20 16:55:58

340

0

221

6

Automotive chip shortage may last until 2026, about 50% of mature node capacity growth from mainland China

On October 18, DIGITIMES reported that McKinsey & Company and Boston Consulting Group (BCG) said that the shortage of automotive chips has not been fully resolved and could last until 2026 or even 2030.

Although foundries such as TSMC and UMC have been increasing their 28nm capacity, the two consulting firms stressed that more mature nodes for different applications in cars will still be in short supply. Even if only one chip of any kind needed to run is missing, these cars will be stalled in the production line.

BCG recently released a report titled "Automotive Industry Semiconductor Outlook," saying that although the supply of automotive chips has been rising, it still can't keep up with demand growth.

BCG predicts that the automotive semiconductor market is expected to grow at more than 9 percent per year through 2030, as the adoption of electric vehicles and advanced driver assistance systems (ADAS) will increase chip content in vehicles.

Based on the fact that battery-only electric vehicles (BEVs) will become mainstream in electric vehicles by 2026 and will require the most semiconductor components, BCG expects the shortage of analog and MEMS-related chips to be a major challenge for the automotive industry by 2026.

Demand growth will be highest for logic chips fabricated at 20nm to 45nm nodes to meet the growing computing demands of centralized electrical/electronic architectures, while demand pressure at mature nodes larger than 55nm may ease.

However, McKinsey's analysis shows that chips manufactured using 90nm and above process nodes are also facing the same supply shortage problem. Its report shows that the annual demand for 12-inch equivalent automotive wafers may increase from about 11 million in 2019 to 33 million in 2030, a compound annual growth rate of 11%. But production of 90-nanometer and above process node chips, which account for 67 percent of automotive demand, will grow by only about 5 percent between 2021 and 2026.

BCG said that as about 50% of the growth in mature node semiconductor capacity comes from mainland China, geopolitical risks or resulting uncertainty about access to capacity in mainland China could increase the risk to the global automotive supply chain. In addition, underinvestment in mature node capacity outside of mainland China is likely to persist due to a lack of cost efficiency.

source:aijiwei

wanda

/include/upload/kind/image/20221019/20221019165838_9000.jpg

On October 18, DIGITIMES reported that McKinsey & Company and Boston Consulting Group (BCG) said that the shortage of automotive chips has not been fully resolved and could last until 2026 or even 2030.

Although foundries such as T

2022/10/19 16:59:10

2022/10/19 16:59:10

651

0

220

6

Average global chip lead time shortened by 4 days to 26.3 weeks in September

October 18 news, according to Bloomberg local time reported on October 17, Susquehanna Financial Group released the latest research report pointed out that the overall average chip delivery cycle in September 2022 was 26.3 weeks, shortened by 4 days compared to August, the largest drop in the past two years, showing that the chip industry supply tightness is being eased.

Susquehanna analyst Christopher Rolland pointed out that the waiting time for all key product categories are showing a trend of shortening, power management, analog chips fell the most.

It is worth noting that the U.S. Department of Commerce Bureau of the Census released data on October 14, 2022 September U.S. retail sales of electronic and electrical stores fell 8.6% annually (0.8% monthly) to $ 7.444 billion, the lowest since January of this year, the seventh consecutive month showing a year-on-year decline.

The U.S. Department of Labor Bureau of Labor Statistics (BLS) released on October 7, 2022, the number of U.S. semiconductor and related electronic components employment in September compared to the August 388,400 (the highest since March 2009) decreased by 100 people a month to 388,300, the first time in nine months to show a contraction.

AMD CEO Lisa Su said on Oct. 6 that the personal computer (PC) market turned significantly weaker in the third quarter of 2022, and the overall economic situation led to lower-than-expected PC demand, resulting in a significant adjustment in the entire PC supply chain inventory.

U.S. media "Automotive News" (Automotive News) reported on October 16, forecasting agency AutoForecast Solutions (AFS) pointed out that so far this year, the global car manufacturers due to chip supply shortage and cut nearly 3.6 million units of production capacity, down from 10.5 million units in 2021, chip shortage led to a shortfall of 25,900 units of global car production last week. The chip shortage led to a 25,900-unit shortfall in global vehicle production last week, including 23,300 units for North American car makers.

Sam Fiorani, vice president of AFS Global Automotive Forecast, pointed out that although the chip supply continues to improve, the end point of the shortage of automotive chips continues to be delayed, and automakers expect the chip shortage to enter its third year and have begun to revise production plans for 2023.

The Federal Reserve Board (FED) announced on September 15 that the annual rate of U.S. car and light truck assembly in August (adjusted for seasonal factors) rose to 10.16 million units from 10.06 million units in July, the highest since April, the third consecutive month of upward movement.

The Kelley Blue Book (KBB), a Cox Automotive brand, announced on October 12 that the U.S. average transaction price (ATP) for new vehicles increased 6.1% annually (0.3% monthly) to $48,094 in September 2022, the first monthly decrease in five months.

source:xinzhixun

wanda

/include/upload/kind/image/20221018/20221018163700_1180.jpg

October 18 news, according to Bloomberg local time reported on October 17, Susquehanna Financial Group released the latest research report pointed out that the overall average chip delivery cycle in September 2022 was 26.3 weeks, shortened by 4 day

2022/10/18 16:37:49

2022/10/18 16:37:49

319

0

219

6

High semiconductor inventory level affects next year's packaging market

According to Taiwan's Central News Agency, the problem is estimated to continue into the first half of next year; TSMC has even warned that the biggest impact of inventory adjustment will be in the first half of next year, and the pressure of inventory de-stocking in the IC design industry will also affect the latter part of IC packaging and testing demand.

Looking ahead to next year's electronic technology industry market conditions, the "Institute for Industrial Information" (MIC) senior industry consultant and director of Hong Chunhui pointed out that the current demand has not seen a rebound, the supply chain downstream to the upstream spread of different degrees of inventory problems, the slow pace of depletion, fear will continue into the first half of next year.

From the days point of view, MIC analysis, compared to the same period last year in the second quarter of this year, all types of industry inventory days increased by an average of 15.5% to 25.1%, of which the inventory days to the semiconductor industry increased by 100.1 days the most, the electronic components industry 98.3 days next.

Allianz Investment Trust's Taiwan stock team said that inventory adjustments began in the third quarter, especially in personal computers and notebook computers related to the most obvious, inventory adjustments are expected to end in the first half of next year.

MIC industry analyst Yang Kexin pointed out that the negative factors in the external environment have not been removed, the consumer market buying is not good, the pulling power is weak, customer stocking momentum slowed down, from the terminal, the system factory to the semiconductor chip production and marketing supply chain operators, are facing the problem of high inventory levels, inventory decomposition will affect the semiconductor market performance next year.

Observe the semiconductor field, MIC analysis, semiconductor chip production and marketing is limited by the long-contract mechanism, repeat, over-orders have to take delayed delivery and other practices, unfavorable semiconductor supply chain regulation, inventory adjustment is expected to last until the first half of next year.

Wafer foundry leading TSMC President Wei Zhejia pointed out that the semiconductor industry inventory adjustment and other factors, affecting the 4th quarter to the first half of next year TSMC overall crop performance, he expected the semiconductor supply chain inventory inventory high point in the 3rd quarter of this year hit the top, the 4th quarter began to decline, it is estimated that the first half of next year to return to a healthy level, inventory adjustment factors will have the greatest degree of impact in the first half of next year.

Chip design major MediaTek predicts that customer inventory adjustment may continue for 2 to 3 quarters; wafer foundry world advanced recently said that the 4th quarter customers continue to adjust inventory, do not rule out that may continue into the first half of next year.

Observe the IC design, memory, IC packaging end, Yang can Xin analysis, the current semiconductor industry inventory adjustment, IC design and memory industry is facing a decline in demand, oversupply problem, IC design industry is facing the pressure of inventory de-stocking, and the impact of the latter part of the IC packaging demand, unfavorable to the overall operation next year.

From the perspective of products, including panel driver chips, consumer power management chips (PMIC), general-purpose and consumer microcontrollers (MCU) and other weak demand, related industry inventory levels continue to rise.

Among them, the passive component maker Guoguang said that in the fourth quarter, due to the long holiday in mainland China in October and the Christmas holidays in December in Europe and the United States to reduce the number of working days, and the standard product inventory adjustment period than expected to extend, prudent response to the performance and operating outlook.

The U.S. foreign corporation pointed out that the weak end market demand, supply chain inventory level to record high, is the main reason for the decline in the passive components market, the terminal channel continues to de-stocking, the estimated adjustment time takes 6 months.

In the memory, MIC pointed out that the consumer terminal market to server customers are facing different degrees of inventory adjustment, and there is a high degree of uncertainty in the short-term demand of the memory industry.

However, the industry is not all pessimistic, PEGATRON Chairman Tzu-Hsien Tong recently said that the current market needs a little time to digest the relevant product inventory, and he believes that about 2 quarters can be completed digestion.

The memory factory South Asia Tech General Manager Lee Pei-ying analysis, some customers to de-stocking positive development, demand has the opportunity to rebound, although the 4th quarter prices may continue to fall, but the decline will converge.

The MIC pointed out that the chip industry is facing the problem of high inventory turnover days and is now facing severe inventory de-stocking challenges. If the terminal market situation still does not improve, it is difficult to avoid a price and volume drop. The rapid decline in prices cannot be avoided.

source:aijiwei

wanda

/include/upload/kind/image/20221017/20221017164045_7928.jpg

According to Taiwan's Central News Agency, the problem is estimated to continue into the first half of next year; TSMC has even warned that the biggest impact of inventory adjustment will be in the first half of next year, and the pressure of inven

2022/10/17 16:41:23

2022/10/17 16:41:23

244

0

218

6

IBM Announces the Integration of Red Hat Storage into the Storage Business Unit, Redefining Hybrid Cloud Applications and Data Storage

IBM has announced that it will incorporate the Red Hat Storage product roadmap and its associated teams into the IBM Storage business unit to provide enterprises with consistent application and data storage across local infrastructures and the cloud.

With this move, IBM will integrate Red Hat OpenShift Data Foundation (ODF) storage technologies as the foundation for IBMSpectrum Fusion. This combines IBM and Red Hat's containerized storage technology for providing data services and helps accelerate IBM's capabilities in the emerging Kubernetes platform market.

In addition, IBM intends to offer a new Ceph solution that provides a unified software-defined storage platform that bridges the architectural divide between data center and cloud providers. This will further advance IBM's leadership position in the software-defined storage and Kubernetes platform market.

Under the agreement between IBM and Red Hat, IBM will assume lead sponsorship of the Ceph Foundation, and Ceph Foundation members will collaborate to drive innovation, development, marketing and community activities for the Ceph open source project. will continue to follow an upstream-first model that reinforces IBM's commitment to these important communities. the involvement of the Ceph leadership team and other aspects of the open source project is a key priority for IBM to maintain and nurture Red Hat's ongoing innovation.

Red Hat and IBM intend to complete the transition by January 1, 2023, which will involve the storage roadmap and the transfer of relevant Red Hat employees to IBM's storage business unit. After this date, Red Hat OpenShift Platform Plus will continue to include OpenShift Data Foundation, sold by Red Hat and its partners. in addition, Red Hat OpenStack customers will still be able to purchase Red Hat Ceph storage from Red Hat and its partners. Red Hat OpenShift and Red Hat OpenStack customers with existing subscriptions will be able to maintain and expand their storage footprint as needed, without changing their relationship with Red Hat.

The upcoming Ceph-based IBM Ceph and IBM Spectrum Fusion storage solutions are reportedly expected to begin shipping in the first half of 2023.

source:aijiwei

wanda

/include/upload/kind/image/20221013/20221013171128_1386.jpg

IBM has announced that it will incorporate the Red Hat Storage product roadmap and its associated teams into the IBM Storage business unit to provide enterprises with consistent application and data storage across local infrastructures and the clou

2022/10/13 17:11:59

2022/10/13 17:11:59

335

0

217

6

Analog IC party is over? Foreign media: delivery delays, cancellations widespread

Citi Research has issued a warning that widespread delivery delays and cancellations suggest that the analog IC party is over.

MarketWatch, Investing.com reported that Citi analyst Christopher Danley published a research report on July 11, indicating that the delayed and cancelled lead times that hit analog IC and DSP major Analog Devices, Inc. (ADI), a major analog IC and digital signal processor (DSP) manufacturers, delivery delays and cancellation problems now also affect other analog IC manufacturers, lead time gradually reduced, "we believe that the demand turned weak (especially in Europe) and high inventory is the main cause of this boom cooling.

Danley predicts that Texas Instruments Inc. and NXP Semiconductors N.V. will report poor earnings, "This is only the beginning of the cycle of the downturn, and every company and every end market will feel the impact.

Danley also predicts that the Philadelphia Semiconductor Index will reach a new low due to increased downward momentum and lower corporate earnings estimates on Wall Street. He believes that the chip stocks will bottom out in the first half of 2023 after each company aggressively revises its profit outlook downward, investors pledge to surrender, and memory, logic IC, and foundry industry players cut capital expenditures.

Danley as early as more than a month ago, a lone opinion, warning automotive and industrial customers (the most severely affected by the chip shortage industry) signs of correction.

TSMC is scheduled to report earnings this Thursday (Oct. 13), while Dutch semiconductor equipment giant ASML Holding NV will also report then, and semiconductor etching machine maker Lam Research Corp. will announce a week later on Oct. 19.

The earnings season for U.S. chip stocks will be kicked off by Texas Instruments on Oct. 25.

So far, some analog IC stocks have performed much better than their semiconductor counterparts. Year-to-date, ON Semiconductor (ON Semiconductor), DEI only fell 12.44%, 18.58%, respectively, performing much better than the 43.78% decline in fee and a half.

source: EETOP半导体社区

wanda

/include/upload/kind/image/20221012/20221012162549_3653.jpg

Citi Research has issued a warning that widespread delivery delays and cancellations suggest that the analog IC party is over.

MarketWatch, Investing.com reported that Citi analyst Christopher Danley published a research report on July

2022/10/12 16:26:32

2022/10/12 16:26:32

364

0

216

6

Korea semiconductor sales in overseas markets in September 11.49 billion U.S. dollars, still down year-on-year

According to foreign media reports, under the influence of the dual decline in demand and prices, South Korea's semiconductor sales in overseas markets, in August this year fell to $10.78 billion, down 7.8% year-on-year, after 26 months of year-on-year decline again.

And from the latest data released by the Korean Ministry of Trade, Industry and Energy, September their semiconductor product sales in overseas markets, year-on-year growth still has not resumed.

The latest data released by the Korean Ministry of Trade, Industry and Energy show that sales of semiconductor products in overseas markets in September were $11.49 billion, down 5.7% year-on-year.

Although there is a decline year-on-year, but in September, South Korea's semiconductor product sales in overseas markets, but still higher than in August, 10.78 billion U.S. dollars, a return to growth.

As in August, Korea's semiconductor sales in overseas markets in September fell year-on-year, still affected by the global economic slowdown caused by the decline in demand and price declines.

Sitting Samsung Electronics and SK Hynix, the two major memory chip manufacturers in South Korea, is an important global supplier of semiconductors, semiconductors are also an important export commodity in South Korea, in their exports accounted for about 20% of the proportion of semiconductor products in overseas sales stability, for their export stability has an important impact.

source:TechWeb

wanda

/include/upload/kind/image/20221011/20221011170545_6933.jpg

According to foreign media reports, under the influence of the dual decline in demand and prices, South Korea's semiconductor sales in overseas markets, in August this year fell to $10.78 billion, down 7.8% year-on-year, after 26 months of year-on-

2022/10/11 17:06:19

2022/10/11 17:06:19

490

0

215

6

Survey Shows China's EV Battery Market Share Is Rising Rapidly

Market research firm SNE Research said on Oct. 6 that global EV battery usage from January to August this year was 287.6 GWh, which was up 78.7 percent from a year ago. usage of CATL EV batteries rose 114.7 percent year-on-year to 102.2 GWh, and the company's market share rose from 29.6 percent to 35.5 percent.

In comparison, LG Energy Solutions' market share fell from 22.3% to 13.7%, while the combined market share of SK On, Samsung SDI and LG Energy Solutions fell from 33.5% to 25%. BYD's EV battery usage, on the other hand, grew over 192% year-over-year.

Right now, Chinese companies are rapidly expanding their overseas operations. Companies like CATL recently announced that its cylindrical batteries will be supplied to BMW starting in 2025. Currently, cylindrical batteries are a major product for LG Energy Solutions, Samsung SDI and Panasonic.

CATL is currently building a 100 GWh per year plant in Hungary with an investment of €7.3 billion. This is CATL's second plant to be built in Europe, after the German plant scheduled to be operational this year. In addition, it is considering building a third plant in Europe to double its production.